BTC has crossed right into a historical “buying groceries space,” indicating {that a} bounce-back is drawing close.

U.S. buyers have began buying BTC on this area, whilst by-product investors are promoting as an alternative.

Bitcoin [BTC] has but to completely recuperate following the market-wide sell-off.

The development noticed its value drop from $90,000, which it had held for the reason that fifteenth of November, buying and selling underneath it at the twenty fourth of February, placing it at a lack of 17.47% up to now month.

In step with AMBCrypto’s research, BTC may see a big jump upper as sure sentiment aligns with a bullish narrative.

On the other hand, with the present promoting force from the by-product marketplace, the rally won’t materialize. Right here’s why.

U.S. buyers acquire Bitcoin as costs hit new stage

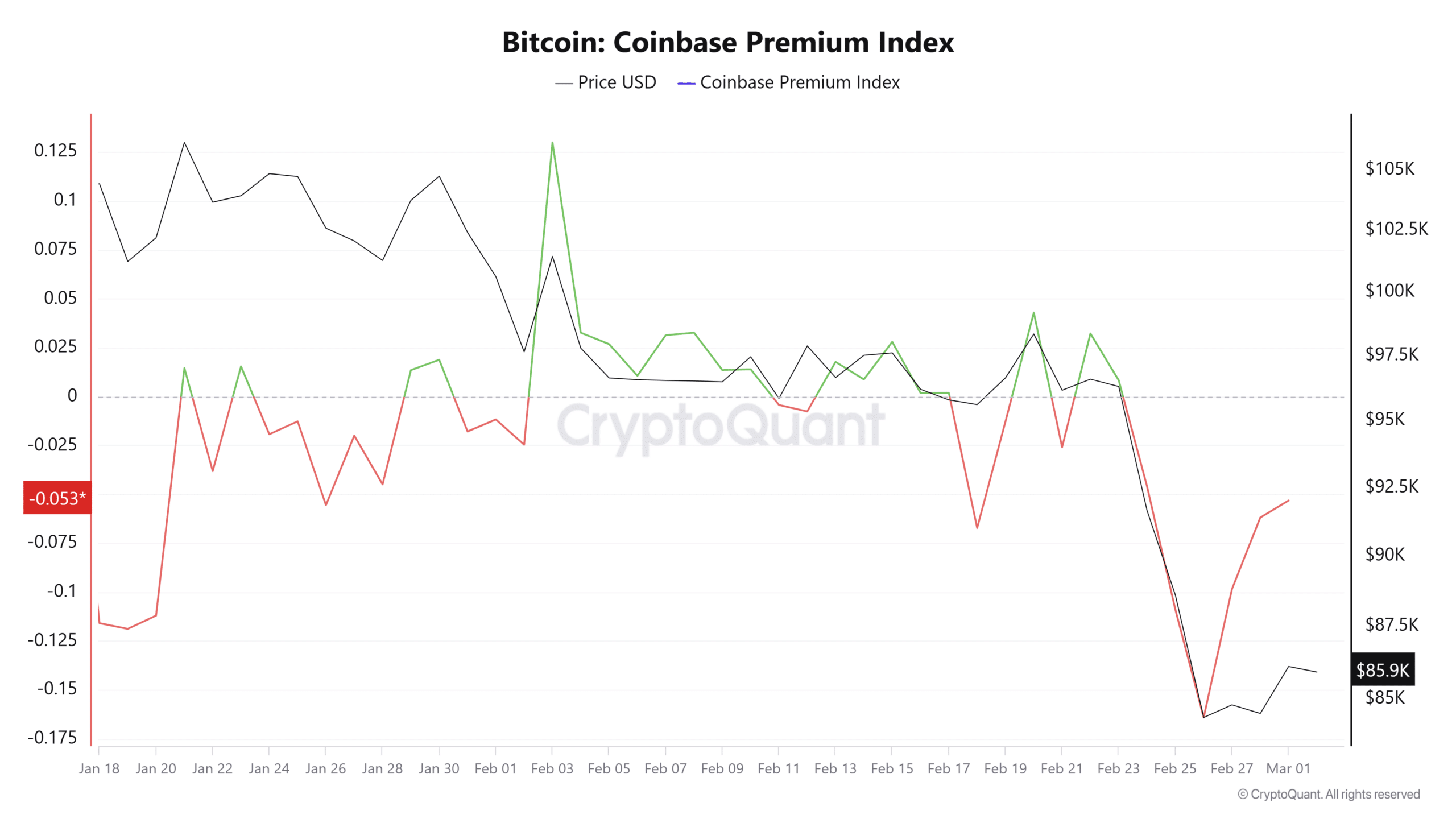

Fresh research from CryptoQuant presentations that Bitcoin has entered a zone known as a historical buying groceries space 1 & 2 at the chart.

