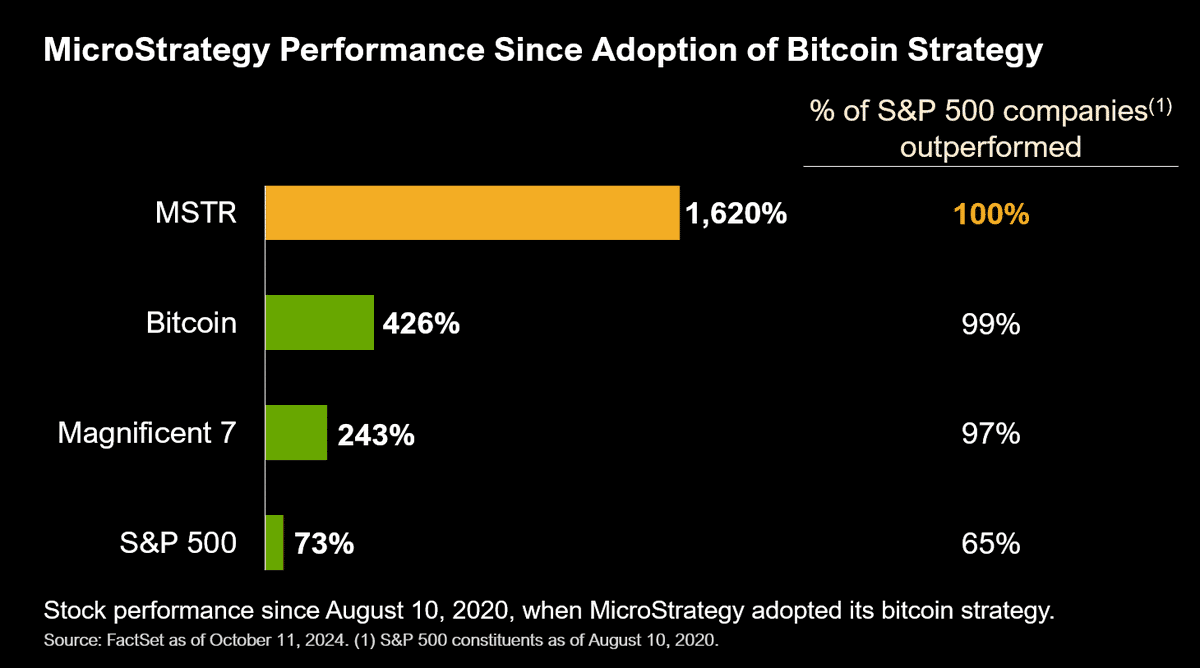

Saylor plans to make MicroStrategy a Bitcoin financial institution.

MSTR rallied and hit an ATH after the revelation.

MicroStrategy’s MSTR inventory hit ATH (all-time top) after the revelation of its finish objective of changing into a trillion-dollar Bitcoin [BTC] financial institution.

MicroStrategy’s founder, Michael Saylor, informed Bernstein analysts his company used to be eyeing a $1 trillion valuation as the most important BTC financial institution.

This may be partially aided via its competitive accumulation of the arena’s biggest asset, because the analysts projected a worth goal of $290 for the inventory.

