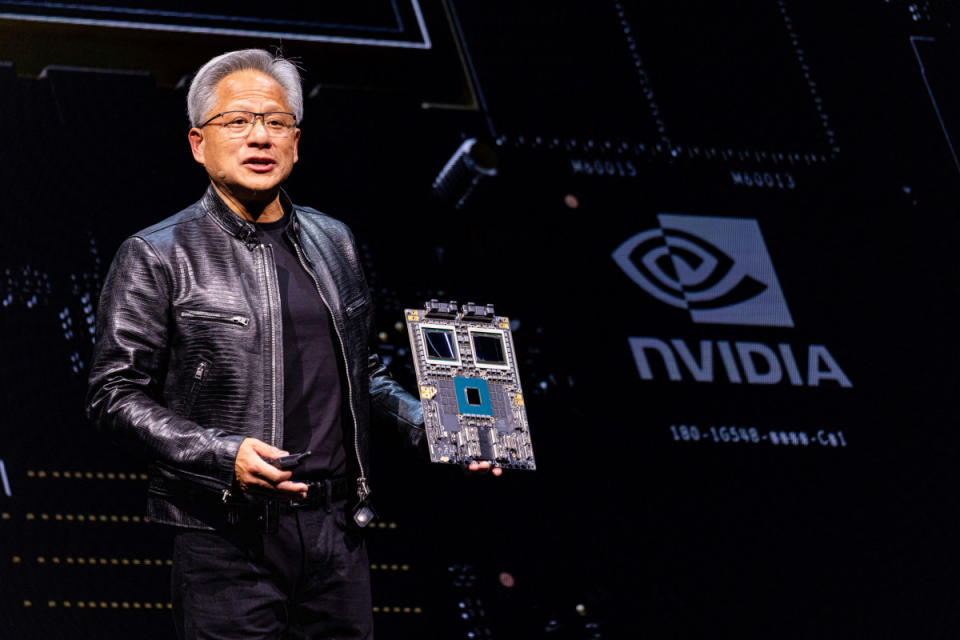

Nvidia inventory (NVDA) traders noticed a roller-coaster experience forward of its Q2 profits liberate in August. Its percentage value dropped under $100 on August 5, rebounded, and went up for 6 consecutive days from the twelfth to the nineteenth. Nvidia traded at round $128 on August 21.Nvidia’s early-month plunge used to be in part because of the worldwide marketplace turmoil after the yen-carry industry and a possible chip supply extend brought about through a design flaw within the Blackwell structure.The chip large stays the AI trade chief, with an 80% marketplace percentage in AI processors. However competitors like AMD are choosing up the tempo.On August 19, AMD introduced a 5 billion acquisition of ZT Programs to spice up its GPU gross sales. Nvidia inventory misplaced 2% at the subsequent buying and selling day. GPUs are {hardware} specialised in appearing the matrix calculations required through AI processing.Similar: Analysts reset AMD inventory outlooks after AI acquisitionNvidia will submit its fiscal Q2 profits on August 28. Regardless of the effects, they’ll mark a key climate vane for the AI and the semiconductor trade. The profits studies from its peer chip makers is usually a just right reference for profits prediction and long run inventory value actions.The No. 2 marketplace participant, AMD, delivered robust Q2 profits on July 30, exceeding analysts’ expectancies for each earnings and earnings. Income rose 9% to $5.84 billion, whilst profits greater through 19% to 69 cents a percentage. It additionally sees tough AI call for forward.However Intel tumbled on an profits omit. On August 1, the corporate reported a web lack of $1.61 billion, in comparison with a web source of revenue of $1.48 billion a 12 months previous. Income and profits have been additionally less than analysts’ forecasts.Intel attributed the loss to a call to extra impulsively produce Core Extremely PC chips that may care for AI workloads, in line with CEO Pat Gelsinger.HSBC analysts raised Nvidia’s value goal to $145 from $135 and stored a purchase score.Bloomberg/Getty ImagesWhat to be expecting after a file Q1 revenueNvidia reported file quarterly earnings of $26.0 billion for fiscal Q1 2025, up 18% from This autumn and 262% from a 12 months in the past.The AI large anticipates Q2 FY25 earnings of $28 billion, with GAAP and non-GAAP gross margins projected at 74.8% and 75.5%, respectively. When put next, Q2 FY24 reported earnings of $13.51 billion, with GAAP and non-GAAP gross margins of 70.1% and 71.2%.Similar: Analysts reset goals for key Nvidia provider after profits“The following business revolution has begun — firms and nations are partnering with NVIDIA to shift the trillion-dollar conventional information facilities to speeded up computing and construct a brand new form of information middle — AI factories — to supply a brand new commodity: synthetic intelligence,” stated CEO Jensen Huang in Q1’s profits liberate, “We’re poised for our subsequent wave of expansion.”Tale continuesHSBC analyst raises Nvidia inventory value goal sooner than earningsOn August 21, HSBC analyst Frank Lee raised Nvidia’s value goal to $145 from $135 and stored a purchase score.The analyst sees persevered energy for Nvidia pushed through underlying AI GPU call for, with “restricted have an effect on on profits from any product roadmap extend.”“The 2025 AI hyperscaler capex pattern stays intact, along side underlying AI call for,” the analyst stated.HSBC expects Nvidia’s Q2 gross sales to be $30 billion, beating the corporate’s steering and consensus estimates of $28 billion and $28.6 billion, respectively.Extra AI Shares:TheStreet additionally reported on August 19 that Goldman Sachs analyst Toshiya Hari reiterated a purchase score on Nvidia with a $135 goal sooner than profits, bringing up robust call for and Nvidia’s “tough” aggressive place.“Whilst the reported extend in Blackwell may lead to a few near-term volatility in basics, control remark, coupled with provide chain information issues over the approaching weeks, will have to result in upper conviction in Nvidia’s profits energy in 2025,” the analyst stated in a analysis word.Similar: Veteran fund supervisor sees international of ache coming for shares

Analyst resets Nvidia inventory value goal sooner than profits