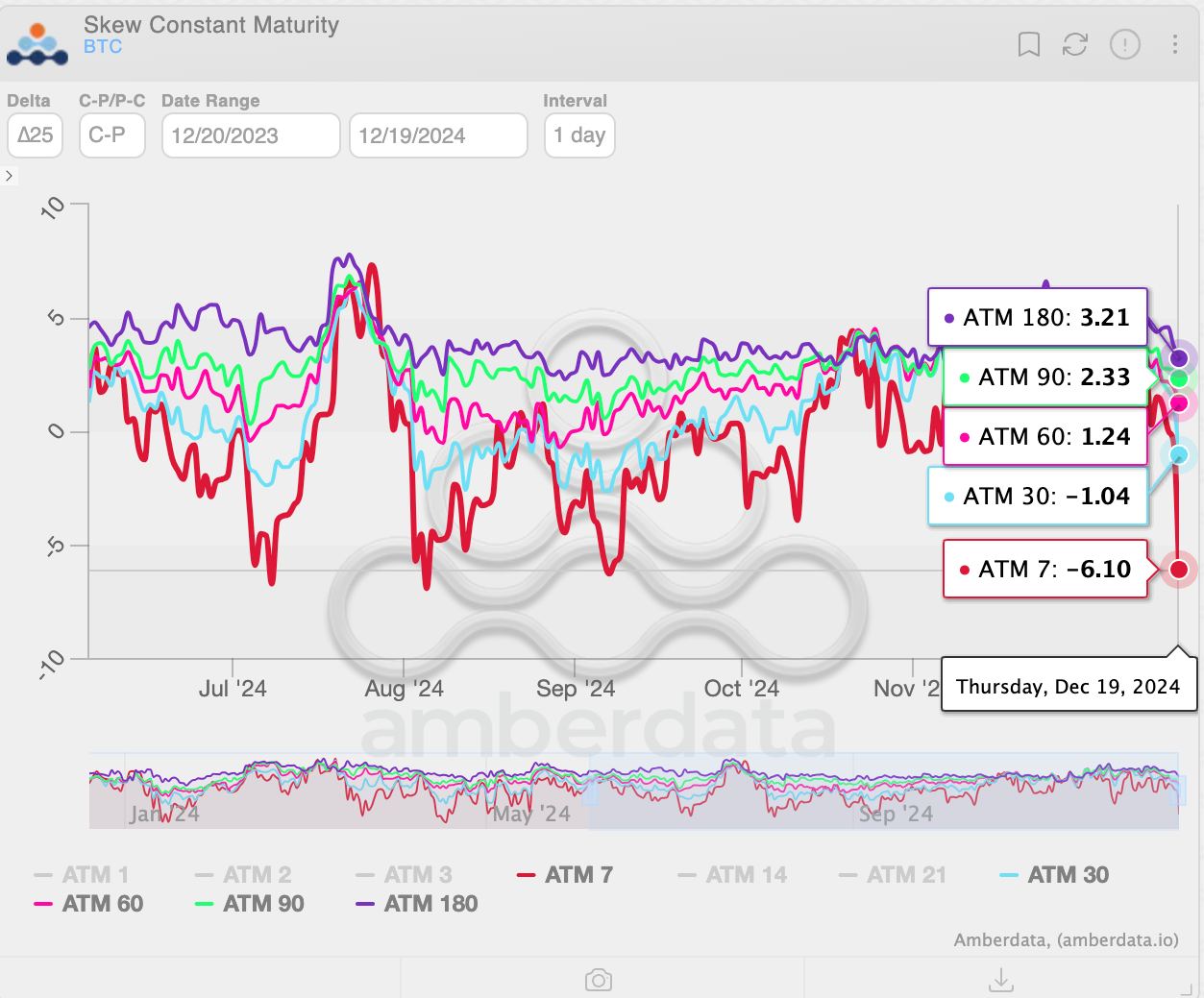

The cost of Bitcoin plunged under $59,000 past due Tuesday, in keeping with CoinGecko information, achieving lows no longer observed in per week. The greater than 3% fall was once echoed via Ethereum, which fell under $2,500.The unexpected value drop precipitated over $170 million in long-position liquidations in one hour, in keeping with CoinGlass, stinging buyers having a bet for the asset costs to upward push. The ones liquidations had been ruled via BTC and ETH buyers, with $65 million and $52 million in longs rekt, respectively.Bitcoin had observed a cast upward push above $63,000 on Friday at the heels of remarks via U.S. Federal Reserve Chairman Jerome Powell signaling an rate of interest reduce subsequent month. However the cost of BTC stumbled the day gone by, previous to the most recent drop.The cost of Solana (SOL) may be down greater than 6% for the day at $147. Tokens together with XRP and Dogecoin (DOGE) additionally noticed Tuesday dips of greater than 5% over 24 hours.There does not seem to be a particular cause for the short shift, because the U.S. inventory markets closed Tuesday buying and selling most commonly flat for the day.Some analysts have pointed to the new state of Bitcoin value actions as attaining “equilibrium,” with a contemporary file from crypto analytics platform Coinglass noting that it would precede a length of “heightened volatility.”In the meantime, in its newest file, Fairlead Methods warned of a “seasonally susceptible length in September.” The company makes use of technical research for its forecasts, and prompt “any other two months of corrective value motion.”Day-to-day Debrief NewsletterStart each day with the highest information tales at the moment, plus authentic options, a podcast, movies and extra.

Bitcoin and Ethereum Costs Plummet, Over $170 Million in Longs Liquidated – Decrypt