3 Hours AgoPortfolio supervisor argues there isn’t a lot information to make stronger a shift in BOJ coverage The Financial institution of Japan caught to its ultra-loose financial coverage remaining 12 months, preserving rates of interest at -0.1% and status pat on its yield curve regulate coverage that assists in keeping the higher certain for 10-year Eastern executive bond yield at 1% as a reference.The central financial institution additionally stays cautious of unwinding its coverage stance, on fears that any untimely transfer may jeopardize contemporary nascent financial enhancements.Richard Kaye, portfolio supervisor at Comgest says, “I believe there is even an opportunity that we can no longer see elementary trade in financial coverage right here.”Kaye argues in opposition to what consensus expects will likely be a coverage unwind from the BOJ quickly, including “there is no longer that a lot drive to switch them. And once more, at the inflation tale, the theory may be very a lot Japan is all of sudden going to switch its quantitative stance, I don’t believe the knowledge helps that.”What buyers will now be specializing in will likely be the yearly spring salary negotiations in March, which is when the BOJ may most likely make adjustments, if any, to its coverage.”But when we all of sudden see a significant trade in wages, then we can see a significant trade in inflation readings, as a result of thus far wages are alright. There may be no longer that a lot drive to switch them,” Kaye says.— Shreyashi Sanyal5 Hours AgoChina’s December exports most sensible expectancies, however general business declines in 2023 China’s exports rose greater than anticipated in December, however did not offset an general decline in 2023, customs information confirmed Friday.Exports rose by way of 2.3% 12 months on 12 months in U.S. greenback phrases remaining month, greater than the 1.7% build up forecast by way of a Reuters ballot. Imports rose by way of 0.2% in December from a 12 months previous in U.S. greenback phrases, rather not up to the 0.3% build up anticipated the Reuters ballot.For the entire of 2023, exports fell 4.6% whilst imports dropped 5.5%, in line with customs information.Learn the total tale right here.— Evelyn Cheng6 Hours AgoChina CPI declines much less then anticipated, stocks opposite lossesShares in mainland China and Hong Kong reversed losses after China’s shopper worth index recorded a softer fall then anticipated in December.The Dangle Seng index rose 0.32%, whilst the CSI 300 was once up 0.21%, after each opening in damaging territory,The rustic recorded an inflation price of -0.3%, in comparison with -0.5% in November and likewise a softer fall in comparison with the 0.4% anticipated in a Reuters ballot.China’s manufacturer worth index — which measures the trade in the cost of items bought by way of producers — recorded a 2.7% fall year-on-year, softer than the three% decline in November.