Lengthy-term holders have began promoting Bitcoin to non permanent holders.

Social media sentiment and crypto marketplace information remained reasonably sure.

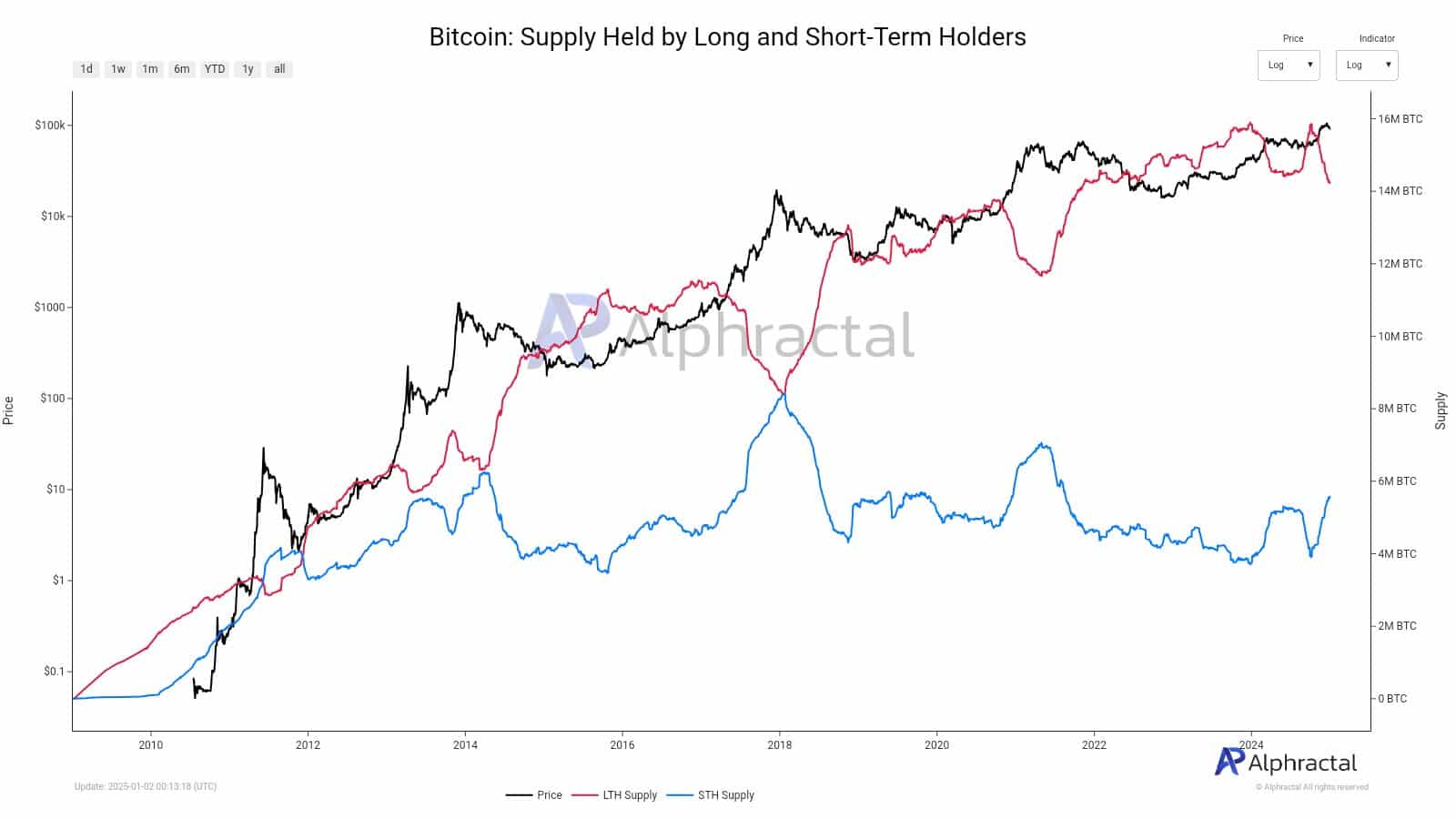

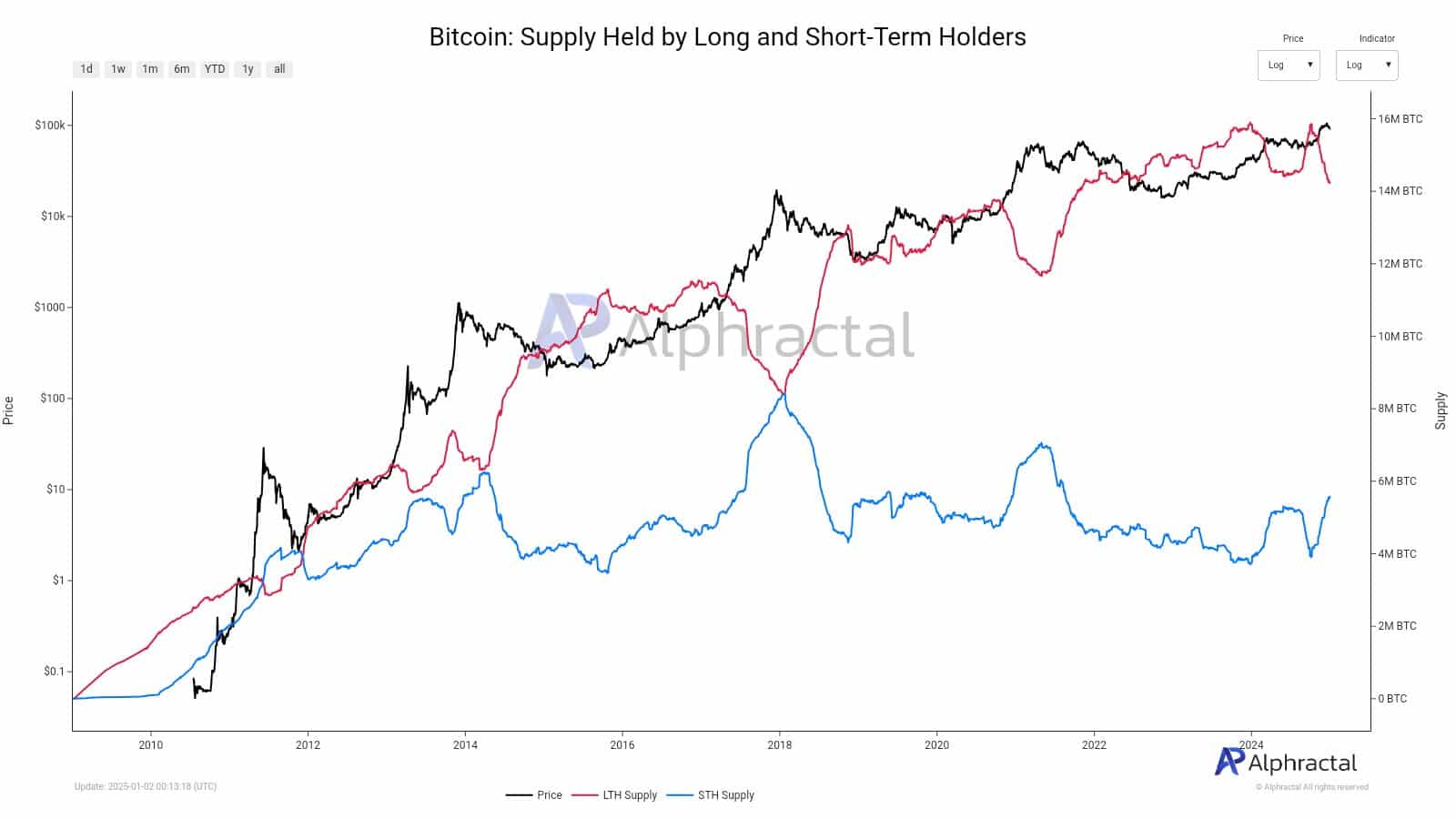

Bitcoin’s [BTC] historic knowledge published important shifts between long-term (LTH) and non permanent holders (STH). LTHs have begun offloading their holdings to STHs, marking a notable trade in BTC’s possession dynamics.

The Coin Days Destroyed metric spiked, indicating that giant, older holdings being offered, incessantly presaging volatility.

Concurrently, the availability held through STHs surged, taking pictures those cash, suggesting a shift from seasoned traders to more moderen marketplace members.

Supply: Alphractal

Supply: Alphractal

This redistribution may just probably destabilize costs within the quick time period, as more moderen holders may well be much less prone to dangle thru turbulence, resulting in larger promoting drive.

Traditionally, such handovers have preceded both important worth corrections or consolidations, as new holders’ habits all the way through marketplace swings may just dictate the following main transfer.

If LTHs proceed to promote into energy, this may cap possible rallies or exacerbate downturns, relying on marketplace reactions and broader financial signs.

Bitcoin energy grid

Then again, the Energy Grid which tracks Bitcoin’s energy alerts by no means breached the 100% energy threshold till not too long ago, a space indicative of cycle tops.

The 2025 studying at the grid displayed an uptick, achieving 82.5% energy, signaling powerful marketplace momentum however falling in need of a definitive cycle top.

This recommended that whilst Bitcoin approached an important marketplace juncture, a cycle most sensible hadn’t conclusively shaped because the marketplace navigated throughout the get started of 2025.

