The Bitcoin 2024 convention driven BTC close to $70K once more.

Whales appear to have come to a standstill as bulls look ahead to BTC’s subsequent strikes with bated breath.

Bitcoin’s [BTC] dominance used to be emerging because the king coin kicked off the week with a powerful bullish bid, aiming for $70,000.

This bullish efficiency builds at the Bitcoin 2024 convention hype and politically charged pleasure that prevailed all the way through the weekend.

The Bitcoin 2024 convention had a momentous affect on call for, and particularly Bitcoin dominance.

The latter has been on an upward trajectory since mid-July, peaking at 56.76%, only a few issues shy from reaching a brand new 3-year prime.

Bitcoin dominance peaked at 57.03% in April 2024. The remaining time that it used to be that top used to be in April 2021.

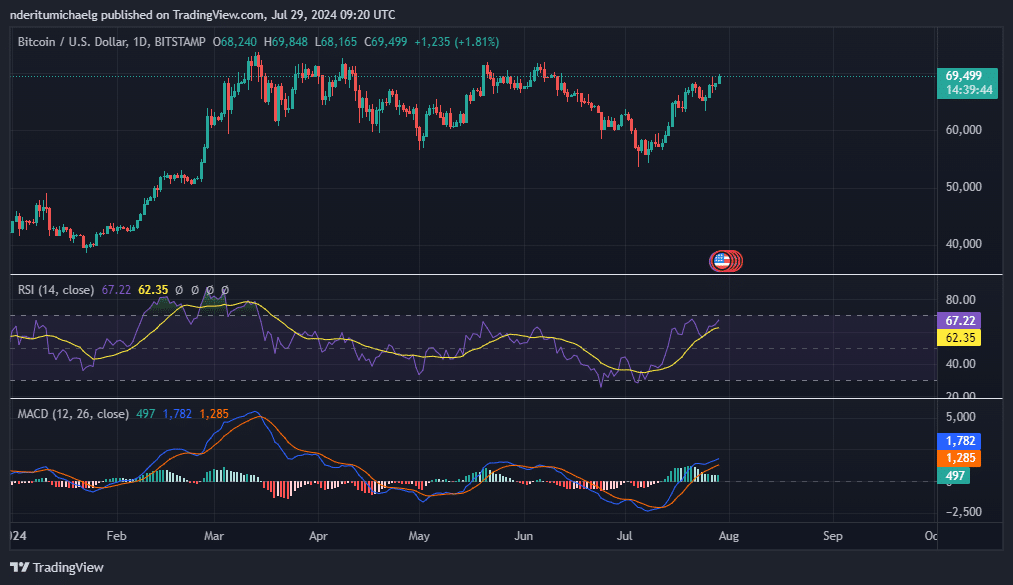

Supply: Tradingview

Supply: Tradingview

Will the FED’s upcoming announcement want Bitcoin dominance?

A big Federal Reserve announcement is simply days away, every other issue that might push Bitcoin dominance to new 2024 highs. The FED will announce its subsequent rate of interest determination at the thirty first of July.

The clicking time marketplace sentiment instructed that 96% of analysts anticipated rates of interest to stay unchanged in August.

Supply: Tradingeconomics.com

Supply: Tradingeconomics.com

Chance-on property like Bitcoin would enjoy a surge in call for if the FED have been to announce a price minimize. The FED’s announcement won’t have a lot of an affect on asset costs if charges stay unchained.

Marketplace sentiment is overwhelmingly in want of a price minimize by way of 25 BPS in September.

Extra marketplace self assurance?

