Bitcoin’s [BTC] dominance has lately proven indicators of decline, with its marketplace percentage slipping beneath key thresholds.

Consequently, capital is more and more flowing into altcoins, sparking debate amongst buyers and analysts.

Is that this an indication that Bitcoin is shedding its grip available on the market, or is it simply a short lived dip in an another way dominant pattern?

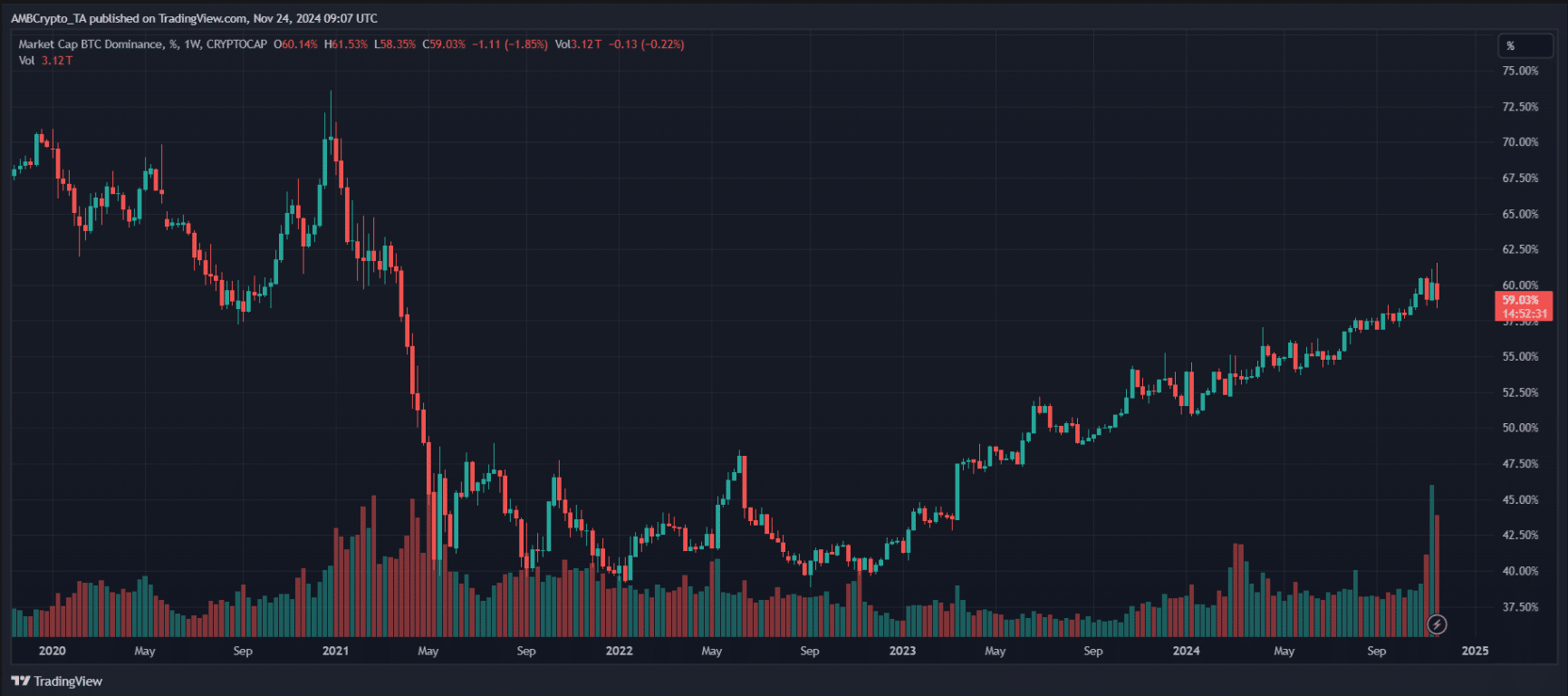

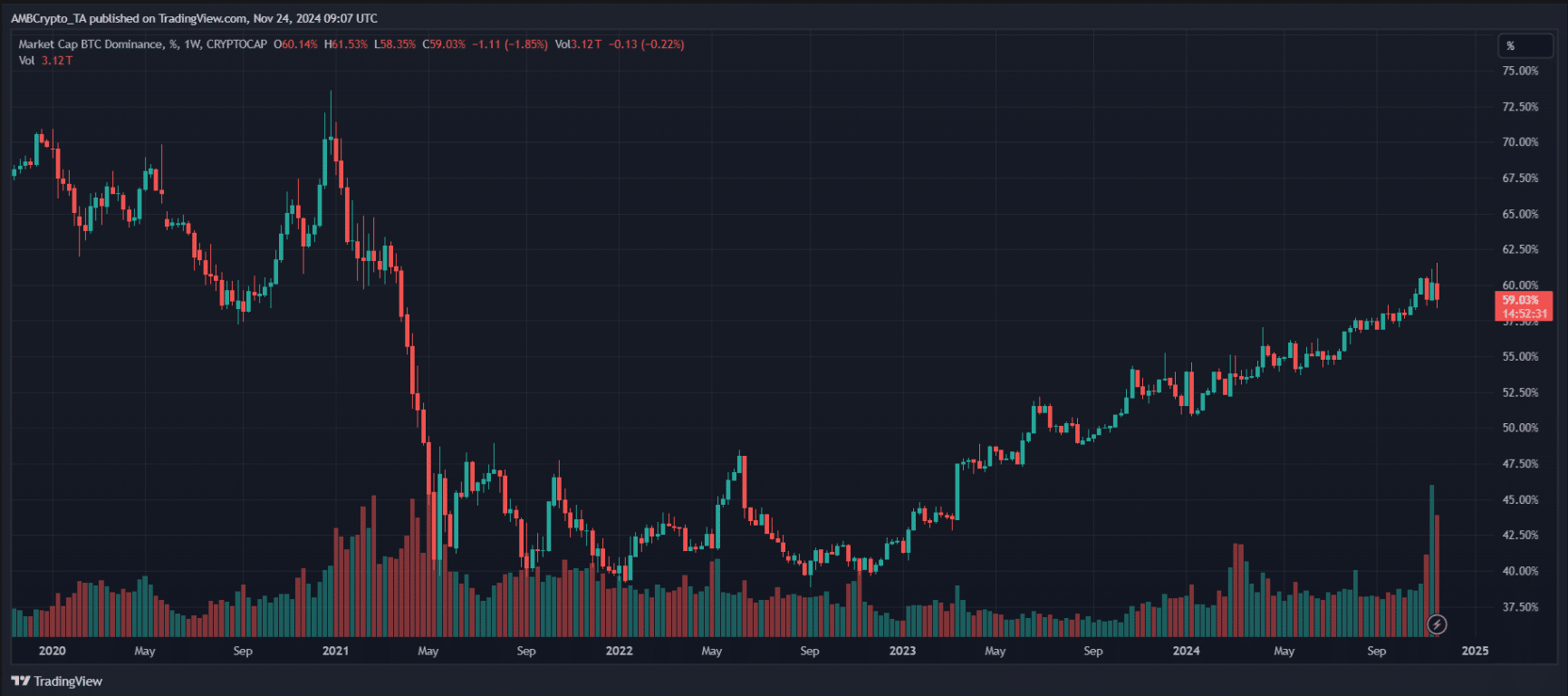

The autumn of Bitcoin’s dominance

Supply: TradingView

Supply: TradingView

As depicted within the hooked up 1-day chart, Bitcoin’s dominance has slipped beneath an important threshold of fifty%, reflecting a zoomed-out projection of its weakening grasp at the crypto marketplace.

This decline urged rising investor passion in altcoins, with capital flowing into Ethereum [ETH], Solana [SOL], and rising tokens — probably difficult Bitcoin’s supremacy.

Supply: TradingView

Supply: TradingView

Traditionally, Bitcoin’s dominance has oscillated with marketplace cycles.

All through the early crypto technology, it commanded over 90% of the marketplace, however the 2017 bull run marked a shift as altcoins surged, lowering its dominance to beneath 40%.

