Main cryptocurrencies inched upper Monday, coinciding with a surge in tech shares.

CryptocurrencyGains +/-Value (Recorded at 8:30 p.m. ET)Bitcoin BTC/USD+0.60%$91,007.28Ethereum ETH/USD

+1.49%$3,158.99Dogecoin DOGE/USD +2.23%$0.3725

What Took place: Bitcoin exhibited uneven motion, oscillating between $92,000 and $89,000. The main cryptocurrency has misplaced momentum since smashing previous $93,000 ultimate week.

Ethereum moved fairly northward, attaining an intraday top of $3,225 prior to unexpectedly backing out to $3,150.

Prior to now 24 hours, 114,745 investors have been liquidated, with the overall liquidations at $329.61 million. Over $200 million in upside bets used to be burnt up.

The Open Pastime (OI) in Bitcoin futures rose 2% within the ultimate 24 hours, suggesting sustained speculative passion.

The selection of investors conserving Bitcoin lengthy positions climbed significantly over the former 24 hours, signaling expectancies that the rally will resume.

The “Excessive Greed” sentiment greater to 90, as according to the Cryptocurrency Worry and Greed Index.

Most sensible Gainers (24-Hours)

CryptocurrencyGains +/-Value (Recorded at 8:30 p.m. ET)Hedera (HBR)+40.64%$0.1395Tezos (XTZ)+40.27%$1.13Akash Community (AKT)+38.64%$4.55

The worldwide cryptocurrency marketplace capitalization stood at $3.08 trillion, emerging 1.84% within the ultimate 24 hours.

The Nasdaq Composite, the barometer of tech shares, popped 111.68 issues, or 0.60%, to finish at 18,791.81. The S&P 500 received 0.39% to near at 5,893.62, whilst the Dow Jones Commercial Reasonable closed 0.13% decrease at 43,389.60.

The tech rally used to be pushed through a 5.62% soar in stocks of EV juggernaut Tesla Inc. TSLA on reviews suggesting that the approaching regulatory framework beneath Trump may ease mandates for self-driving cars.

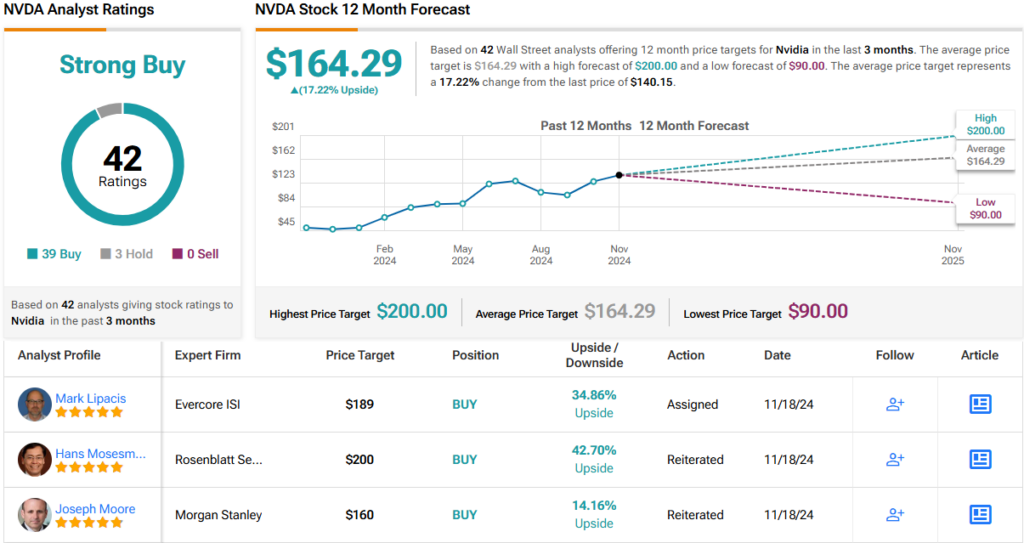

Moreover, buyers have been outfitted for AI behemoth Nvidia Corp.’s NVDA income file on Wednesday.

See Extra: Perfect Cryptocurrency Scanners

Analyst Notes: Widespread cryptocurrency analyst Ali Martinez used historic trajectories to undertaking Bitcoin’s subsequent strikes prior to an important correction.

“All over the 2017 bull marketplace, Bitcoin surged 156% previous its earlier all-time top prior to the primary main correction of -39%. In 2020, BTC rose 121% prior to a -32% correction,” Martinez mentioned.

Must historical past repeat, Bitcoin may succeed in $138,000 prior to its “first main pullback,” the analyst added.

All over the 2017 bull marketplace, #Bitcoin surged 156% previous its earlier all-time top prior to the primary main correction of -39%. In 2020, $BTC rose 121% prior to a -32% correction.If historical past repeats, $BTC may succeed in a minimum of $138,000 prior to experiencing the primary main pullback. %.twitter.com/eM3kLt6DA9— Ali (@ali_charts) November 18, 2024

Widespread on-chain analytics company CryptoQuant stated that Bitcoin has “room” for additional enlargement in keeping with the studying of the Quick Time period Holders SOPR indicator.

The SOPR, mixed with the 30-day transferring moderate (30d MA), printed that non permanent holders are taking average income, with out a indicators of over the top euphoria.

“Recently, the indicator stays within the heart area, some distance from the Excessive Greed vary, suggesting that the asset nonetheless has room to proceed emerging prior to attaining a conceivable marketplace most sensible,” CryptoQuant famous.

Learn Subsequent:

Marketplace Information and Information dropped at you through Benzinga APIs© 2024 Benzinga.com. Benzinga does now not supply funding recommendation. All rights reserved.

:max_bytes(150000):strip_icc()/MSTRChart.py-2c9306aabdaf4aa0bc6e0d6569996c7c.jpg)