Barry Naughton, the So Kwan Lok Chair of Chinese language Global Affairs at UC San Diego, is among the international’s main professionals on China’s economic system and its transformation during the last part century. His textbook The Chinese language Economic system: Transitions and Enlargement, has lengthy been a must-read for college students of China; extra not too long ago he has coined the time period ‘Grand Steering’ to explain how Xi Jinping’s executive is attempting to form the rustic’s construction. On this evenly edited transcript of a contemporary interview, we mentioned Beijing’s present stimulus efforts sooner than occurring to discuss the strengths and weaknesses of Xi’s imaginative and prescient for China.

Barry Naughton.

Barry Naughton.

Representation via Lauren Crow

Q: We’re talking after an autumn right through which Beijing has introduced quite a lot of stimulus measures, and simply after the Central Financial Paintings Convention the place they mentioned looser coverage to reinforce the economic system subsequent yr. How do you assess the motion they’ve taken?

A: Obviously, the December Financial Paintings Convention represents the end result of a coverage flip that dates again a few months. It places considerably extra pressure on expanding mixture call for, and particularly intake. It’s a very powerful shift, but it surely comes within the context of inauspicious financial demanding situations that they’ve in point of fact best begun to grapple with. I’d have a look at this extra as a essential precondition for placing in combination an efficient set of insurance policies, reasonably than the real insurance policies wanted themselves. We will have to wait and spot in the event that they put extra meat at the bones this time.

There’s been various grievance of Beijing’s financial coverage lately, and alarm about whether or not China is getting into a length of so-called ‘Japanification’, the place it reviews years of gradual enlargement. How do you assume we will have to represent the ‘Xi Jinping economic system’ presently?

BIO AT A GLANCE

BIRTH YEAR

1951

BIRTHPLACE

Chicago, USA

CURRENT POSITION

So Kwanlok Professor on the Faculty of International Coverage and Technique on the College of California, San Diego

We unquestionably want to ask what Xi Jinping is attempting to succeed in along with his financial coverage. Xi Jinping most likely feels that the economic system’s efficiency, on the subject of his wishes and calls for, is in reality beautiful just right.

In fact, we don’t know evidently what is going on in Xi Jinping’s thoughts. However I feel we will be able to represent his manner as this: ‘Billions for tech, however no longer one cent for bailouts.’

Now, that’s oversimplified. Nevertheless it captures two components of what Xi Jinping desires. The primary is, excessive tech and safe construction, or what Xi would name top of the range enlargement. And the opposite is that he’s very averse to bailing out failing companies or failing native governments, even if they may probably be put again on their ft with somewhat of a monetary serving to hand.

MISCELLANEA

BEST BOOKS OF 2024

The Blue Device: How the Ocean Works, via Helen Czerski, and A Swim in a Pond within the Rain, via George Saunders

MOST ADMIRED

The ones individuals who take a look at to stay with their beliefs in an excessively advanced and imperfect international.

Xi Jinping has necessarily imposed those constraints at the economic system: That is the framework inside of which coverage making has to happen. Those constraints provide an explanation for so much about what’s occurring, and why they haven’t completed issues that outdoor economists could be urging.

The place does this come from on the subject of Xi Jinping’s political and financial philosophy? Why does he need to steer China on this path?

In some senses, it’s very herbal. Xi has, from an early degree of his management, insisted that China’s no longer simply on the lookout for GDP enlargement. They’re on the lookout for enlargement and safety; later, he added that they’re on the lookout for top of the range enlargement. They have got a collection of developmental desirables which can be somewhat other from simply maximizing GDP.

The humorous factor is that there’s an extended checklist of those desirables. There’s in reality a venture on the Nationwide Bureau of Statistics, in step with Xi Jinping’s directives, to measure how top of the range China’s enlargement is on a yr to yr foundation. They have got arrange indices for environment friendly, leading edge, harmonious, inexperienced, open and inclusive enlargement. And also you’ll feel free to understand that, in line with the NBS, China’s city construction was once of a 1.3 p.c upper high quality in 2023 than it was once in 2022.

So there are a large number of issues that Xi Jinping is looking for. However after all, amongst the ones, via a long way an important is excessive era construction — and the corresponding construction of monetary, strategic and clinical self-sufficiency that permits China to be a world energy, unconstrained via what he sees as opposed powers, together with america.

Xi Jinping discusses top of the range construction right through the 20 th Nationwide Congress, October 16, 2022. Credit score: CCTV

In some way, that implies that Xi Jinping doesn’t in point of fact care about what Chinese language other people need to purchase and need to make, as a result of that may be simply atypical GDP. He’s saying that there’s one thing extra basic than that: top of the range GDP, which is made up our minds, on the finish of the day, via Xi Jinping himself. That’s an excessively sturdy, deeply rooted tendency of his.

And it’s in point of fact similar to the impulse that drives a deliberate economic system. In fact, China now has a a lot more environment friendly set of establishments, and so the federal government is guidance the economic system thru most commonly marketplace appropriate tools. That doesn’t imply they paintings smartly, however no less than it method they’re appropriate.