Whilst Bitcoin regained some flooring in next cycles, hitting round 70% in 2021, its marketplace percentage has since confronted stable erosion.

This cycle-driven ebb and waft highlights how evolving narratives, technological inventions, and investor personal tastes form the marketplace, leaving Bitcoin to compete with an more and more numerous ecosystem of virtual belongings.

Altcoin season: Cash main the rate

Supply: TradingView

Supply: TradingView

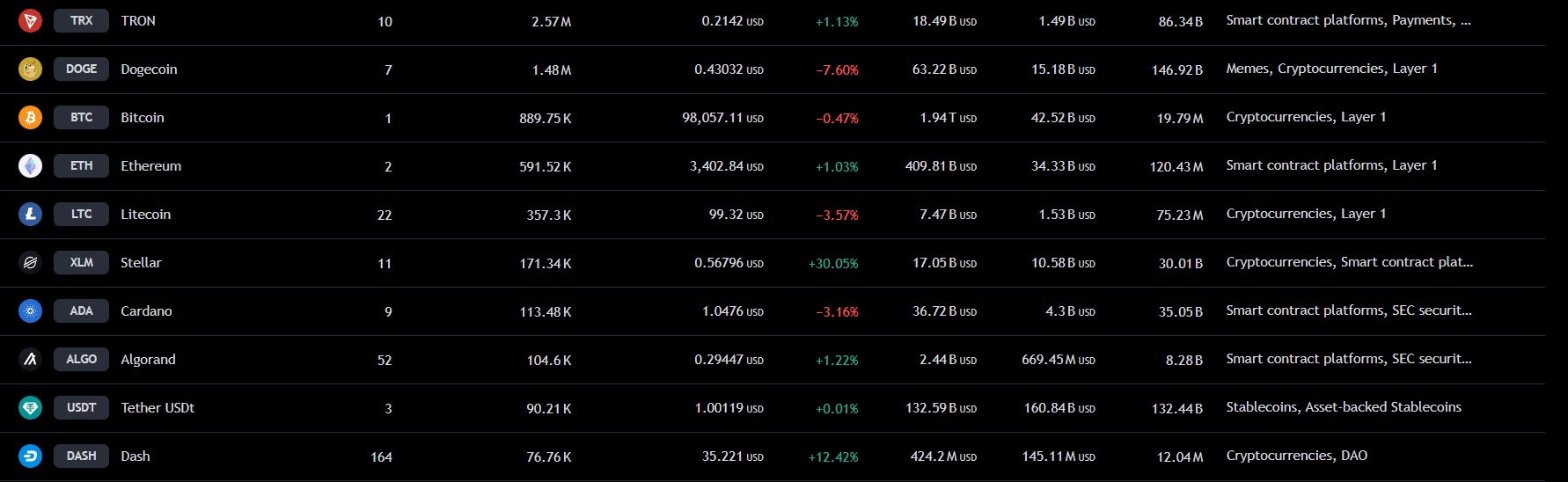

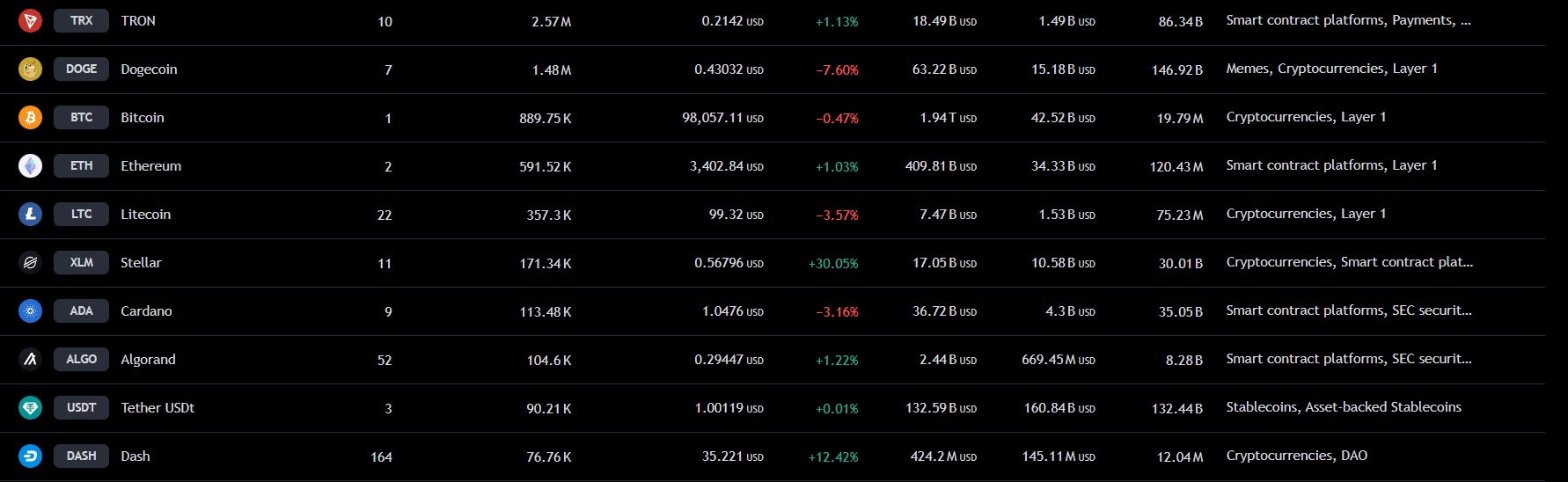

The transition of capital into altcoins signifies a possible altcoin season, as proven via the score of cash according to lively addresses.

Cash like Ethereum, Stellar [XLM], and TRON [TRX] are experiencing notable traction, making the most of higher community job.