To business on this space, Bitcoin wishes to peer a worth drop of 15 to twenty%—a decline it has just lately recorded.

Supply: CryptoQuant

Supply: CryptoQuant

Those ranges, as observed at the chart, are characterised as buying groceries spaces as a result of two primary actions happen: the historic accumulation of BTC by means of marketplace individuals and buyers capitalizing at the overreaction that led to a cost drop.

On the time of writing, U.S. buyers available in the market have been profiting from this drop and feature begun gathering the asset because the Coinbase Top class Index spikes to -0.053, trending up.

Usually, when this index is within the detrimental area, it signifies promoting from U.S. buyers. On the other hand, when the asset developments upper and heads towards crossing above 0, it alerts that purchasing sentiment is step by step increase.

Supply: CryptoQuant

Supply: CryptoQuant

If the index crosses above 0, any other wave of BTC purchasing may happen, as buyers at this stage achieve self assurance that the asset is prone to rally in keeping with its efficiency and different marketplace sentiment.

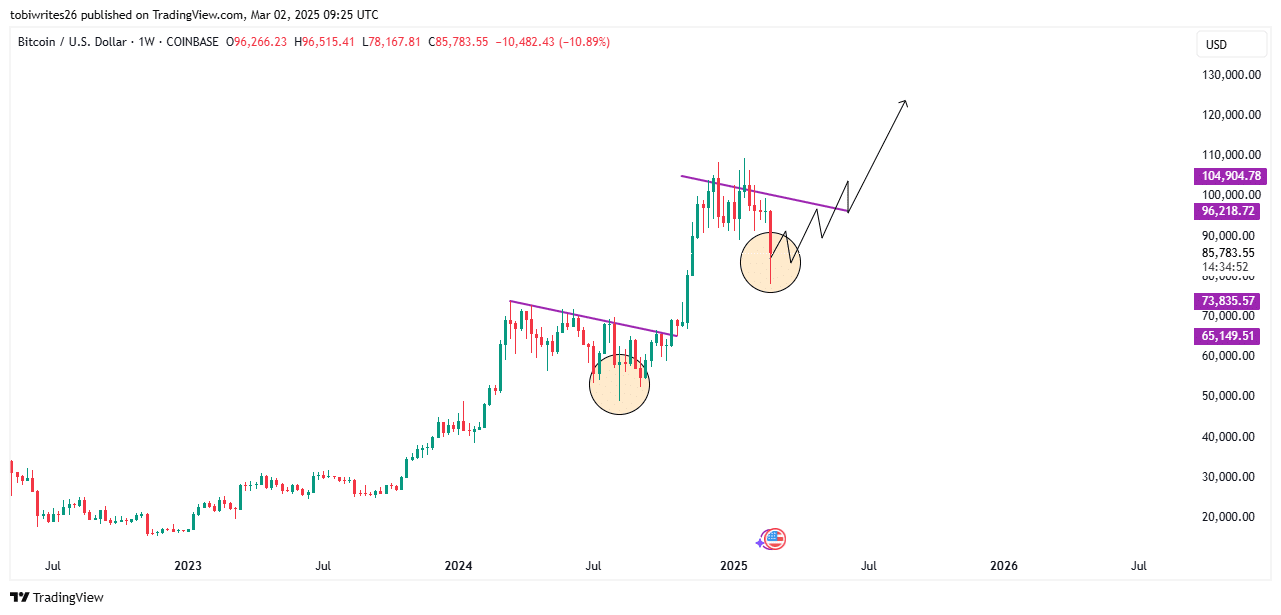

At the chart, BTC might be at the fringe of replicating the transfer that resulted in its value surge after a pointy decline in August, highlighted within the orange circle. Lately, a an identical drop has took place.

Following this trend, the bullish transfer for BTC could be showed as soon as the asset breaches the crimson resistance line above it, probably resulting in a brand new all-time prime.

