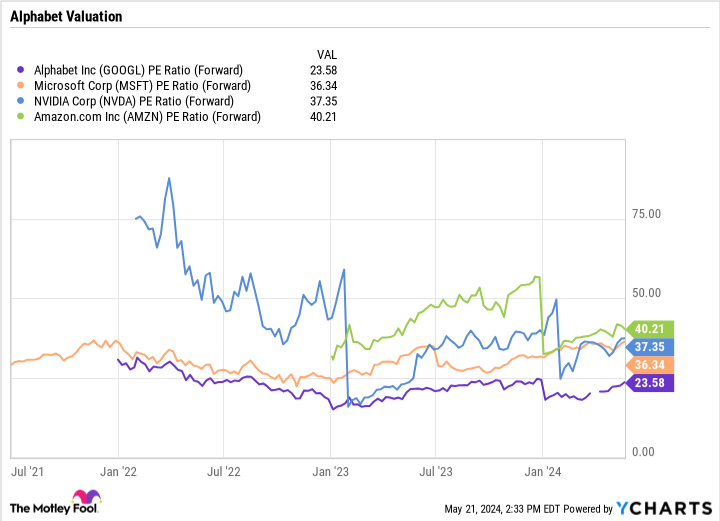

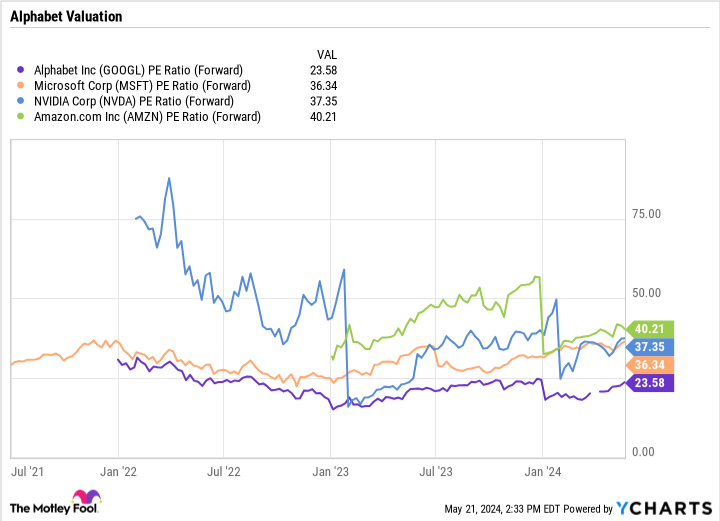

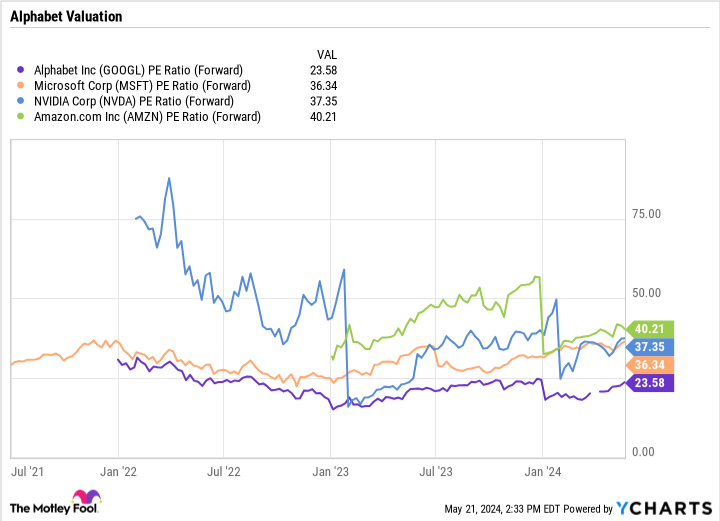

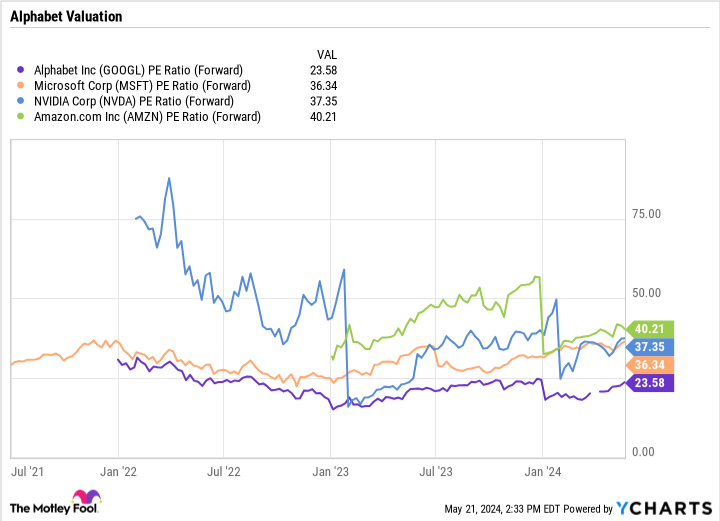

Taking earnings in chip large Nvidia (NASDAQ: NVDA) used to be a well-liked transfer amongst billionaire hedge fund managers within the first quarter, with a variety of notable ones decreasing their stakes within the corporate. Given the run the inventory has had, it in all probability will have to be of little marvel that some big-name traders have been taking some earnings.Some of the billionaires decreasing their stakes in Nvidia have been Stanley Druckenmiller of Duquesne Capital Control, David Tepper of Appaloosa Control, Paul Tudor Jones of Tudor Investments, and Philippe Laffont of Coatue Control.Druckenmiller mentioned his explanation why for decreasing his stake in Nvidia, announcing in a CNBC interview that he nonetheless favored Nvidia however that synthetic intelligence (AI) could be overhyped within the close to time period. Then again, he mentioned the massive payoff might be massive in 4 to 5 years and that AI could also be underhyped in the long run.Whilst it is common to look billionaire hedge fund managers taking some earnings in a inventory like Nvidia, a number of best hedge fund managers also are piling into Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Some of the traders aggressively purchasing the inventory in Q1 have been Chase Coleman of Tiger World, Glen Kacher of Mild Boulevard Capital, Gavin Baker of Atreides Control, and Foxhaven Asset Control’s Michael Pausic and Nick Lawler.Let us take a look at why those traders would possibly assume Alphabet is a phenomenal funding.Alphabet is drawing investor interestOne of the primary issues that has a tendency to clutch hedge fund managers’ consideration is valuation. Alphabet trades at a pretty big bargain in comparison to many different AI-related shares with a ahead price-to-earnings (P/E) ratio of simplest 23.6 instances. Numerous opponents are buying and selling at over 35 instances.

