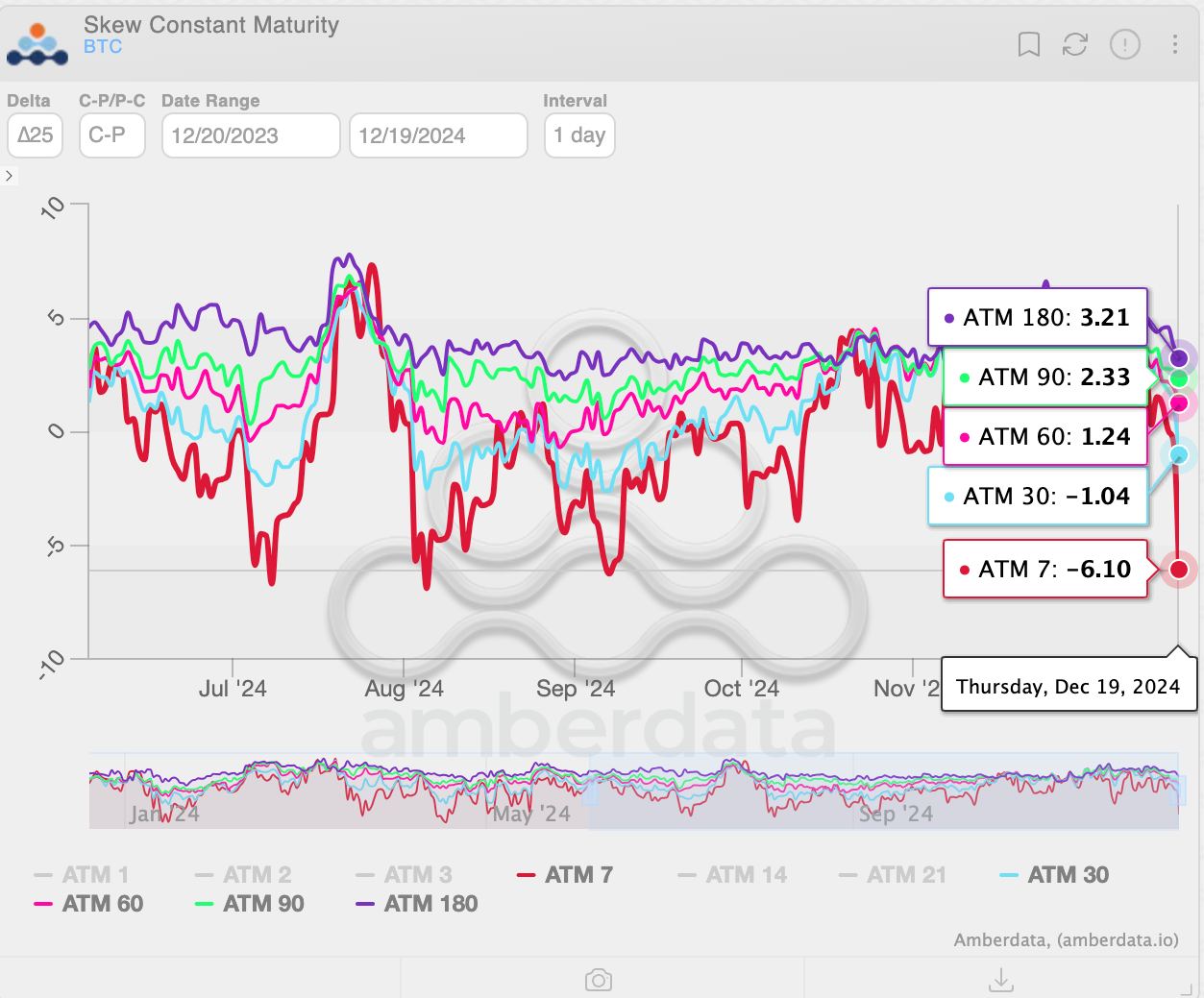

“Bitcoin stays risky with the drawdown of 10% we noticed this week, with the hot catalyst being pushed via spot bitcoin ETF outflows from GBTC of about 300mm on March 20,” Semir Gabeljic, Director of Capital Formation at Pythagoras Investments, mentioned in an electronic mail interview.“The drawdown nonetheless stays in step with the predicted vary of 10-20% as we’ve observed traditionally that occurs proper sooner than the BTC halving match. Extra volatility is anticipated to come back going into the BTC halving,” he persevered.In the meantime, the CoinDesk 20 (CD20), a measure of the arena’s maximum liquid virtual belongings, is down 0.5%.CoinDesk’s Digitization Index (DTZ), which measures the efficiency of digitization protocols like Ethereum Identify Carrier (ENS), used to be the best-performing index all over Asia buying and selling hours, up 2.7%.In a observe despatched out Friday morning Asia time, Singapore-based QCP Capital wrote that the marketplace is consolidating with bitcoin and ether buying and selling in a “fairly tight vary” and that the marketplace “would possibly take a spoil this weekend” after remaining weekend’s pre-FOMC volatility.The buying and selling area additionally famous that the Grayscale Bitcoin Believe (GBTC) persevered to peer steep outflows, with $358.8 million leaving the fund. QCP expects a fourth consecutive day of BTC spot exchange-traded fund internet outflows.Referring to ether (ETH), QCP says that the marketplace is beginning to value out the possibilities of a place ether ETF being licensed anytime quickly.“The Grayscale ETH bargain has widened from -8% to -20% during the last two weeks,” QCP famous.Blockchain bettors on Polymarket additionally imagine that the second one quarter is when ether will hit its all-time top, however a large portion of buyers additionally suppose there can be no all-time highs in 2024.

Bitcoin Assessments $66K as Analysts Be expecting Extra Volatility Sooner than Calm