Chainlink breaks out with robust momentum.

Ancient correlation and incoming altseason to spur LINK’s bull run.

Chainlink [LINK] has not too long ago damaged via a an important resistance degree at $10.6 at the 4-hour time frame, reaching an outstanding 18.58% go back on funding.

This breakout used to be marked via robust momentum, with out a quick retest, signaling possible energy in the fee motion.

Supply: Ola Wealth/X

Supply: Ola Wealth/X

Then again, demanding situations stay within the mid-term downtrend that has persevered since March. The following vital resistance ranges to observe are at $13.1 and $16.8. The important thing query now’s whether or not this robust rally will proceed.

Weekly outlook

Over the last week, LINK/BTC has proven resilience, pushing in opposition to the $12 value degree. Then again, to care for this momentum, LINK wishes to damage during the 2100 sats degree.

If LINK can transparent this hurdle, it’ll get started following different DeFi tasks and goal the 4400 sats degree. The hot sweep of weekly liquidity additional helps the opportunity of an upward transfer.

Supply: TradingView

Supply: TradingView

Chainlink [LINK] seems to have finished a mini cycle, with a transparent weekly divergence between value motion and the RSI.

This divergence signifies that the present upward transfer may mark the start of a brand new LINK bull run. The truth that many altcoins are appearing an identical patterns provides additional self assurance to this expected upward pattern.

Supply: TradingView

Supply: TradingView

Incoming altseason

The wider altcoin marketplace is appearing indicators of repeating the patterns observed in 2017 and 2021, the place altcoins rallied strongly post-halving.

The marketplace cap of altcoins is recently in consolidation, very similar to the former cycles, which continuously preceded vital rallies.

Supply: TradingView

Supply: TradingView

This implies that an altseason may well be at the horizon, probably reaping benefits LINK in conjunction with different altcoins.

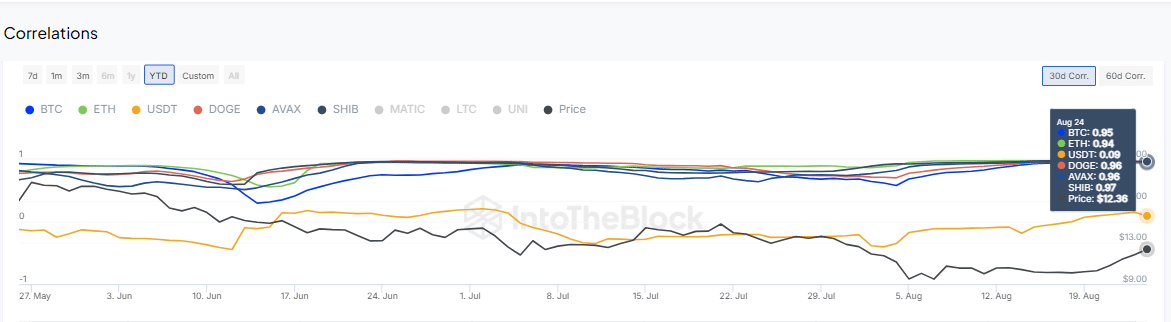

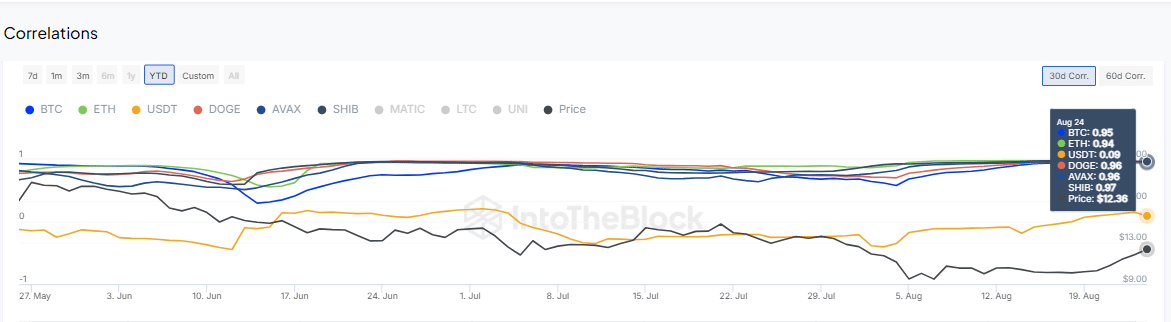

Ancient correlation

Chainlink’s correlation matrix finds a robust courting with main crypto property: 0.95 with Bitcoin, 0.94 with Ethereum, 0.96 with Dogecoin, and nil.97 with Shiba Inu.

Which means that an upward transfer in those property might be reflected via Chainlink. With the Federal Reserve anticipated to start up charge cuts in mid-September, resulting in a weaker US greenback, this state of affairs may additional bolster Chainlink’s value.

IntoTheBlock

IntoTheBlock

For the reason that the USD has a damaging correlation of 0.09 with Chainlink and different crypto property, a vulnerable greenback would most likely be bullish for LINK.

Is your portfolio inexperienced? Take a look at the LINK Benefit Calculator

With key resistance ranges being examined and powerful correlations with different main crypto property, the outlook for Chainlink seems sure.

The impending altseason and a possible weakening of the USD supply further fortify for a endured upward trajectory in LINK’s value.

Subsequent: Is Bitcoin a purchase as of late? Rainbow Chart says ‘nonetheless affordable’ whilst…

:max_bytes(150000):strip_icc()/GettyImages-2183848670-076b937f91864b9b8b394d0f50ec48f6.jpg)