— Lim Hui Jie7 Hours AgoOil climbs over 2% after U.S. and U.Okay. moves on Houthi rebels in YemenOil costs rose after Britain and america performed army moves in opposition to goals in Houthi-controlled spaces of Yemen, U.S. officers stated, as tensions within the Pink Sea fastened.International benchmark Brent jumped 1.87% upper to $78.90 a barrel Friday Asia buying and selling hours, whilst the U.S. West Texas Intermediate futures climbed 2.05% to $73.49 in line with barrel.”Those focused moves are a transparent message that america and our companions won’t tolerate assaults on our group of workers or permit adverse actors to imperil freedom of navigation in one of the most international’s most crucial industrial routes,” U.S. President Joe Biden stated in a commentary Thursday night time. – Lee Ying Shan3 Hours AgoShares of Uniqlo’s dad or mum corporate spike virtually 7% after first quarter effects beat expectationsShares of Japan retail keeping corporate Speedy Retailing spiked virtually 7% after the corporate posted higher than anticipated first quarter effects. The corporate’s fiscal first quarter runs from September to November 2023.The corporate is the biggest inventory at the Nikkei 225 index, making up 10.45% of its weightage.Speedy Retailing’s number one subsidiary is clothes chain Uniqlo, but in addition has different manufacturers in its strong, comparable to cut price informal put on store GU.In an income unlock, the corporate stated it has posted a web benefit of 107.80 billion yen ($739.57 million), a 26.7% upward push in comparison with the similar duration a 12 months previous. General earnings was once up 13.2% 12 months on 12 months to 810.83 billion yen, pushed basically by way of higher gross sales in Uniqlo.8 Hours AgoCNBC Professional: TSMC and extra: Goldman Sachs loves those Asian tech shares, giving one 37% upsideMany buyers had been bullish on generation shares during the last few months, and Goldman Sachs isn’t any exception.The funding financial institution highlighted alternatives within the Asian tech {hardware} trade, bringing up “focal issues” for 2024, comparable to cyclical restoration, synthetic intelligence and the have an effect on of geopolitical stipulations, together with adjustments within the semiconductor provide chain.”Whilst we think an excessively modest cyclical restoration as an entire, we proceed to search for alternatives amongst person shares,” Goldman Sachs’ analysts, led by way of Daiki Takayama, wrote within the notice, naming buy-rated names, together with 4 conviction record shares to play the theme.The financial institution’s conviction record incorporates its most sensible buy-rated inventory concepts which can be anticipated to overcome the marketplace.learn— Amala Balakrishner8 Hours AgoCNBC Professional: Those Ecu shares are prone to outperform as soon as price cuts start, BofA saysInvestors are eagerly taking a look ahead to price cuts this 12 months — the U.S. Federal Reserve signaled no less than 3, which might finish an competitive hobby rate-hiking marketing campaign for the remaining couple of years.The query is when the primary of the velocity cuts will come.BofA created a display of which international corporations would possibly outperform as charges fall, and feature “no longer but rallied as strongly” as the typical ancient efficiency following the preliminary lower of the cycles.It additionally screened for corporations underneath situations comparable to whether or not the Fed cuts at a quicker or slower tempo than the Ecu Central Financial institution — and vice versa.CNBC Professional subscribers can learn extra right here.