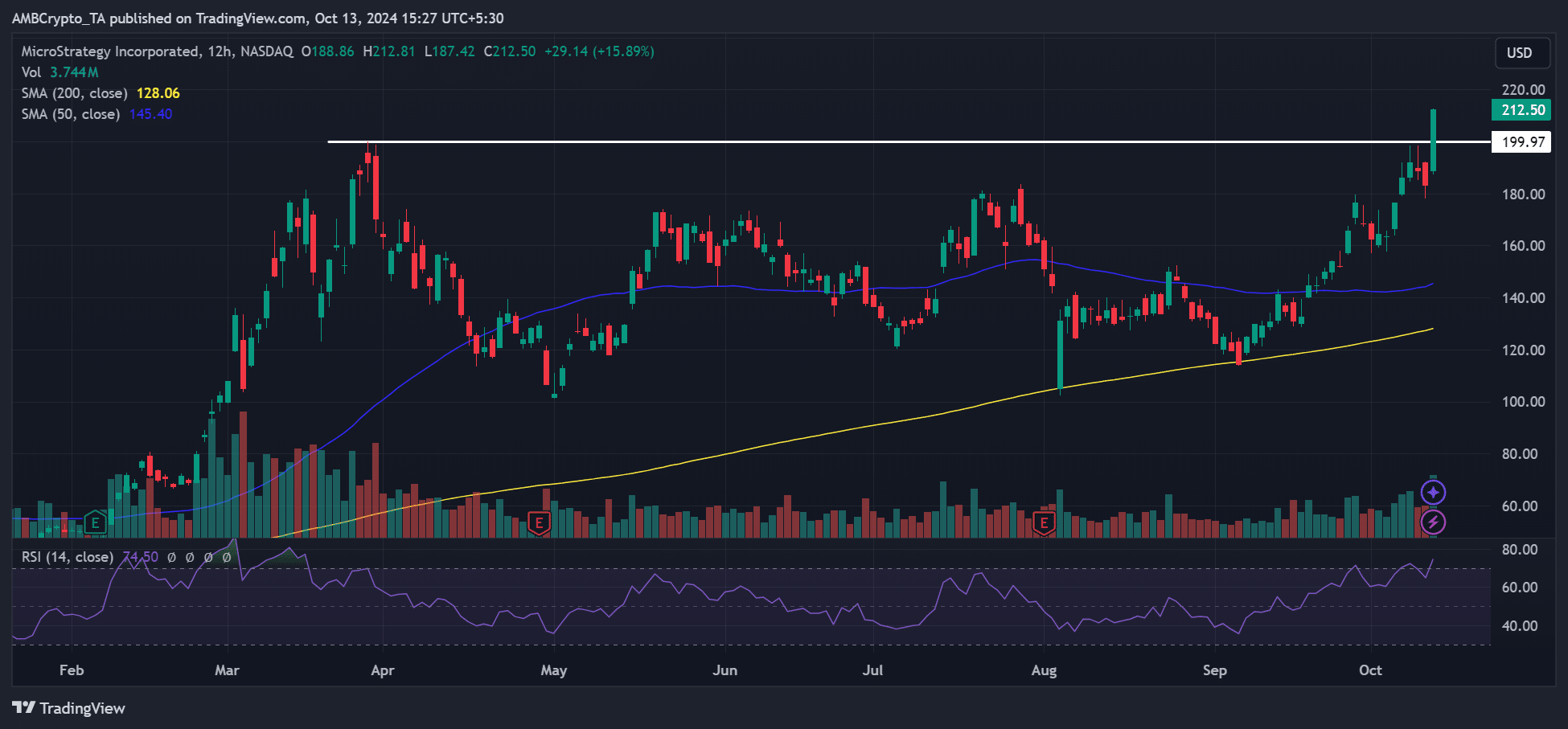

Supply: MSTR, TradingView

Supply: MSTR, TradingView

Following the replace, MSTR soared to a document top of $212.50, a fifteen% build up throughout the intra-day buying and selling consultation on October eleventh. It even smashed the $200 resistance.

Bitcoin financial institution end-game

Reacting to MSTR’s rally, Saylor famous that the one factor that plays higher than BTC used to be extra BTC.

“The one factor higher than #Bitcoin is extra Bitcoin.”

Supply: X

Supply: X

At press time, MicroStrategy held 252,220 BTC, value about $15.8 billion according to information from Bitcoin Treasuries. In maximum interviews, Saylor hasn’t ever said whether or not the company will promote its BTC hoard or its finish objective.

However the end-game used to be made transparent closing week.

So, what’s a Bitcoin financial institution?

In step with Saylor, BTC financial institution would act like different asset categories and construct monetary entities constructed round them. A part of the Bernstein file said,

“Michael believes MSTR is within the core industry of making Bitcoin capital marketplace tools throughout fairness, convertibles, mounted source of revenue, and most popular stocks and so forth.”

Saylor had in the past projected that BTC may just hit $3M-$49M via 2045 because the asset expands as a part of world capital.

Thus, the chief projected that getting cash from growing BTC-based monetary tools like bonds or shares can be more uncomplicated than lending out cash held via MicroStrategy.

