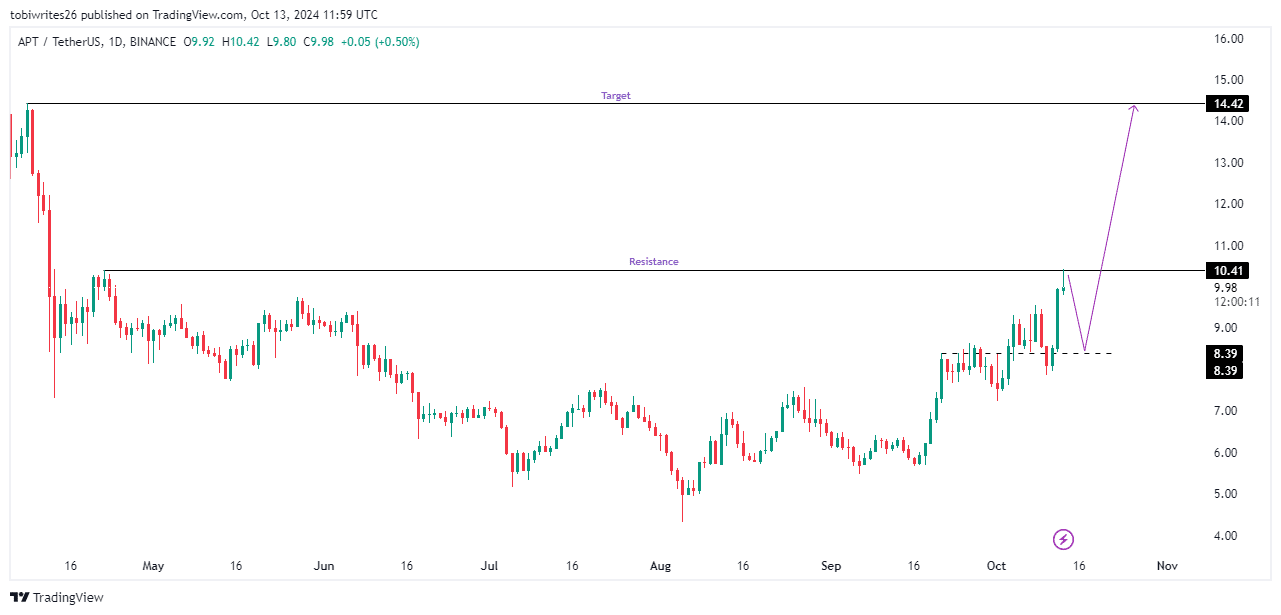

APT lately hit $10.41, a key degree that might sign whether or not a momentary rally is at the horizon or if a downturn is much more likely.

A number of signs recommend APT would possibly pull again ahead of making its manner towards $14.42, a near-term goal for the token.

The previous month has been a standout length for Aptos [APT], which surged via 63.30%. Within the closing 24 hours on my own, robust purchasing momentum driven the associated fee up via 18.17%, at the same time as maximum altcoins struggled in a unstable marketplace.

In spite of the hot good points, AMBCrypto’s research suggests APT is about for every other rally, doubtlessly including to its contemporary upward momentum.

Brief-term rally stays in play for Aptos

APT seems set to proceed its upward momentum after buying and selling previous the $10.41 mark, the place it confronted important promoting power at this degree.

Within the closing 24 hours, APT’s buying and selling quantity has surged via 174.19%, attaining $581.21 million, whilst its marketplace capitalization climbed via 20.86% to $5.17 billion.

For Aptos to push towards its momentary goal of $14.42—a degree known as preserving important liquidity—it will have to first damage throughout the resistance at $10.41. That means, its quantity will wish to take care of a favorable increment as recorded.

Supply: Buying and selling View

Supply: Buying and selling View

If APT fails to transparent this resistance, it’s more likely to retrace to the $8.39 fortify degree, the place it will search renewed purchasing momentum to maintain its upward trajectory.

