Generative AI is producing giant passion amongst traders, and this ETF supplies quite a few trade publicity.

Hiking 467% over the last 3 years, Nvidia (NVDA 3.46%) inventory has skyrocketed as traders have raced to realize synthetic intelligence (AI) publicity. The ones taking a look so as to add AI publicity to their portfolios might really feel they have got neglected the boat on Nvidia inventory. Plus, they will really feel beaten through the number of different alternatives to believe.

However the Roundhill Generative AI & Generation ETF (CHAT 2.19%) has all the ones bases coated. Along with preserving a big place in Nvidia, the Roundhill Generative AI & Generation ETF supplies publicity to numerous different AI-focused firms that stand to get pleasure from enlargement in generative AI, system studying, and massive language fashions.

That is going to be giant

It wasn’t goodbye in the past that folks had little publicity to generative AI. This present day, it feels unavoidable.

And it is just about a simple task that its presence in our lives goes to proceed ramping upper. In reality, many pundits expect that it is going to boost up significantly. Industry intelligence company Markets and Markets initiatives the generative AI marketplace will constitute about $21 billion in 2024 and jump at a 37% compound annual enlargement fee (CAGR) thru 2030 when it’s going to achieve $137 billion.

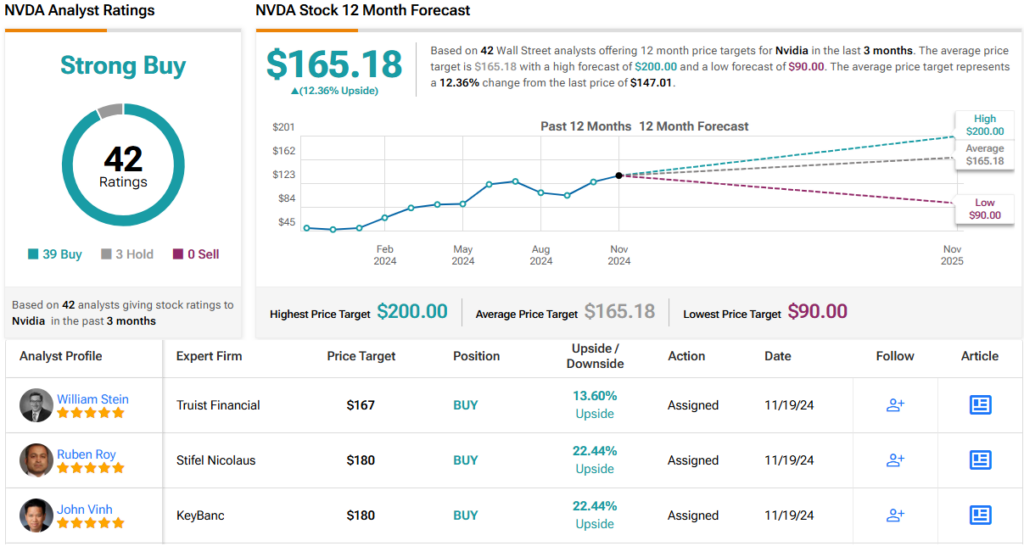

Desperate to get pleasure from the expansion in generative AI, traders have unsurprisingly raced to Nvidia inventory. A pace-setter in graphics processing devices (GPUs), Nvidia is helping information facilities maintain the super computing calls for that generative AI platforms position on them. With its contemporary upward thrust, on the other hand, Nvidia inventory is now buying and selling at 69 instances working money float (OCF), making it unappealing for the ones taking a look to steer clear of top valuations.

An AI ETF like no different

Branding the Roundhill Generative AI & Generation ETF because the “global’s first Generative AI ETF,” Roundhill Investments, the executive of the fund, cites analysis from Goldman Sachs that estimates AI can give a contribution to $7 trillion in financial enlargement international over the following 10 years.

With 46 holdings within the fund, the Roundhill Generative AI & Generation ETF provides traders large publicity to main firms that can force the development of generative AI. After all, Nvidia holds a outstanding place within the ETF with a ten.1% weighting, making it the biggest place, so the ones cautious of Nvidia inventory by itself will nonetheless have some publicity. Rounding out the top-three positions, Microsoft (NASDAQ: MSFT) and Alphabet (NASDAQ: GOOGL) are the second- and third-largest positions, respectively.

While Nvidia makes the GPUs that assist strengthen generative AI computing, Microsoft is growing AI answers corresponding to Copilot, an AI assistant that integrates with a number of Microsoft merchandise. The corporate’s achieve in AI extends additional with its multibillion-dollar funding in ChatGPT. In a similar fashion, Google is incorporating AI into choices corresponding to Gemini, a generative AI chatbot. And in exploring the opportunity of AI in quite a lot of programs, Google operates the DeepMind Lab the place its exploring the advance of man-made common intelligence.

Whilst Meta Platforms (NASDAQ: META), whose Llama 3 massive language type can be utilized to broaden generative AI programs, is the fifth-largest place within the Roundhill Generative AI & Generation ETF, it isn’t simplest Magnificent Seven shares that cling height spots; Adobe (NASDAQ: ADBE) is the fourth-largest place. A generative AI software, Adobe’s Firefly can be utilized throughout quite a lot of Adobe merchandise, corresponding to Specific, Photoshop, and Illustrator.

Is the Roundhill Generative AI & Generation best for you?

There is no denying that Nvidia inventory is very alluring at the moment making an allowance for the corporate’s place as a stalwart GPU developer, however it is hardly ever the one generative AI sport on the town. Buyers cognizant of this reality — and who’re in search of complete publicity to the trade — subsequently will need to pay specific consideration to the Roundhill Generative AI & Generation ETF, which supplies a novel alternative to realize vast publicity to generative AI. I do know I’m. This exchange-traded fund (ETF) has been on my watchlist for a number of months now, and I plan on beginning a place within the coming weeks to sit down within the area of interest of my portfolio carved out for enlargement investments.

Randi Zuckerberg, a former director of marketplace building and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Scott Levine has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Adobe, Alphabet, Goldman Sachs Team, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.