2 Hours AgoMicrosoft opens first regional knowledge centre in ThailandTech massive Microsoft introduced it’ll open its first regional knowledge heart in Thailand.The corporate mentioned it’ll additionally construct new cloud and AI infrastructure in Thailand, in addition to supply AI skilling alternatives for over 100,000 peopleMicrosoft mentioned the information heart area will extend the provision of its hyperscale cloud services and products, “facilitating enterprise-grade reliability, efficiency, and compliance with knowledge residency and privateness requirements.”— Lim Hui Jie3 Hours AgoMitsui’s full-year benefit falls 6%, stocks climb as $1.26 billion buyback announcedJapanese buying and selling area Mitsui and Co reported a 6.4% fall in benefit to at least one.08 trillion yen ($6.84 billion) for its 2023 monetary yr ended March 31.Benefit ahead of tax got here in at 1.3 trillion yen, down 6.7% year-on-year, whilst earnings dipped 6.9% to 13.32 trillion yen in comparison to the similar duration ultimate yr.In spite of the poorer effects, stocks of the corporate climbed 1.23% because it additionally introduced a 200 billion yen proportion buyback from Might 2 to Sept. 20.Mitsui will purchase again as much as 40 million stocks, or 80 million after a proportion break up on July 1.5 Hours AgoOil on tempo for 3 instantly days of losses amid emerging stock and ceasefire hopesOil costs have fallen for a 3rd instantly day as U.S. inventories upward push in addition to optimism for a ceasefire settlement within the Heart East.Brent contracts slid 0.88% to $85.57 in step with barrel, whilst U.S. West Texas Intermediate crude noticed a bigger lack of 1.03% to $81.09 in step with barrel.Reuters reported that U.S. crude oil inventories swelled ultimate week through 4.906 million barrels, whilst gas and distillate stockpiles fell, in line with marketplace resources bringing up American Petroleum Institute figures on Tuesday.— Lim Hui Jie6 Hours AgoMoney marketplace knowledge means that yen strengthening could have been intervention: Reuters The surprising strengthening of the yen on Monday is most probably because of intervention through Jap government, Reuters reported, bringing up cash marketplace knowledge from the Financial institution of Japan.Cash marketplace knowledge printed that the central financial institution’s projection for Wednesday’s cash marketplace prerequisites indicated a 7.56 trillion yen ($47.91 billion) internet receipt of budget.Reuters mentioned this when put next with a 2.05 billion to two.30 billion yen estimate from cash marketplace brokerages that excludes intervention, including that forex trades take two days to settle.On Monday, the yen weakened to a 34-year low in opposition to the buck, hitting 160.03 ahead of strengthening to about 155 within the area of a couple of hours.7 Hours AgoSouth Korea’s exports put up sharp build up in April, beats expectationsSouth Korea posted a 13.8% build up in exports in April, a pointy build up in comparison to the three.1% upward push in March, in line with initial estimates through the rustic’s customs carrier.The upward thrust additionally beat the 13.7% build up anticipated through economists polled through Reuters.Imports to South Korea climbed 5.4%, not up to the 6.2% upward push anticipated and a reversal from the 12.3% fall in March.As such, the rustic’s industry steadiness narrowed to $1.53 billion, down from the $4.29 billion recorded in March.— Lim Hui Jie8 Hours AgoCNBC Professional: Citi names 3 biotech shares to play a rising $2.9 billion alternative — giving one about 50% upsideThe outlook is beginning to glance brilliant for biotech shares, in accordance to a couple.With markets now anticipating the primary price minimize to be in September fairly than June or July, as prior to now concept, biotech shares may begin to do neatly.Biotech encompasses many alternative spaces, however Citi has recognized one with a $2.9 billion marketplace — which it says is ready for much more expansion. In step with Citi, the marketplace for it’s set to develop through mid-single digit over the following 5 years.CNBC Professional subscribers can learn extra right here.