Ethereum has a rather extra bullish bias for the approaching week.

The Bitcoin consolidation segment used to be nonetheless ongoing, and a revisit to $60k used to be rising much more likely.

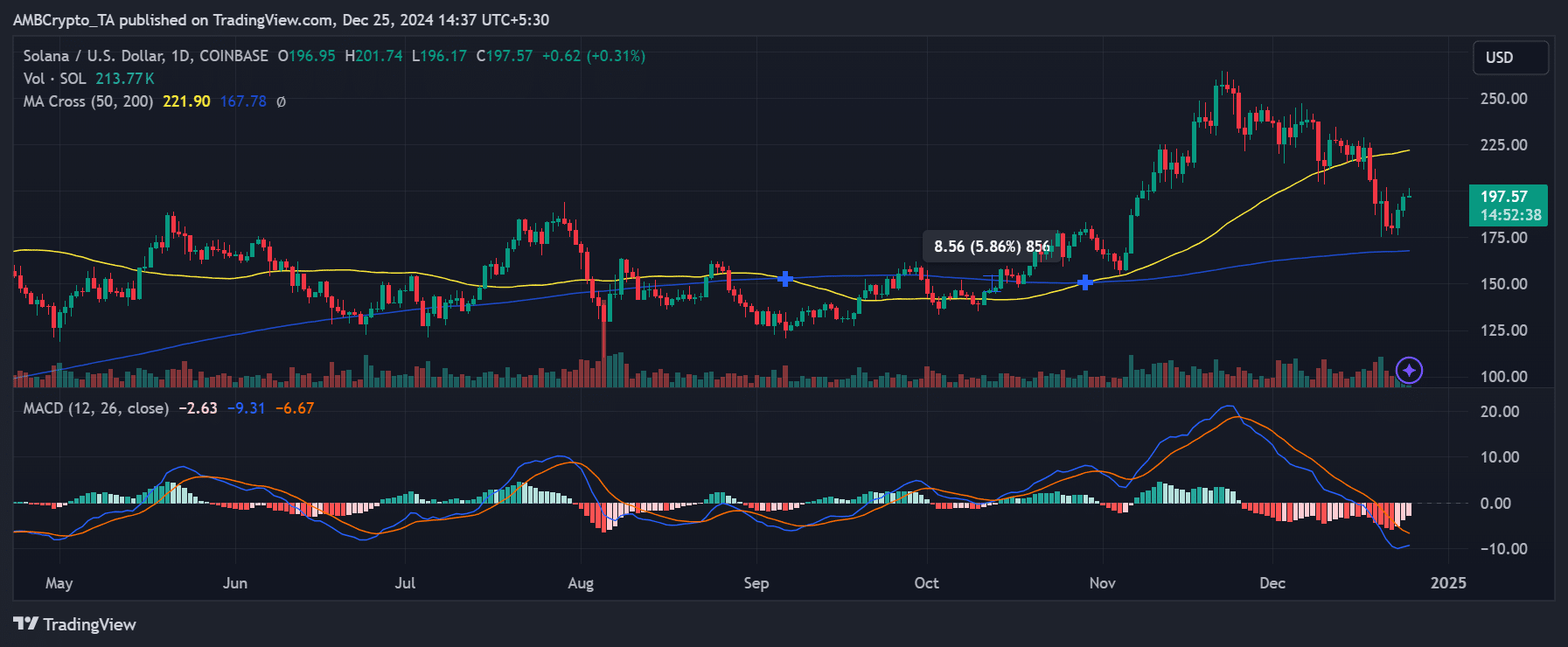

Bitcoin [BTC] investors have been going via a slightly difficult length after the straightforward, easy rallies which were the norm since closing October.

Ethereum [ETH] has been extra difficult, however BTC’s halving match closing month has modified the marketplace prerequisites to cut and vary formations in every single place the marketplace.

AMBCrypto investigated what the marketplace sentiment used to be having a look like over the weekend, and the place this week’s worth motion may just move.