If, via some miracle, Xi Jinping was once to sign up for this dialog, he would most likely say the method’s running: that China is the worldwide chief in spaces like batteries and electrical automobiles, and is also catching up in chips. Would he be proper to mention that?

Neatly, it will be affordable for him to mention that. There undoubtedly are spaces, in more than one comparable inexperienced sectors, the place China has established a dominant place, on the subject of the potency with which they may be able to produce issues. And I’m positive that once Xi Jinping will get up within the morning, and has his first cup of tea, he’s feeling very constructive. He’s taking a look at those intersecting inexperienced sectors — solar energy, wind energy, batteries, electrical garage, electrical automobiles, possibly hydrogen manufacturing — and in all of those, the massive Chinese language dedication to construction has resulted in very dramatic value discounts which can be nonetheless ongoing.

Despite the fact that we’ve adjusted to this dynamic value efficiency, it nonetheless exceeds our talent to know the results. This inexperienced power advanced may have reached the purpose the place it turns into economically inexpensive than the outdated fossil gas advanced. That’s going to have large implications. Even supposing we’re suspicious of Chinese language coverage, even though we’re apprehensive about Chinese language conduct and the way in which they manipulate financial good fortune, we’re nonetheless no longer going so to forestall an financial and technical transformation of this magnitude.

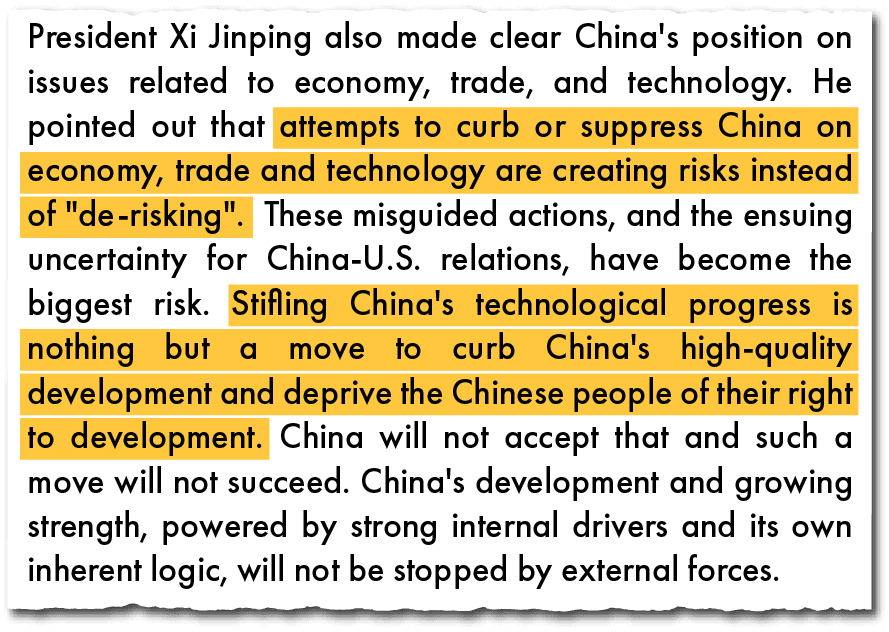

A readout of ways China perspectives “de-risking” and U.S.-China disagreements, following Xi’s assembly with Biden, November 15, 2023. Credit score: MFA

He’s additionally most likely feeling beautiful glad as a result of he can argue that his insurance policies have ready China quite smartly to reply to no matter is coming down the street with the brand new Trump management. The ironic factor is, they’ve performed their de-risking and decoupling program, even whilst they rail towards different international locations de-risking and decoupling. They’ve in reality completed a moderately efficient task of insulating their economic system and figuring out the spaces the place different economies are depending on them. I guess he feels beautiful self glad a lot of the time.

Do you notice it as practical that China will change into self-reliant in chips, in the way in which that Xi may also need?

No, no longer in an inexpensive, foreseeable time period, 5 to ten years. However China is making primary investments in each and every hyperlink of all of the semiconductor business chain, and so they’re making growth. That’s no longer pronouncing up to it will, as a result of in lots of of those hyperlinks, they began with not anything. Making growth implies that they’re growing embryonic buildings that may transform innovative amenities in a decade. In fact, in a decade, the semiconductor trade may have moved on. I don’t assume anyone may just say that that has been a a hit business coverage to this point, and it’s been very expensive.

![]()

Left: Chinese language Premier Li Qiang visits Shanghai Tremendous Silicon Semiconductor Co., August 28, 2020. Proper: Xi Jinping visits HGLaser, a laser apparatus provider, June 30, 2022. Credit score: Shanghai Govt, HGTECH

To show to the second one part your method: no bailouts. How has that manifested itself within the closing two or 3 years?

