The unfavourable pattern of the marketplace cap vs. the discovered cap is traditionally a bearish sign

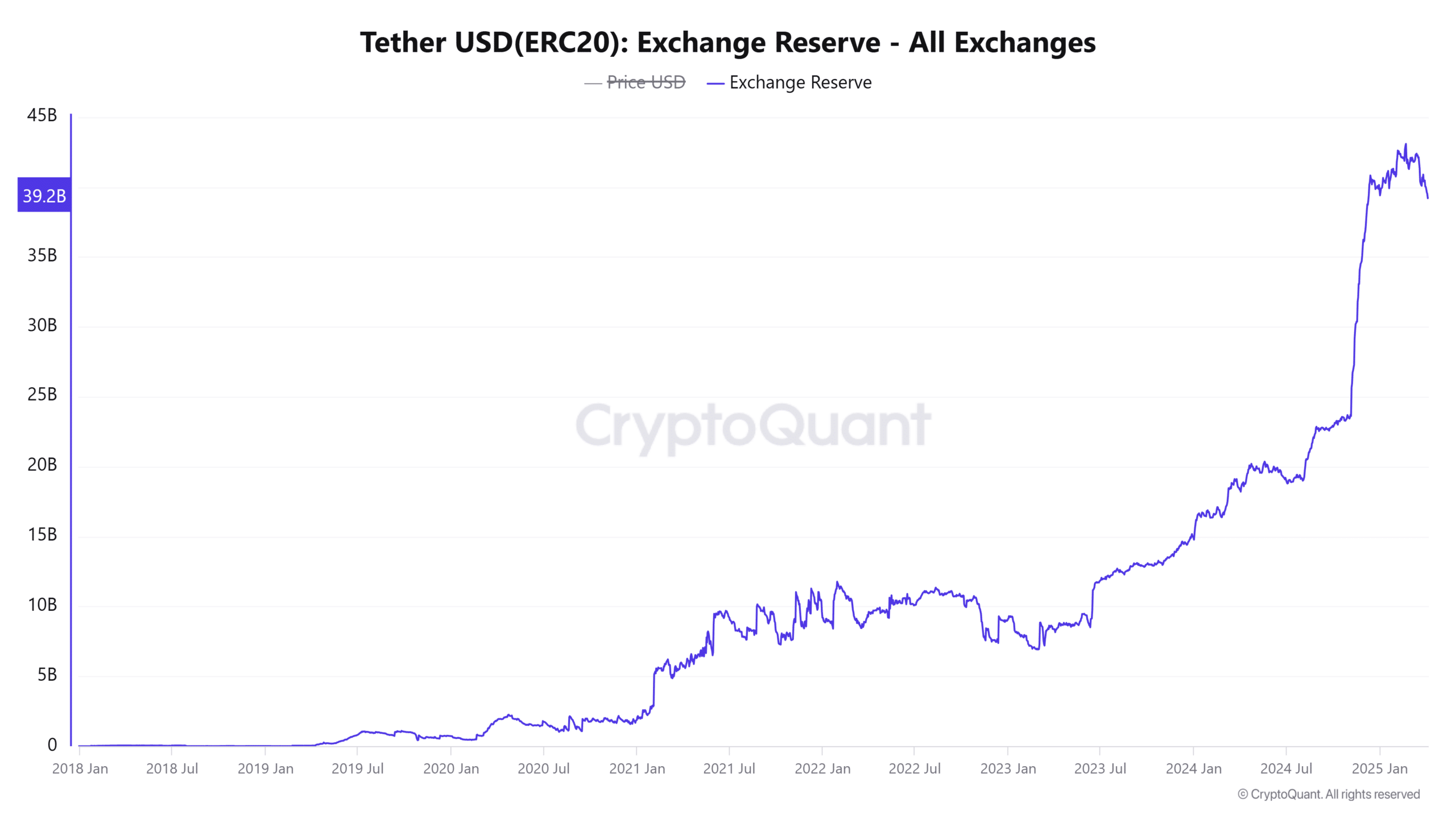

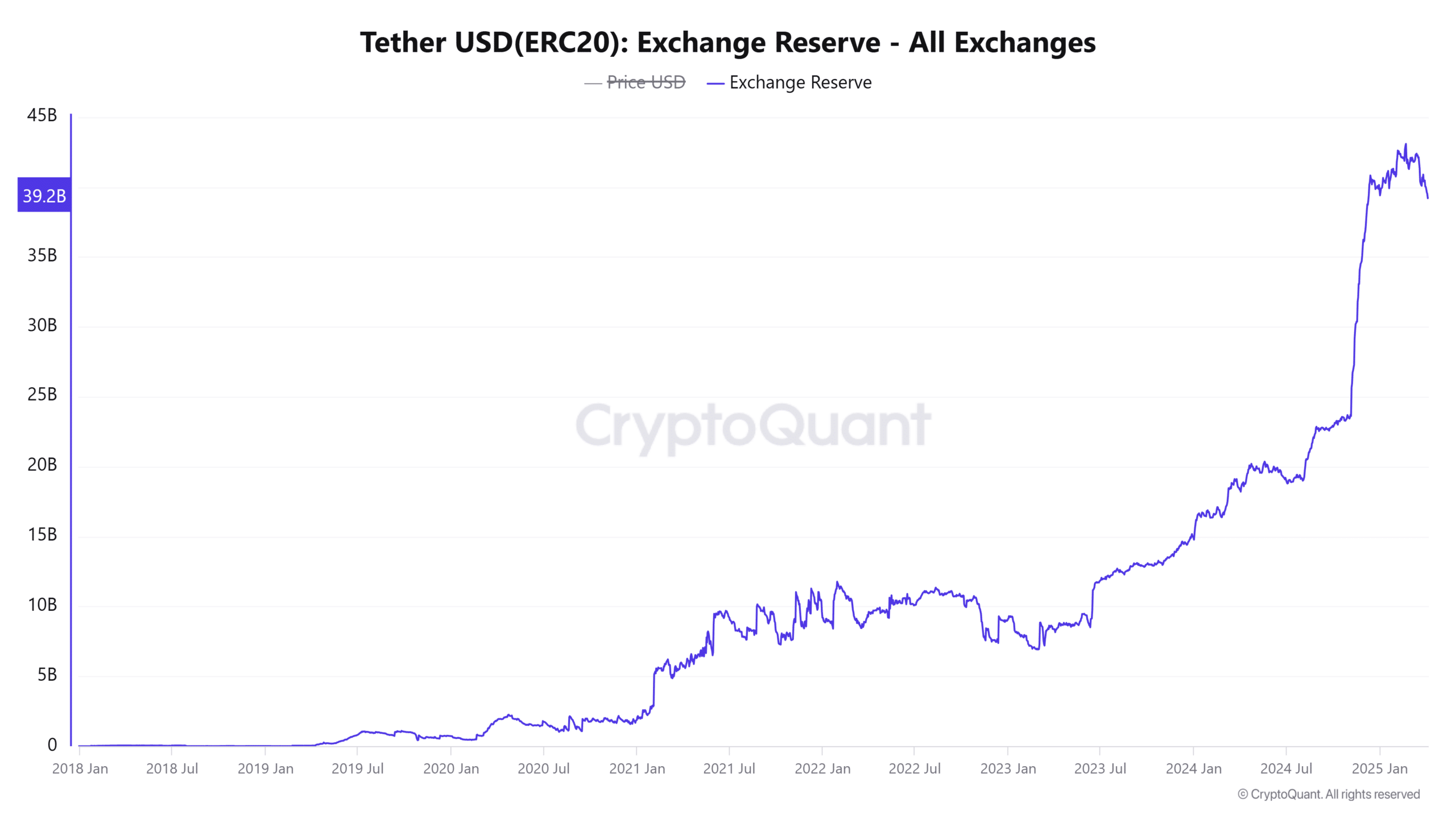

The halt within the Tether reserve enlargement pointed to strong, somewhat than expanding, purchasing energy

The worldwide M2, a cash provide classification that comes with cash marketplace budget, refers back to the cash provide from primary economies comparable to the usA., China, and the Eurozone.

In a up to date document, it used to be famous that the worldwide M2 cash provide went parabolic in 2025 whilst Bitcoin [BTC] used to be consolidating.

Traditionally, such divergences don’t remaining lengthy. Therefore, there’s a probability for Bitcoin to realize.

However, the industry struggle initiated by means of the U.S. has dented investor self belief. China’s retaliatory 34% tariff at the 2d of April deepened tensions, affecting the crypto marketplace as smartly.

Assessing the bearish arguments for Bitcoin

The Bitcoin spot ETFs were susceptible in fresh days. The pessimistic macroeconomic outlook because of the continuing industry wars used to be an element right here.

Supply: Coinglass

Supply: Coinglass

Blackrock’s spot ETF IBIT (iShares Bitcoin Consider ETF) noticed some inflows previously two weeks, however maximum different merchandise have witnessed promoting power lately. This defined a bearish momentary sentiment.

Amidst this bearish backdrop, the CEO and Co-Founding father of widespread crypto analytics company CryptoQuant mentioned that the “bull cycle is over”.

Is the BTC bull cycle over?

In a submit on X (previously Twitter), he defined the concept that of the Learned Cap to reinforce this argument.

Supply: Ki Younger Ju on X

Supply: Ki Younger Ju on X

The Marketplace Cap of an asset is calculated by means of multiplying its circulating provide with its present marketplace worth.