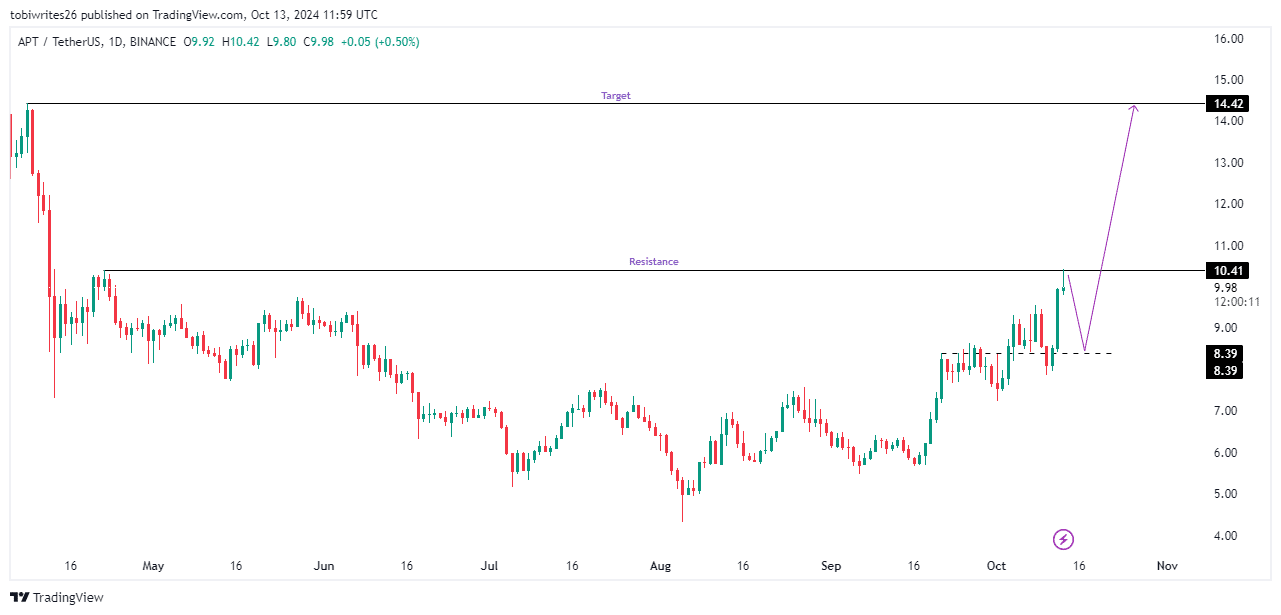

AMBCrypto’s research of present technical signs means that APT is more likely to revel in a pullback from its present ranges.

A slight dip ahead of the rally to $14.42 goal

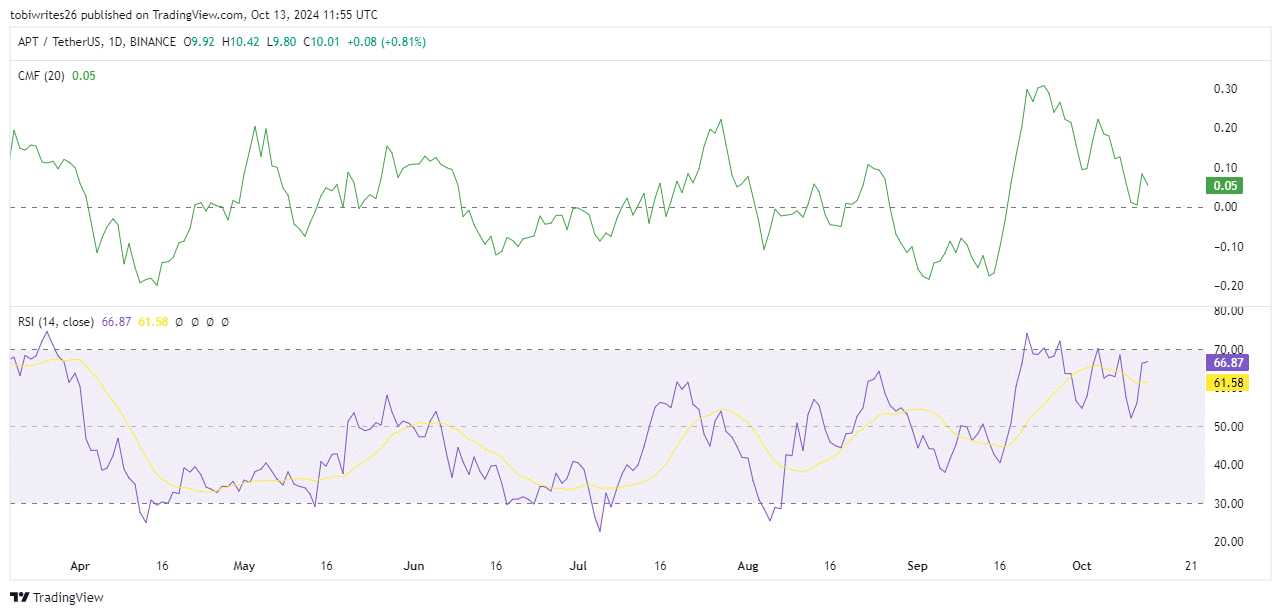

APT is more likely to revel in a minor pullback ahead of resuming its rally towards the momentary goal of $14.42, consistent with key technical signs such because the Relative Power Index (RSI) and Chaikin Cash Glide (CMF).