Sooner than we communicate concerning the closing couple years, let’s once more hyperlink this to deep seated components of Xi Jinping’s international view. In fact, anti-corruption is the linchpin of Xi Jinping’s consolidation of energy. The truth that the anti-corruption marketing campaign remains to be ongoing displays that he has a definite suspicion of the motives and the ethics of a large number of other people within the energy device, and that he desires a a lot more disciplined society — particularly a a lot more disciplined Communist Birthday celebration. That’s a large a part of his basic international view.

A Xinhua cool animated film highlighting anti-corruption circumstances filed within the first 3 quarters of 2023. Credit score: Xinhua

A Xinhua cool animated film highlighting anti-corruption circumstances filed within the first 3 quarters of 2023. Credit score: Xinhua

And so when he comes to take a look at how you can get to the bottom of an financial scenario just like the housing bust, and the disaster in native executive finance, he’s very averse to the concept you’re going to praise anyone who both failed to regulate their native jurisdiction successfully, or who made reckless investments. He simply does no longer need to bail any of the ones other people out, as a result of it will create a nasty precedent.

This additionally implies that not one of the issues that we’ve noticed to prop up call for and stay institutional buildings intact haven’t begun concerned a considerable answer of huge quantities of debt. He assists in keeping refinancing, kicking the can down the street, injecting some finances into the device to stay anyone from failing, however with out resolving any of the issues.

Xi Jinping is making of venture that most of these applied sciences will one day come in combination and convey a surprising surge of productiveness. And he could be proper. We will’t say evidently that he’s no longer. However up to now, he’s very a lot no longer.

That’s in point of fact an issue, as a result of at a definite level you must blank up the mess. You discussed previous whether or not China was once changing into Japan-like: that is one admire through which it undoubtedly is. Japan spent virtually a decade looking to painlessly restructure a monetary device that had suffered an enormous relief within the price of its property. It was once the basic drawback that lay at the back of the so-called ‘Misplaced Decade’ in Japan; and now China appears to be repeating some portions of that.

Any try to totally repair the monetary device to well being goes to indicate spotting and apportioning losses regardless that, proper? For instance, you both say to traders that purchased native executive debt that has long gone unhealthy that they will take the hit, otherwise you apportion the price to the central executive. There appears to be an ongoing reluctance to make the ones kinds of possible choices.

I love the way in which you place it. It’s a query, in monetary slang, of deciding who will get a haircut and what kind of — and China hasn’t completed that. The one factor they’ve completed is attempt to say, no haircuts for individuals who pay as you go for his or her housing devices, we will have to try to ensure supply for them. That’s politically a good suggestion, but it surely’s additionally the politically simple coverage.

Xiao Yuanqi, Vice Minister of the Nationwide Monetary Regulatory Management, discusses the “white checklist” mechanism, October 17, 2024. Credit score: CCTV

What is way more difficult is deciding who will get compelled out of business, who will get bailed out, and who can pay what prices within the procedure. The most efficient apply is to pressure one of the most early, worst case, unhealthy actors out of business, however then with the intention to repair self belief, supply monetary reinforce to the easier companies. China had the danger to do that with [collapsed real estate developer] Evergrande, but it surely by no means did put it decisively out of business, and as a substitute simply let it bleed to demise. And in spite of the meant life of a “white checklist,” it’s by no means supplied plausible reinforce to non-public actual property companies. Because of this, no person’s expectancies in the true property sector can also be stabilized, and there’s an enormous overhang of unsold assets, particularly out of doors the largest towns, Beijing, Shanghai and Shenzhen. Even supposing there’s been some stabilization not too long ago, it’s onerous to imagine that the housing sector is anyplace close to returning to well being.

Why received’t the ‘billions for tech, no bailouts’ manner paintings long term?

![]() Workers paintings within the dust-free room at Xtek Semiconductor (Huangshi) Corporate Ltd., a take a look at wafer recycling manufacturing facility in Hubei. Credit score: Hubei Govt

Workers paintings within the dust-free room at Xtek Semiconductor (Huangshi) Corporate Ltd., a take a look at wafer recycling manufacturing facility in Hubei. Credit score: Hubei Govt

There are two basic issues. The primary is it leads to an enormous misallocation of sources, in order that the underlying productiveness of the economic system is principally no longer bettering. After we have a look at general issue productiveness enlargement, which is the economists’ try to determine what you’re getting from natural potency positive aspects, China’s no longer in point of fact experiencing important productiveness enlargement. This is astonishing, as a result of if we have a look at this economic system that’s enforcing most of these new applied sciences, we predict, wow, that’s gotta produce some roughly explosive enlargement in productiveness. However we don’t see it.

And it’s basically as a result of, for instance, China is making an investment in a variety of semiconductor apparatus vegetation which can be dropping immense quantities of cash; it’s making an investment in hundreds of miles of excessive pace rail that pass the place no person desires to move. There are simply those large, long term implicit prices from no longer bettering the potency of your society.

