Volatility. Powell discussed it too. The ten-year yield is massively unstable, and the drop over the last few days suits proper in.

Via Wolf Richter for WOLF STREET.

The ten-year yield dropped as little as 4.63% previous nowadays and now trades at 4.68%. It’s going thru its same old gyrations – however at upper yields than sooner than.

Within the morning of October 23, it in short pierced 5% for a couple of seconds for the primary time since 2007, after which “plunged” over the following few hours, turning this right into a spectacle in its personal proper, and it persisted to drop tomorrow, last at 4.83%, adopted through a jump on October 25 to near at 4.95%, after which it dropped into the 4.88% vary for a couple of days till the day past at 8:30 A.M., when it let pass.

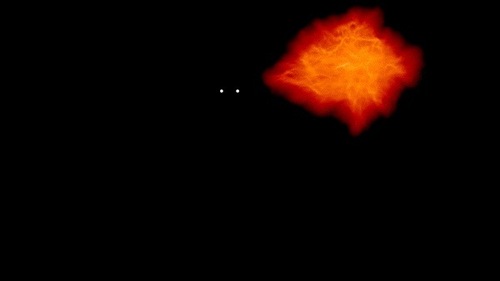

This multi-day drop suits proper in with the ups and downs that mark the volatility of the 10-year yield, and no development was once damaged, and there wasn’t any roughly paradigm shift or no matter in spite of what the hype-and-hoopla organs are spreading round available in the market:

In the case of last yields (consistent with Treasury Division information), the 10-year yield dropped from the top of four.98% on October 19 to 4.68% now, a drop of 30 foundation issues in 10 buying and selling days. In order that’s a fairly large drop.

But if was once the closing time a 30-basis-point drop in 10 buying and selling days passed off? In March 2023 (-58 foundation issues); in January 2023 (-45 foundation issues); in December 2022 (-34 foundation issues); in November 2022 (-46 foundation issues); in August 2022 (-36 foundation issues); in July 2022 (-43 foundation issues), and so forth. and so forth.

You get the theory: The ten-year yield is unstable, as Powell identified, and these items occurs so much, and to a bigger extent.

And most of these drops had been adopted through giant surges within the yield, and amid the entire ups and downs, the yield saved wobbling upper.

In two buying and selling days from the shut of four.88% on October 31, to the present yield of four.68%, the yield dropped 20 foundation issues, which is a fairly large transfer for 2 days. How continuously has that passed off lately? So much, beginning with October 10 (-20 foundation issues), July 14 (-23 foundation issues), and so forth. and so forth.:

So what took place?

The day past at 8:30 A.M., the Treasury Division introduced projections for its issuance of longer-term securities as a part of its Quarterly Refunding paperwork. It had already introduced on Monday that there’s a tsunami of issuance coming to fund the extremely ballooning deficit. The day past got here the main points.

The day past at 8:30 A.M., it mentioned that issuance of longer-term securities, specifically 10-year notes, in This autumn and Q1 2024 would no longer balloon up to feared as a result of it might shift issuance from longer-term securities to T-bills (1 month to one 12 months) and to 2-year notes.

In different phrases, issuance of longer-term Treasuries will nonetheless balloon, however simply no longer rather up to feared. As an alternative T-bill issuance and 2-year be aware issuance would balloon much more than feared.

It made this announcement particularly to power down longer-term yields that have turn into an enormous fear for the Treasury division that has to pay the hobby, and a blue eye for the present fiscal insurance policies that experience turn into a nightmare.

The Treasury Division indexed a dozen causes within the paperwork why longer-term yields had shot up, and I made a giant deal out of this and indexed the ones causes. I additionally integrated a green-line-versus-red-line chart evaluating the August 2 projections to the brand new projections for a similar period of time, This autumn and Q1 2024. And the 10-year yield careened decrease. And that was once the Treasury Division’s purpose.

Then got here the Fed’s resolution at 11 A.M. to carry charges at 5.5% on the best finish and go away additional charge hikes at the desk. Powell showed all this on the press convention. He additionally identified that tightening monetary stipulations – together with particularly a better 10-year yield – can be had to switch the Fed’s tightening of economic coverage to the financial system.

The rise in longer-term yields “has contributed to a tightening of broader monetary stipulations for the reason that summer time,” he mentioned. Right here’s what Powell in fact mentioned on the press convention.

“On this case the tighter monetary stipulations we’re seeing from upper long-term charges and likewise from different assets just like the more potent greenback and decrease fairness costs may subject for long term charge selections, so long as two stipulations are glad.”

“The primary is the tighter monetary stipulations would want to be chronic. And that’s one thing that is still noticed. However this is important. Issues are fluctuating back-and-forth. That’s not what we’re in search of. With monetary stipulations, we’re in search of chronic adjustments which can be subject matter,” he mentioned.

“The second one factor is that the longer-term charges that experience moved up, they may be able to’t merely be a mirrored image of anticipated coverage strikes from us that will then, if we didn’t apply thru, come backtrack,” he mentioned.

So now the 10-year yield is fluctuating, however it must be constantly upper to do the paintings for the Fed, and so the drop within the yield isn’t useful for the Fed’s coverage transmission, however what else is new, markets had been preventing the Fed for 18 months.

Revel in studying WOLF STREET and need to enhance it? You’ll be able to donate. I admire it immensely. Click on at the beer and iced-tea mug to learn the way:

Do you want to be notified by the use of electronic mail when WOLF STREET publishes a brand new article? Enroll right here.

![]()