By contrast, the Learned Cap measures Bitcoin’s marketplace capitalization in line with the worth at which every coin used to be remaining moved. This gives a extra correct view of the capital flowing into the Bitcoin marketplace.

The analyst used 365-day Shifting Averages (MA) for each Marketplace Cap and Learned Cap to calculate the 365-day MA of the delta enlargement.

A decline on this metric indicators a emerging discovered cap paired with a falling marketplace cap—a pattern noticed since November-December 2024.

Ki Younger Ju emphasised that capital inflows failing to power worth positive aspects point out a undergo marketplace. On the time of study, the delta enlargement’s MA used to be unfavourable, which aligns with undergo marketplace stipulations.

A equivalent state of affairs came about in December 2021, following Bitcoin’s earlier all-time top of $69k and its next decline. Ju additionally predicted {that a} momentary rally is not likely, and this bearish segment may persist for every other six months.

Supply: CryptoQuant

Supply: CryptoQuant

In step with the discovered cap information, the onset of every other undergo marketplace seemed imaginable. In the meantime, however, the trade reserve of Tether [USDT] has halted its enlargement in fresh months.

Opposing those perspectives, the emerging international M2 discussed previous pointed towards emerging purchasing energy available in the market.

A slowdown within the Tether reserve enlargement accompanied the former marketplace height.

The knowledge right here advised every other undergo marketplace might be underway, but it surely will have to be famous that none of the standard cycle-top metrics haven’t begun reached overheated ranges mirroring the former cycle.

Subsequent: Dogecoin longs hit 80% on Binance Futures: Investors, this implies…