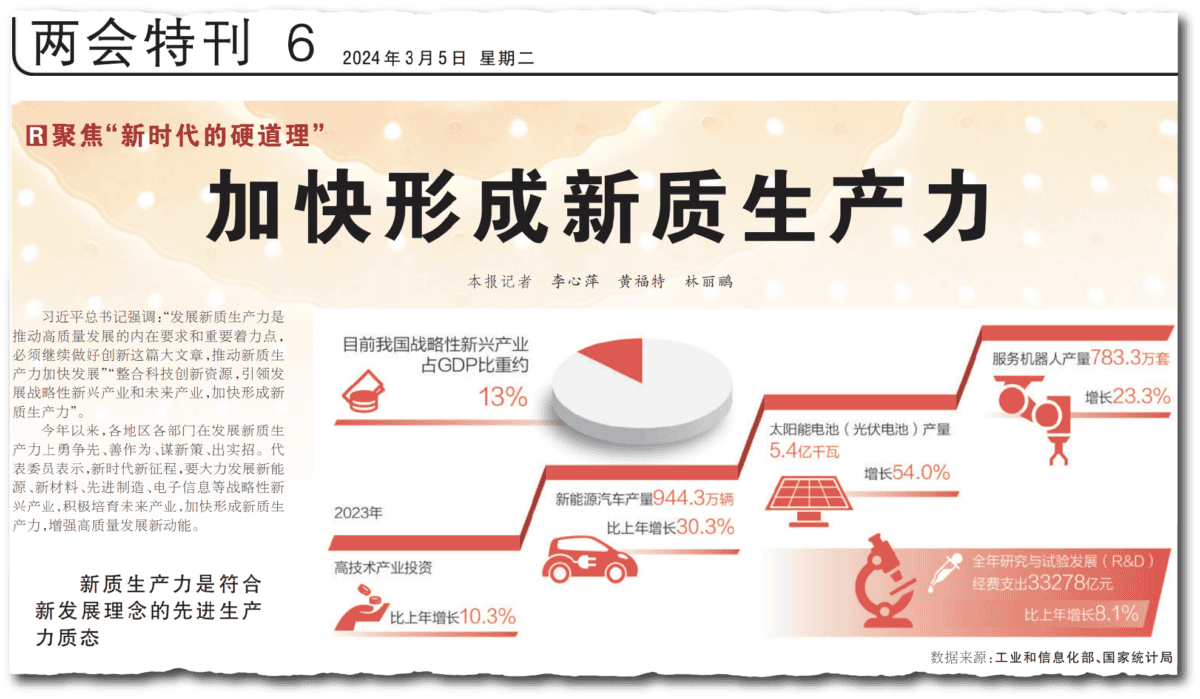

An excerpt from a March 2024 factor of the Other people’s Day by day on accelerating the formation of “new high quality productive forces” (新质生产力). Credit score: Other people’s Day by day

An excerpt from a March 2024 factor of the Other people’s Day by day on accelerating the formation of “new high quality productive forces” (新质生产力). Credit score: Other people’s Day by day

Now, after all, on some degree, Xi Jinping is making of venture that most of these applied sciences will one day come in combination and convey a surprising surge of productiveness. And he could be proper. We will’t say evidently that he’s no longer. However up to now, he’s very a lot no longer.

In order that’s one drawback, and one thing economists fear about, even though possibly atypical other people can’t be anticipated to take this that severely. The second one drawback is one thing that atypical other people do need to take very severely: and that’s that China hasn’t been in a position to position in combination an efficient macro financial coverage.

In some way, it’s virtually comedian. For just about 3 years now, the worldwide funding banks were pronouncing China wishes extra stimulus. Then they have a look at each and every coverage that comes out and so they say, it’s no longer sufficient. So we want to ask what’s riding this, systemically?