Probably the most two has speculators expectant of bullish returns within the close to time period

Supply: Coinalyze

Supply: Coinalyze

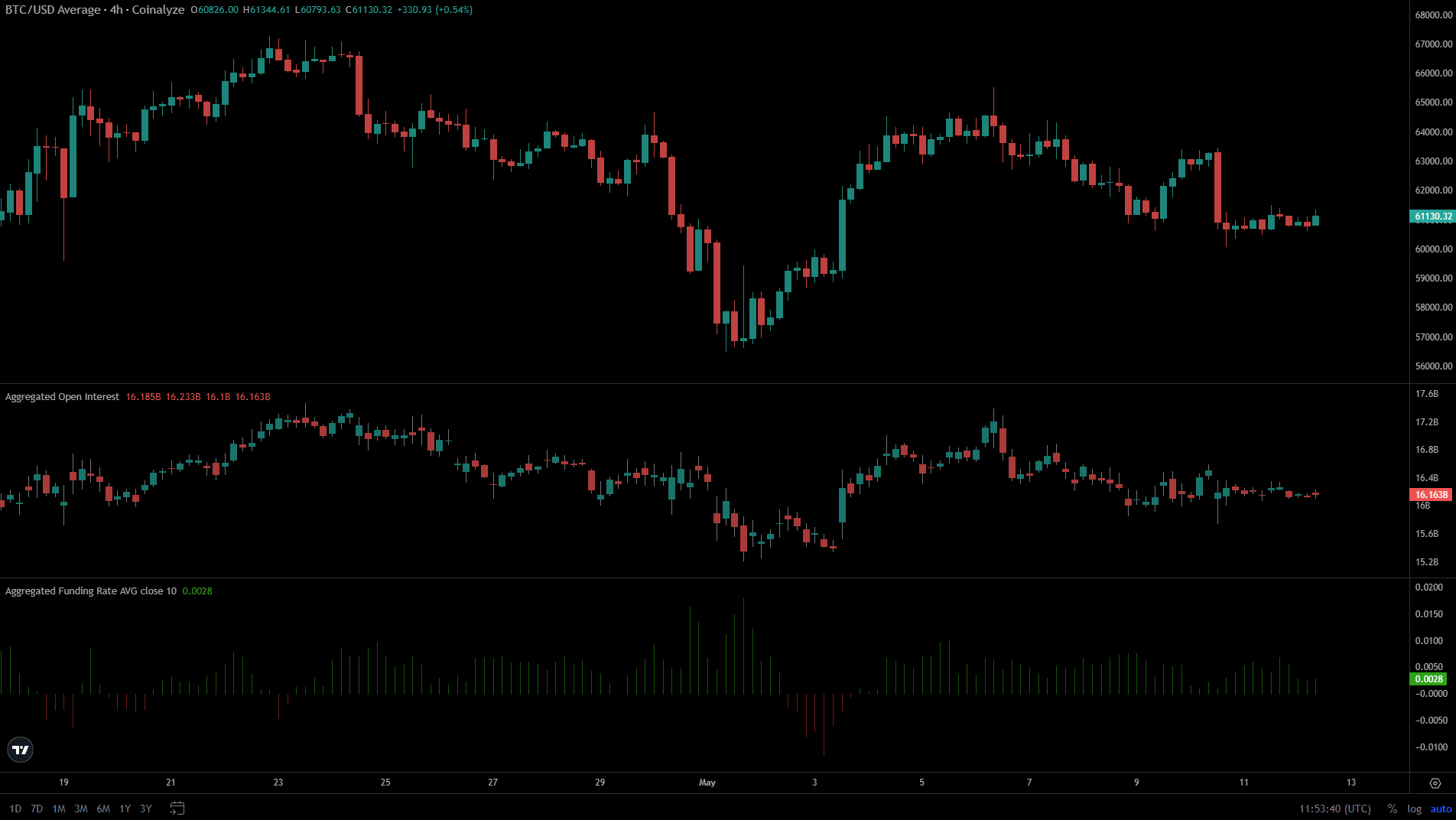

The tenth of Might noticed an build up within the Bitcoin Open Pastime, however the OI has been trending downward for the reason that worth spike at the sixth of Might.

In the meantime, the cost additionally shaped a chain of decrease highs during the last week, descending from $64k to $61.1k at press time.

The Investment Charge used to be destructive initially of Might when Bitcoin plummeted to $56k. Since then, the Investment Charge has recovered.

Then again, prior to now few days, it’s been slightly above 0, which indicated the sentiment used to be now not strongly bullish.

