Ape’s breakout alerts bullish doable, however resistance at $2.70 stays crucial.

Declining cope with job may problem sustained momentum in spite of certain on-chain and technical metrics.

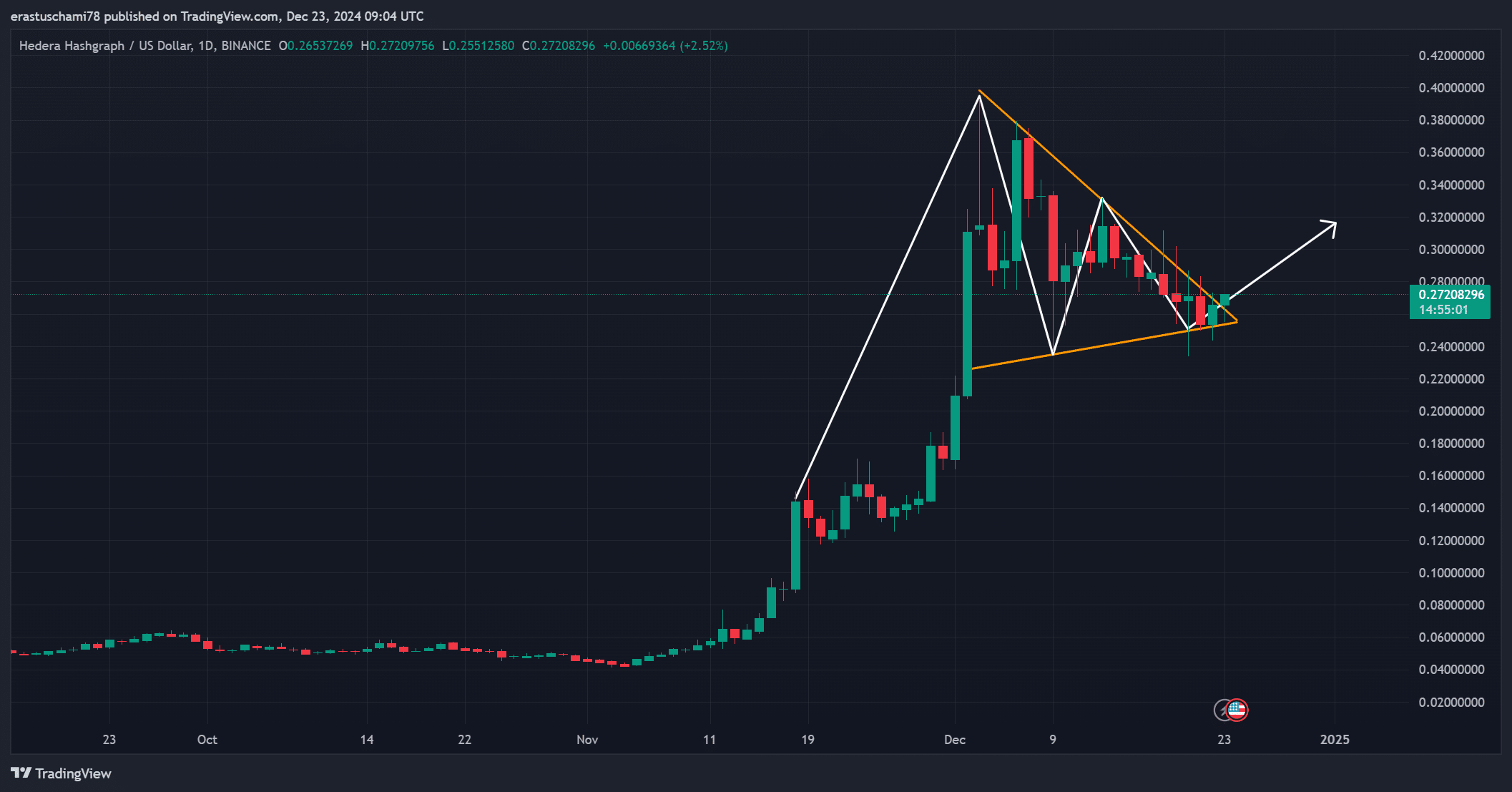

ApeCoin’s [APE] contemporary value breakout from a descending triangle trend at the weekly chart has stirred marketplace pleasure, signaling a possible shift towards bullish momentum.