— Weizhen Tan8 Hours AgoCNBC Professional: Most effective 2 shares in Europe have crushed estimates for five quarters and rallied every timeOnly two Ecu shares have undoubtedly shocked markets each quarter for the previous 5 quarters, in line with research through CNBC Professional.CNBC Professional screened for Stoxx 600 shares that document EPS figures and feature analysts’ estimates to be had on FactSet. One of the crucial shares stood out for a number of massive proportion worth jumps following quarterly profits releases. Maximum not too long ago, the corporate beat profits estimates through 6.1% and stocks rallied through greater than 8% within the following consultation. In a similar way, the inventory rallied through 12.8% in one consultation 4 quarters in the past.CNCB Professional subscribers can learn extra concerning the shares right here.— Ganesh Rao12 Hours AgoBitcoin in short dips below $60,000, slides to worst month since 2022Bitcoin persevered its month-long slide to near out April, falling 4% and at one level buying and selling slightly below the $60,000 degree.The flagship cryptocurrency is on tempo to finish the month down 15% and put up its first damaging month prior to now 8. It could be its worst month since November 2022, when FTX collapsed. It is nonetheless up 43% for 2024.See Chart…Bitcoin (BTC) during the last monthStocks whose efficiency is tied to the cost of bitcoin tumbled with the cryptocurrency. Crypto change Coinbase fell 6%, whilst MicroStrategy misplaced 15%. The device corporate and self-described Bitcoin construction corporate additionally reported a loss for the primary quarter.Within the mining sector, Marathon Virtual dropped 10.5%, whilst Revolt Platforms misplaced 8.5%. IREN and CleanSpark had been every decrease through 7%. For extra on what is in retailer for bitcoin within the month forward, learn our funding outlook right here.— Tanaya Macheel17 Hours AgoConsumer sentiment measure hits lowest degree since July 2022People store on the Macy’s retailer on Usher in Sq. in New York Town.Michael M. Santiago | Getty Pictures Information | Getty ImagesConsumer self belief hit its lowest degree since mid-2022 in March as fears grew over employment and inflation, the Convention Board reported Tuesday.The board’s primary index registered a studying of 97, underneath the downwardly revised 103.1 in March and lacking the Dow Jones consensus estimate of 103.5. This used to be the bottom degree for the index since July 2022, although board officers mentioned their measure of present prerequisites continues to be at a somewhat wholesome degree and the headline index has been in a “reasonably slim vary” for greater than two years.Nonetheless, there have been issues about the place issues are headed. Respondents solutions mirrored that “increased worth ranges, particularly for meals and gasoline, ruled shopper’s issues, with politics and world conflicts as far-off runners-up,” mentioned Dana M. Peterson, the board’s leader economist.—Jeff Cox19 Hours AgoEmployment reimbursement measure higher greater than anticipated in Q1Total reimbursement prices for employees rose through greater than anticipated within the first quarter, offering some other signal that inflation pressures aren’t going away.The employment price index higher 1.2% for the duration, sooner than the 0.9% within the fourth quarter of 2023 and better than the Dow Jones estimate for 1%, the Exertions Division reported Tuesday. The index is watched through Federal Reserve officers as an indication of underlying inflation.On a yr over yr foundation, the index for civilian staff rose 4.2% after having higher 4.8% for a similar duration in 2023.—Jeff Cox

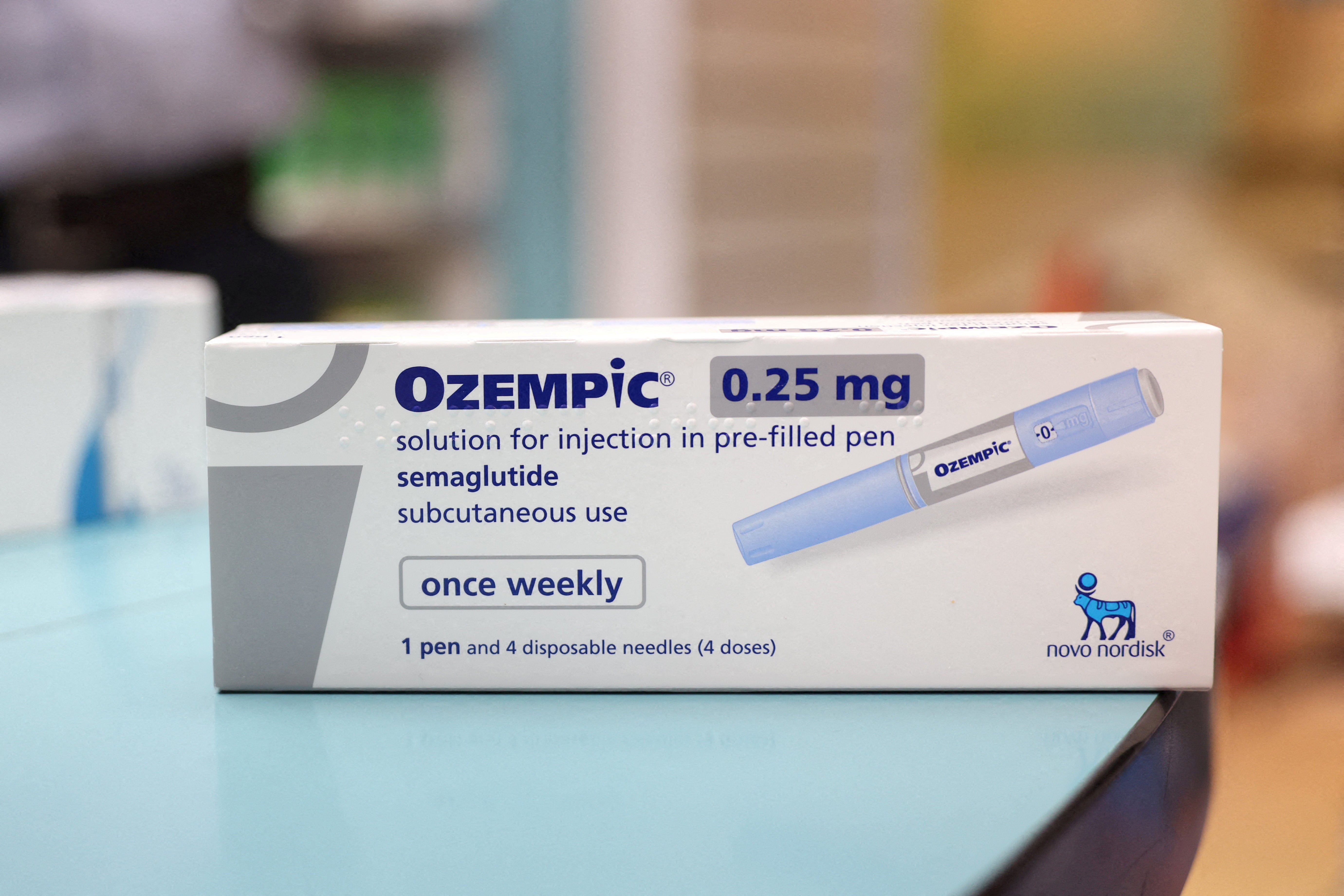

Australia and Japan markets slip as Fed choice looms, maximum Asian markets closed