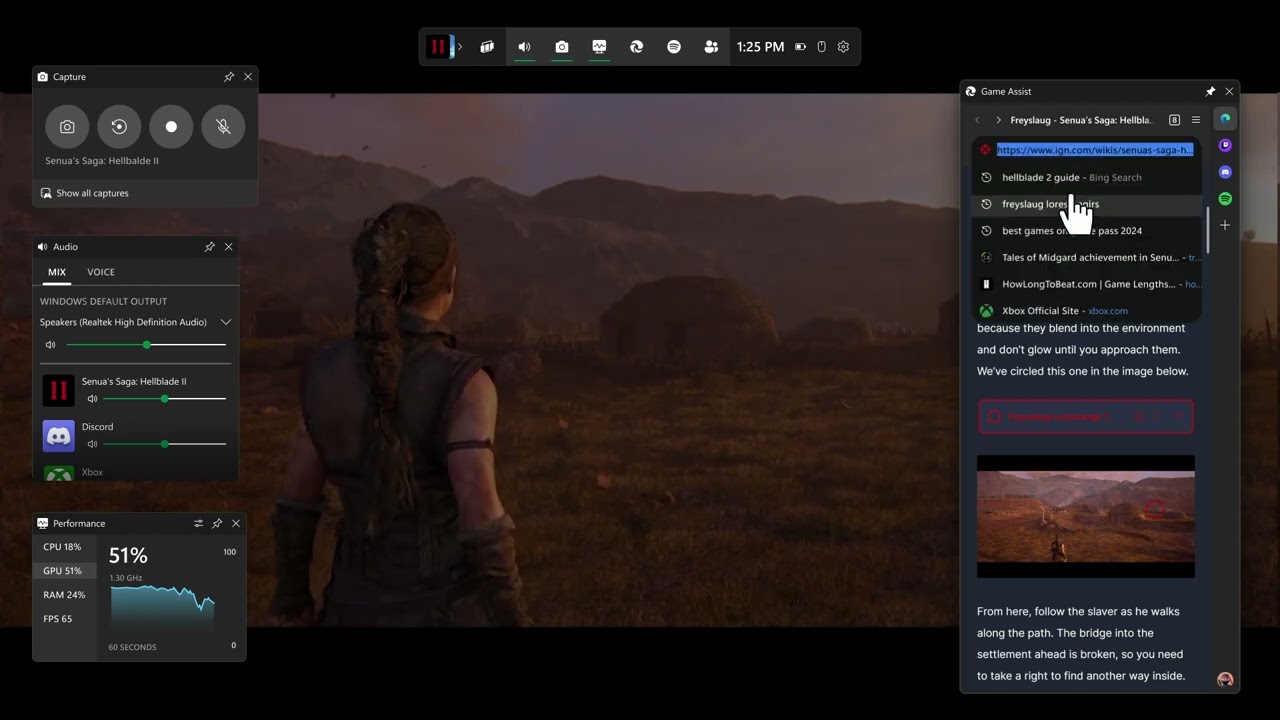

Bitcoin traded at $69,503 at press time, after a 1.81% rally within the remaining 24 hours. AMBCrypto is raring to peer if it may possibly drum up sufficient bullish self assurance to push above the $70,000 vary.

That is the most important value level as a result of BTC has been experiencing resistance and a resurgence of promote force above this zone since March.

Supply: Tradingview

Supply: Tradingview

At the technical aspect, a push above $70,000 will even topic BTC to overbought stipulations, as in keeping with the RSI. The MACD already instructed that bullish momentum used to be slowing down at press time.

Those observations, along the approaching resistance zone, signaled possible for a pullback, fueled by way of momentary profit-taking.

The long-term outlook remained bullish, then again, particularly after the Bitcoin convention. The joy across the match has drummed up extra self assurance in different markets.

For instance, Eastern company Metaplanet has reportedly bought Bitcoin price over 1 billion Yen.

Metaplex’s inventory has reportedly rallied by way of over 1,300% to this point this yr. A great deal of its inventory value good points passed off in July, as the corporate ramped up its Bitcoin purchases in July. At press time, it held 246 BTC.

Whilst this underscores some marketplace self assurance, Bitcoin’s talent to push above its present resistance zone is determined by the extent of call for that it may possibly maintain above the ones ranges.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

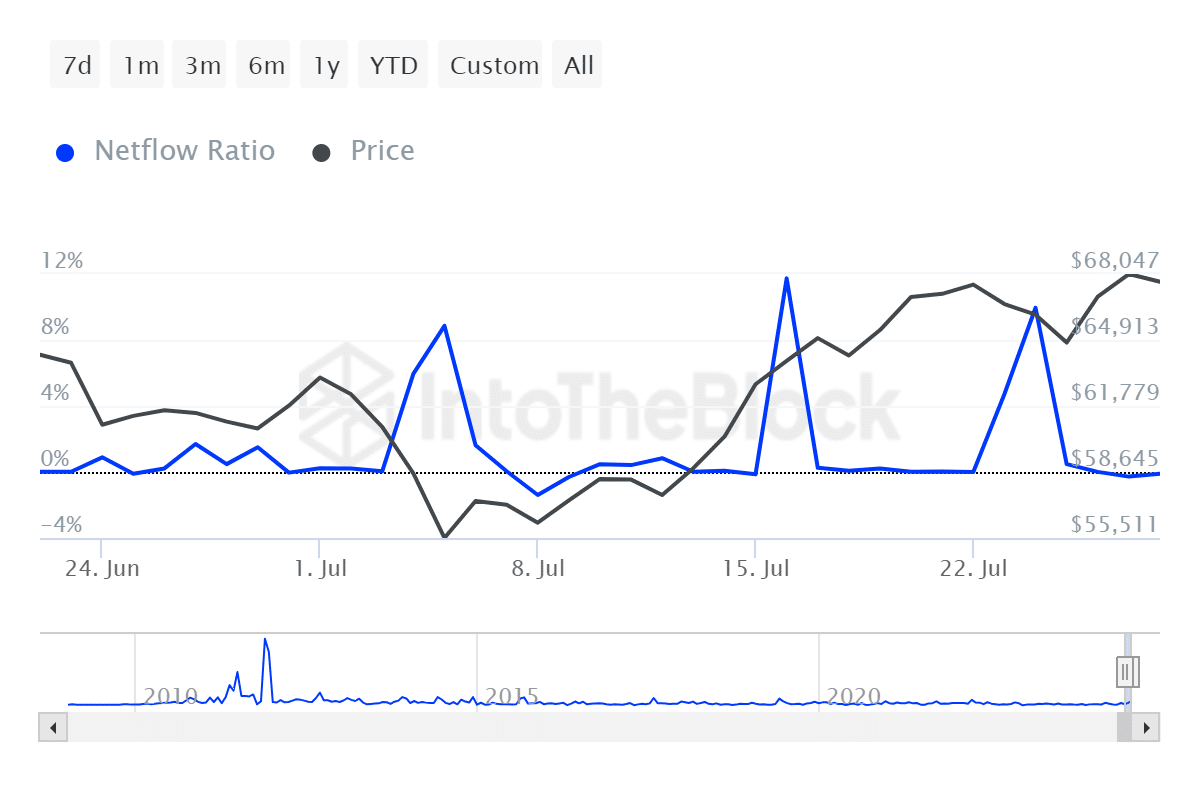

Bitcoin’s massive holder netflow to switch netflow ratio indicated that whales might not be shifting numerous their finances to this point.

AMBCrypto will stay tracking this indicator to evaluate the prospective flows that might affect Bitcoin dominance and worth in the following couple of days.

Supply: IntoTheBlock

Supply: IntoTheBlock