Bitcoin struggled towards $67,583 resistance; breaking this degree may just cause a transfer towards $70,000.

RSI and MACD display weakening momentum, whilst emerging energetic addresses counsel possible bullish process.

Bitcoin [BTC] fell under $67,000, achieving an intraday low of $65,700 after shedding its in a single day positive aspects. Priced at $66,972.95 at press time, it displays a 1.22% decline prior to now 24 hours and a couple of.01% during the last week.

Regardless of the momentary dip, Bitcoin’s marketplace cap stays at $1.32 trillion, with a circulating provide of 20 million BTC. Within the final 24 hours, buying and selling quantity reached $46.32 billion, reflecting persisted pastime from buyers.

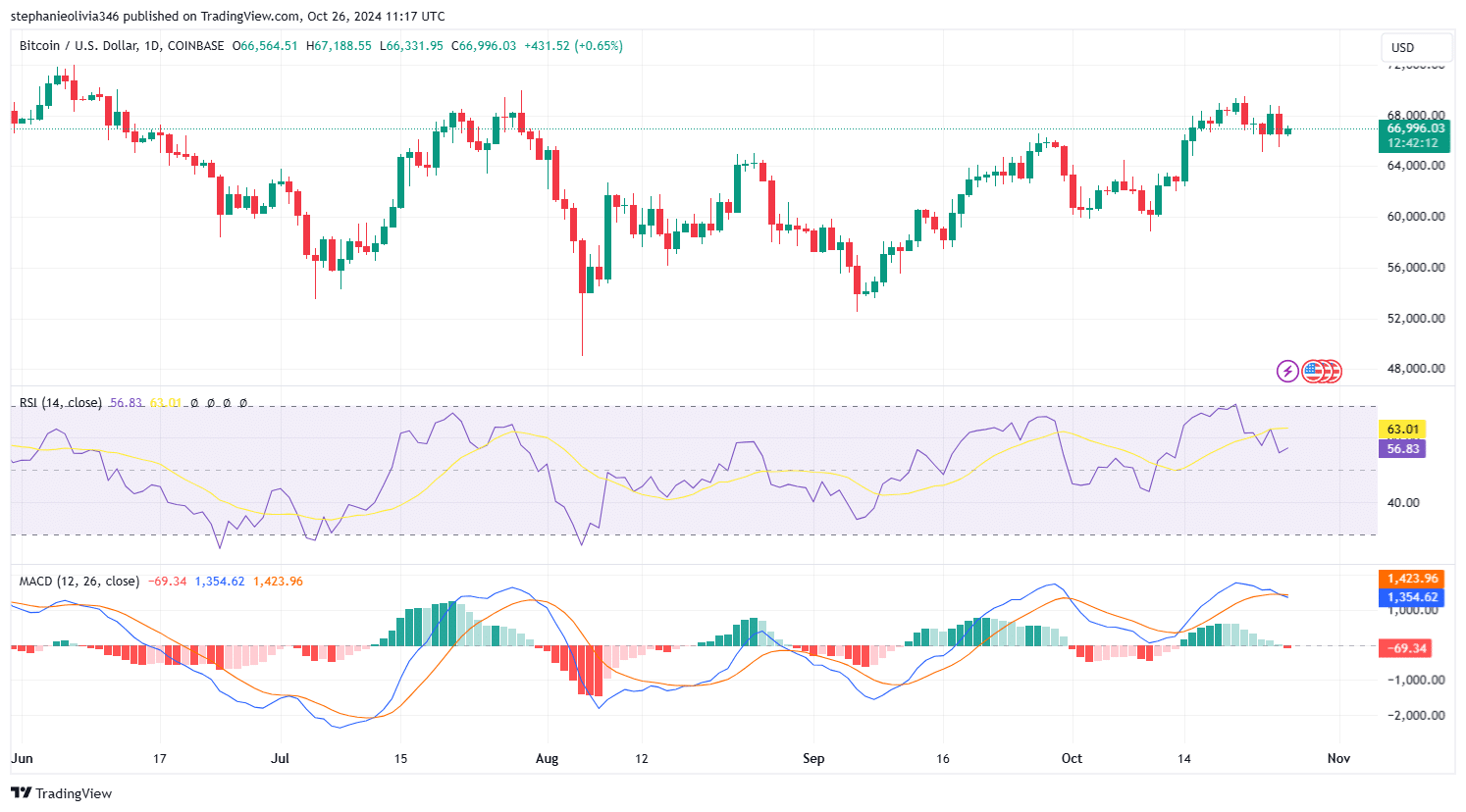

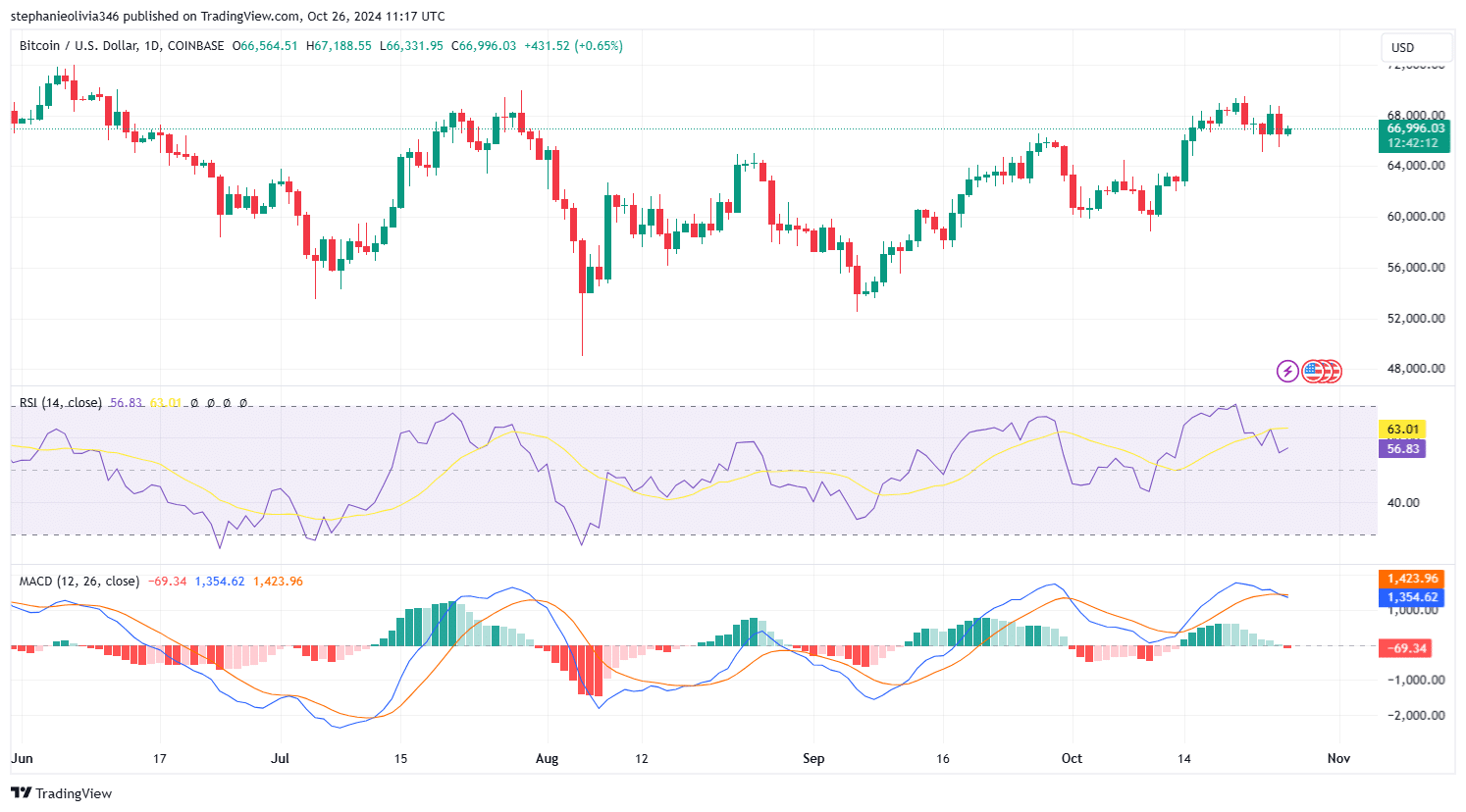

Bitcoin has been buying and selling inside a transparent descending channel. This trend displays a chain of decrease highs and decrease lows, indicating a bearish pattern.

