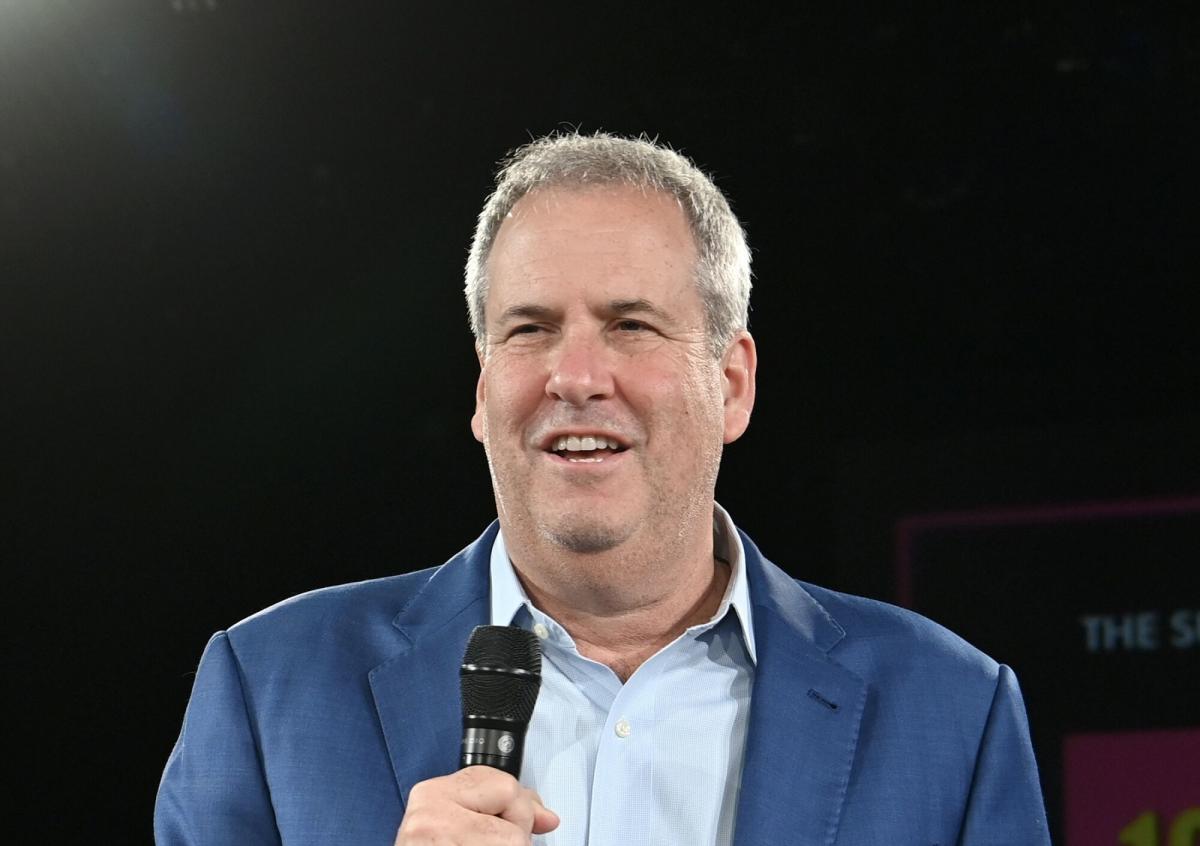

(Bloomberg) — Bryant Riley, the co-founder and biggest shareholder of B. Riley Monetary Inc., informally presented to shop for the stocks of the embattled funding company he doesn’t already personal.Maximum Learn from BloombergRiley is keen to shop for the inventory at $7 a proportion, in step with a regulatory submitting Friday. Whilst that represents a nearly 40% top class to Thursday’s remaining worth, it’s a long way from the kind of $50 that the Los Angeles-based brokerage and funding company was once buying and selling at a 12 months in the past.The stocks rose 27% to $6.39 at 9:56 a.m. in New York, pegging the corporate’s marketplace worth at about $193 million.Riley defined prerequisites of a possible bid in a letter to the board, noting that it “does now not represent an be offering or proposal able to acceptance and is also withdrawn at any time.” He received’t continue until it’s licensed by way of impartial administrators and a majority of stocks he doesn’t already keep an eye on, Riley wrote.The transaction can be financed with debt, and most likely fairness “from third-party capital suppliers with whom I’ve deep and long-standing relationships,” Riley wrote.The transfer comes simply days after the corporate suspended its dividend, introduced its biggest-ever quarterly loss and showed the USA Securities and Trade Fee is investigating the trade. That despatched B. Riley’s stocks right into a tailspin this week.“I wish to make it transparent that I plan on proceeding to file financials to the SEC and our bonds and preferreds will proceed to be publicly traded,” Riley mentioned in his letter to the board. “It’s conceivable that I can proceed to record on a secondary alternate if there are shareholders that want to take part on this transaction.”Federal regulators are investigating whether or not B. Riley adequately disclosed the hazards embedded in a few of its property, Bloomberg Information has reported. The company may be in quest of knowledge at the interactions between Bryant Riley and longtime trade spouse Brian Kahn, the previous leader government of Franchise Staff Inc., folks aware of the topic mentioned.Riley informed buyers all over an Aug. 12 convention name that he and the corporate won subpoenas from the SEC in quest of details about B. Riley’s dealings with Kahn. The latter has confronted controversy over his alleged position in occasions that led as much as the cave in of a hedge fund he prompt, Prophecy Asset Control. Kahn insists he hasn’t completed anything else fallacious, and B. Riley has mentioned it didn’t have anything else to do with Kahn’s actions at Prophecy.Tale continues“We’re responding to the subpoenas and are totally cooperating with the SEC,” Riley mentioned on the time. “We’re assured that the SEC will achieve the similar conclusion that our personal inside investigation, with the help of two separate legislation corporations, did – that we had no involvement with or wisdom of any alleged misconduct regarding Brian Kahn or his associates.”Riley has a private stake in his bid’s consequence, score as the most important holder with about 24% of the average stocks, and he’s pledged a lot of it to protected a mortgage. Filings display he took out a mortgage in 2019 from Axos Financial institution during which he used 4,389,553 stocks as collateral. A plunging inventory worth can cause a collateral name on this sort of mortgage, doubtlessly forcing the borrower to promote stocks at a deep bargain.Previous this week, an Axos spokesperson mentioned Riley’s mortgage is secured by way of a couple of collateral sorts along with inventory. “This collateral, as opposed to B. Riley inventory, is enough to protected a majority of the underlying mortgage,” the spokesperson mentioned.Riley additionally misplaced a great deal of his source of revenue when the corporate unnoticed its quarterly dividend, which was once $1 a proportion as lately as November. It was once therefore lower in part as B. Riley’s troubles fixed.(Updates with inventory response and mortgage secured by way of inventory, beginning within the 0.33 paragraph)Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

B. Riley Founder Provides to Purchase Remainder of Embattled Corporate