Supply: Coinalyze

Supply: Coinalyze

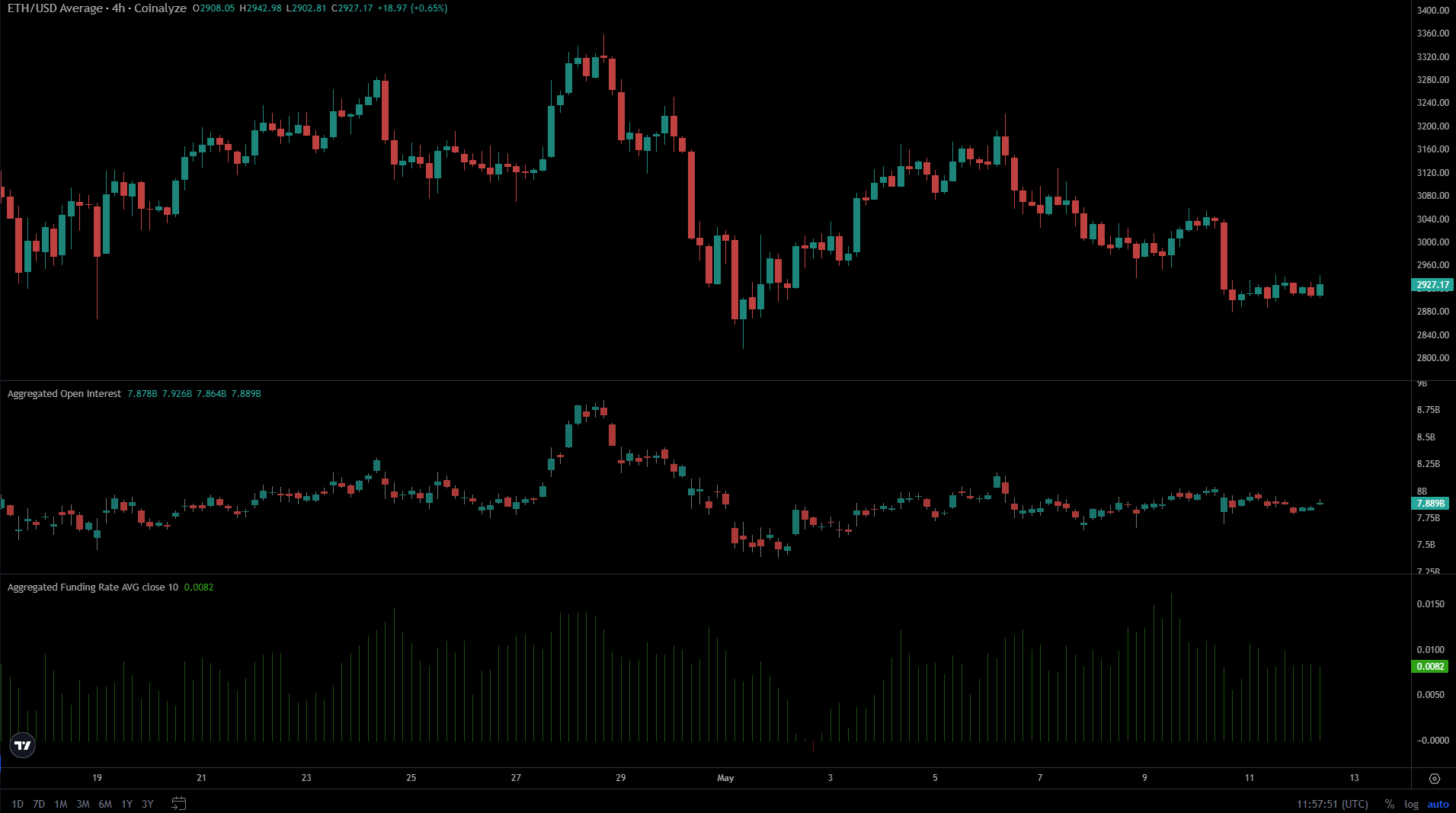

Ethereum additionally noticed Investment Charges slip into the destructive territory in early Might however has since recovered. The previous week’s downtrend noticed the investment fee hover across the baseline +0.01 mark.

A slight jump from $2980 to $3040 at the ninth of Might noticed the Open Pastime and the investment fee bounce upper.

This didn’t repeat with Bitcoin regardless of a an identical worth jump, which prompt that speculators have been extra desperate to lengthy ETH than BTC.

What are the following liquidity wallet that would draw in costs?