The higher boundary of this channel, close to $69,000, has again and again acted as a robust resistance degree, pushing costs decrease after every try to wreck above it.

As observed at the chart, fresh rejections have adopted an identical patterns, suggesting that this resistance stays a key problem for additional positive aspects.

Supply: TradingView

Supply: TradingView

Make stronger and resistance ranges

Bitcoin’s press time higher resistance zone was once between $67,583.25 and $69,000, a variety that has persistently rejected bullish makes an attempt.

If Bitcoin manages to damage above this vary, it might pave the best way for a longer transfer towards $70,000.

Then again, failure to transparent this degree may just see Bitcoin reverting decrease throughout the descending channel.

Speedy improve is recognized round $66,423.76, marked as a crucial degree at the chart. Will have to Bitcoin breach this improve, it might drop towards the decrease boundary of the channel, projected between $60,000 and $62,000.

RSI and MACD research

On the time of this newsletter, Relative Power Index (RSI) was once at 56.75, situated under its sign line at 63.00. This indicated that bullish momentum was once weakening, drawing near a extra impartial zone.

In the meantime, previous in October, the RSI rose above 70, pointing to overbought stipulations. The following drop indicated a correction, but the present RSI degree nonetheless permits room for upward motion.

Keeping up above the 50 mark is vital for bullish momentum to maintain.

Supply: TradingView

Supply: TradingView

The Transferring Moderate Convergence Divergence (MACD) line stays above the sign line, suggesting an ongoing bullish pattern. Then again, shrinking histogram bars trace at lowering momentum.

If the MACD line crosses under the sign line, it’s going to point out momentary problem or a duration of consolidation.

