Binance just lately bought over $596,000 value of ONDO, appearing rising hobby.

Then again, this transfer has now not swayed broader marketplace habits, as many members endured promoting.

Ondo Finance [ONDO] maintained its bullish sentiment at press time, gaining 46.43% during the last month and posting a 1.69% build up within the remaining 24 hours.

Then again, a divergence between contemporary worth positive aspects and weakening hobby instructed {that a} doable pattern reversal may well be at the horizon.

AMBCrypto equipped deeper insights into ONDO’s present efficiency and what traders must look ahead to subsequent.

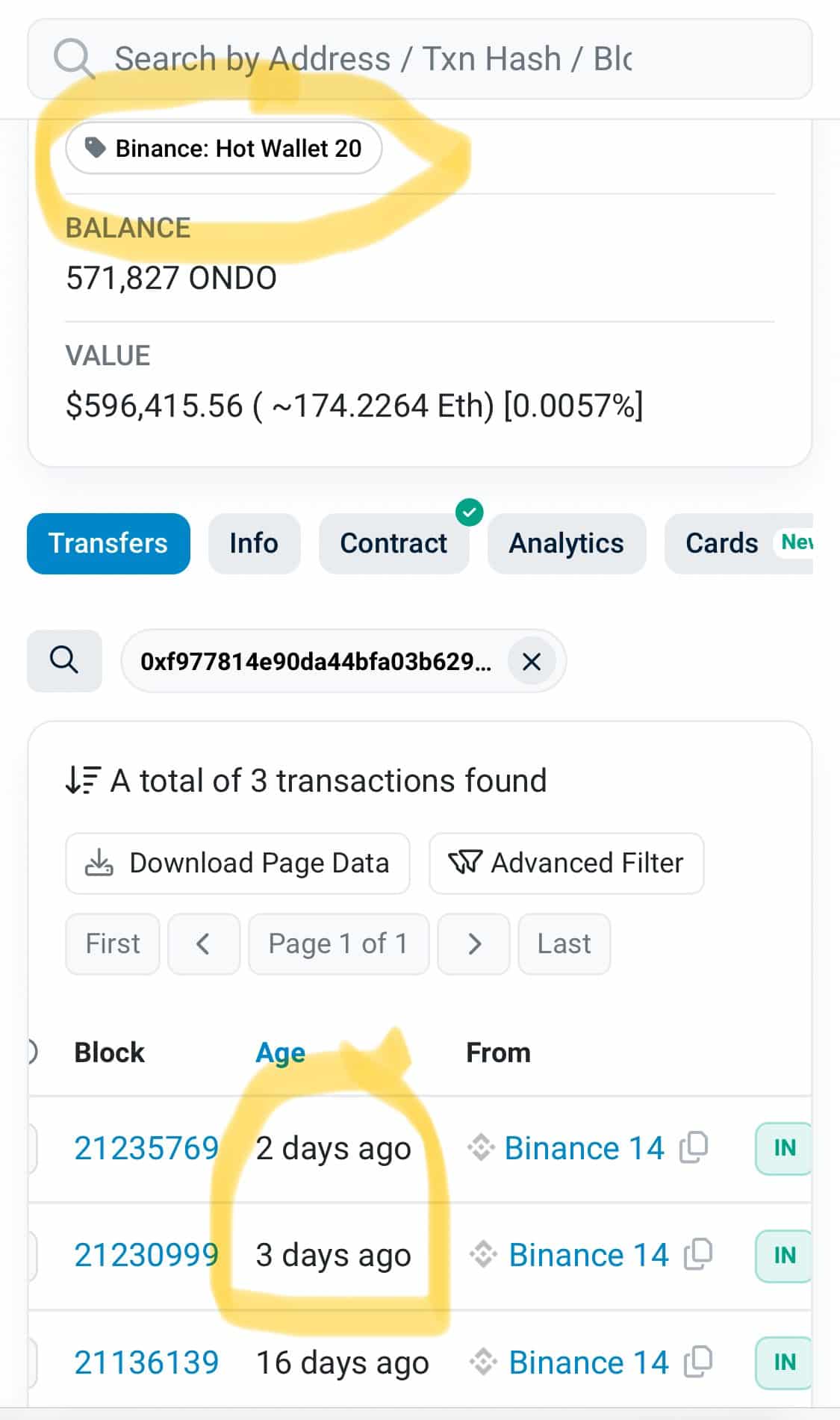

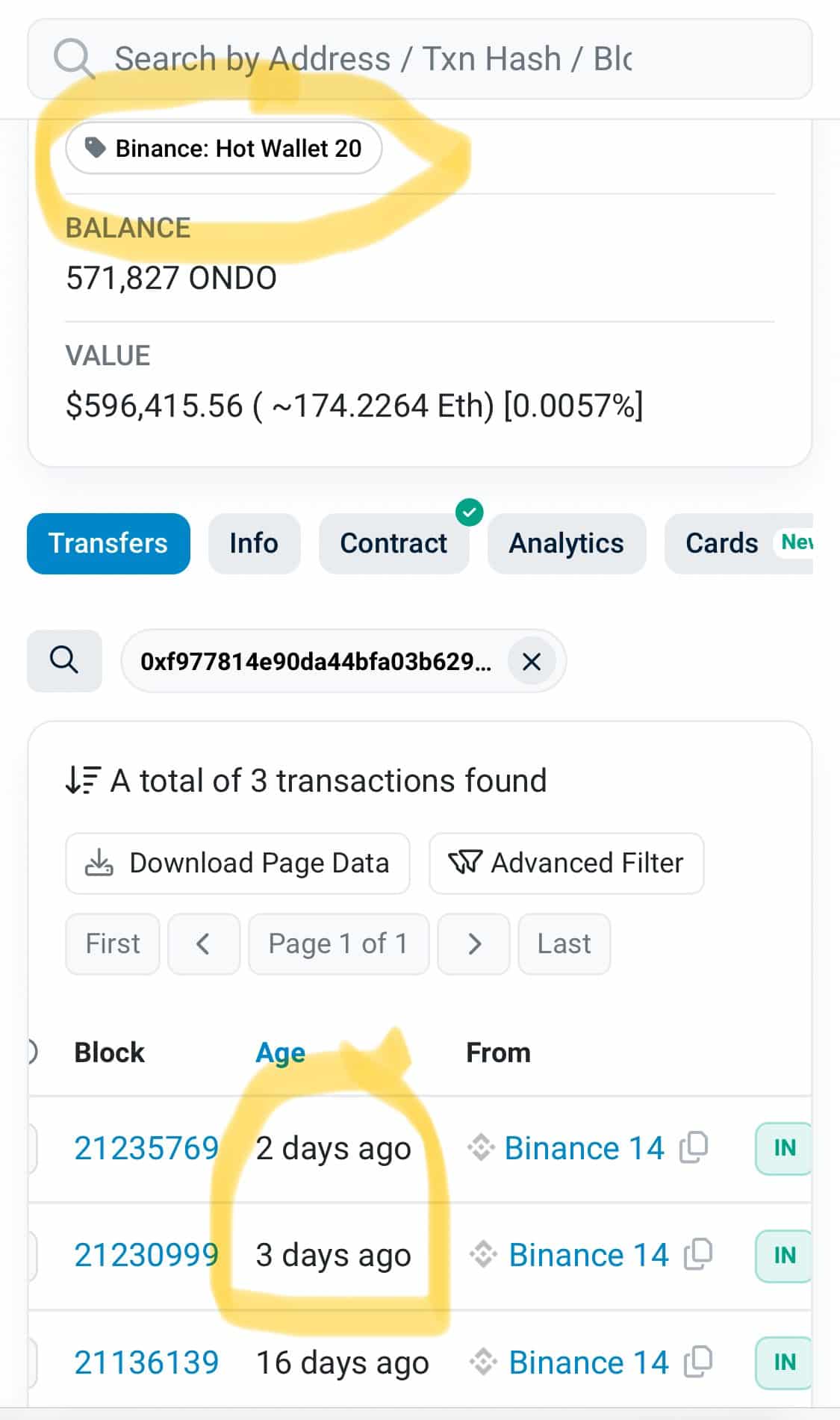

Binance accumulates ONDO

Binance, the arena’s greatest cryptocurrency trade by way of marketplace capitalization, has just lately collected $596,415.56 value of ONDO, identical to 174.22 ETH, during the last 5 days.

Those transactions had been performed thru Binance’s cold and hot wallets in two separate transfers, bringing its overall ONDO holdings to 571,827 tokens.

Supply: X

Supply: X

Such large-scale acquisitions regularly trace at rising institutional hobby, suggesting that primary avid gamers is also positioning themselves for a possible rally.

Then again, a better glance unearths a stark distinction: whilst establishments are collecting, spinoff investors are actively promoting, signaling a possible divergence in marketplace sentiment.

