SAND’s breakout from a falling wedge trend indicators an 80% value surge if it clears the 100-day transferring moderate.

Bullish momentum is supported by way of emerging energetic addresses, decrease alternate reserves, and brief liquidations.

The Sandbox [SAND] has showed a breakout from its falling wedge trend, elevating anticipation of a vital upward value motion. With key objectives set at $0.31 and $0.40, analysts are carefully gazing the 100-day transferring moderate.

A damage above this essential stage may cause an 80% value surge. Will SAND maintain this momentum and ignite a long-term rally?

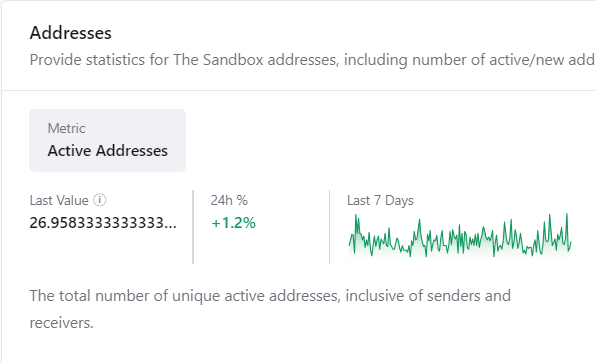

How are transactions and energetic addresses shaping up?

One of the crucial key signs of marketplace task is the selection of distinctive energetic addresses. On the time of press, SAND has 26.96 energetic addresses, reflecting a 1.2% build up up to now 24 hours.

Supply: CryptoQuant

Supply: CryptoQuant

Moreover, transaction quantity helps this sure momentum, appearing a 1.37% upward thrust to 529 transactions, as consistent with CryptoQuant information.

This stable build up in task implies that extra customers have interaction with the community, doubtlessly development the root for the predicted value surge.