Supply: TradingView

Supply: TradingView

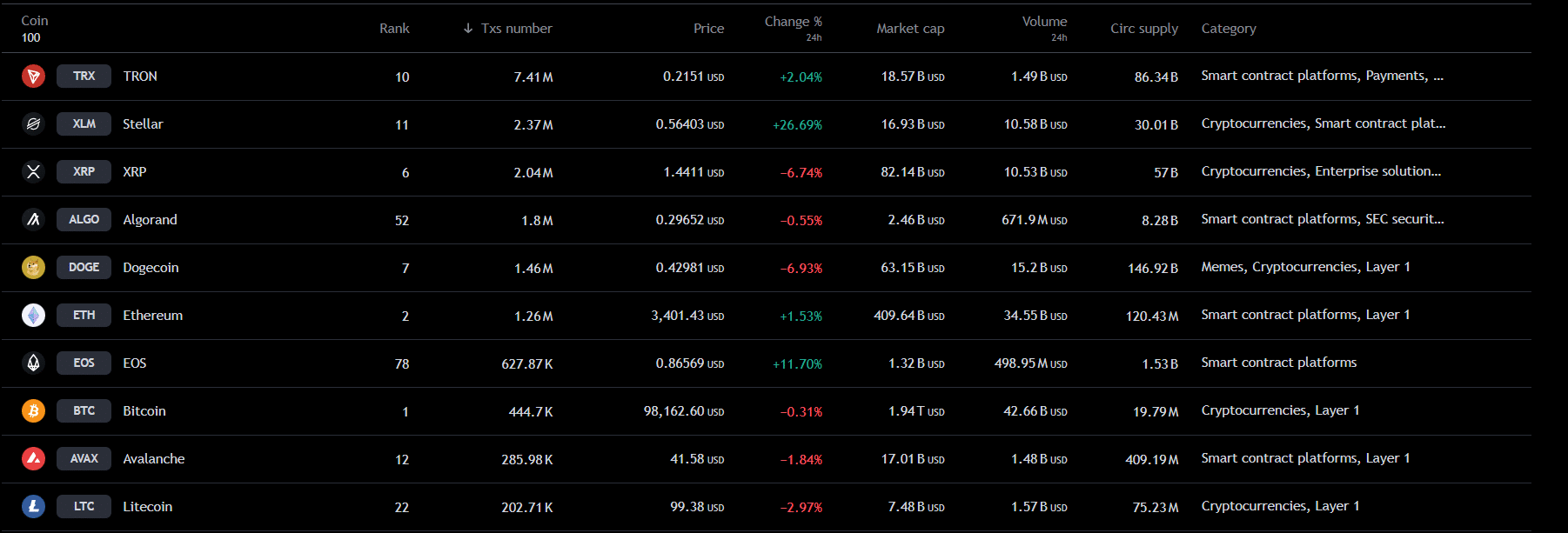

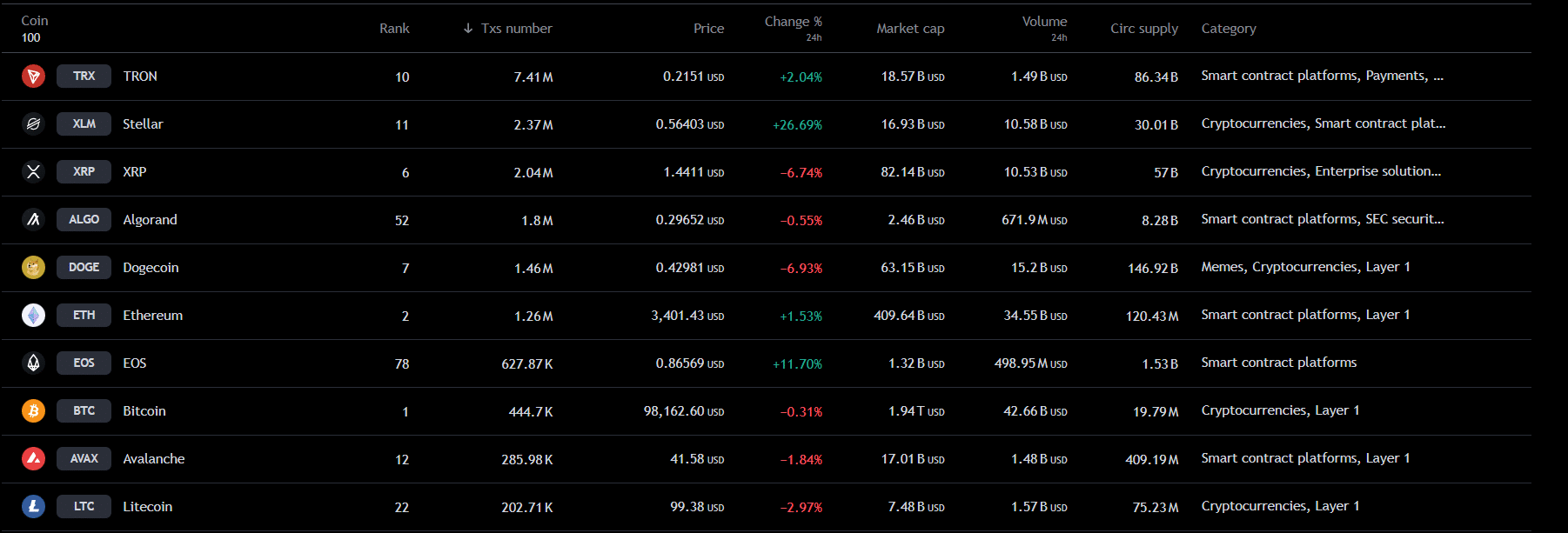

The transaction scores additional emphasize TRON’s dominance, with 7.41 million transactions showcasing its rising function in bills and DeFi.

Stellar adopted carefully with 2.37 million, highlighting its energy in cross-border remittances, whilst Ethereum maintains relevance with 1.26 million, with a focal point on high-value actions like DeFi and NFTs.

