In a tumultuous flip of occasions, the cryptocurrency marketplace has been rattled by way of a pointy decline in Bitcoin costs. After a sustained duration of exceptional positive factors and report highs, Bitcoin has plunged to a weekly low of $65,000, marking a vital setback for traders.

On the time of writing, Bitcoin numbers had been all painted in crimson, and buying and selling at $65,710, dropping worth within the 24-hour and weekly timeframes by way of 5.6% and four.5%, respectively, in line with knowledge from Coingecko.

A couple of days after its earlier low of $68,000, Bitcoin plummeted to its provide degree, a determine no longer observed in every week, as bears persevered of their downward force.

Bitcoin plunging within the remaining 24 hours. Supply: Coingecko.

Bitcoin plunging within the remaining 24 hours. Supply: Coingecko.

Altcoins Additionally Take A Beating

Whilst Bitcoin bears the brunt of the downturn, altcoins don’t seem to be spared from the fallout. Ethereum (ETH) and Binance Coin (BNB) have additionally witnessed considerable losses, losing 10% in their worth or extra.

Dogecoin and Shiba Inu, two fashionable meme cash, have skilled even steeper declines, plunging by way of 20% and just about 30%, respectively. The wider altcoin marketplace mirrors Bitcoin’s downward trajectory, amplifying the sense of unease amongst traders.

BTC marketplace cap these days at $1.29 trillion. Chart: TradingView.com

Bitcoin: Affect On Marketplace Dynamics

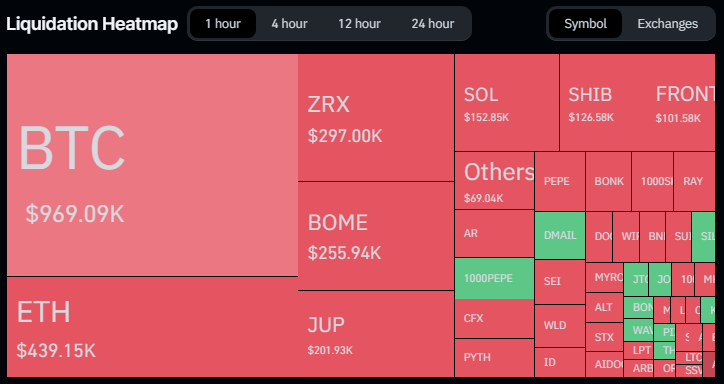

The hot value correction in Bitcoin has reverberated around the cryptocurrency panorama, reshaping marketplace dynamics and investor sentiment. The surge in liquidations, with over 151,000 investors dealing with margin calls up to now 24 hours, underscores the magnitude of the marketplace upheaval. Bitcoin’s dominance out there is obvious because it accounts for the lion’s percentage of the overall liquidations, highlighting its pivotal position in shaping general marketplace traits.

Because of the decline in worth, the overall marketplace liquidations have reached $426 million, with Bitcoin taking the worst hit.

Liquidation Spree

The volume that the cost of Bitcoin has liquidated during the last 24 hours has exceeded $104 million, with lengthy investors dropping probably the most cash—they misplaced $86 million in comparison to $18 million for brief dealers. Ethereum noticed a $48 million general liquidation, with $33 million going to lengthy investors and $15 million going to quick investors, because of the dropping run.

Analyst Sounds Alarm Siren

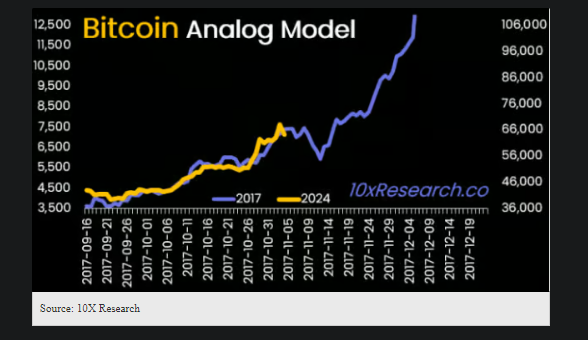

In the meantime, marketplace analysts similar to Markus Thielen, CEO of 10x Analysis, have sounded the alarm bells, caution of additional problem dangers for Bitcoin. Thielen’s prediction of a possible drop to $63,000 sends a sobering message to traders, urging warning and prudence in navigating the present marketplace surroundings.

His insights make clear underlying issues about Bitcoin’s marketplace construction, together with low buying and selling volumes and liquidity, which exacerbate the chance of sharp value corrections.

Amidst the marketplace turbulence, traders are grappling with the results of Thielen’s research and adjusting their methods accordingly. The technology of meme coin mania seems to be waning, prompting traders to reconsider their positions and safe earnings whilst they nonetheless can.

Featured symbol from Kinesis Cash, chart from TradingView

:max_bytes(150000):strip_icc()/meganhs11-0550977a84f84b89966cf1799ce2bfb1.jpeg)