February 2025 noticed steep declines for Bitcoin and Ethereum, leaving traders frightened for March.

Ancient developments recommend March may convey extra weak spot for each BTC and ETH costs.

February 2025 has been a brutal month for the marketplace, with each Bitcoin [BTC] and Ethereum [ETH] seeing their steepest declines in over ten years.

As the 2 dominant forces within the house combat to regain momentum, uncertainty looms huge over the marketplace’s long run.

With historic information pointing to March as a normally vulnerable month for crypto, traders are left questioning whether or not this contemporary downturn is just the start of an extended hunch or if a restoration is at the horizon.

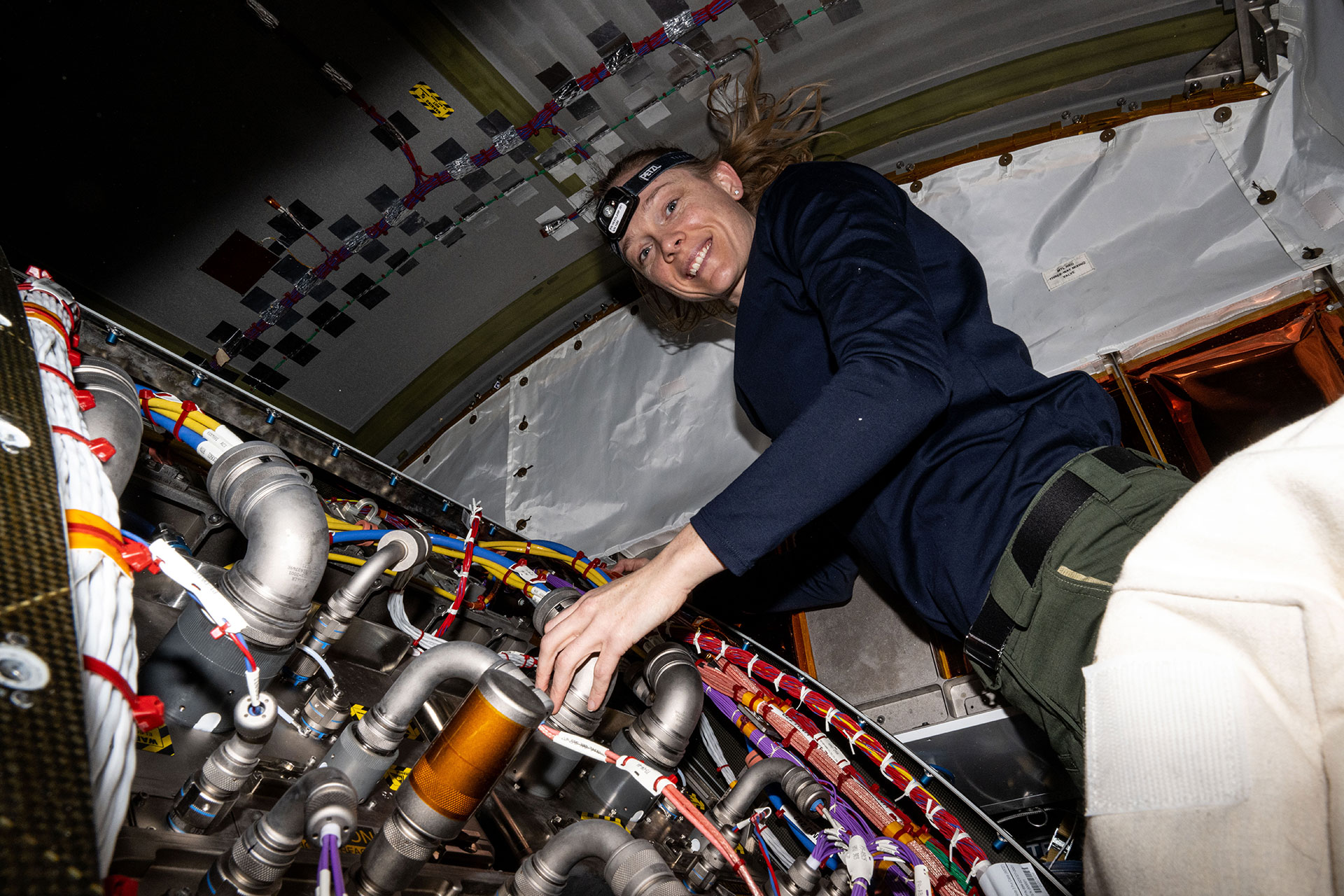

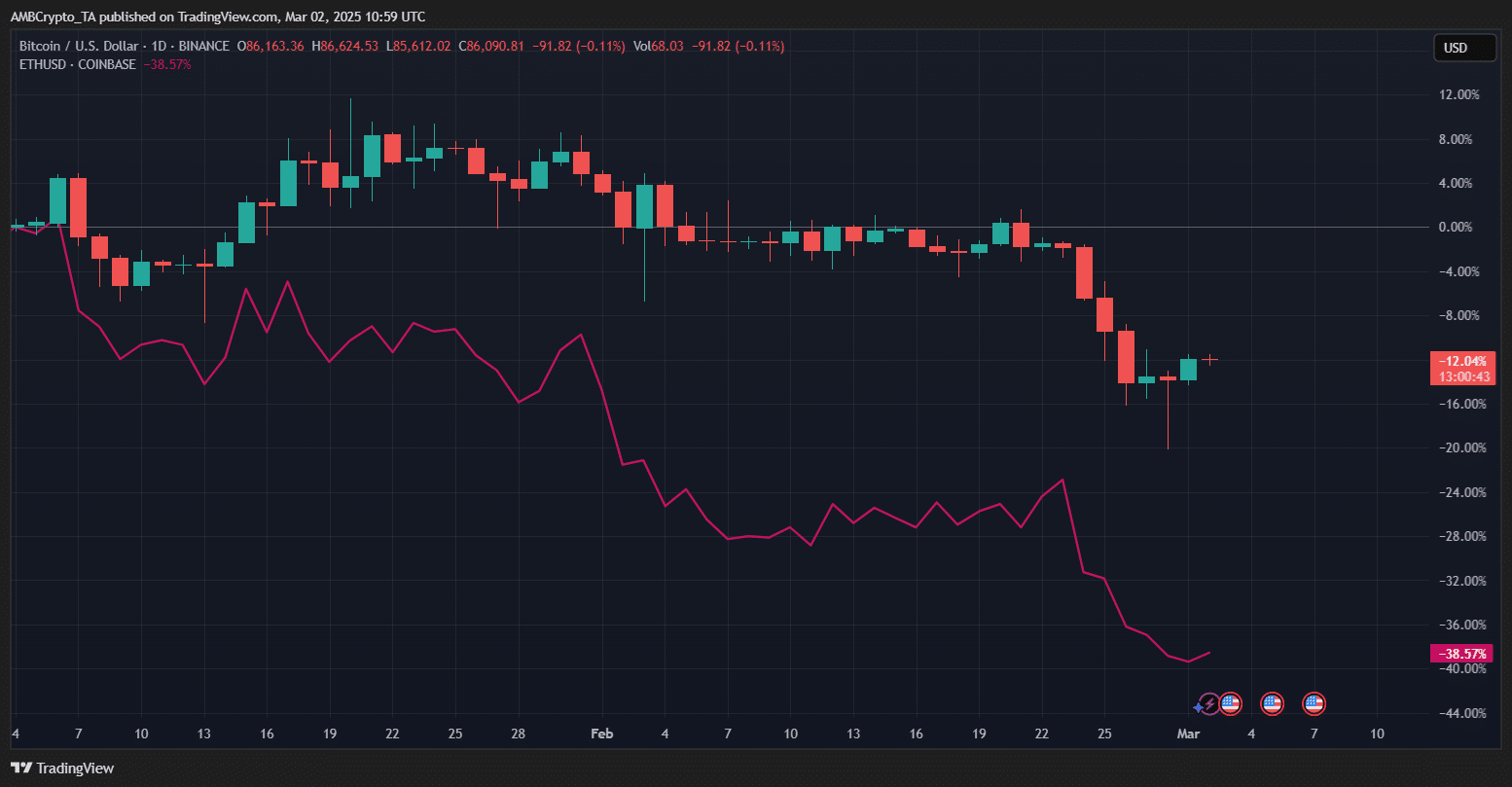

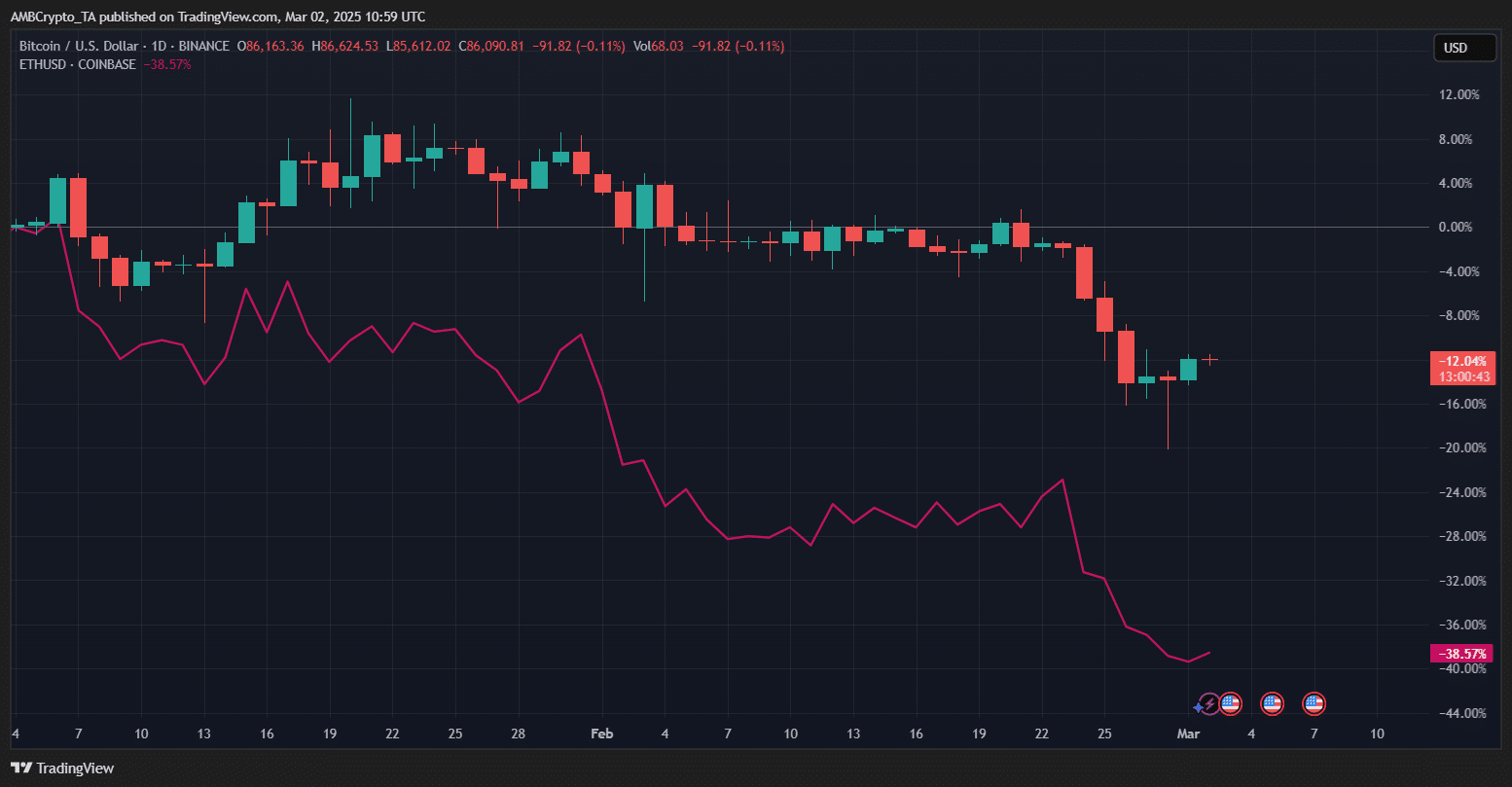

BTC and ETH efficiency

February 2025 used to be marked by means of heightened volatility for Bitcoin and Ethereum, with each property dealing with vital corrections.

