We speculated on the time that the verdict to withdraw Apple Pay Later used to be most probably pushed by way of a need to get forward of upcoming law, and a work as of late means that it’s in truth a brand new interpretation of an excessively previous legislation.

The Fact in Lending Act used to be handed in 1968, and grants customers a lot of protections relating to bank cards – and Apple Pay Later gave the impression set to fall inside scope …

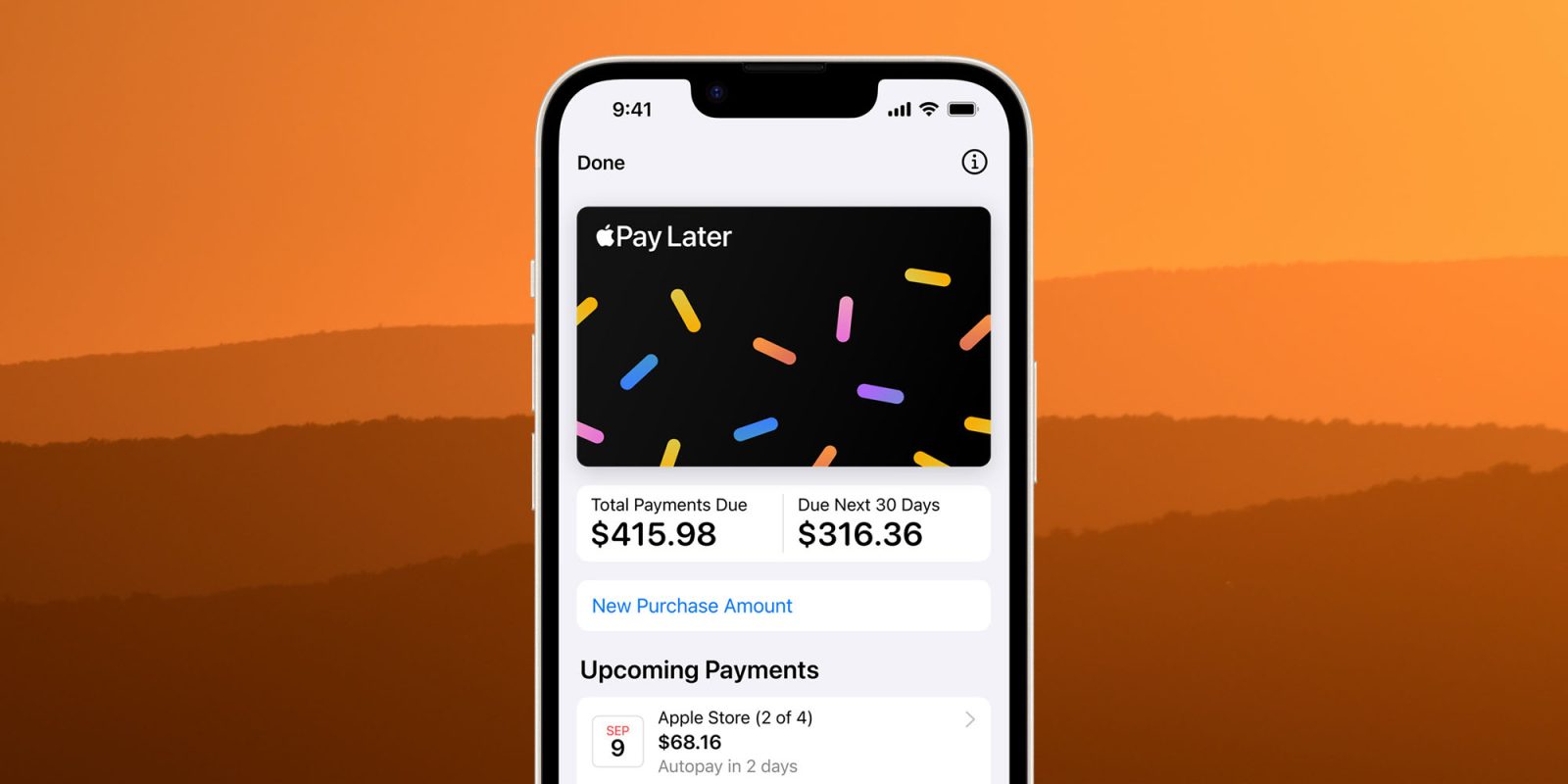

Apple Pay Later can be topic to TiLA

The Fact in Lending Act (TiLA) is a federal legislation handed in 1968 which regulates the bank card business. It units out a spread of duties card firms have to fulfill, and units out shopper rights which practice to buy made with a bank card.

None of it carried out to Purchase Now, Pay Later (BNPL) loans like Apple Pay Later – however that’s converting.

America Client Monetary Coverage Bureau (CFPB) introduced an investigation into those loans again in 2021, and ultimate month proposed that they fall inside the scope of the TiLA.

[The Bureau] is issuing this interpretive rule to handle the applicability of subpart B of Law Z to lenders that factor virtual person accounts used to get admission to credit score, together with to these lenders that marketplace loans as “Purchase Now, Pay Later” (BNPL). This interpretive rule describes how those lenders meet the standards for being “card issuers” for functions of Law Z. Such lenders that stretch credit score also are “collectors” topic to subpart B of Law Z, together with the ones provisions governing periodic statements and billing disputes.

Necessarily, because of this BNPL lenders should be a lot more cautious about their lending selections, as Arstechnica studies.

“When customers take a look at and select Purchase Now, Pay Later, they don’t know if they are going to get a reimbursement in the event that they go back their product or whether or not the lender will assist them in the event that they didn’t get what used to be promised,” mentioned CFPB Director Rohit Chopra. “Irrespective of whether or not a client swipes a bank card or makes use of Purchase Now, Pay Later, they’re entitled to essential shopper protections below longstanding regulations and rules already at the books.”

Through getting out of the BNPL recreation, Apple can keep away from necessities that the CFPB plans to impose on BNPL lenders, together with possible duties to research buyer disputes, pause bills, supply refunds, and factor credit when essential.

It’s no longer that Apple would have engaged in any sketchy conduct, however the determination – if finalized – would have created a large number of possible forms for the corporate. Given the somewhat small spice up in gross sales that might were completed by way of such temporary loans, it’s most probably Apple determined it merely didn’t need the complications.

9to5Mac collage of pictures from Apple and Taylor Wright on Unsplash

FTC: We use source of revenue incomes auto associate hyperlinks. Extra.