The capital markets were given off to a roaring get started in 2024. On the other hand, the S&P 500 and Nasdaq Composite have given again a few of their features over the past month or in order equities have skilled some pronounced promoting task. As of the time of this text, stocks of synthetic intelligence (AI) darling Nvidia (NASDAQ: NVDA) have fallen just about 14% within the closing month.Whilst one of the decline may also be attributed to sell-offs within the broader marketplace, Nvidia not too long ago hit buyers with some disappointing information. Must buyers be troubled through this quandary, or is that this a unprecedented probability to shop for the dip in AI’s freshest inventory?What is going on with Nvidia inventory?There are numerous components influencing Nvidia inventory’s contemporary charge motion.For starters, the unemployment charge impulsively rose to 4.3% in July — its absolute best degree in over two years. Additionally, contemporary statement from the Federal Reserve continues to have economists wondering whether or not or no longer a lower to rates of interest is at the horizon or no longer.All issues thought to be, the cloudy macroeconomic image coupled with some standard election-driven volatility has unquestionably led to some buyers to begin promoting inventory and hoard money amid a pool of uncertainty. Sadly, this is just one aspect of the equation for Nvidia buyers. Possibly maximum relating to of all is that Nvidia’s extremely expected Blackwell graphics processing unit (GPU) is going through delays because of design flaws, consistent with a number of media retailers.Making an allowance for firms of all sizes and each business are doubling down on generative AI investments, Nvidia’s Blackwell extend does not precisely encourage self assurance. However, I do not believe that is essentially a explanation why for buyers to hit the panic button simply but.