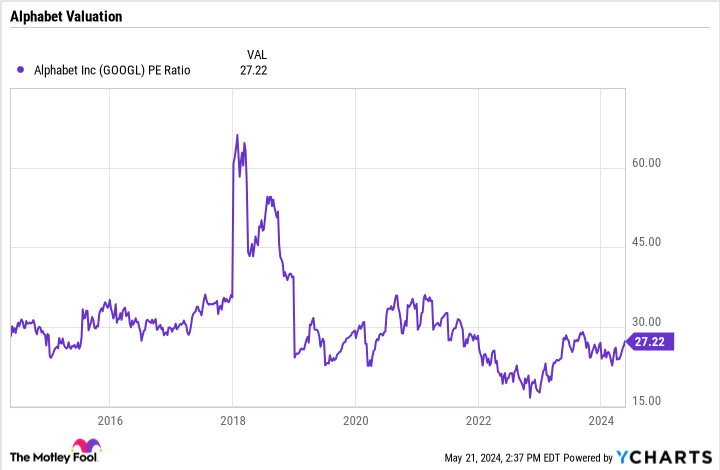

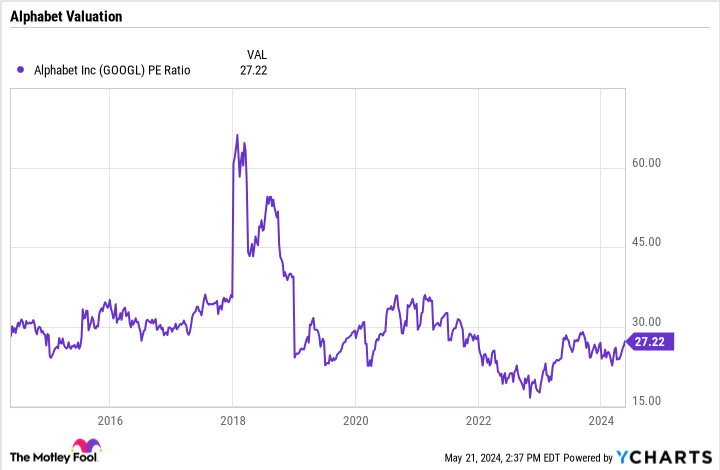

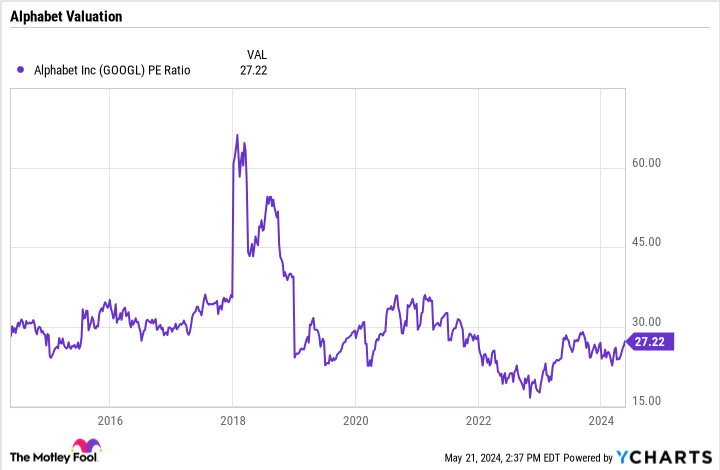

GOOGL PE Ratio (Ahead) ChartIn addition, this is under the more than one the place Alphabet has traded traditionally earlier than the pandemic when it could ceaselessly business above a 30 instances P/E ratio.

GOOGL PE Ratio (Ahead) ChartIn addition, this is under the more than one the place Alphabet has traded traditionally earlier than the pandemic when it could ceaselessly business above a 30 instances P/E ratio.

GOOGL PE Ratio ChartThat provides Alphabet inventory room to run upper, however valuation by myself isn’t a explanation why that well-regarded hedge fund managers would purchase the inventory.An funding in Alphabet is an funding in an organization that has two dominant companies with Google seek and video platform YouTube. Google is just about a monopoly with about an estimated 90% proportion in world seek. Whilst there were some fears of AI impacting its seek trade, the corporate is embracing the generation, rolling out AI overlays on the best of web page effects to reply to extra advanced questions.Alphabet will glance towards new advert codecs to lend a hand monetize its newest AI efforts to force expansion. With simplest about 20% of its seek effects together with advertisements, that is if truth be told a pretty big alternative for Google seek to transform much more successful sooner or later by means of monetizing the quest effects it does not generate profits from recently.Tale continuesAlphabet’s YouTube platform will have to additionally now not be overpassed. Whilst many streaming services and products outdoor of Netflix have struggled with profitably because of content material prices, the revenue-sharing type that Alphabet makes use of with creators has lengthy alleviated those problems. In the meantime, the corporate has a powerful alternative to take advantage of short-form movies that compete with TikTok, which it has simply began to monetize. If its competitor will get banned within the U.S., this can be a massive alternative for the corporate.As well as, Alphabet’s cloud computing trade continues to be within the early days of ramping up profitability. Given the top mounted prices of the trade, profitability will have to now develop a lot sooner than profit, which will likely be pushed by means of AI adoption.

