BTC has surged via 9.92% over the last seven days, however fell once more at press time.

In spite of the surge, BTC stays in a bearish marketplace particularly with declining transaction quantity.

During the last week, Bitcoin [BTC] has made a restoration returning to the $60k stage quickly.

Since hitting native lows every week in the past, Bitcoin tried to handle an upward momentum, however failed because it fell under $60k once more. At the upside, the existing marketplace prerequisites have analysts speaking.

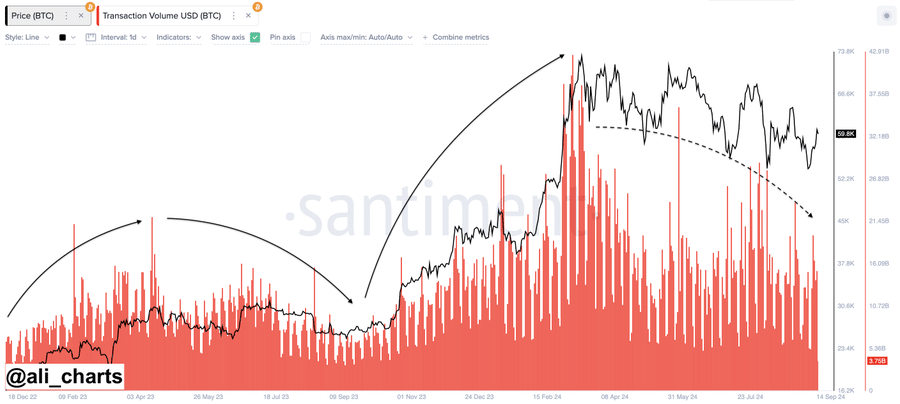

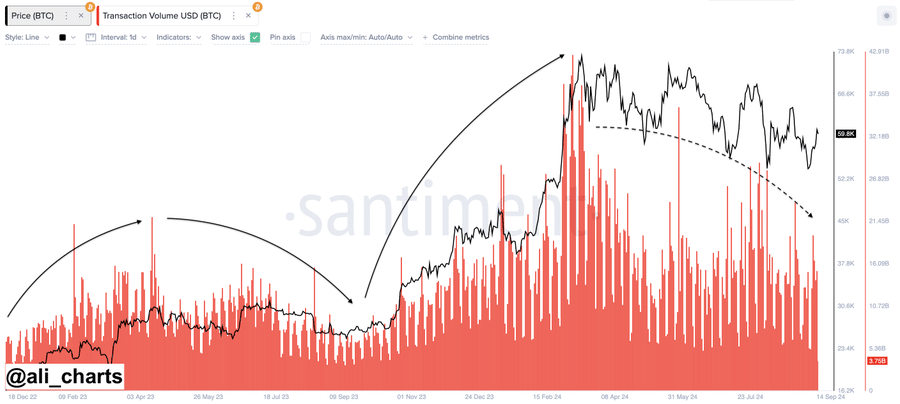

Well-liked crypto analyst Ali Martinez prompt {that a} development reversal used to be no longer entire bringing up Bitcoin’s transaction quantity.

Prevailing marketplace sentiment

In his research, Martinez cited the declining buying and selling quantity which means a development reversal hasn’t took place.

Supply: X

Supply: X

In keeping with this research, all over uptrends, BTC transaction quantity has a tendency to extend and reduce all over a downtrend. Thus, since, the present situation sees declining buying and selling quantity, the marketplace remains to be in a downtrend.

In context, all over a worth uptrend, transaction quantity will increase as a result of extra traders are actively purchasing and promoting leading to upper marketplace job.

Thus, an building up in quantity most often confirms the energy of an uptrend, as extra traders are actively engaged available in the market.

Due to this fact, when markets are in a downtrend, quantity reduces. A decrease quantity suggests fewer marketplace members. This means that the bearish marketplace sentiment remains to be in play.

As Martinez notes, Bitcoin buying and selling quantity has declined via 58.66% over the last day. Subsequently, in response to this research, BTC remains to be in a bearish marketplace.

