In spite of the cost drop, bearish sentiment round AVAX greater.

In case of a persisted bull run, AVAX may reclaim $32 quickly.

Whilst the marketplace situation remained slow, Avalanche [AVAX] showcased promising efficiency. If truth be told, AVAX used to be the highest performer with regards to value positive aspects within the closing 24 hours a few of the best 20 cryptos through marketplace capitalization.

Let’s have a better have a look at AVAX’s state to look the place it will succeed in if the bull pattern continues.

Avalanche beats Bitcoin, Ethereum

CoinMarketCap’s knowledge printed that whilst typo cash like Bitcoin and Ethereum witnessed slight upticks, AVAX bulls driven the token’s value up through greater than 6% within the closing 24 hours.

On the time of writing, Avalanche used to be buying and selling at $23.03 with a marketplace capitalization of over $9.33 billion, making it the twelfth biggest crypto.

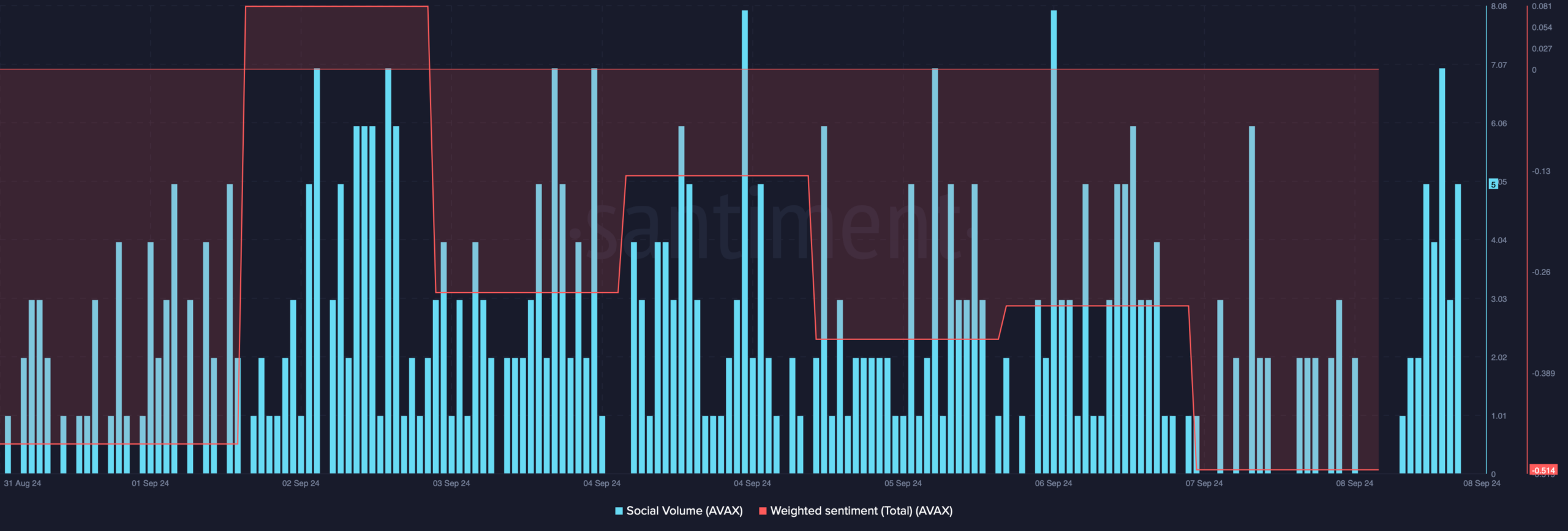

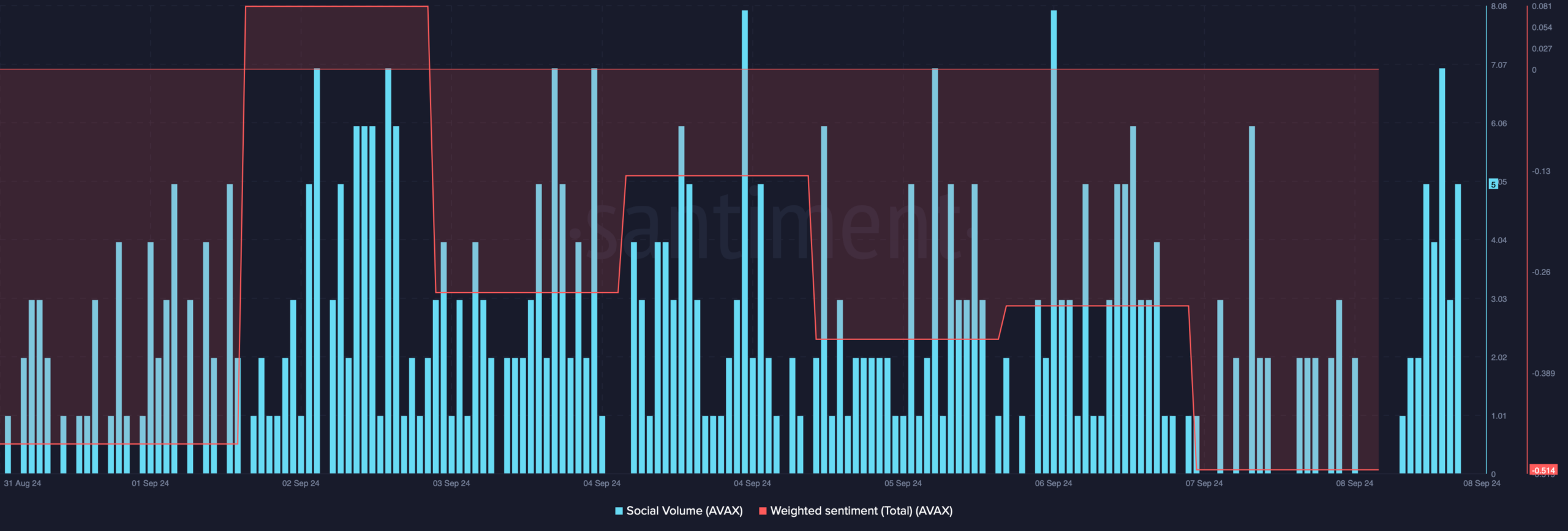

On the other hand, it used to be sudden to notice that the cost uptick didn’t fire up bullish sentiment available in the market. AMBCrypto’s research of Santiment’s knowledge printed that AVAX’s weighted sentiment dropped.

This indicated that bearish sentiment across the token greater. However its social quantity remained prime, reflecting the token’s recognition within the crypto area.

Supply: Santiment

Supply: Santiment

Nevertheless, long-term traders’ self assurance in AVAX did build up over the previous couple of weeks.

As according to IntoTheBlock’s knowledge, the choice of AVAX holders (addresses retaining an asset for greater than 1 12 months) exceeded the choice of AVAX cruisers (addresses retaining an asset for 1-365 days).

This indicated that long-term holders had been anticipating the token’s value to upward push additional within the coming weeks or months.

Supply: IntoTheBlock

Supply: IntoTheBlock

Will AVAX care for its bullish momentum?

AMBCrypto then deliberate to evaluate Avalanche’s on-chain metrics to look whether or not they trace at a persisted value build up.