Supply: X

Supply: X

This information portended persevered marketplace energy for Bitcoin, aligning with predictions that 2025 would emerge as a top 12 months for crypto, reflecting an positive outlook for sustained expansion and funding enthusiasm.

What’s the sentiment amongst holders?

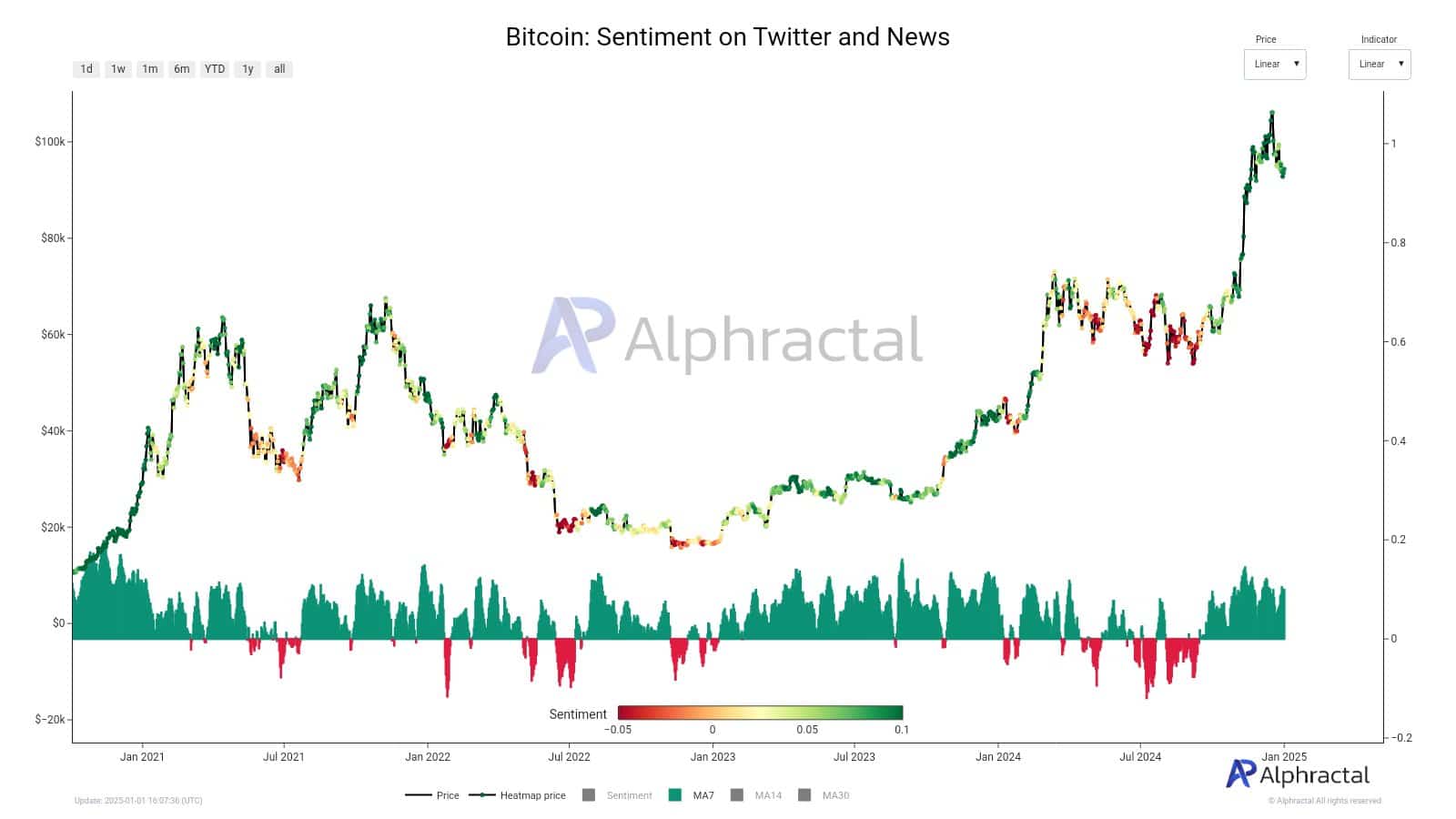

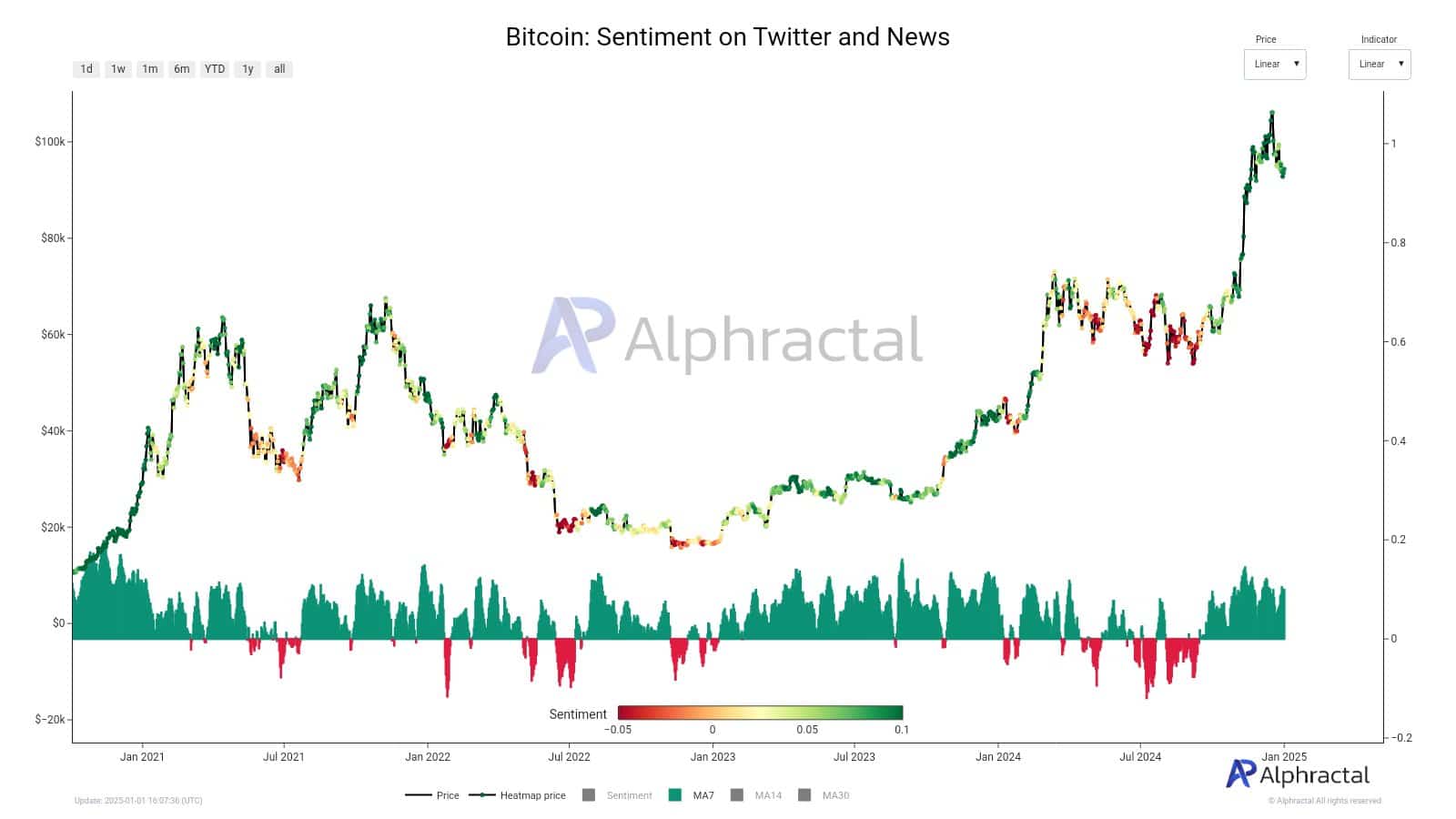

Once more, the sentiment research for Bitcoin, depicted on Twitter and in crypto marketplace information, confirmed an overwhelmingly sure development.

There have been handiest sparse cases of unfavourable sentiment some of the public, coinciding with notable worth fluctuations.

In particular, regardless of BTC’s worth oscillating between $108K and $92K, traders confirmed loss of worry.

Historic patterns recommended that once sentiment tremendously drops, it in most cases heralds a worth backside, signaling opportune moments for getting. This has been famous a couple of occasions yearly.

Supply: Alphractal

Supply: Alphractal

In the end, the Worry & Greed Index, marked at 66 in early January 2025, indicated a slight aid in greed, the bottom since November 2024.

Regardless of this dip, the present sentiment remained predominantly grasping, suggesting sustained purchasing passion in Bitcoin.

Because the index stayed above the impartial 50 mark, Bitcoin’s worth hovered round $95K, appearing balance after fresh fluctuations.

Learn Bitcoin’s [BTC] Worth Prediction 2025–2026

This sentiment alignment indicated no rapid worth surge, but the groundwork for persevered funding used to be obvious.

It recommended that important marketplace corrections may just nonetheless draw in powerful purchasing from the ones having a bet on long run good points.

Subsequent: China’s new FX laws escalate crypto crackdown – What’s subsequent?