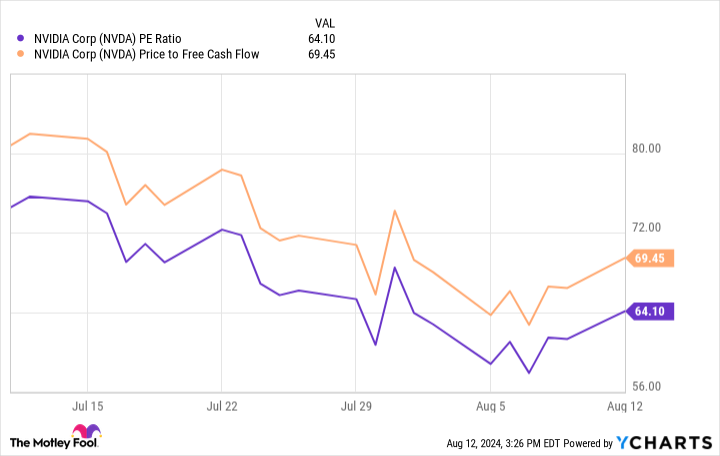

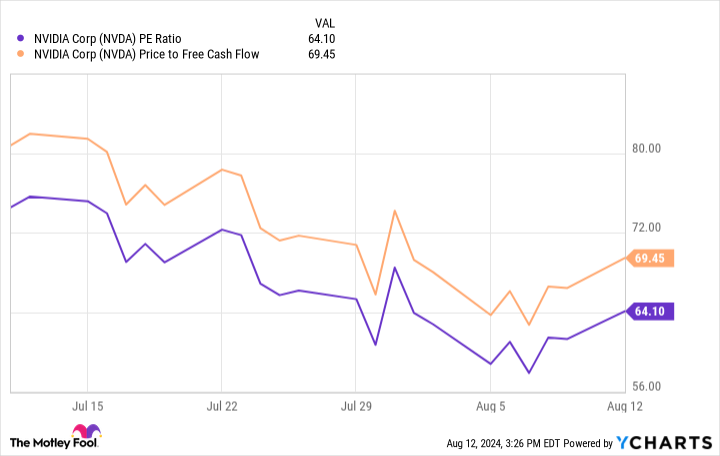

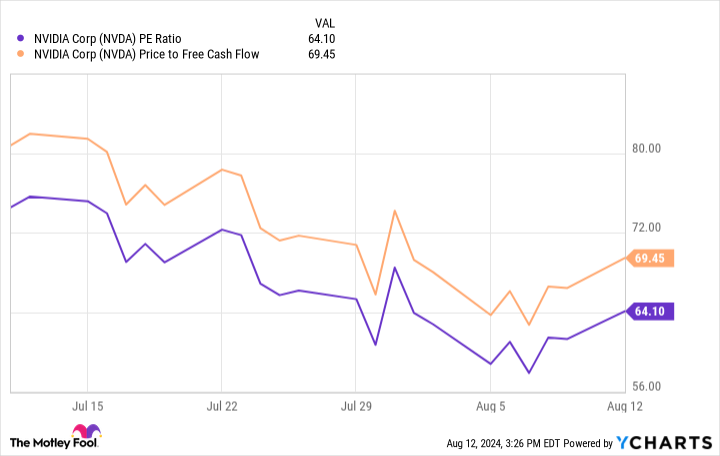

Symbol supply: Getty Photographs.Why the Blackwell extend is not a large dealWhile estimates range, public analysis means that Nvidia owns a minimum of 80% of the AI chip marketplace. So, whilst a extend to the Blackwell release could also be a lowlight, it is extremely not going that Nvidia will lose important marketplace percentage on account of this design blunder.Leader Funding Officer of Harvest Portfolio Control Paul Meeks not too long ago expressed a equivalent sentiment all over an interview on CNBC. He makes a perfect level in that call for for Nvidia’s GPUs is so top that the corporate will haven’t any actual downside promoting the Blackwell chips after they in reality come to marketplace — irrespective of the extend.”I simply want to see those shares stabilize for a few classes at some type of trough degree.”Harvest Portfolio Control Co-CIO Paul Meeks is intently observing the technicals as he discusses why he is not purchasing the dip in tech simply but: %.twitter.com/XqsOM9qABO– Cash Movers (@moneymoverscnbc) August 5, 2024Additionally, each and every of the “Magnificent Seven” firms has reported revenue this season apart from Nvidia. One of the vital not unusual threads sewing mega-caps in combination is that spending on AI-powered services has often risen over the past 12 months. Particularly, capital expenditures (capex) had been on the upward thrust amongst mega-cap tech as call for for cloud computing infrastructure, knowledge heart services and products, and semiconductor chips will increase.Tale continuesConsidering that the majority of Nvidia’s income enlargement these days stems from {hardware} operations in chips and information facilities, I believe the emerging funding in capex amongst giant tech firms represents a compelling secular narrative round Nvidia’s brilliant long term.Purchase the dip like there is not any tomorrowWhen buyers are hit with some distressing information, it is at all times essential to zoom out and imagine the entire variables.Again in 1997, Apple just about filed for chapter. Lately, Apple is the most important corporate on the earth through marketplace cap. Even the most productive firms hit street bumps every so often. What is extra essential is how control navigates those demanding situations within the second.The chart beneath illustrates Nvidia’s price-to-earnings (P/E) ratio and price-to-free money float (P/FCF) a couple of over the past month. Whilst a 14% drop in Nvidia inventory won’t appear to be so much within the grand scheme of items, the compression this decline has made on valuation multiples in this type of quick time-frame should not be lost sight of.

Symbol supply: Getty Photographs.Why the Blackwell extend is not a large dealWhile estimates range, public analysis means that Nvidia owns a minimum of 80% of the AI chip marketplace. So, whilst a extend to the Blackwell release could also be a lowlight, it is extremely not going that Nvidia will lose important marketplace percentage on account of this design blunder.Leader Funding Officer of Harvest Portfolio Control Paul Meeks not too long ago expressed a equivalent sentiment all over an interview on CNBC. He makes a perfect level in that call for for Nvidia’s GPUs is so top that the corporate will haven’t any actual downside promoting the Blackwell chips after they in reality come to marketplace — irrespective of the extend.”I simply want to see those shares stabilize for a few classes at some type of trough degree.”Harvest Portfolio Control Co-CIO Paul Meeks is intently observing the technicals as he discusses why he is not purchasing the dip in tech simply but: %.twitter.com/XqsOM9qABO– Cash Movers (@moneymoverscnbc) August 5, 2024Additionally, each and every of the “Magnificent Seven” firms has reported revenue this season apart from Nvidia. One of the vital not unusual threads sewing mega-caps in combination is that spending on AI-powered services has often risen over the past 12 months. Particularly, capital expenditures (capex) had been on the upward thrust amongst mega-cap tech as call for for cloud computing infrastructure, knowledge heart services and products, and semiconductor chips will increase.Tale continuesConsidering that the majority of Nvidia’s income enlargement these days stems from {hardware} operations in chips and information facilities, I believe the emerging funding in capex amongst giant tech firms represents a compelling secular narrative round Nvidia’s brilliant long term.Purchase the dip like there is not any tomorrowWhen buyers are hit with some distressing information, it is at all times essential to zoom out and imagine the entire variables.Again in 1997, Apple just about filed for chapter. Lately, Apple is the most important corporate on the earth through marketplace cap. Even the most productive firms hit street bumps every so often. What is extra essential is how control navigates those demanding situations within the second.The chart beneath illustrates Nvidia’s price-to-earnings (P/E) ratio and price-to-free money float (P/FCF) a couple of over the past month. Whilst a 14% drop in Nvidia inventory won’t appear to be so much within the grand scheme of items, the compression this decline has made on valuation multiples in this type of quick time-frame should not be lost sight of.