Divergence amid ONDO accumulation

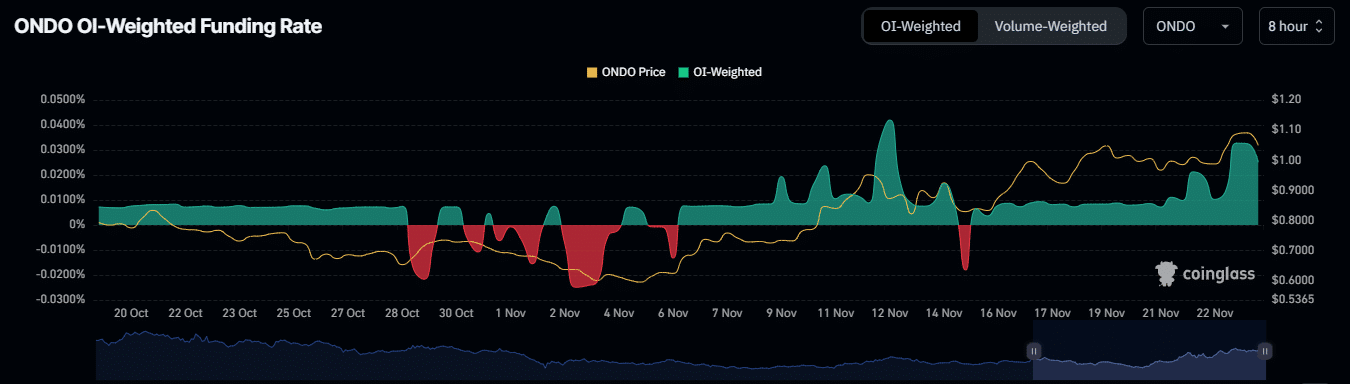

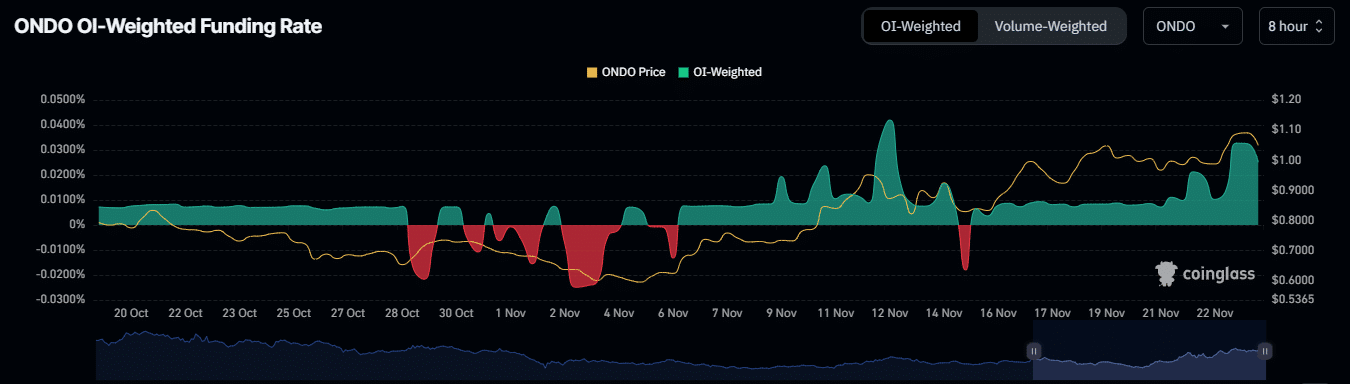

On the time of writing, bearish sentiment used to be growing, diverging from the bullish undertone set by way of large-scale accumulation.

The OI-Weighted Investment Fee, which adjusts the Investment Fee by way of Open Pastime (OI), supplies a clearer view of marketplace sentiment.

A good price suggests a bullish marketplace with dominant longs, whilst a adverse price displays a bearish marketplace led by way of shorts.

At press time, ONDO’s Investment Fee gave the look to be ceaselessly declining, and has entered the adverse area, with a studying of 0.0251%, appearing rising bearish power.

Supply: Coinglass

Supply: Coinglass

Lengthy liquidation knowledge printed that the marketplace seemed adverse for lengthy investors who aligned with the buildup tendencies of bigger traders.

A complete of $538,610 value of lengthy positions has been forcefully liquidated, indicating that downward momentum would possibly proceed to influence ONDO’s worth decrease.

Build up briefly contracts

With lengthy positions being liquidated and marketplace sentiment transferring towards bearish, AMBCrypto has noticed an important build up briefly contracts.

Learn Ondo Finance’s [ONDO] Value Prediction 2024–2025

In line with Coinglass, the clicking time long-to-short ratio used to be beneath 1 at 0.8734, indicating the next collection of brief contracts. This instructed a marketplace tilt in prefer of shorts.

If the fashion of opening extra brief contracts continues, it would additional pressure down ONDO’s worth, delaying any doable rally and pushing the asset farther from its present stage.

Subsequent: Is Bitcoin overheating close to $100K? 3 key spaces to stay up for

:max_bytes(150000):strip_icc()/Tomorrowland-stage-071625-9a7fa9c75fb742bfaabb09bd9676a517.jpg)