What BTC charts counsel

As famous via Martinez, even supposing BTC has attempted to damage out, bears are nonetheless dominating the marketplace. Subsequently, the present marketplace prerequisites may just set Bitcoin for a decline.

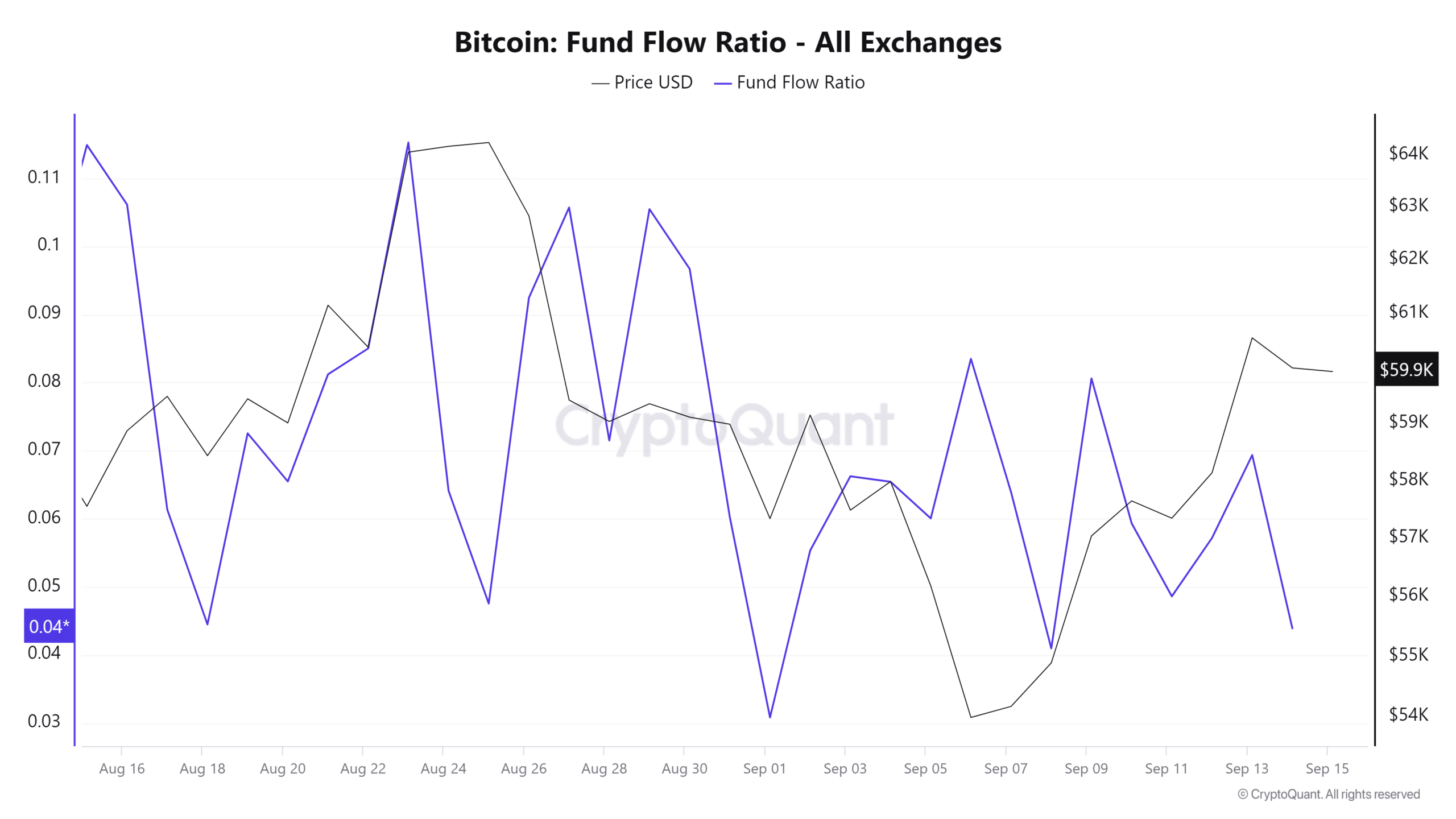

Supply: Cryptoquant

Supply: Cryptoquant

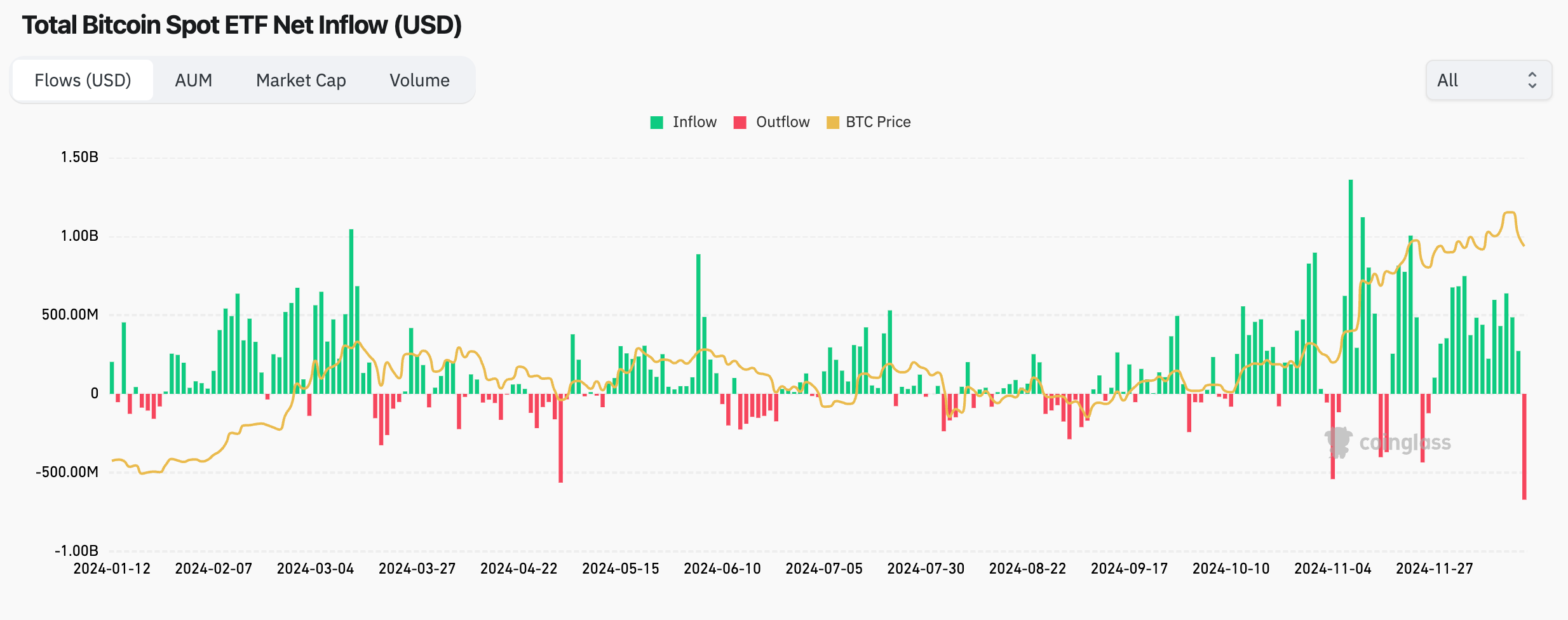

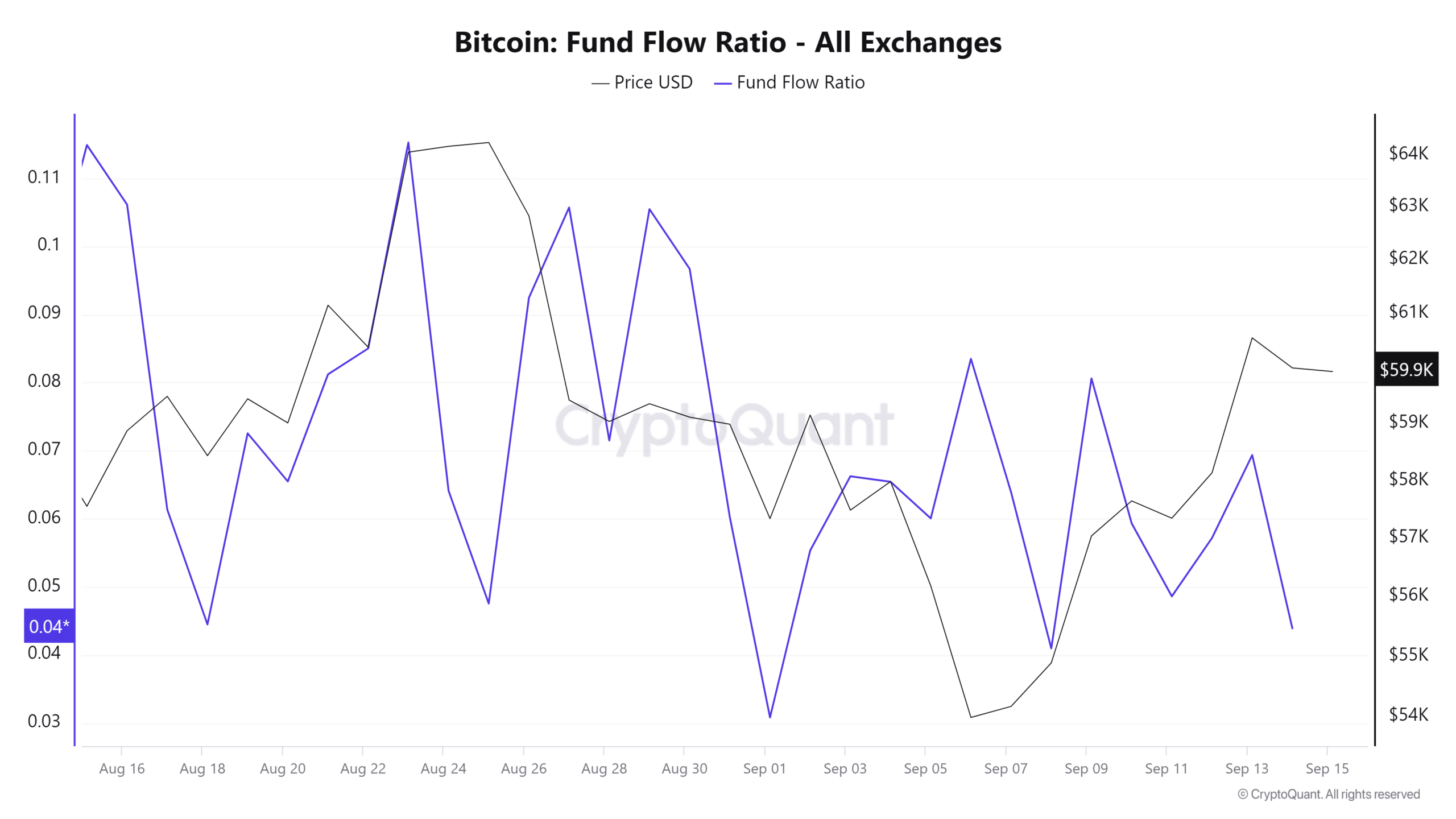

As an example, Bitcoin’s fund glide ratio has declined over the last week. This means there’s much less purchasing job in comparison to promoting because of this few traders are injecting their price range into the marketplace.

It is a bearish marketplace sentiment as traders are remaining their positions contributing to downward value power.