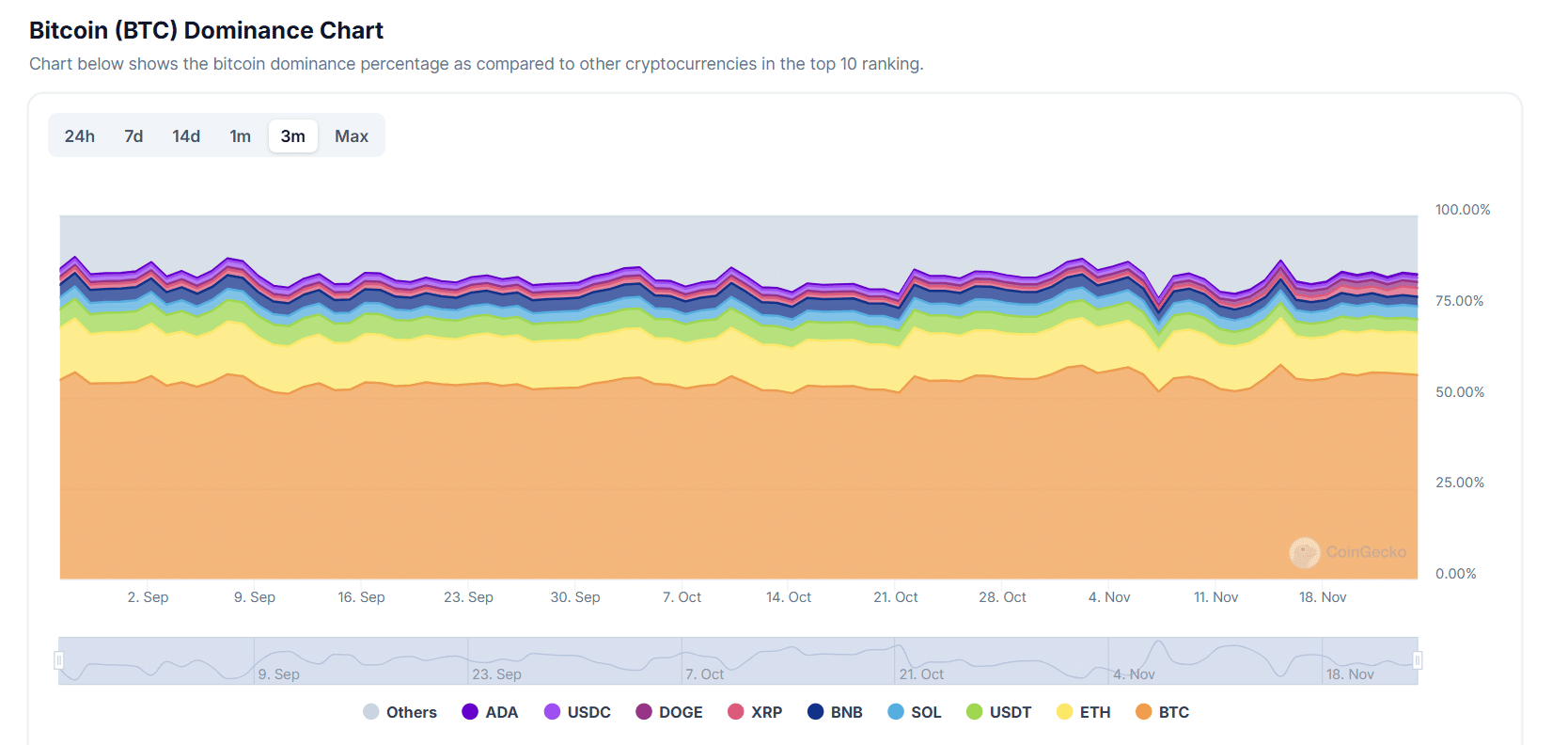

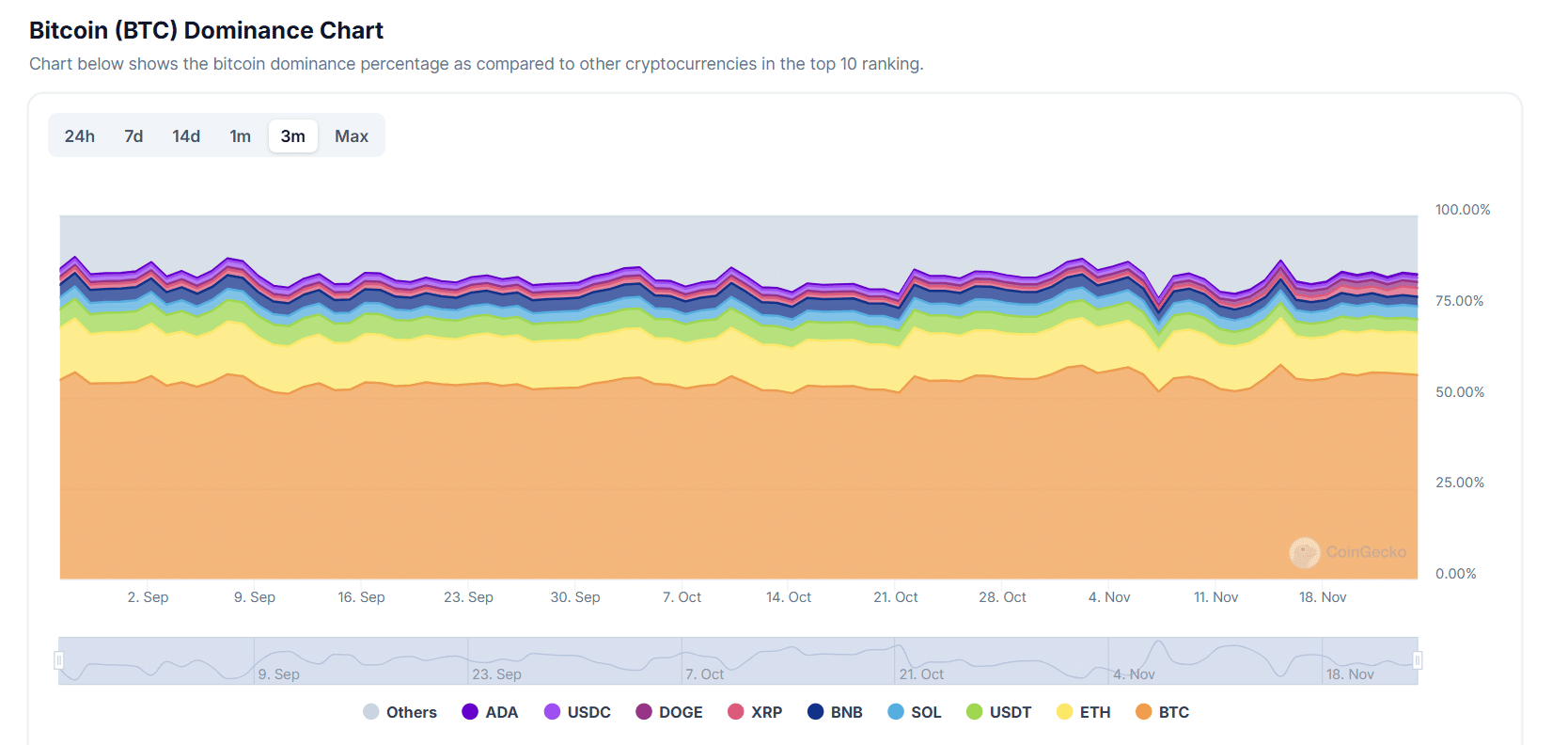

Supply: CoinGecko

Supply: CoinGecko

Insights from the Bitcoin dominance chart additional strengthened this pattern. Bitcoin’s marketplace percentage decline has allowed altcoins like Ethereum, Solana, and TRON to carve out vital area.

Ethereum now instructions over 20% of marketplace percentage in some sectors, whilst rising avid gamers like Avalanche [AVAX] are seeing stable inflows.

This dynamic alerts a redistribution of capital as buyers search price past Bitcoin.

Is altcoin season in the end upon us?

The shift from Bitcoin dominance to altcoins is pushed via a mixture of components.

Regulatory pressures have additionally driven buyers towards altcoins with compliant frameworks, reminiscent of Stellar, whilst macroeconomic uncertainty encourages diversification.

Technological developments, like Ethereum’s upgrades, additional make stronger altcoin competitiveness.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Even though cyclical, Bitcoin’s marketplace percentage decline displays a maturing ecosystem, with altcoins gaining structural significance and signaling a possible long-term shift quite than a fleeting “altcoin season.”

This diversification highlights evolving investor priorities in a swiftly converting marketplace.