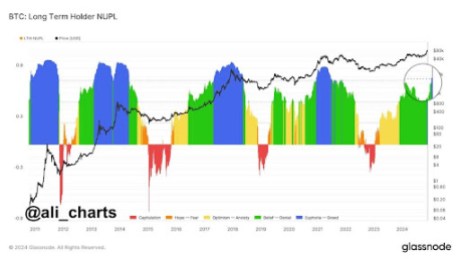

Unencumber the Editor’s Digest for freeRoula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.The creator is a former funding banker and creator of ‘Energy Failure: The Upward push and Fall of an American Icon’The cryptoworld has been abuzz in contemporary weeks in regards to the chance that the Securities and Alternate Fee will quickly greenlight a bitcoin exchange-traded fund. The concept that such an ETF will quickly be introduced to hungry, if erroneous, US buyers has helped supply a year-end kicker to the outstanding rally in bitcoin from the depths of its newest “iciness” in past due 2022. It changed into some of the highest acting investments of 2023, emerging round 160 in line with cent during the last yr to almost $44,000. This is moderately a turnaround given the crypto global has been at the ropes reputationally ceaselessly all the way through the previous yr or so. Now not most effective has there been the chapter of crypto replace FTX and the legal conviction of its founder Sam Bankman-Fried, but additionally its leader rival Binance agreeing to pay $4.3bn in consequences associated with cash laundering and breaching global sanctions. That used to be some of the biggest company consequences in US historical past. Binance founder Changpeng Zhao additionally pleaded responsible to failing to offer protection to towards cash laundering and resigned from his place. However should you take into accounts it, there has already been some way for buyers to play the bitcoin rollercoaster for years: through purchasing, or promoting, the inventory of endeavor device corporate MicroStrategy which has hitched its fortunes to bitcoin, rendering its gross sales of endeavor device fairly beside the point to its inventory marketplace valuation.Underneath a technique pushed through the corporate’s 58-year-old, MIT-educated government chair Michael Saylor, MicroStrategy has been purchasing bitcoin since 2000. “Because of its restricted provide, bitcoin provides the chance for appreciation in price if its adoption will increase and has the prospective to function a hedge towards inflation in the longer term,” it mentioned on the time. MicroStrategy is regarded as the biggest indexed holder of bitcoin on the earth. The corporate owns 189,150 bitcoins, bought through the years at an mixture value of round $5.9bn, as of the top of December.MicroStrategy’s device operations have introduced Saylor into the regulatory highlight. In 2000, he agreed to pay $8.3mn plus a $350,000 penalty to settle SEC fees of materially overstating device revenues and income. But if bitcoin used to be using prime, say round November 2021, when its value hit $69,000, he drew numerous consideration. He even bedazzled Tucker Carlson for greater than an hour in regards to the knowledge of the cryptocurrency earlier than the tv anchor used to be defenestrated from Fox. Saylor is a real believer, and an articulate one at that. His interviews about bitcoin are long and spellbinding. He speaks in entire paragraphs. You come back clear of taking note of him satisfied that bitcoin is the following nice innovation within the monetary global. After which, you step again, give it a concept or two and take into account that Jamie Dimon, CEO of JPMorgan, mentioned of cryptocurrency, “If I used to be the federal government, I’d close it down.” MicroStrategy government chair Michael Saylor: ‘We’re roughly like your nonexistent spot ETF’ © BloombergSaylor relinquished the position of the CEO of MicroStrategy in August 2022 to transform government chair after but some other bitcoin plunge. On the time, the corporate had reported cumulative impairment losses of just about $2bn on its virtual property since acquisition.However because of the run-up in the cost of bitcoin in 2023, MicroStrategy’s hoard is now price greater than $8bn, giving the corporate a acquire of a few $2bn on its funding. Now not strangely, MicroStrategy’s inventory value additionally outperformed in 2023, up greater than 330 in line with cent for the yr. Its marketplace price of round $8.8bn signifies that buyers are valuing its device industry at round $800mn. (This is nonetheless hefty given MicroStrategy made a small pre-tax benefit of round £13mn on revenues of $371mn within the 9 months to September 30, after making an allowance for share-based pay however with the exception of impairments on its virtual holdings.) So MicroStrategy is largely a play on bitcoin and has been for years. In different phrases, there’s been no wish to watch for the SEC to approve a bitcoin ETF, it kind of feels to me. Saylor himself instructed CNBC: “We’re roughly like your nonexistent spot ETF.”The issue with bitcoin isn’t that there hasn’t been a strategy to speculate on it. The issue with bitcoin is that it’s all about hypothesis. We don’t want new techniques to take a position at the cryptocurrency. What we’d like, if bitcoin goes to be the saviour its advocates need us to suppose it’s, is a use for bitcoin. When it may be used to shop for and promote the issues we wish, as seamlessly as fiat foreign money, that’ll be the sport changer. The true pleasure for bitcoin gained’t come from the SEC authorising new techniques to take a position on it, however quite when there’s extra to it than simply hypothesis.

MicroStrategy government chair Michael Saylor: ‘We’re roughly like your nonexistent spot ETF’ © BloombergSaylor relinquished the position of the CEO of MicroStrategy in August 2022 to transform government chair after but some other bitcoin plunge. On the time, the corporate had reported cumulative impairment losses of just about $2bn on its virtual property since acquisition.However because of the run-up in the cost of bitcoin in 2023, MicroStrategy’s hoard is now price greater than $8bn, giving the corporate a acquire of a few $2bn on its funding. Now not strangely, MicroStrategy’s inventory value additionally outperformed in 2023, up greater than 330 in line with cent for the yr. Its marketplace price of round $8.8bn signifies that buyers are valuing its device industry at round $800mn. (This is nonetheless hefty given MicroStrategy made a small pre-tax benefit of round £13mn on revenues of $371mn within the 9 months to September 30, after making an allowance for share-based pay however with the exception of impairments on its virtual holdings.) So MicroStrategy is largely a play on bitcoin and has been for years. In different phrases, there’s been no wish to watch for the SEC to approve a bitcoin ETF, it kind of feels to me. Saylor himself instructed CNBC: “We’re roughly like your nonexistent spot ETF.”The issue with bitcoin isn’t that there hasn’t been a strategy to speculate on it. The issue with bitcoin is that it’s all about hypothesis. We don’t want new techniques to take a position at the cryptocurrency. What we’d like, if bitcoin goes to be the saviour its advocates need us to suppose it’s, is a use for bitcoin. When it may be used to shop for and promote the issues we wish, as seamlessly as fiat foreign money, that’ll be the sport changer. The true pleasure for bitcoin gained’t come from the SEC authorising new techniques to take a position on it, however quite when there’s extra to it than simply hypothesis.

Bitcoin ETFs omit the purpose

/cdn.vox-cdn.com/uploads/chorus_asset/file/25758299/2023738908.jpg)