— Weizhen Tan19 Hours AgoCPI rises greater than anticipated in DecemberInflation rose at a greater-than-expected tempo in December.The patron worth index higher by way of 0.3% remaining month from November. Yr over 12 months, CPI was once up 3.4%. Economists polled by way of Dow Jones anticipated CPI to have risen 0.2% month over month in December and three.2% 12 months over 12 months.Alternatively, So-called core CPI, which strips out meals and effort costs, was once in line pointing to a conceivable easing of pricing pressures.— Fred Imbert17 Hours AgoFed nonetheless able to chop even with top inflation, economist McCulley saysSlightly warmer than anticipated inflation information from December is not likely to knock the Federal Reserve off path from chopping rates of interest later this 12 months, economist Paul McCulley stated Thursday.Even with the patron worth index appearing that that inflation rose 3.4% from a 12 months in the past, McCulley contended that the Fed’s coverage “pivot is unambiguously in.””The next step is a lower, and it’ll be a sequence of cuts to take us again to impartial. That is the theme the marketplace is operating on. I believe it is the proper theme and the day’s information does not trade that truly in any respect,” McCulley stated all over an interview on CNBC’s “Squawk at the Boulevard.” Nonetheless, shares fell following the inflation information.”It is noisy within the information, it is noisy out there, however we are essentially in a comfortable touchdown with a pivot already in rhetorically and we are simply looking forward to it come actually, timing, tempo and magnitude,” McCulley added.—Jeff Cox13 Hours AgoBitcoin miners tumble in afternoon tradingBitcoin miners gave again previous features as the cost of the cryptocurrency retreated in unstable buying and selling, after the Securities and Trade Fee’s approval of the primary U.S. spot bitcoin ETFs, which hit the marketplace Thursday.The 2 greatest mining shares, Marathon Virtual and Rise up Platforms each and every misplaced greater than 15%. Wall Boulevard favorites Iris Power and CleanSpark fell 9% and seven%, respectively. Buyers have been taking earnings after the cost of bitcoin in short spiked to above $49,000 for the primary time since December 2021. It has pulled again since to the $46,000 stage.Miners have been one of the crucial greatest gainers within the inventory marketplace in 2023. Marathon completed this 12 months upper by way of virtually 590%, whilst Rise up rose greater than 350%. CleanSpark and Iris Power posted features of greater than 400%. — Tanaya Macheel13 Hours AgoFAA investigating Boeing for panel blow outThe Federal Aviation Management stated Thursday it has opened a probe on Boeing after a panel at the facet of certainly one of its Boeing 737 Max 9 planes blew off midflight on Saturday. The investigation will dig into whether or not Boeing “failed to verify finished merchandise conformed to its authorized design and have been in a situation for protected operation in compliance with FAA laws,” the FAA stated. Stocks of Boeing slipped just about 2% in noon buying and selling.— Leslie Josephs, Michelle Fox

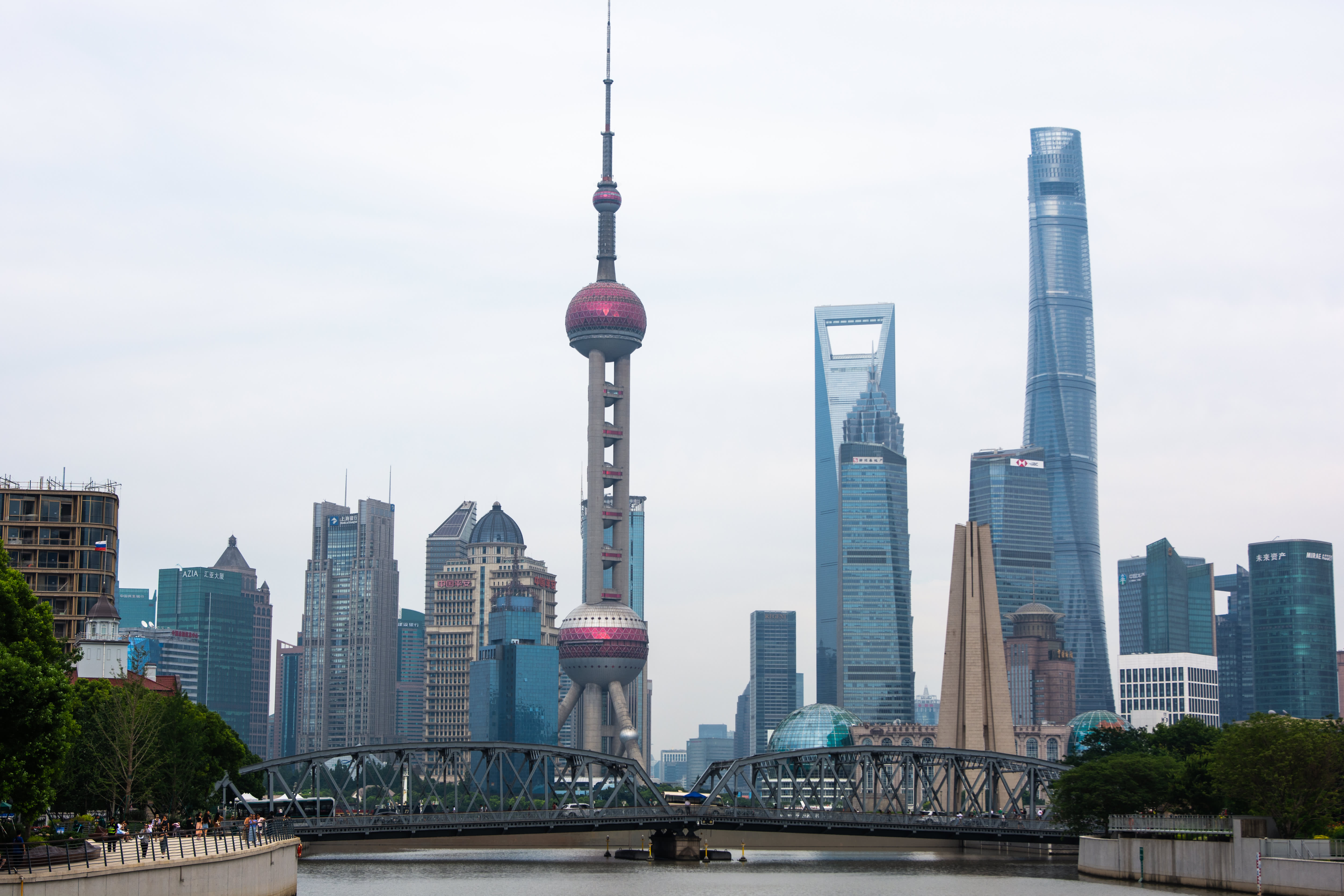

Asia markets fall as China annual exports drop, Japan dollars the rage to increase report rally