As inventory markets crumbled for a 2d day on April 4, US Federal Reserve Chair Jerome Powell mentioned that the Trump management’s “reciprocal price lists” may just considerably have an effect on the financial system, probably resulting in “upper inflation and slower enlargement.”Addressing the general public at a convention on April 4, Powell maintained a wary method and famous that price lists may just spike inflation “within the coming quarters,” complicating the Fed’s 2% inflation goal, simply months after charge cuts indicated a cushy touchdown. Powell mentioned,“Whilst price lists are extremely prone to generate a minimum of a short lived upward thrust in inflation, it is usually conceivable that the results might be extra power.” Moments sooner than Powell’s speech, US President Donald Trump known as out the Fed chair to “CUT INTEREST RATES” in a publish at the Fact Social, taking a jab at Powell for being “all the time overdue.”Supply: Fact SocialCurrently, the Fed faces a vital selection: pause rate of interest cuts right through the 12 months or reply temporarily with charge discounts if the financial system displays indicators of weakening. Whilst the Fed legit famous that the financial system is in a excellent position, Powell mentioned that it was once, “Too quickly to mention what’s going to be the right trail for financial coverage,”On April 4, the unemployment charge additionally greater to 4.2% in March from 4.1% in February, however to the contrary, March’s Non-Farm Payrolls added 228,000 jobs, which exceeded expectancies and bolstered financial energy. In March, the Shopper Worth Index (CPI) additionally rose via 2.8% 12 months over 12 months, with March knowledge due on April 10. The above figures spotlight a robust exertions marketplace however nagging inflation considerations, thus aligning with Powell’s caution about attainable tariff affects. Similar: Bitcoin bulls protect $80K enhance as ‘Global Conflict 3 of industry wars’ crushes US stocksPowell’s warning on upper inflation and slowing financial enlargement got here at the identical day that the DOW dropped 2,200 and a ten% two-day loss from the S&P 500. X-based markets useful resource ‘Watcher Guru’ introduced that, “$3.25 trillion burnt up from the USA inventory marketplace lately. $5.4 billion was once added to the crypto marketplace.”

Inventory marketplace losses hit $3.5 trillion. Supply: Watcher Guru / X Bitcoin to entertain additional volatilityMost traders wait for that within the quick time period, Bitcoin (BTC) may just see a surge in volatility. Powell’s remarks about price lists riding “upper inflation” and perhaps “upper unemployment” may just rattle conventional marketplace traders, prompting a pivot to BTC.Actually, analysts have identified that BTC value seems to be “decoupling” from shares contemporary downturn. Even if Bitcoin hit a 9-day top on April 2 sooner than President Trump rolled out his “reciprocal price lists” on “Liberation Day,” the associated fee bought off sharply as soon as the price lists had been published at a White Space presser. Since then, Bitcoin has held secure above the $82,000 degree, and as US equities markets collapsed on April 4, BTC rallied to $84,720, reflecting value motion, which is uncharacteristic of the norm.

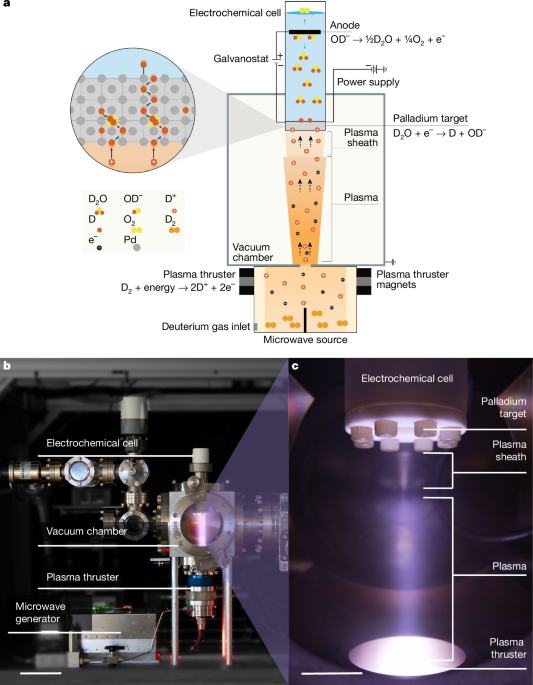

BTC/USD value as opposed to primary inventory indices. Supply: X / Cory BatesIndependent marketplace analyst Cory Bates posted the above chart and mentioned, “[…]Bitcoin is decoupling proper sooner than our eyes.” With China retaliating with 34% price lists on US items and Trump pressuring Powell to chop rates of interest, marketplace volatility may just push Bitcoin’s value upward as a hedge in opposition to uncertainty. All through the 2018 U.S.-China industry warfare, Bitcoin value didn’t see any building up throughout all the 12 months. Then again, it skilled notable volatility and a fifteen% value upward thrust when the industry warfare escalated in mid-2018, with the USA enforcing price lists on Chinese language items in July, adopted via retaliatory measures from China. Similar: Bitcoin sentiment falls to 2023 low, however ‘chance on’ setting might emerge to spark BTC value rallyThis article does now not comprise funding recommendation or suggestions. Each funding and buying and selling transfer comes to chance, and readers will have to behavior their very own analysis when you make a decision.