At press time, ApeCoin used to be buying and selling at $1.86, down 2.61% prior to now 24 hours, however technical signs recommend room for additional beneficial properties.

The RSI stood at 65.94, reflecting sturdy momentum, whilst a bullish transferring moderate crossover, the place the shorter MA has surpassed the longer MA, confirms an upward trajectory.

On the other hand, with a crucial resistance stage at $2.70 looming, the trail forward stays unsure.

Supply: TradingView

Supply: TradingView

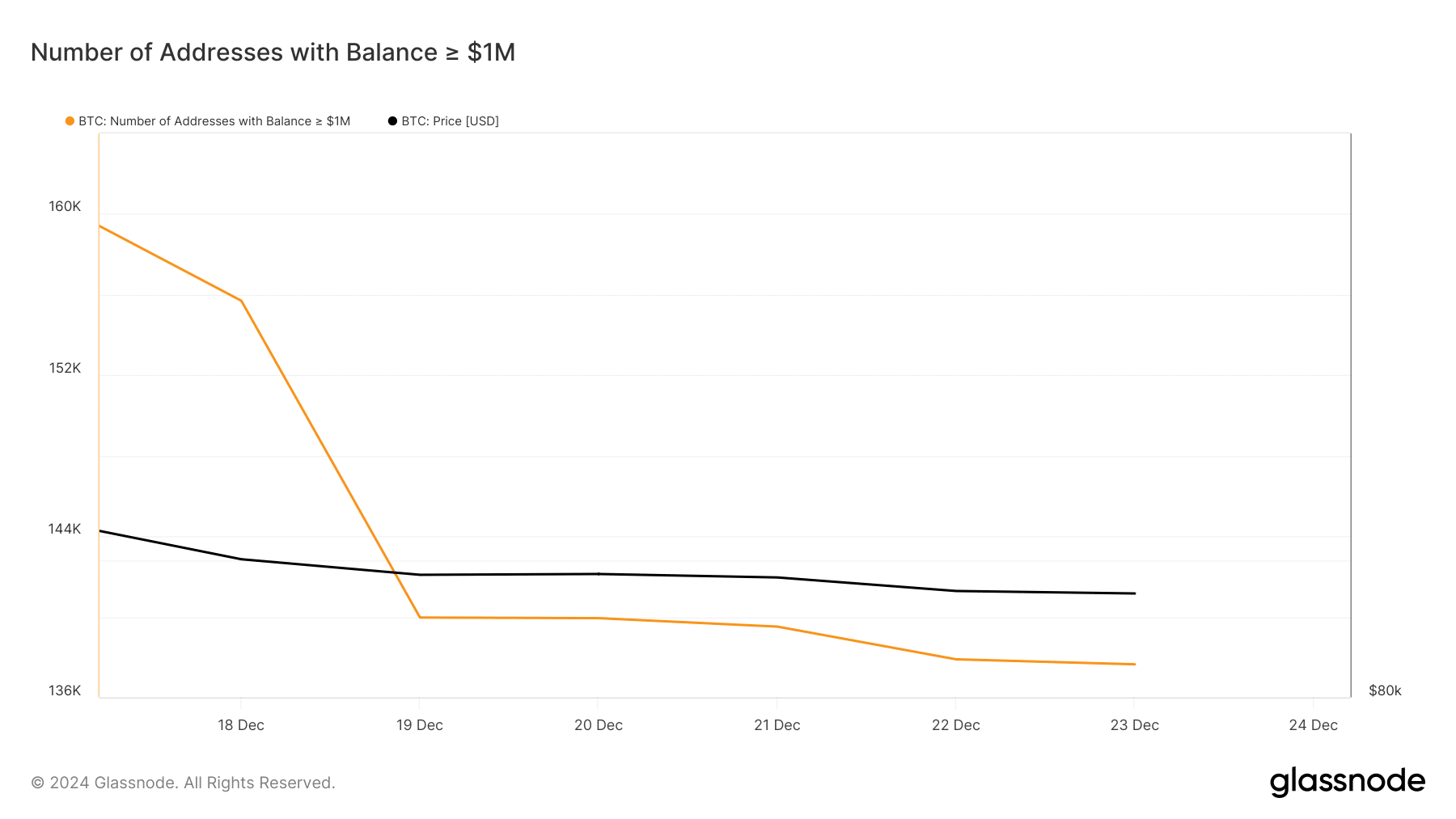

APE on-chain knowledge displays blended alerts

On-chain metrics supply a nuanced standpoint on APE’s outlook. Web community enlargement displays a modest 0.63% bullish sign, and big transactions are up 2.45%, highlighting hobby from important avid gamers.

Moreover, focus amongst holders finds a minor bullish tilt of -0.03%. On the other hand, the “within the cash” metric stays impartial at 0.42%, suggesting a loss of decisive sentiment.

Due to this fact, whilst on-chain alerts lean bullish, they replicate warning, emphasizing the desire for sustained momentum.

Supply: IntoTheBlock

Supply: IntoTheBlock

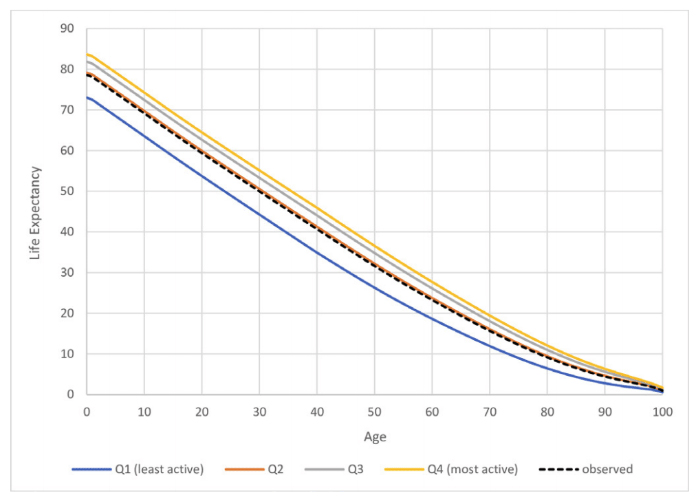

Cope with job drops considerably

Cope with job metrics, then again, elevate considerations concerning the ecosystem’s engagement. Over the last seven days, new addresses have fallen via 10.96%, whilst energetic addresses dropped via 6.58%.