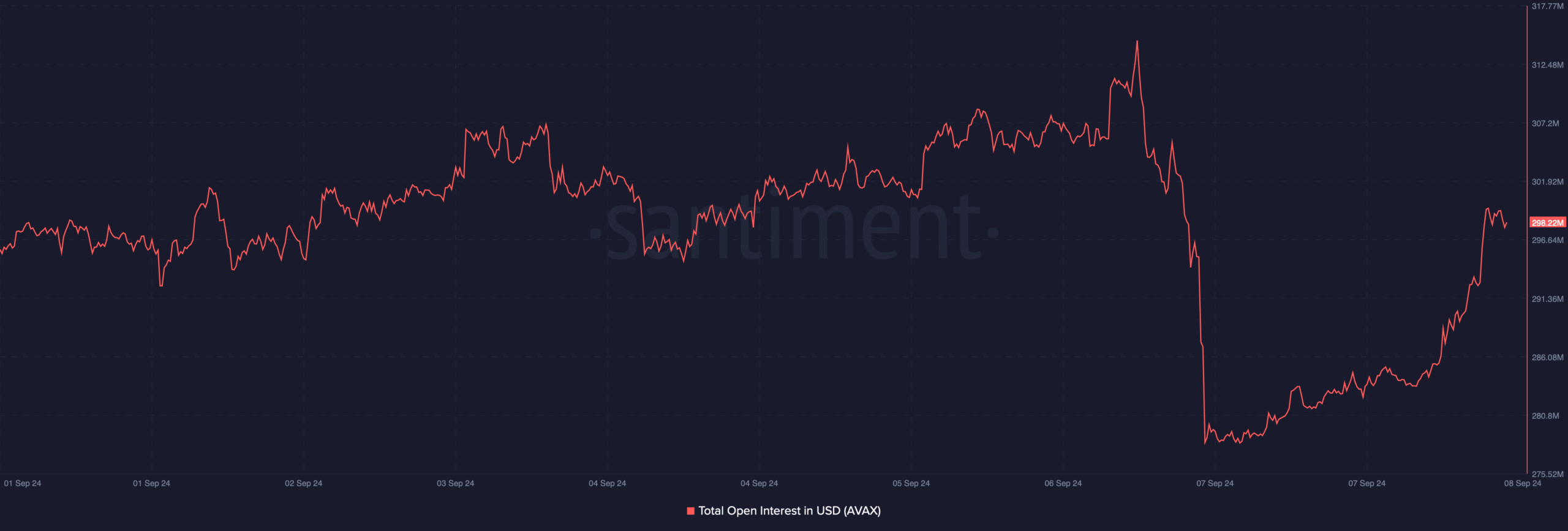

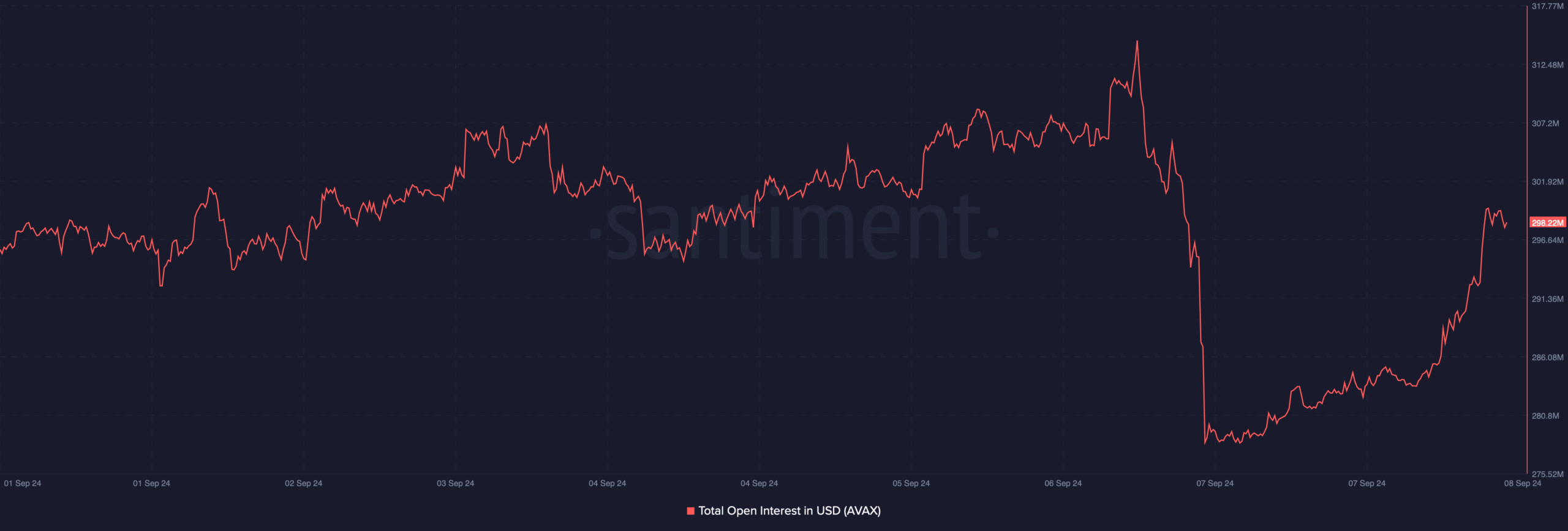

As according to our research, after a decline, AVAX’s open passion began to extend together with its value. This prompt that the probabilities of the bull rally proceeding had been prime.

Supply: Santiment

Supply: Santiment

Aside from that, we additionally discovered that promoting power at the token declined. In step with our have a look at DeFiLlama’s knowledge, AVAX’s netflows dropped to -$2.47 million at the seventh of September.

For starters, a unfavourable newflow signifies a upward push in purchasing power, which may also be regarded as a bullish sign.