BTC began the month robust, soaring close to native highs, however bearish force regularly took over, resulting in a steep decline of over 12%.

Supply: TradingView

Supply: TradingView

In the meantime, ETH struggled much more, underperforming BTC with a staggering 38% drop.

The widening hole between the 2 suggests moving investor sentiment, doubtlessly pushed by means of liquidity considerations and sector-specific weaknesses.

Whilst BTC discovered some give a boost to, ETH’s sharp downturn raises questions on its resilience amid broader marketplace turbulence.

March weak spot: A historic pattern

Bitcoin and Ethereum have traditionally presented little aid in March. BTC’s moderate March go back stood at simply 3.42%, with an average of 0.51%, indicating muted or unfavorable efficiency in a few years.

ETH fared rather higher with an 8.22% moderate go back, however the median of one.80% suggesting inconsistency.

Supply: X

Supply: X

Particularly, BTC posted March declines in 2014, 2015, 2018, and 2020, whilst ETH suffered in 2018 and 2022.

Given BTC’s -17.39% and ETH’s -31.95% February declines in 2025, historic information suggests persisted warning for March, reinforcing a seasonally vulnerable length for each property.

Bitcoin and Ethereum: Can they rebound in March?

Bitcoin enters March after a brutal February, dropping 17.39% — certainly one of its worst per 30 days performances in recent times.

Traditionally, March has been a vulnerable month, with a median go back of -0.39% and an average of 0.51%, reinforcing considerations of persisted drawback force.

Supply: TradingView

Supply: TradingView

From a technical point of view, BTC is suffering beneath its 50-day SMA ($97,570.68) and soaring close to its 200-day SMA ($82,231.19).

The RSI at 36.85 steered that the asset used to be nonetheless in bearish territory, however no longer but deeply oversold. A short lived jump off the $80,000 give a boost to zone is visual, however the broader pattern stays downward.

OBV at -92.82K mirrored vulnerable accumulation, additional dimming the probabilities of a powerful restoration.

Until Bitcoin reclaims key ranges above $90,000 with quantity give a boost to, any non permanent rally may well be met with promoting force.

Supply: TradingView

Supply: TradingView

Ethereum fared even worse than Bitcoin in February, crashing 31.95% — the steepest decline for the month in its historical past.

Traditionally, March has been lackluster for ETH, averaging 2.82%, however the median go back of one.18% suggests blended efficiency.

The technicals painted a in a similar way bearish image. ETH remained considerably beneath its 50-day SMA ($2,890.37) and 200-day SMA ($2,926.03), with the RSI at 37.82, appearing gentle restoration from oversold stipulations.

The OBV at 10.61M steered some accumulation, which might assist ETH stabilize, however momentum remained vulnerable.

For Ethereum to damage out of its hunch, it must reclaim the $2,500-$2,600 zone and spot more potent purchasing quantity. In a different way, any rebounds in March could also be short-lived.

Investor sentiment and marketplace psychology

Throughout marketplace downturns, investor psychology performs a a very powerful position in shaping worth motion. Worry, uncertainty, and doubt (FUD) continuously result in panic promoting, exacerbating declines past basic justifications.

As costs drop, retail traders have a tendency to capitulate, whilst institutional gamers search discounted entries.

The present sentiment suggests warning, however no longer outright capitulation. Alternatively, if macroeconomic considerations persist, sentiment may flip excessively bearish, developing alternatives for contrarian patrons.

Subsequent: Bitcoin or the U.S. greenback – Which is the larger ‘rip-off?’ Robert Kiyosaki says…