Supply: TradingView

Supply: TradingView

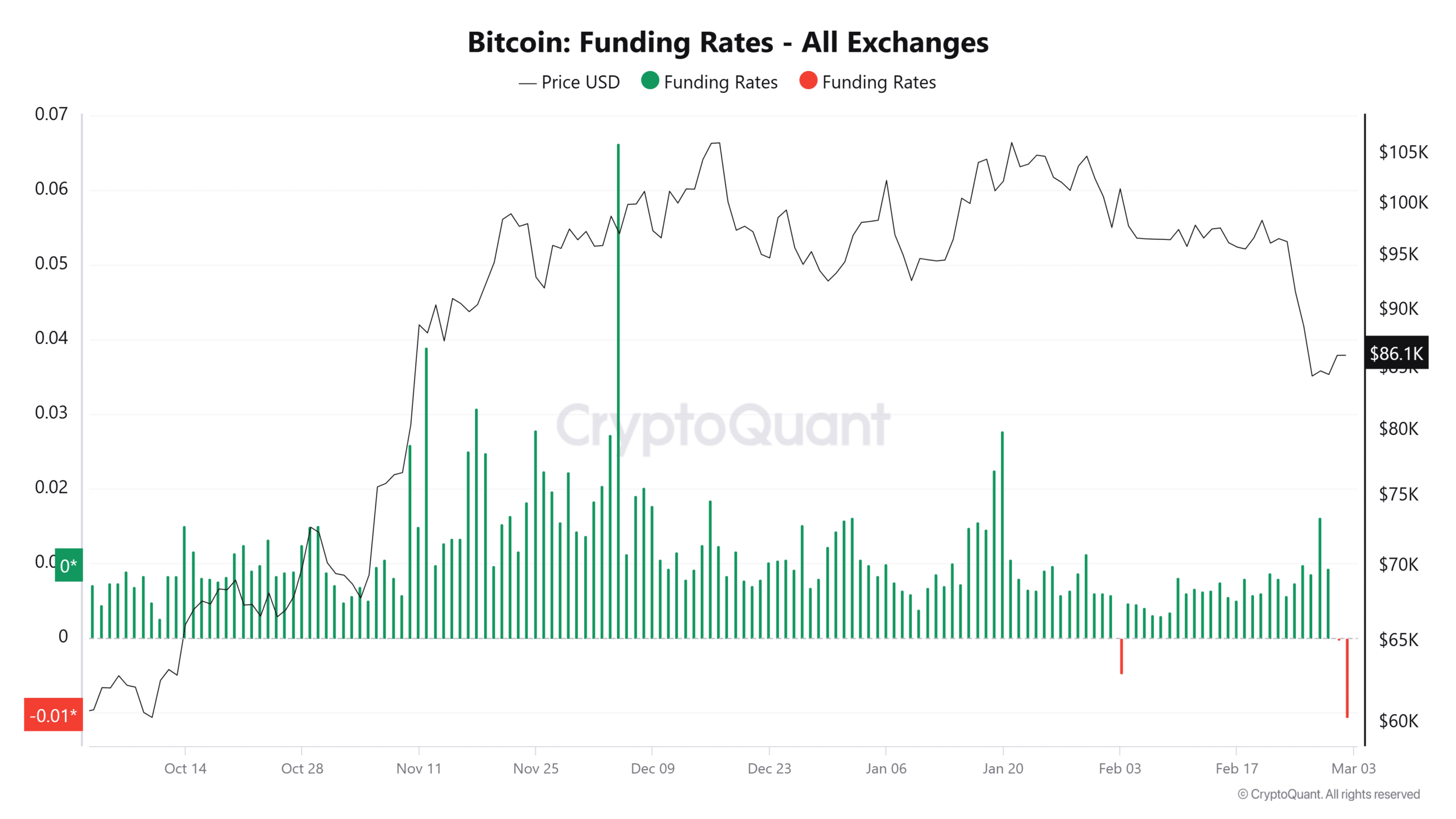

Whilst task on-chain and the chart counsel a possible rally for Bitcoin, by-product investors are promoting, which might obstruct the expected upswing.

Spinoff investors guess in opposition to BTC

Conviction within the by-product marketplace is low, with investment charges losing and promoting quantity seeing a big hike, suggesting those investors have impeded BTC’s primary value transfer.

The present Bitcoin Investment Fee throughout cryptocurrency exchanges has observed a big drop for the reason that third of February decline, with a press time studying of -0.01.

A detrimental Investment Fee signifies that dealers available in the market are paying a top rate to handle their positions in anticipation of additional value declines.

Supply: CryptoQuant

Supply: CryptoQuant

With the Taker Purchase/Promote Ratio, used to decide whether or not purchasing or promoting quantity is dominating, research presentations that dealers available in the market are in keep watch over, as their promote force outweighs purchase force.

With key basic signs turning bearish, BTC’s rally may face a minor setback. On the other hand, if different key signs flip bullish, dealers within the by-product marketplace may get liquidated because the asset strikes upper.

Subsequent: XRP faces resistance at $2.4 – Will bulls conquer the barrier?