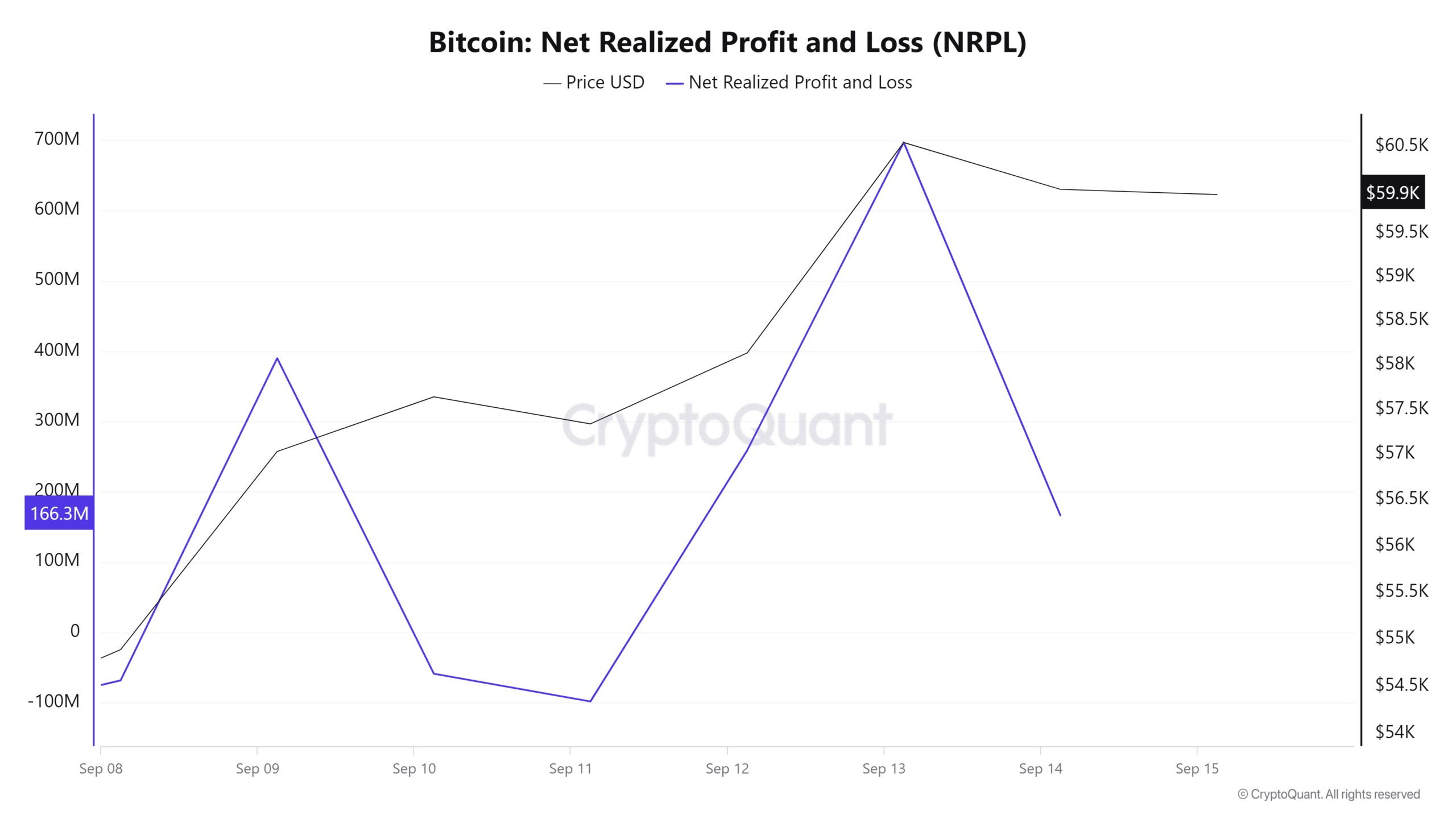

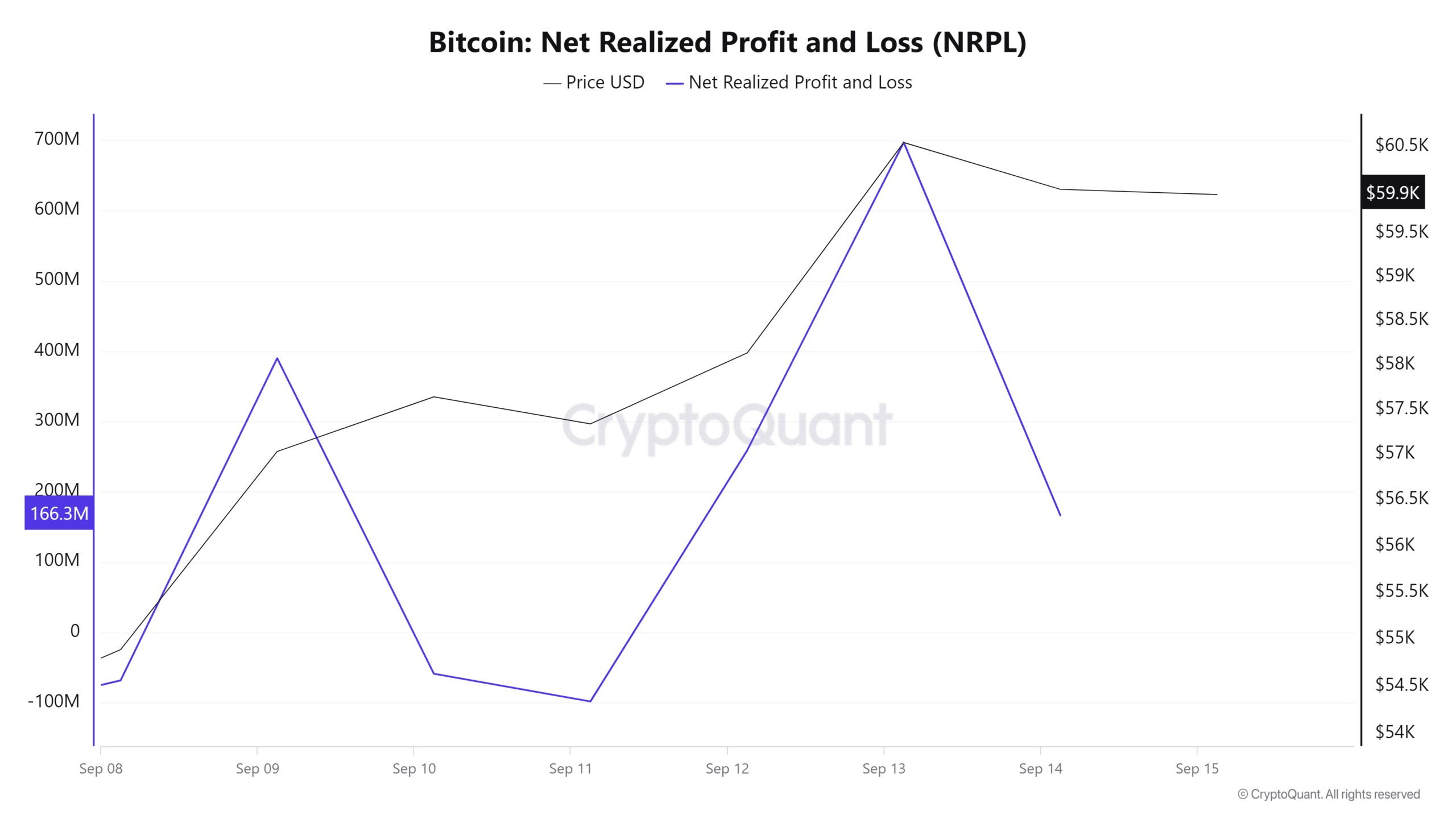

Supply: Cryptoquant

Supply: Cryptoquant

Moreover, Bitcoin’s internet learned benefit/loss has declined over the last 2 days after spiking the former days. A decline in NRPL implies traders are promoting at a loss.

Supply: Santiment

Supply: Santiment

This means that there’s decreased call for for BTC as fewer consumers are keen to buy at upper costs or there’s much less buying and selling job.

In any case, Bitcoin’s value DAA divergence has remained over the past week. A damaging DAA divergence approach Bitcoin costs are emerging whilst day-to-day lively addresses decline.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

This means that whilst the costs are emerging, the elemental utilization of the community isn’t catching up. That is bearish as the associated fee upward thrust is an insignificant speculative rally.

Merely put, as Martinez notes, Bitcoin remains to be within the bearish development. Thus, if this damaging marketplace sentiment holds, BTC dangers a decline to $57342.

Subsequent: SUNDOG sees large avid gamers guess $2.5M: What’s Subsequent?