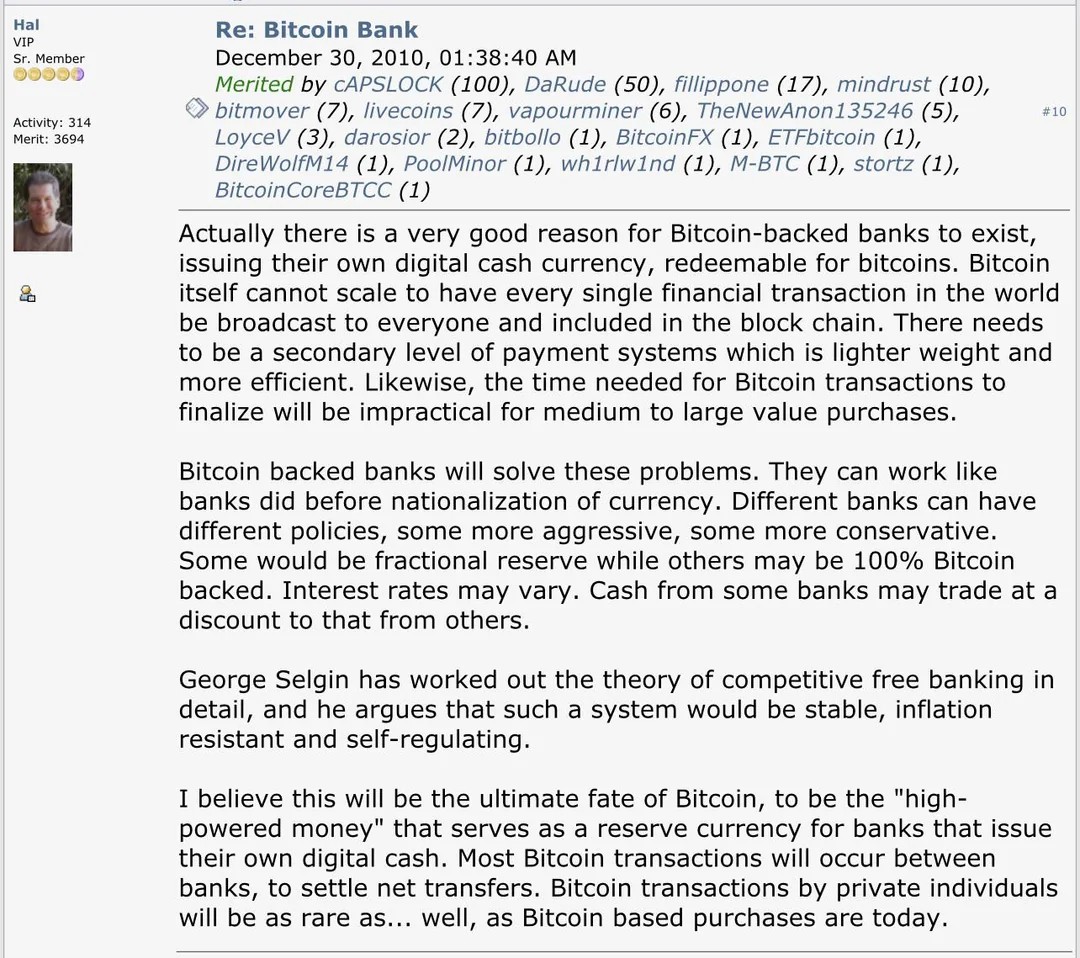

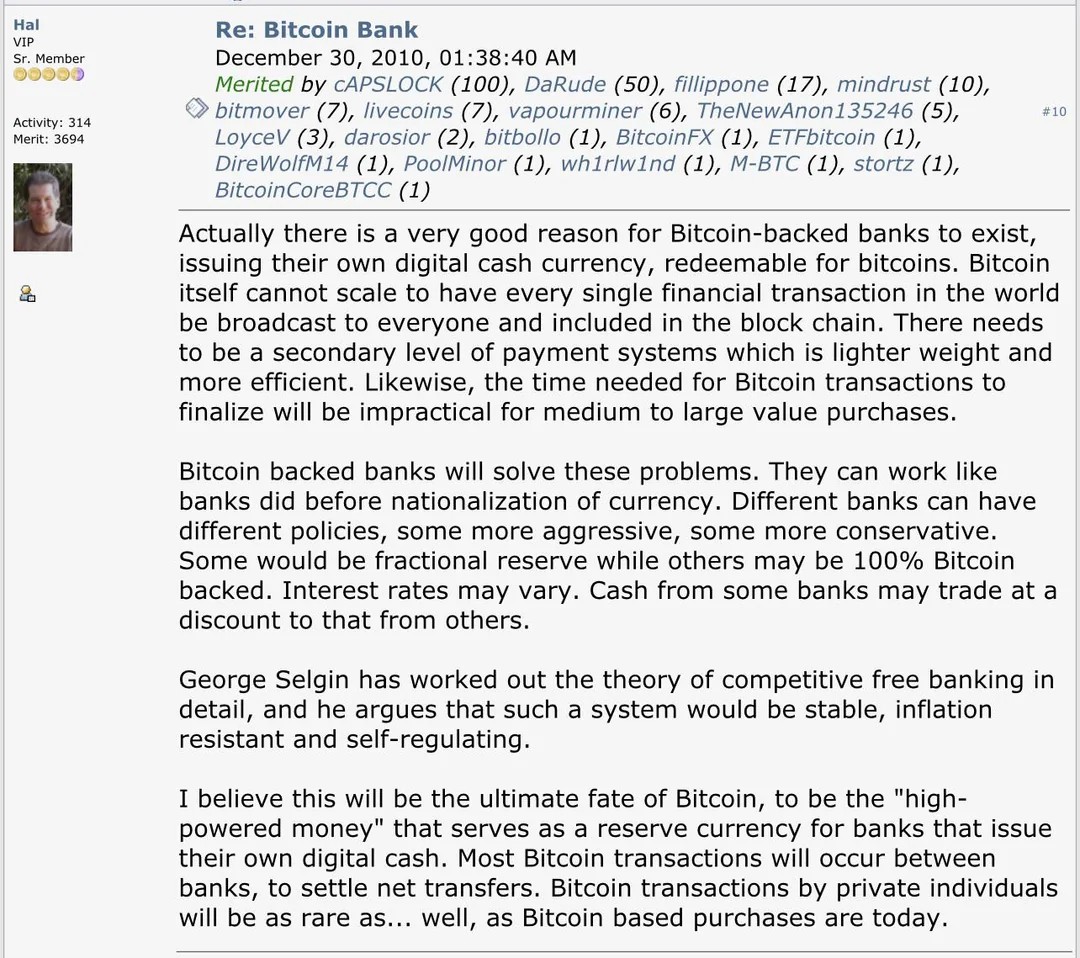

Apparently, Hal Finney, probably the most early BTC community individuals, floated a an identical thought in 2010.

Supply: X

Supply: X

However some known as for complex self-custody era to make sure any such device stays fair.

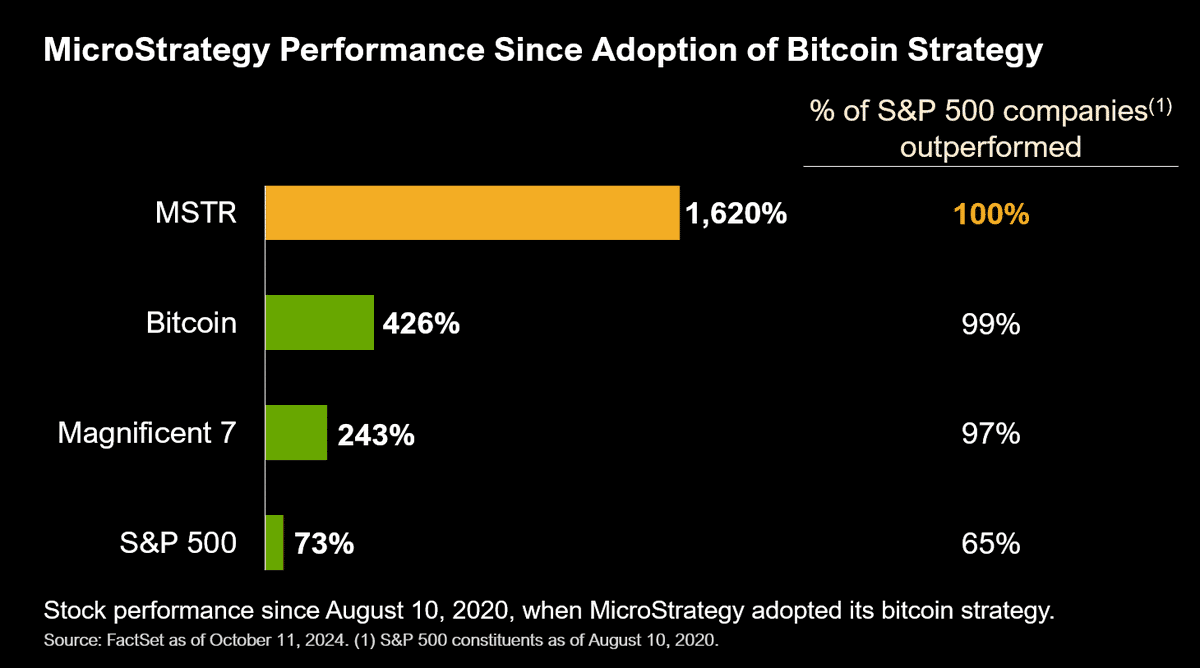

That stated, some marketplace pundits foresaw a powerful BTC rally as a favorable catalyst for MSTR’s worth.

In step with monetary guide Ben Franklin, in response to MicroStrategy’s monetary well being and BTC appreciation, MSTR’s worth may just develop 6x-10x.

Subsequent: Ripple whales collect as XRP struggles with key resistance

![2024 noticed OM [Mantra] outperform the remaining, will 2025 be any other? 2024 noticed OM [Mantra] outperform the remaining, will 2025 be any other?](https://ambcrypto.com/wp-content/uploads/2024/12/om-2024.jpeg)