On-chain process

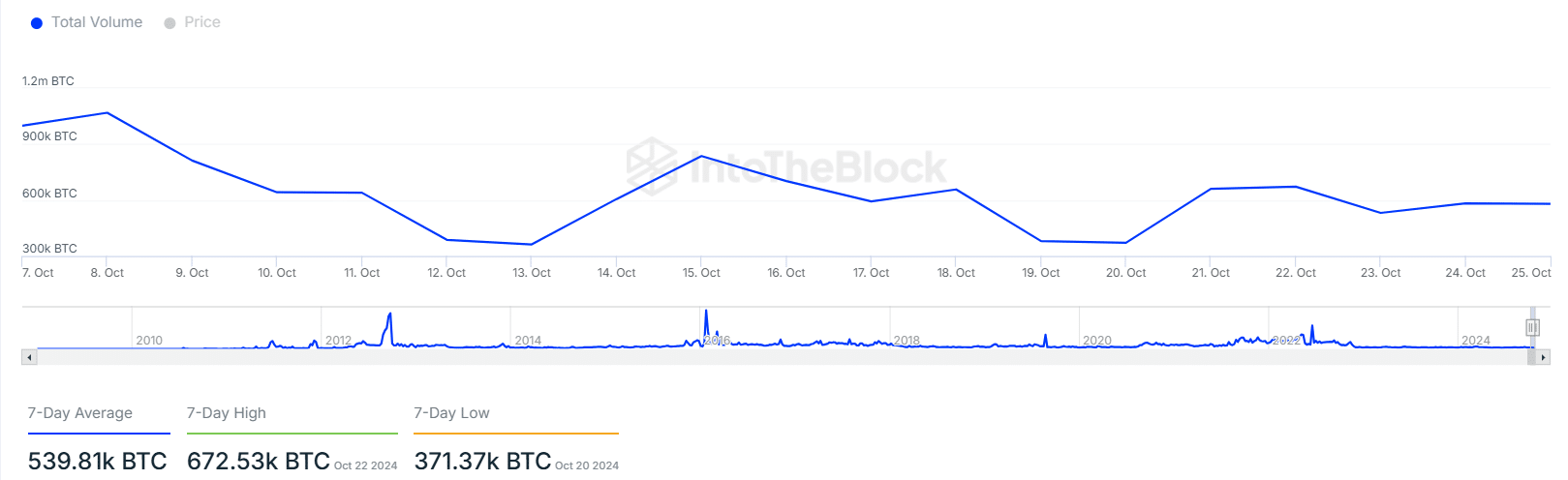

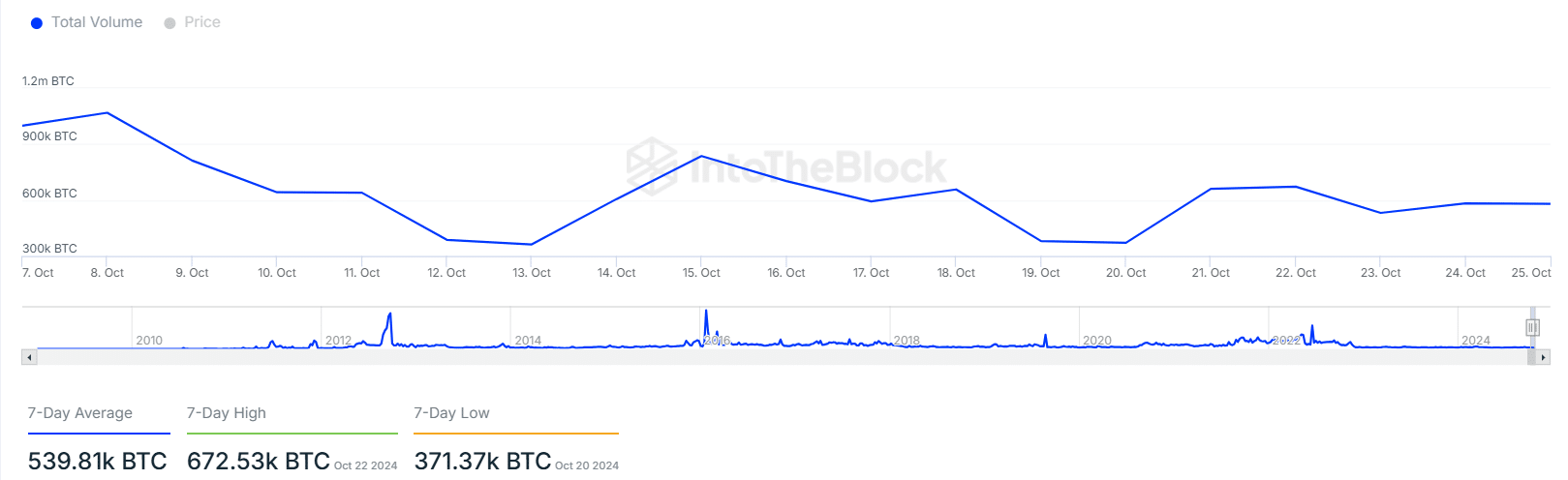

In line with IntoTheBlock information, energetic Bitcoin addresses have larger by means of 5.20% within the final week, suggesting upper consumer engagement.

This contrasted with a 6.50% decline in new addresses, indicating that current customers have been using community process.

Bitcoin’s 7-day moderate transaction quantity stood at 539.81k BTC at press time, with a contemporary top of 672.53k BTC at the twenty second of October and a low of 371.37k BTC at the twentieth of October.

Supply: IntoTheBlock

Supply: IntoTheBlock

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

The fluctuating quantity displays transferring marketplace process, with the new spike indicating emerging engagement.

This variability in transaction quantity suggests ongoing adjustments in buying and selling patterns, which might form Bitcoin’s worth actions within the coming days.

Subsequent: Ethereum whales goal the dip, however right here’s why ETH can slide to $2.3K