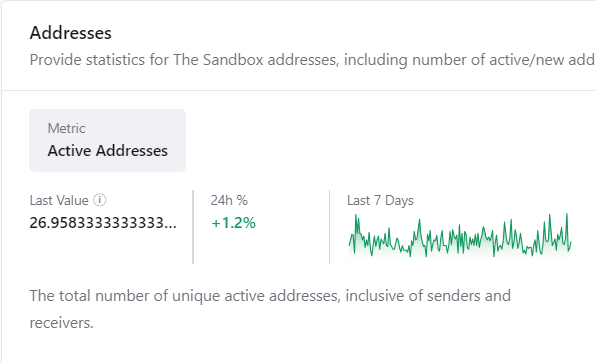

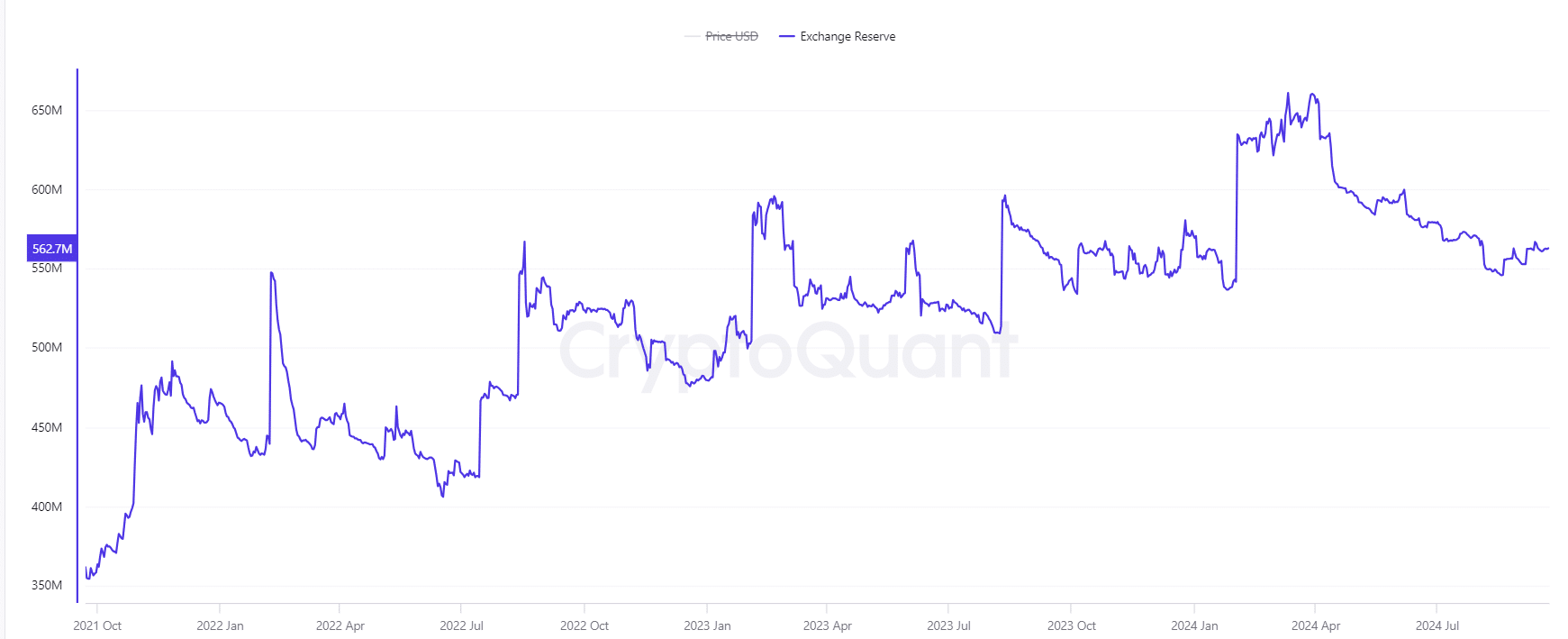

Trade reserve research: What does it imply?

The alternate reserve for SAND lately holds 562.76 million tokens. A slight 0.02% lower signifies a discount in promoting drive.

Typically, a falling alternate reserve means that fewer tokens are to be had on the market, suggesting that traders are maintaining onto their belongings in anticipation of a worth upward thrust.

In consequence, this aligns with the bullish breakout trend noticed at the day by day chart, reinforcing the possibility of an upcoming rally.