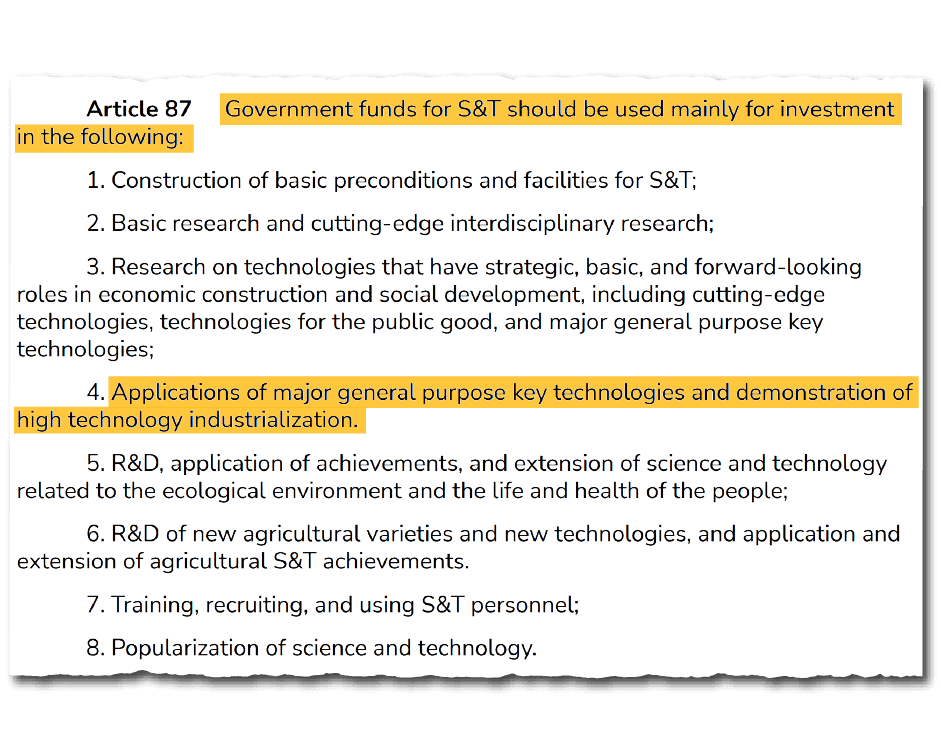

An excerpt from a translation of China’s “Legislation

at the Growth of Science and Generation”, overlaying “excessive era industrialization”. Supply: CSET

I feel the solution is, there’s a stimulus coverage, hiding in simple sight. It’s one this is constrained to be a high-tech industrialization funding program. That can or would possibly not paintings on the subject of growing those industries, but it surely doesn’t supply an excessively efficient stimulus — as it doesn’t create a lot employment, it doesn’t create a lot benefit, it doesn’t create many new source of revenue streams, and so it doesn’t have stimulus multiplier results. It creates a certain quantity of call for for the instant product that will get the funding put into it. After that, it’s a type of a rainy thud on the subject of its affect on the remainder of the economic system.

However there it’s, that’s the stimulus. We will see it once we attempt to observe funding, which isn’t simple to do in China. What we see is a large decline in housing funding, with maximum of that slack taken up via an building up in business funding. Between 2019 and 2024, general mounted asset funding cumulatively has best grown via about 20 p.c, in order that’s 3-4 p.c consistent with yr: however funding in one of the most large excessive tech sectors has greater than doubled right through that point. There’s been a large shift within the composition of funding, in opposition to excessive tech trade. And for those who deal with a definite restrict at the quantity of deficit the federal government is prepared to endure, and for those who say that credit score needs to be allotted at the beginning to high-tech industries, there’s no longer that a lot left over for different kinds of stimulus that may be more practical.

There’s a consistent chorus about China’s economic system, that there must be extra emphasis on shopper call for and not more on funding. The view of the ‘Xi Jinping economic system’ that you just’re expressing turns out to give an explanation for why the reluctance to liberate the ability of the Chinese language shopper persists.

Indubitably, even though I’d simply warning on something. Outsiders are a lot too susceptible to pay attention Chinese language coverage makers say we need to building up home call for, and interpret that as being them in need of to rebalance the construction of the economic system in opposition to intake. So far as I will decide, China hasn’t ever, since 2008, mentioned we’re going to rebalance the economic system clear of funding, in opposition to intake.

Some of the attention-grabbing issues concerning the financial paintings convention that completed a pair days in the past is that the primary precedence for 2025 is to vigorously building up intake call for. That’s new. However then the following clause is, to support the potency of funding. Something it doesn’t say is ‘rebalance’. It doesn’t say shift sources clear of funding in opposition to intake. It’s essential to say, smartly, it’s implicit. Nevertheless it’s best implicit, it’s no longer particular. Do they in point of fact need to do this rebalancing, or do they revel in sitting atop an economic system that may make investments trillions of greenbacks? I feel they reasonably find it irresistible.

Scholars on the Tsinghua College Graduate Task Truthful, March 5, 2024. Credit score: Tsinghua College

Scholars on the Tsinghua College Graduate Task Truthful, March 5, 2024. Credit score: Tsinghua College

Do you notice unemployment being a structural drawback for China? Put merely, is the Xi Jinping economic system going to supply sufficient jobs for the Chinese language other people to do in long term?

It’s in point of fact a major query. Economists are so programmed to imagine that exertions markets regulate, and also you don’t need to be a Luddite. Each new era creates disruption, after which other people adapt, markets adapt. And I do roughly imagine that.

However alternatively, China appears to be speeding so speedy into such a lot of of those applied sciences, with out in point of fact being concerned about what their affect on employment shall be, that it sort of feels, at a minimal, to be reckless.

China, the rustic that benefited probably the most from globalization, selected to show towards it, and to mention, ‘Oh, that was once ok, however we will be able to do significantly better’. That was once in the long run very destabilizing for the entire international.

There’s two other exertions markets, too. There’s the marketplace for newly minted school grads, who compose a complete spectrum of talent ranges, however which undoubtedly contains very extremely expert and really vivid, succesful younger other people. And there’s a complete different exertions marketplace of most commonly migrant staff.