Supply: DeFiLlama

Supply: DeFiLlama

On the other hand, the whales weren’t a lot energetic prior to now few hours when AVAX’s value greater. A have a look at Hyblock Capital’s knowledge printed that Avalanche’s whale vs retail delta dropped from greater than 60 to 44.

A decline within the metric supposed that retail traders had been having extra publicity available in the market than whales.

Supply: Hyblock Capital

Supply: Hyblock Capital

Is your portfolio inexperienced? Take a look at the Avalanche Benefit Calculator

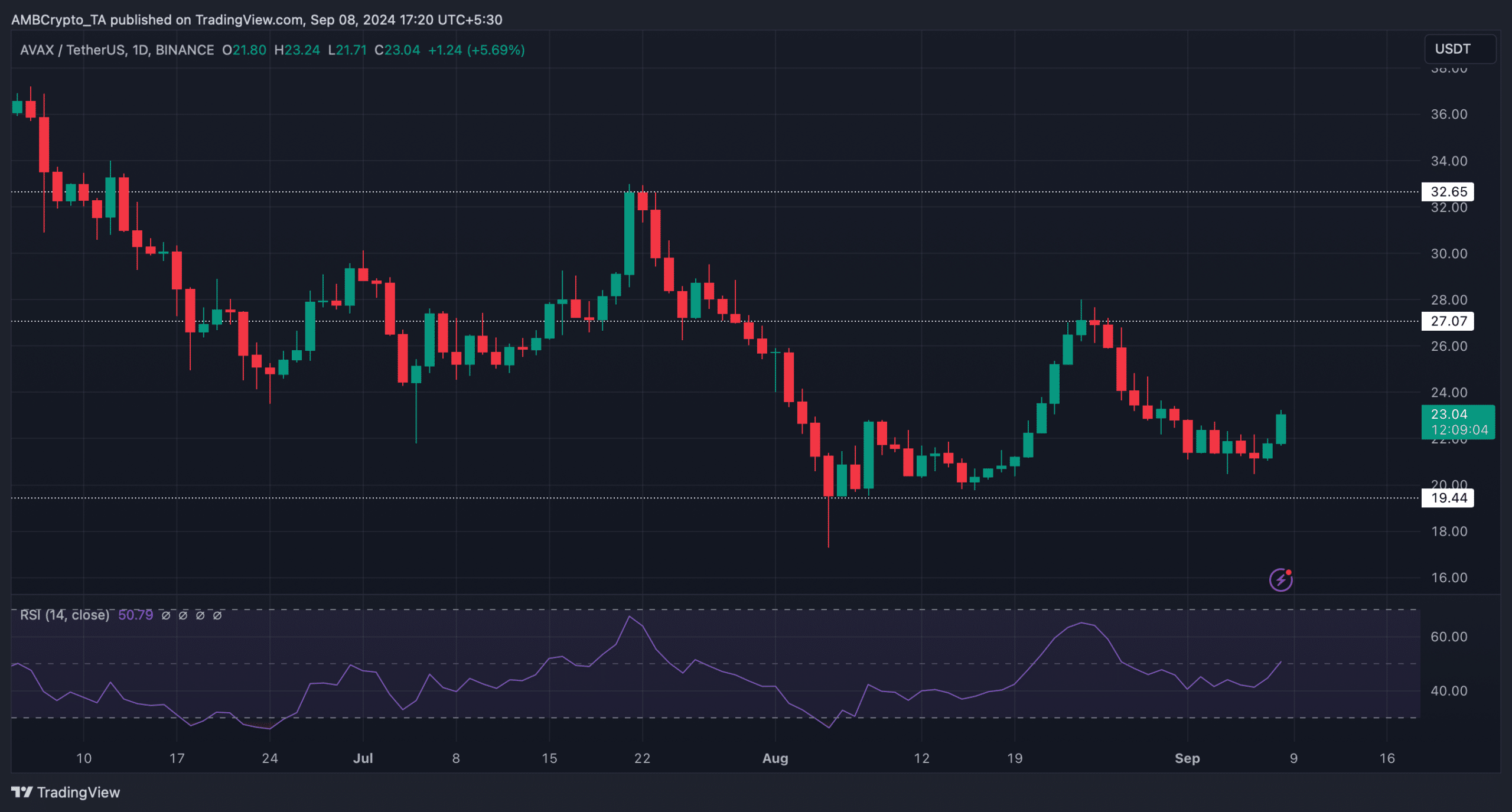