The CMF, which measures liquidity inflows and outflows to evaluate marketplace sentiment, signifies a minor sell-off out there, signaling that some buyers are cashing out.

In a similar fashion, the RSI has proven a slight decline, with momentum slightly tilting downward. If this development continues, APT’s worth is anticipated to apply swimsuit with a short lived downturn.

Supply: Buying and selling View

Supply: Buying and selling View

Then again, regardless of those signs, the marketplace stays in large part bullish. Each the CMF and RSI are nonetheless in certain territory, suggesting that the full development stays upward.

AMBCrypto’s research additionally known different supporting elements that point out APT is more likely to keep inside of bullish territory following this expected retracement.

Emerging open pastime and investment charges sign Aptos rally

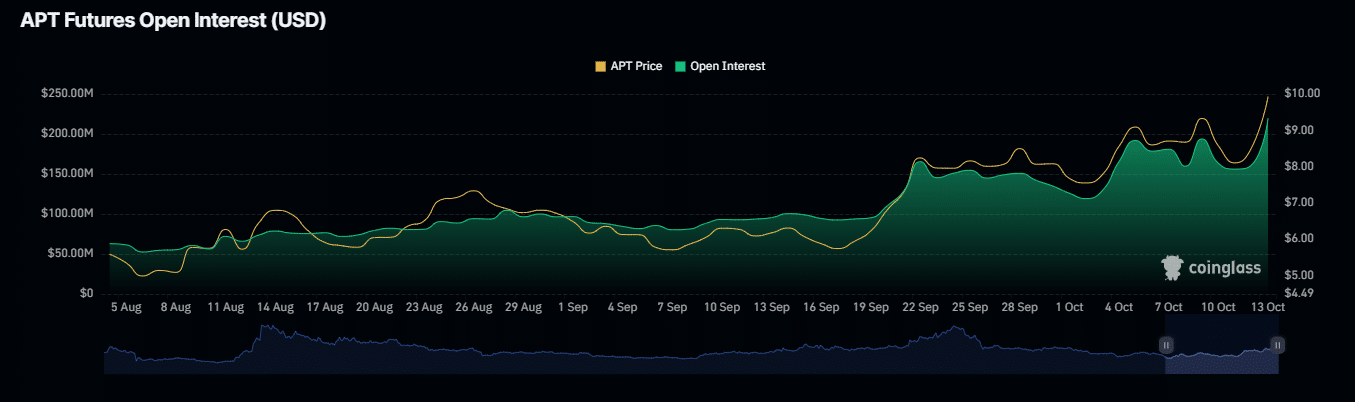

On the time of writing, APT is seeing certain momentum in each Open Pastime (OI) and Investment Charges, positioning it smartly for a possible rally and keeping up its bullish outlook.

Open Pastime, which measures the selection of unsettled spinoff contracts on APT, has proven an important build up.

Learn Aptos’ [APT] Worth Prediction 2024-25

Information from Coinglass signifies that OI has risen via 61.13% to $264.74 million, signaling that extra lengthy contracts were opened, with present ones being maintained.

Supply: Coinglass

Supply: Coinglass

In a similar fashion, the investment fee has noticed a notable build up, attaining 0.0148%. Which means lengthy positions are paying shorts to stability the futures and notice marketplace costs, additional supporting a bullish marketplace sentiment.

Subsequent: Why $2 is the important thing to POPCAT’s dominance over BONK

![Samsung launches cloud gaming for Galaxy gadgets, however it is not what you suppose [Gallery] Samsung launches cloud gaming for Galaxy gadgets, however it is not what you suppose [Gallery]](https://9to5google.com/wp-content/uploads/sites/4/2024/11/samsung-gaming-hub-cloud-1.jpg?quality=82&strip=all&w=1600)