Migrant staff out of doors Shanghai Station. Credit score: China Supertrends by means of Flickr

Migrant staff out of doors Shanghai Station. Credit score: China Supertrends by means of Flickr

Each those markets are in disaster. The information that China releases are principally all concerning the first one: the city, fairly high-skilled marketplace. However the migrant marketplace additionally appears to be in some roughly disaster. Thousands and thousands of migrants have most likely returned house and don’t have very a lot to do: Scott Rozelle has written very movingly and convincingly about this. I feel those dual exertions marketplace issues are severe and longer term, and it’s onerous to look what they’re doing to maintain them.

Why doesn’t China introduce a extra revolutionary tax device, to redistribute wealth moderately, and likewise support the welfare device?

That’s an ideal query. And to be truthful, I don’t know. They have got sponsored themselves right into a nook. Their number one constituency is in point of fact a few hundred million city other people. They care so much about what the ones other people assume, and no longer such a lot about rural other people and migrants. They appear to be dedicated to protective the total price of the pensions and well being care advantages for all of the city citizens, and no longer subjecting them to further taxation.

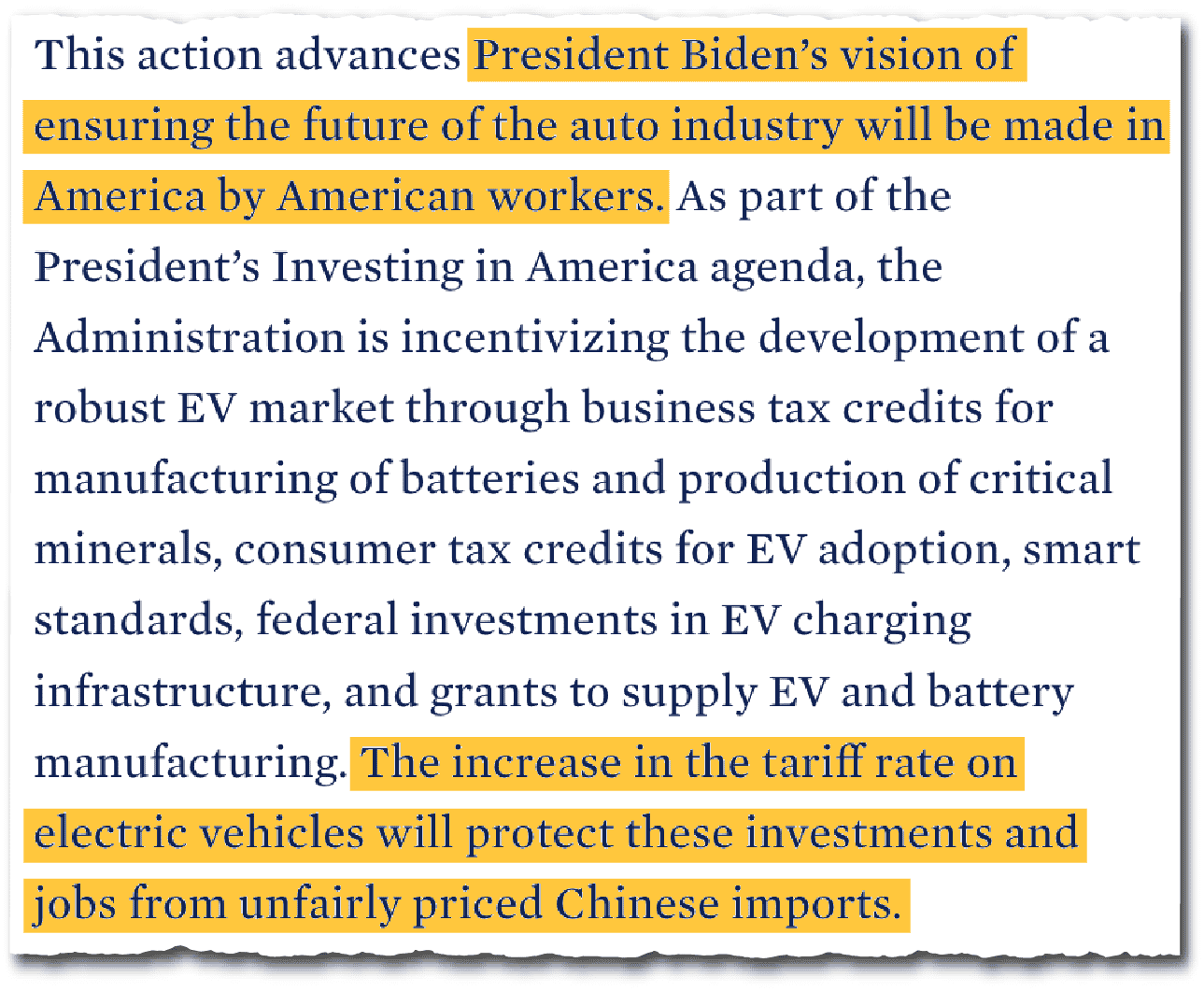

An excerpt from a White Area press commentary titled ‘President Biden Takes Motion to Offer protection to American Staff and Companies from China’s Unfair Business Practices’. Credit score: The White Area

An excerpt from a White Area press commentary titled ‘President Biden Takes Motion to Offer protection to American Staff and Companies from China’s Unfair Business Practices’. Credit score: The White Area

Right here’s this executive that, in some ways, isn’t in any respect conscious of public opinion. However on 4 or 5 a very powerful financial problems that affect state staff, executive workers and concrete complete time workers of other forms, they’re very, very wary.