Supply: CryptoQuant

Supply: CryptoQuant

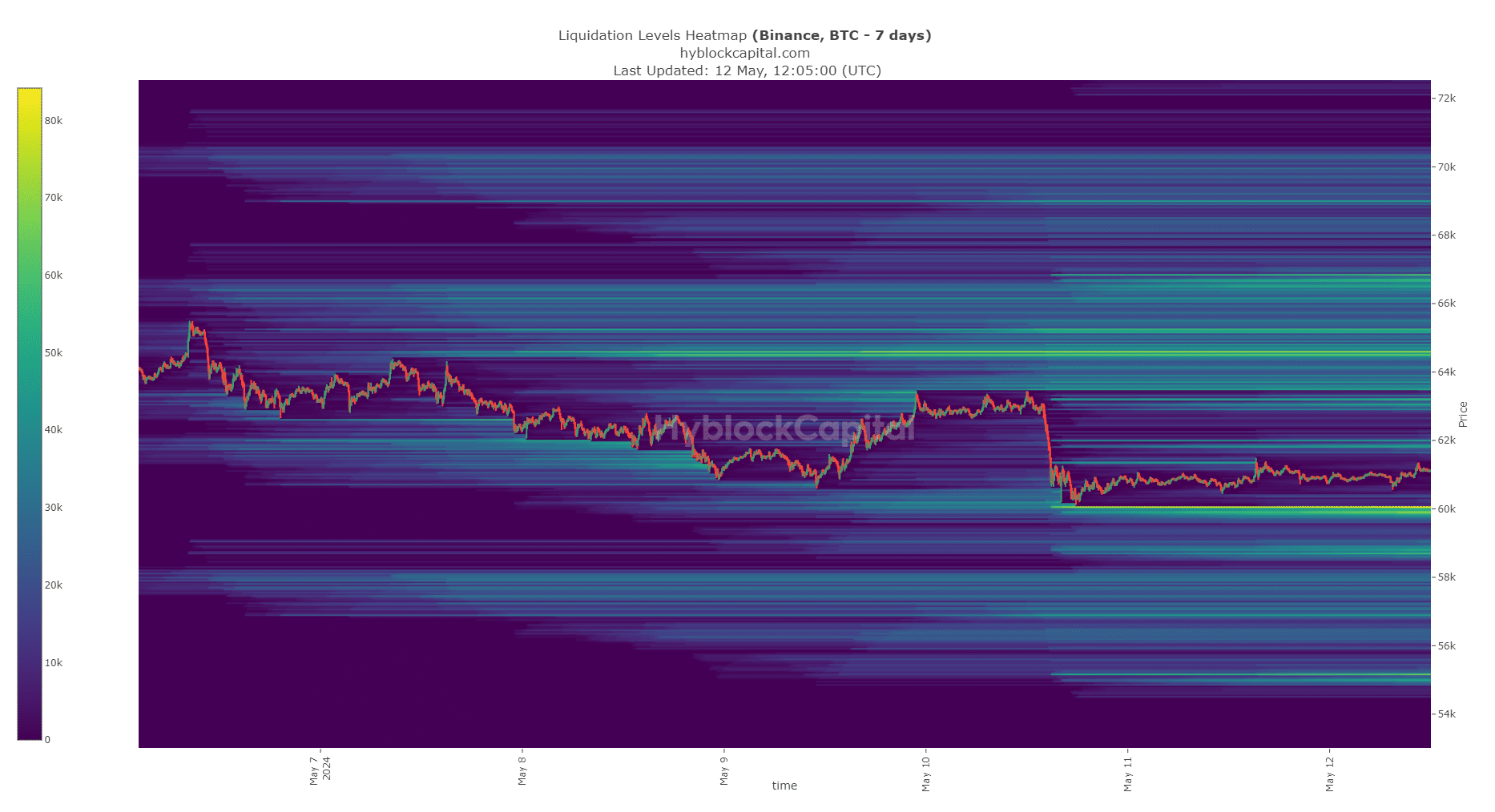

The 7-day liquidation heatmap of Bitcoin confirmed a vibrant cluster of liquidations on the $60k space. To the north, $61.8k and $63k are the following bullish goals.

At the fifth of Might, we noticed costs bounce above the $64k mark to gather liquidity sooner than a brutal momentary reversal.

In a similar way, we may see a downward plunge on Monday to gather the liquidity at $60k sooner than rebounding upper. Therefore, BTC investors would need to purchase the dip to the $50.6k-$60k area.

Then again, investors should even be ready for a transfer underneath $59.4k for BTC, and set their stop-losses accordingly within the match of a dip to $60k.