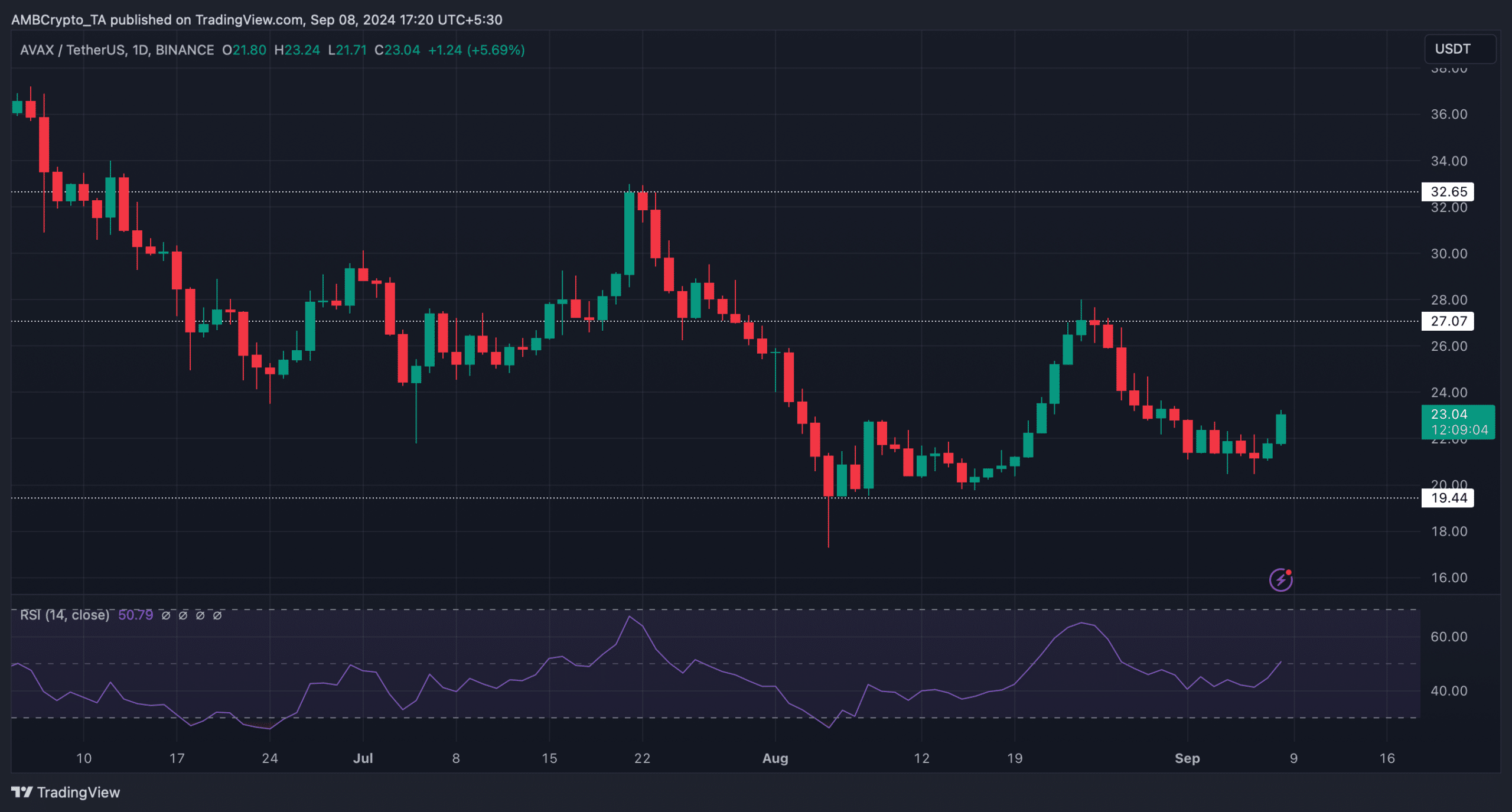

Nevertheless, the technical indicator Relative Power Index (RSI) registered a upward push. This indicated that AVAX bulls may be able to maintain the upward momentum and push the token’s value additional up.

If that occurs, then AVAX may first goal $27 ahead of it eyes $32. However within the tournament of a bearish pattern reversal, AVAX may drop to $19.4.

Supply: TradingView

Supply: TradingView

Earlier: Gold or Bitcoin? Peter Schiff, Jack Mallers debate which is ‘higher cash’

Subsequent: Can Toncoin climb again to the highest 10? Examining TON’s downtrend