GOOGL PE Ratio ChartThat provides Alphabet inventory room to run upper, however valuation by myself isn’t a explanation why that well-regarded hedge fund managers would purchase the inventory.An funding in Alphabet is an funding in an organization that has two dominant companies with Google seek and video platform YouTube. Google is just about a monopoly with about an estimated 90% proportion in world seek. Whilst there were some fears of AI impacting its seek trade, the corporate is embracing the generation, rolling out AI overlays on the best of web page effects to reply to extra advanced questions.Alphabet will glance towards new advert codecs to lend a hand monetize its newest AI efforts to force expansion. With simplest about 20% of its seek effects together with advertisements, that is if truth be told a pretty big alternative for Google seek to transform much more successful sooner or later by means of monetizing the quest effects it does not generate profits from recently.Tale continuesAlphabet’s YouTube platform will have to additionally now not be overpassed. Whilst many streaming services and products outdoor of Netflix have struggled with profitably because of content material prices, the revenue-sharing type that Alphabet makes use of with creators has lengthy alleviated those problems. In the meantime, the corporate has a powerful alternative to take advantage of short-form movies that compete with TikTok, which it has simply began to monetize. If its competitor will get banned within the U.S., this can be a massive alternative for the corporate.As well as, Alphabet’s cloud computing trade continues to be within the early days of ramping up profitability. Given the top mounted prices of the trade, profitability will have to now develop a lot sooner than profit, which will likely be pushed by means of AI adoption.

Symbol supply: Getty Photographs. Must retail traders stick to go well with and purchase Alphabet?Alphabet is a fairly reasonably priced inventory with a dominant place in seek and a large alternative forward of it with AI. Whilst the inventory has had a powerful yr, up about 27% yr thus far, it isn’t too past due to stick to hedge fund billionaires into the inventory.The corporate has a protracted runway of expansion forward and more than one growth doable (which is a rise in its valuation multiples, corresponding to P/E). In combination that may be a tough aggregate and makes the inventory a purchase.Must you make investments $1,000 in Alphabet at the moment?Before you purchase inventory in Alphabet, imagine this:The Motley Idiot Inventory Guide analyst group simply recognized what they imagine are the 10 highest shares for traders to shop for now… and Alphabet wasn’t one among them. The ten shares that made the reduce may just produce monster returns within the coming years.Believe when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $652,342!*Inventory Guide supplies traders with an easy-to-follow blueprint for luck, together with steering on development a portfolio, common updates from analysts, and two new inventory alternatives every month. The Inventory Guide provider has greater than quadrupled the go back of S&P 500 since 2002*.See the ten shares »*Inventory Guide returns as of Would possibly 13, 2024Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has positions in Alphabet. The Motley Idiot has positions in and recommends Alphabet, Netflix, and Nvidia. The Motley Idiot has a disclosure coverage.Billionaires Are Promoting Nvidia and Purchasing Up This Inventory As a substitute used to be at the start revealed by means of The Motley Idiot

Symbol supply: Getty Photographs. Must retail traders stick to go well with and purchase Alphabet?Alphabet is a fairly reasonably priced inventory with a dominant place in seek and a large alternative forward of it with AI. Whilst the inventory has had a powerful yr, up about 27% yr thus far, it isn’t too past due to stick to hedge fund billionaires into the inventory.The corporate has a protracted runway of expansion forward and more than one growth doable (which is a rise in its valuation multiples, corresponding to P/E). In combination that may be a tough aggregate and makes the inventory a purchase.Must you make investments $1,000 in Alphabet at the moment?Before you purchase inventory in Alphabet, imagine this:The Motley Idiot Inventory Guide analyst group simply recognized what they imagine are the 10 highest shares for traders to shop for now… and Alphabet wasn’t one among them. The ten shares that made the reduce may just produce monster returns within the coming years.Believe when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $652,342!*Inventory Guide supplies traders with an easy-to-follow blueprint for luck, together with steering on development a portfolio, common updates from analysts, and two new inventory alternatives every month. The Inventory Guide provider has greater than quadrupled the go back of S&P 500 since 2002*.See the ten shares »*Inventory Guide returns as of Would possibly 13, 2024Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has positions in Alphabet. The Motley Idiot has positions in and recommends Alphabet, Netflix, and Nvidia. The Motley Idiot has a disclosure coverage.Billionaires Are Promoting Nvidia and Purchasing Up This Inventory As a substitute used to be at the start revealed by means of The Motley Idiot

:max_bytes(150000):strip_icc():focal(702x139:704x141)/meghan-trainor-and-her-sons-013024-f7cbc196fa4b47a5a7ee6c65eb49227f.jpg)