NVDA PE Ratio ChartOutside of its GPUs, the corporate is quietly construction a instrument platform to counterpoint the core chip industry. Moreover, the corporate has made a variety of strategic investments in spaces corresponding to robotics to additional diversify its AI ecosystem.I do not see any of those projects as priced into Nvidia inventory in this day and age. In truth, I believe a lot of what Nvidia is doing out of doors of GPUs isn’t but totally understood. For those causes, I believe the response to the Blackwell extend is overblown and look at the hot sell-off as a no brainer alternative to shop for Nvidia inventory presently as additional features glance to be in retailer over the long term.Must you make investments $1,000 in Nvidia presently?Before you purchase inventory in Nvidia, imagine this:The Motley Idiot Inventory Consultant analyst workforce simply recognized what they imagine are the 10 highest shares for buyers to shop for now… and Nvidia wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.Imagine when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $763,374!*Inventory Consultant supplies buyers with an easy-to-follow blueprint for luck, together with steering on construction a portfolio, common updates from analysts, and two new inventory alternatives each and every month. The Inventory Consultant provider has greater than quadrupled the go back of S&P 500 since 2002*.See the ten shares »*Inventory Consultant returns as of August 12, 2024Adam Spatacco has positions in Apple and Nvidia. The Motley Idiot has positions in and recommends Apple and Nvidia. The Motley Idiot has a disclosure coverage.Amid a 14% Promote-Off, Nvidia Simply Hit Buyers With a Impolite Awakening. What Must Buyers Do? was once firstly revealed through The Motley Idiot

NVDA PE Ratio ChartOutside of its GPUs, the corporate is quietly construction a instrument platform to counterpoint the core chip industry. Moreover, the corporate has made a variety of strategic investments in spaces corresponding to robotics to additional diversify its AI ecosystem.I do not see any of those projects as priced into Nvidia inventory in this day and age. In truth, I believe a lot of what Nvidia is doing out of doors of GPUs isn’t but totally understood. For those causes, I believe the response to the Blackwell extend is overblown and look at the hot sell-off as a no brainer alternative to shop for Nvidia inventory presently as additional features glance to be in retailer over the long term.Must you make investments $1,000 in Nvidia presently?Before you purchase inventory in Nvidia, imagine this:The Motley Idiot Inventory Consultant analyst workforce simply recognized what they imagine are the 10 highest shares for buyers to shop for now… and Nvidia wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.Imagine when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $763,374!*Inventory Consultant supplies buyers with an easy-to-follow blueprint for luck, together with steering on construction a portfolio, common updates from analysts, and two new inventory alternatives each and every month. The Inventory Consultant provider has greater than quadrupled the go back of S&P 500 since 2002*.See the ten shares »*Inventory Consultant returns as of August 12, 2024Adam Spatacco has positions in Apple and Nvidia. The Motley Idiot has positions in and recommends Apple and Nvidia. The Motley Idiot has a disclosure coverage.Amid a 14% Promote-Off, Nvidia Simply Hit Buyers With a Impolite Awakening. What Must Buyers Do? was once firstly revealed through The Motley Idiot