Moreover, zero-balance addresses lowered via 13.67%, reflecting declining job around the board. This downturn in cope with participation may problem Ape’s skill to maintain its breakout except investor hobby rebounds.

Supply: IntoTheBlock

Supply: IntoTheBlock

APE derivatives marketplace stays cautiously positive

Within the derivatives marketplace, Ape’s OI-weighted investment charge these days stands at 0.0518%. This means a impartial to moderately bullish sentiment amongst buyers, and not using a important bearish force glaring.

On the other hand, the loss of overwhelming bullish sentiment means that buyers stay wary, watching for more potent catalysts to force a decisive rally.

Supply: Coinglass

Supply: Coinglass

Whilst Ape’s breakout from the descending triangle trend and bullish technical signs recommend a powerful upward doable, a number of components may decide the sustainability of this momentum.

The resistance at $2.70 stays a vital hurdle, and the hot decline in cope with job, with drops in new, energetic, and zero-balance addresses, raises considerations about long-term investor engagement.

Learn ApeCoin’s [APE] Worth Prediction 2024–2025

On-chain and investment charge metrics display blended however cautiously positive alerts, highlighting the desire for sustained participation from each retail and institutional traders.

Due to this fact, Ape’s skill to care for its bullish trajectory is dependent upon overcoming those demanding situations, breaking key resistance ranges, and fostering a extra energetic and engaged ecosystem.

Subsequent: Raydium: Will the $5 make stronger cause restoration for RAY?