Supply: CryptoQuant

Supply: CryptoQuant

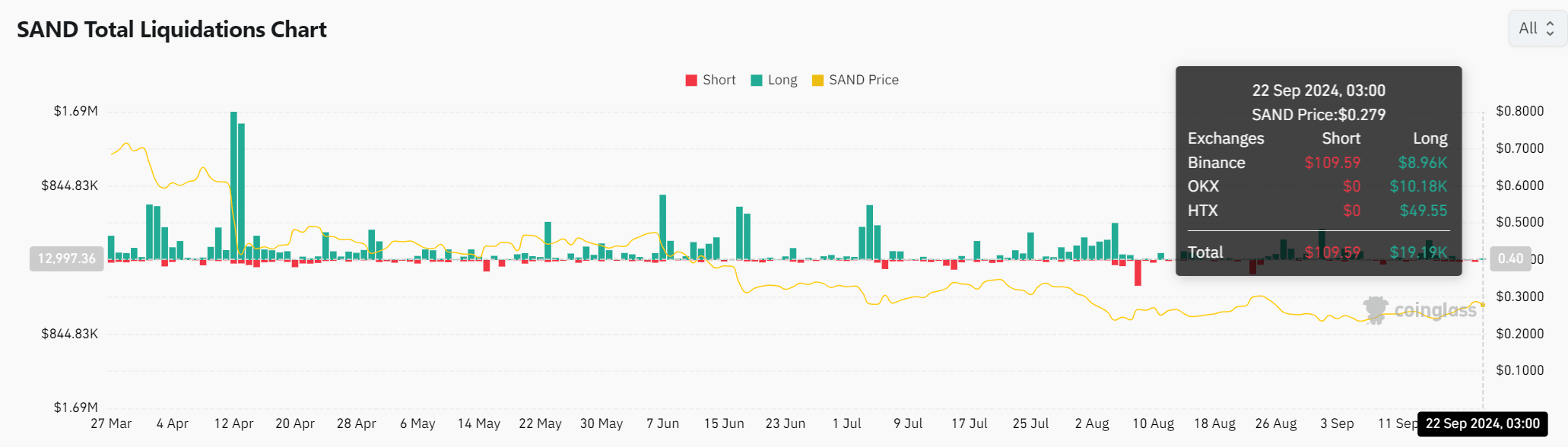

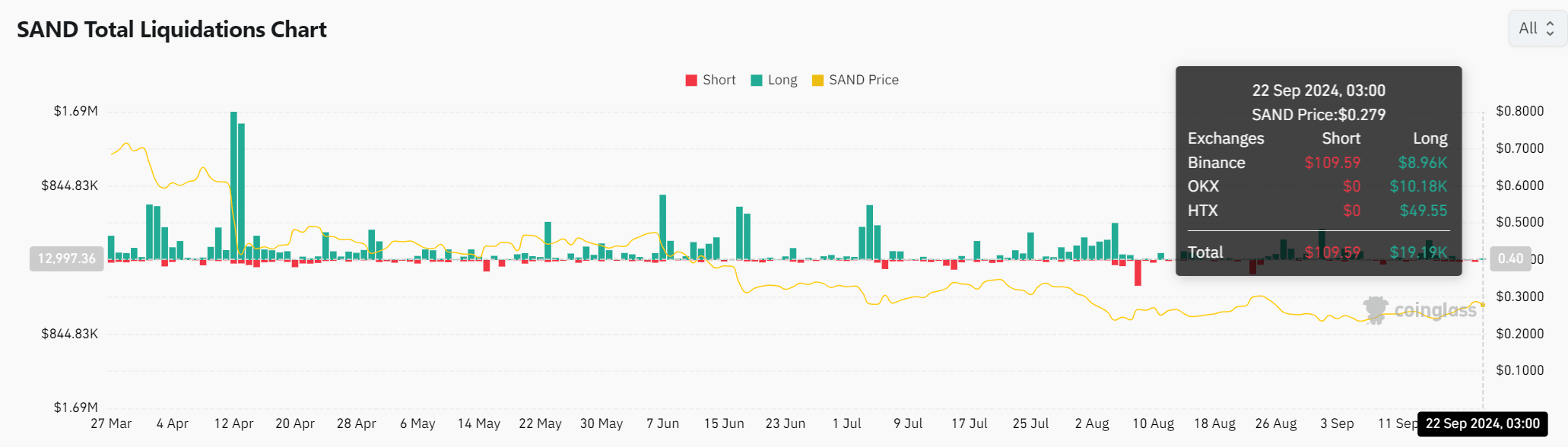

SAND liquidations: Can the bulls take over?

Liquidation information supplies a transparent snapshot of marketplace drive. The new figures divulge that $109.59K of brief positions had been liquidated, in comparison to simply $19.19K in lengthy positions.

This imbalance signifies that investors having a bet towards SAND are going through losses because the asset strengthens.

With the associated fee soaring round $0.279 at press time, this development in liquidations may transparent the trail for additional bullish momentum, doubtlessly pushing SAND to check the $0.31 goal and past.

Supply: Coinglass

Supply: Coinglass

Sensible or now not, right here’s SAND marketplace cap in BTC’s phrases

Will SAND grasp its breakout?

With transaction volumes emerging, energetic addresses expanding, and alternate reserves reducing, SAND’s marketplace construction turns out well-prepared for a sustained upward transfer. The liquidation information additional bolsters a bullish situation, as brief positions proceed to be squeezed out.

Breaking the 100-day transferring moderate may solidly position SAND at the trail to important positive factors, aiming for momentary objectives of $0.31 and $0.40.

Subsequent: Polkadot may surge to $5.1 if it overcomes THIS key hurdle!