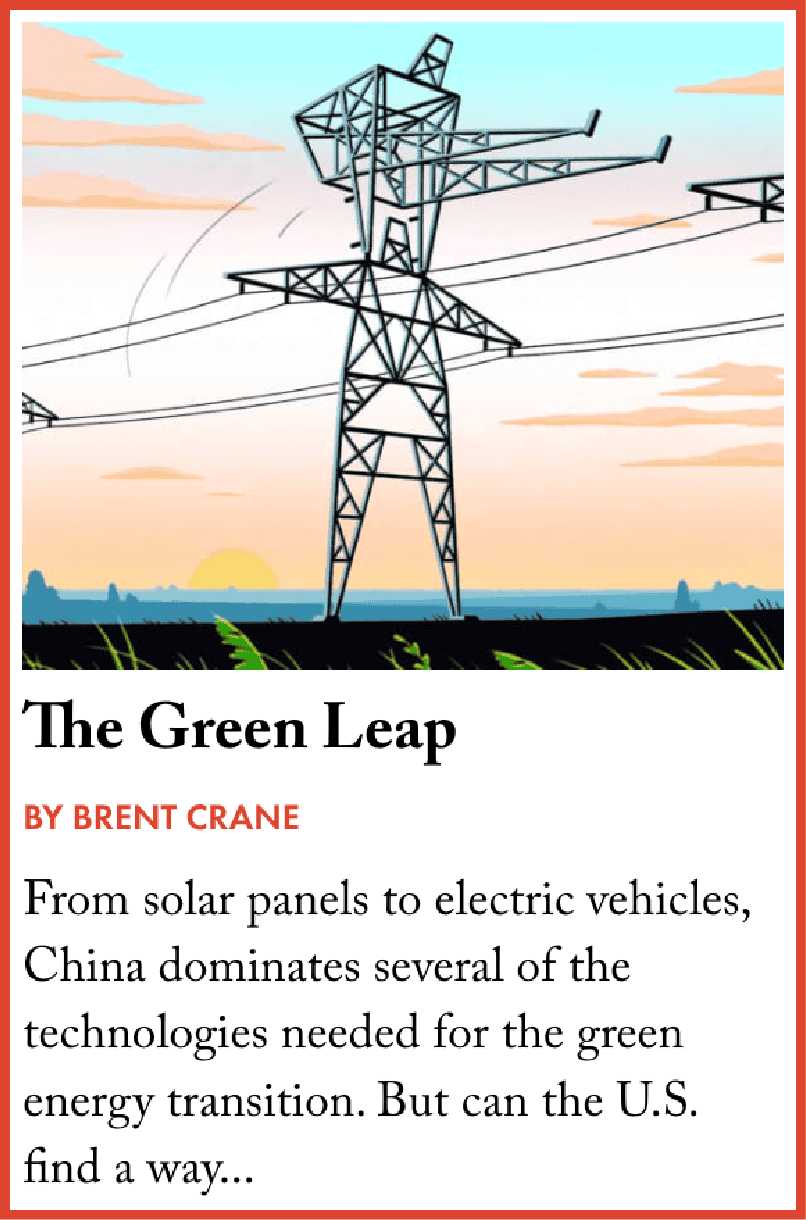

The reaction of the Trump and Biden administrations to all this has to some degree reflected the Chinese language manner, on the subject of protectionism thru price lists, and in looking to steer the U.S. economic system to provide extra in positive excessive tech sectors. The opposite course might be to mention, if China’s development a load of inexpensive electrical automobiles for instance, let’s simply purchase them: we will be able to take pleasure in low cost Chinese language items.

That is sensible for positive merchandise, and it doesn’t make sense for others. We want to get past such a ‘protectionism just right, protectionism unhealthy’ argument, and check out to craft a collection of insurance policies that quantities to quite environment friendly protectionism, that works within the American passion.

Workers paintings at the manufacturing line of U.S. EV producer Rivian’s Rivian Twin-Motor R1T, a long-range electrical pickup truck. Credit score: Rivian

Workers paintings at the manufacturing line of U.S. EV producer Rivian’s Rivian Twin-Motor R1T, a long-range electrical pickup truck. Credit score: Rivian

There’s two portions of that which we will be able to lay out beautiful merely. One is, let’s make a decision what are the sectors that we would like to offer protection to, and what are the sectors the place we will be able to take pleasure in opening up in the way in which that you just counsel. EVs is a sector that we’re going to need to offer protection to, as a result of now we have a large car trade that employs a large number of other people. It’s at the back of the Chinese language trade on the subject of electrical automobiles, but it surely obviously is able to catching up.