Supply: CryptoQuant

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024-25

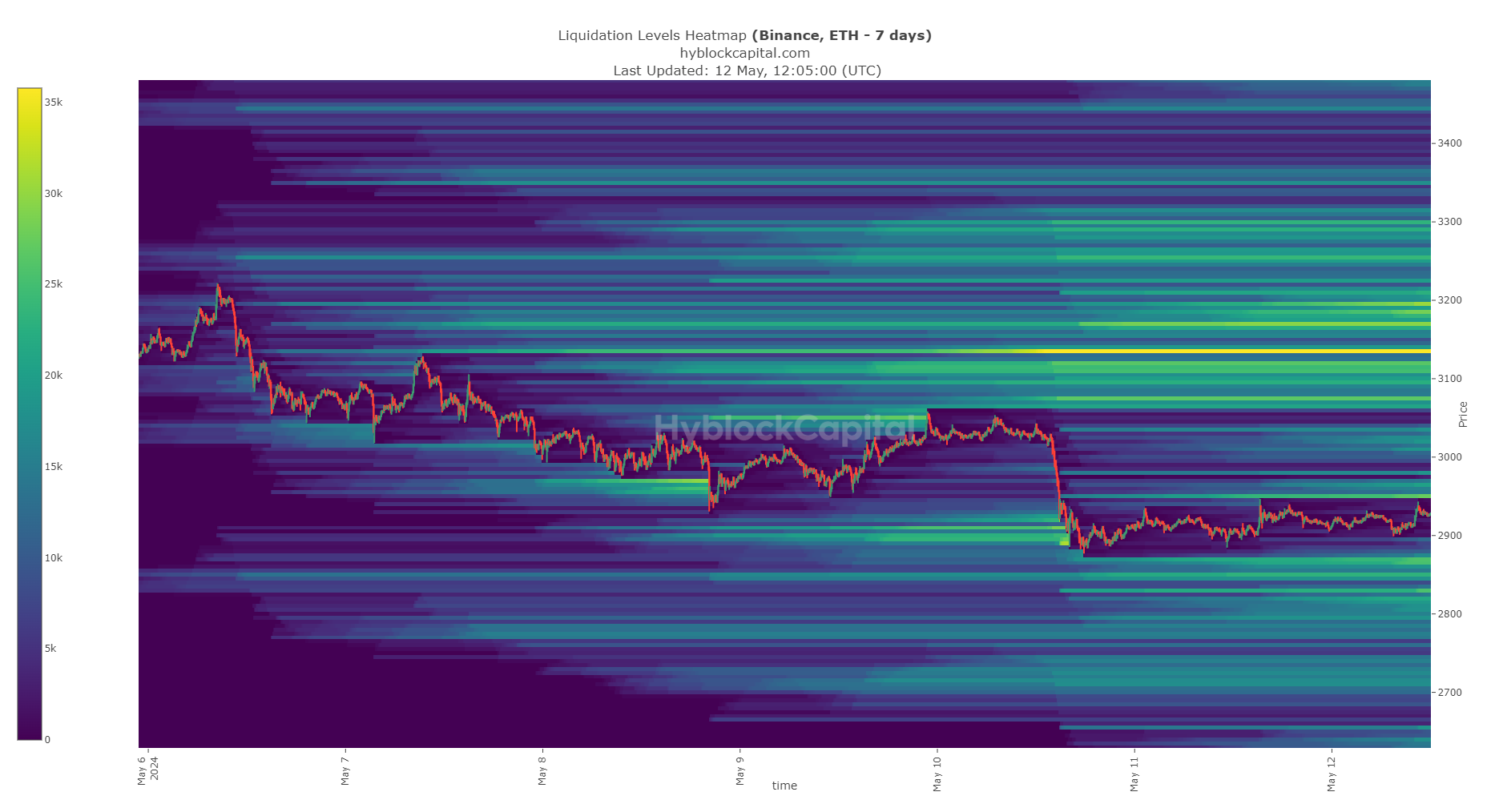

However, Ethereum has a cluster of liquidity within reach to the north at $2950. This used to be just about the present marketplace worth of $2928. A dip to the $2860 area would most likely provide a purchasing alternative.

The liquidation ranges across the $3.1k-$3.2k space provide a phenomenal goal. A drop underneath $2.8k would most likely usher in a powerful momentary downtrend, and investors can minimize their losses on this state of affairs.