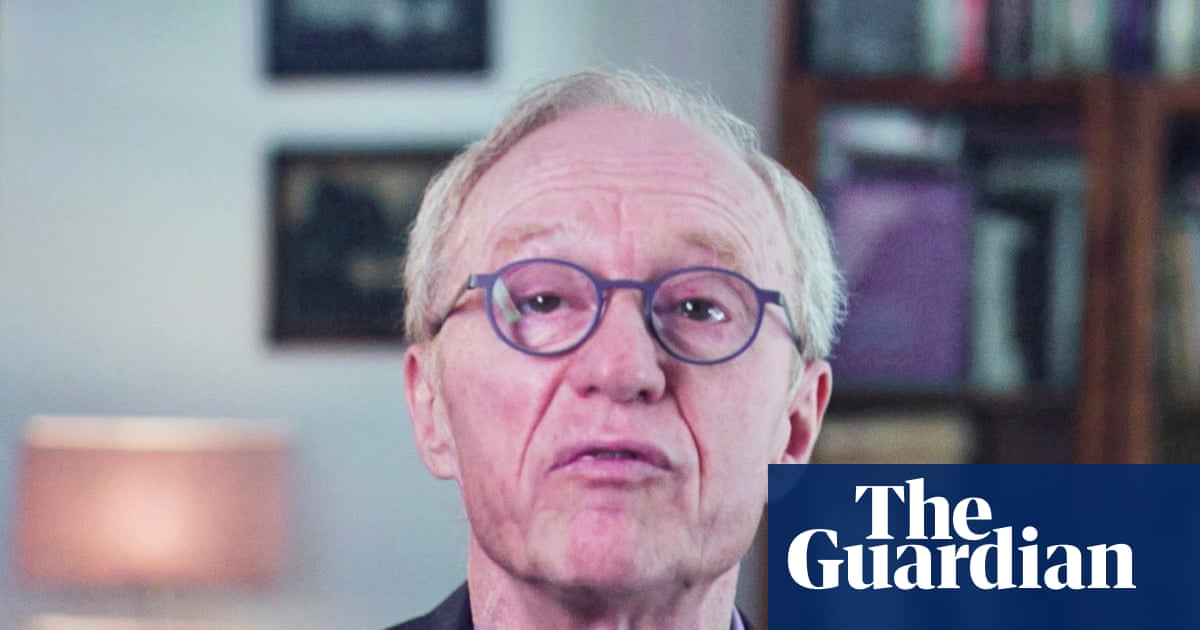

Franklin Templeton leader marketplace strategist Stephen Dover joins Seana Smith and Brad Smith on Morning Temporary to talk about what to anticipate because the marketplace digests contemporary financial knowledge to be launched this week and what it method for the Federal Reserve’s subsequent transfer.The Bureau of Exertions Statistics will unencumber the Process Openings and Exertions Turnover Survey (JOLTS) on Tuesday, adopted through contemporary non-farm payroll knowledge on Friday, November 1. The marketplace may even get the primary minimize of america Gross Home Product (GDP) for the 3rd quarter of 2024 on Wednesday.There are “a pair [of] financial bulletins popping out this week which are more likely to be certain,” Dover tells Yahoo Finance.“The elections expectantly shall be settled inside the subsequent couple of weeks. I feel simply having the ones elections settled, whichever approach it is going, could be certain. I feel the marketplace appears to be pricing in, or over the past week priced in, most definitely a Trump victory. If that does not occur, there is most definitely some unwinding round that,” he notes.The strategist says that jobs knowledge may be “muddled” given the affect of Storm Milton and Storm Helene in addition to the continuing Boeing (BA) union strike.Dover says, “I feel we will have some volatility across the week as the ones numbers are available.” Along side new financial knowledge, the marketplace may even get quarterly effects from Giant Tech avid gamers, together with Alphabet (GOOG, GOOGL), Microsoft (MSFT), Amazon (AMZN), Meta (META), and Apple (AAPL).To observe extra knowledgeable insights and research on the most recent marketplace motion, take a look at extra Morning Temporary right here.This submit used to be written through Naomi Buchanan.

![Microsoft’s Xbox video games dominate PlayStation’s top-selling charts, taking 6 out of 10 spots [Update: new data] Microsoft’s Xbox video games dominate PlayStation’s top-selling charts, taking 6 out of 10 spots [Update: new data]](https://static1.xdaimages.com/wordpress/wp-content/uploads/2025/06/4k-xbox-games-showcase-2025-_-the-outer-worlds-2-grounded-2-direct-38-1-screenshot.png)