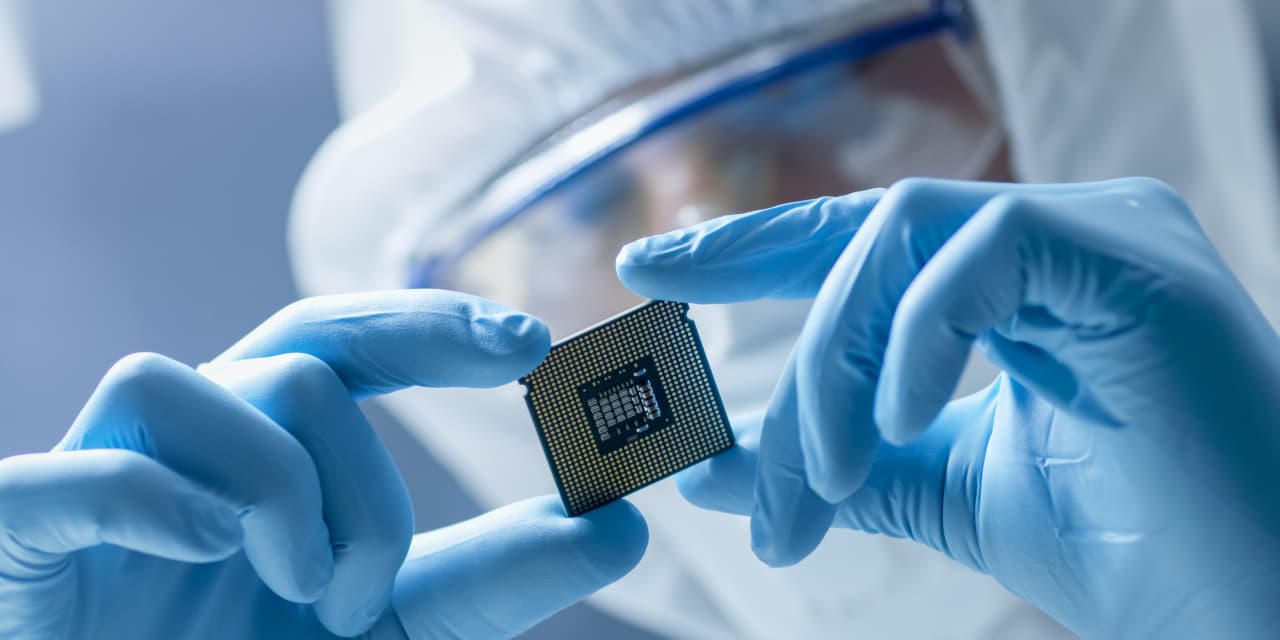

As Nvidia prepares to post its much-anticipated full-year effects this Wednesday, analysts at JPMorgan say VAT Crew, ASML Protecting, and ASM Global all be offering the most powerful potentialities for buyers looking for to money in on an upturn available in the market for microchips. JPMorgan analysts led by way of Sandeep Deshpande defined that whilst the hunch within the microchip marketplace is now appearing indicators of growth, sure segments of the marketplace — together with those who provide chips to the car and commercial sectors — are bettering extra slowly than others. The marketplace for reminiscence chips is, in the meantime, giving off indicators of a bumper restoration, with stock ranges for the microchips utilized in laptop garage gadgets lately sitting at less than moderate seasonal ranges, they stated in a be aware to shoppers that printed Monday.

As such, the ones Europe-based semiconductor corporations least uncovered to the automobiles and commercial sectors, that have the easiest publicity to the marketplace for reminiscence chips, are set to look the largest advantages within the close to time period, stated Deshpande and the workforce.

Swiss corporate VAT Crew

VACN

makes vacuum valves utilized in chip production, whilst Dutch corporations ASML Protecting

ASML

ASML

and ASM Global

ASM

each make the lithography machines used to fabricate semiconductors.

Stocks in all 3 Eu corporations are up considerably over the former three hundred and sixty five days — VAT has won 51%, ASML 43% and ASM 81%.

Particularly, all 3 Eu corporations are all all in favour of making the apparatus used to fabricate the complex microchips utilized in digital merchandise, together with smartphones and private computer systems. In JPMorgan’s view, this places them in an wonderful place to get pleasure from any restoration.

On the identical time, the ones corporations maximum uncovered to the car and tech industries, together with German company Infineon Applied sciences AG

IFX

and Swiss company STMicroelectronics

STM

,

are set to proceed buying and selling at subdued ranges — regardless of already being affordable — because the marketplace stays difficult, they warning.

Deshpande and the workforce famous that stock ranges for the chips used within the auto and commercial sectors lately take a seat at charges 38.7% upper than three-year seasonal averages within the fourth-quarter of 2023, marking a deterioration at the 31.1% charge within the 3rd quarter of 2023.

By contrast, stock ranges for reminiscence chips progressed considerably within the ultimate 3 months of 2023, having fallen from charges 19% above seasonal averages within the 3rd quarter to charges 1.7% underneath commonplace seasonal ranges on the finish of the fourth quarter of ultimate yr.

For reference, ASML Protecting, which was once up to now break up off from ASM Global in 1984 thru a three way partnership with Philips

PHIA

,

is lately the arena’s sole producer of the extraordinary ultraviolet lithography machines used to make the complex chips used within the AI trade.

ASM Global continues to design the wafer processing machines used to make microchips. VAT Crew produces vacuum valves which are had to manufacture top tech chips in sterile environments to verify they don’t seem to be uncovered to outdoor debris.

Nvidia

NVDA

,

the arena’s greatest chip fashion designer, will on Wednesday announce quarterly effects, which buyers are anticipated to pore over, looking for necessary clues at the well being of the worldwide chip marketplace amid a lot pleasure round a imaginable AI pushed increase.

Learn: Nvidia’s income file may kill the momentum riding U.S. shares upper, without reference to the way it seems.