In contrast, sun panels or batteries are spaces the place we don’t in point of fact have an important trade. Chinese language manufacturers have in the meantime change into excellent, and really low value. We will have to inspire Chinese language funding in america to provide those merchandise, each to create jobs and in order that we will be able to discover ways to produce at that roughly scale and potency. We’re going to want a extra particular business coverage.

An excerpt from ‘President Biden Takes Motion to Offer protection to American Staff and Companies from China’s Unfair Business Practices within the Semiconductor Sector’. Credit score: The White Area

The second one factor is, we don’t need to cause a chaotic scramble for protectionism amongst all of the other international locations on the earth. We need to sign that we have got positive pursuits, however they’re quite restricted, and we also are curious about achieving a mutually really helpful equilibrium, particularly with our allies, but in addition with China.

That’s tough to do, however no longer inconceivable. We will have to stay our minds open to the concept the U.S. will transfer in opposition to extra protectionist coverage, however that it’ll be articulated in some way this is much less disruptive, and advantages america’s pursuits.

Oddly sufficient, that’s most likely extra applicable to China. We can necessarily be pronouncing to China, we’re simply doing what you probably did, we’re protective our pursuits. Their response might be: How come you didn’t do that a very long time in the past? This may, with slightly little bit of good fortune and knowledge on either side, lead us to a brand new equilibrium that’s no longer horrible.

Wang Shouwen, China’s Global Business Consultant and Vice Minister of Trade, with U.S. Underneath Secretary of Trade for Global Business, Marisa Lago, in Tianjin, September 7, 2024. Credit score: ITA

Wang Shouwen, China’s Global Business Consultant and Vice Minister of Trade, with U.S. Underneath Secretary of Trade for Global Business, Marisa Lago, in Tianjin, September 7, 2024. Credit score: ITA

Do you fear, regardless that, that folks have a look at China’s financial insurance policies and say, that is only a nationalistic nation pursuing their nationalistic objectives, we will have to withstand all method of Chinese language industry. And that the logical extension is a complete decoupling and a splitting of the sector into other financial spheres?

Sure, I fear about it very a lot. I feel some portions of it are inevitable. We don’t agree with each and every different. We don’t need the Chinese language within our information methods, and so they undoubtedly don’t need us within theirs. So there already is, and can proceed to be, a decoupling in that admire.

That’s some of the the reason why EVs will have to most likely no longer be a number one sector on the subject of inviting Chinese language funding — as a result of they’re computer systems on wheels, with large sensor arrays.

However I totally trust the spirit of your query, that we need to in point of fact take a look at to withstand all of the useless prices that may come from decoupling within the majority of sectors the place there are not any safety problems, and not anything however shared get advantages.

Whilst you glance again over your occupation, do you are feeling depressed about the way in which issues have performed out?

Barry Naughton delivered a chat on China’s financial reform at Tsinghua College’s Heart for Commercial Construction and Environmental Governance Analysis, December 2, 2013. Credit score: CIDEG

Barry Naughton delivered a chat on China’s financial reform at Tsinghua College’s Heart for Commercial Construction and Environmental Governance Analysis, December 2, 2013. Credit score: CIDEG

In fact, I believe unhappy that some of the issues I faithful my occupation to was once making an attempt to give an explanation for to American citizens why what was once taking place in China was once necessary, and sure — and extra probably really helpful than a large number of other people learned.

I used to be very disenchanted at two issues. One was once the very slow exchange in Chinese language coverage after about 2006. It’s a basic problem to our figuring out, no longer simply of China, however of the sector: China, the rustic that benefited probably the most from globalization, selected to show towards it, and to mention, ‘Oh, that was once ok, however we will be able to do significantly better’. That was once in the long run very destabilizing for the entire international.

The second one factor is that China then deserted the non violent upward push coverage that it had within the first a part of the century, and followed a collection of insurance policies to play a better position on a world degree — whilst necessarily eroding the root of the American device, and pre-positioning themselves to be in some roughly choice management place. To make certain, the U.S. additionally contributed to this, particularly via going to struggle in Iraq [in 2003], in violation of our personal ideas about global order. Those adjustments have been additionally deeply destabilizing.

So I believe somewhat stunned, and unhappy. However, it’s what it’s. You’ll be able to’t expect the entire international.

Andrew Peaple is a UK-based editor at The Cord. Prior to now, Andrew was once a reporter and editor at The Wall Boulevard Magazine, together with stints in Beijing from 2007 to 2010 and in Hong Kong from 2015 to 2019. Amongst different roles, Andrew was once Asia editor for the Heard at the Boulevard column, and the Asia markets editor. @andypeaps