Bitcoin miners are embracing AI as choice revenues amidst a decline in mining source of revenue.

Imaginable miner capitulations flash a BTC purchase sign as spikes in Hash Ribbons persist.

Extra Bitcoin [BTC] miners, like Core Clinical, are vastly diversifying into AI (synthetic intelligence) to spice up the earnings streams after April’s halving tournament.

April’s BTC halving tournament diminished miners’ block rewards from 6.25 BTC to three.125 BTC, slashing their earnings via part.

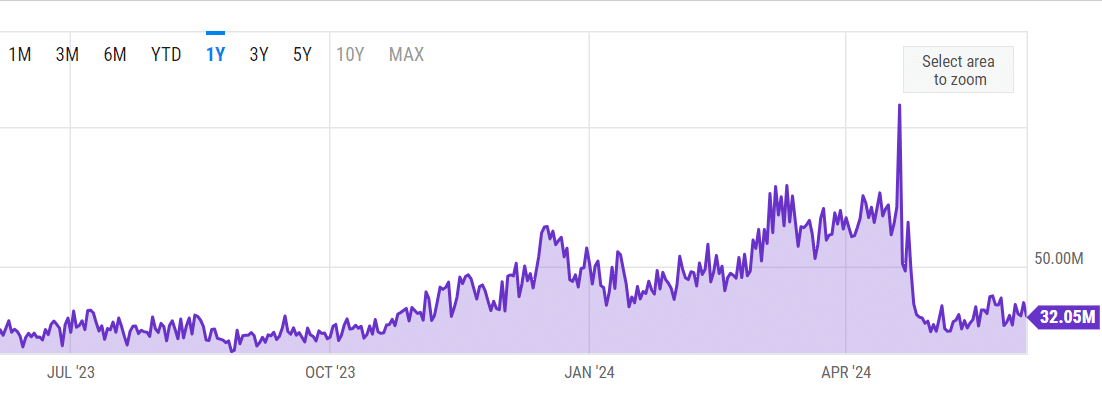

As of fifth June, Bitcoin Miner Income in keeping with day stood at $30.05 million. This used to be down over 70% from the document prime of $107 million hit on April’s 2024 halving day, in keeping with YCharts.

Supply: YCharts

Supply: YCharts

AI to resolve Bitcoin miners’ earnings issues?

Alternatively, in keeping with a up to date CNBC document, miners at the moment are moving their focal point to AI computing for its upper rewards and lengthening call for following the a hit ChatGPT AI fashion from OpenAI.

In keeping with the document, Bit Virtual now will get 27% of its earnings from AI. Hut 8, any other BTC miner, and Hive generated 6% and four%, respectively, in their earnings from AI.

In step with Core Clinical CEO Adam Sullivan, the shift to AI will assist create,

‘Varied industry fashion and extra predictable money flows.’

The AI diversification is usually a welcome reduction given the reported miner capitulations.

Are some Bitcoin miners exiting?

In mid-Would possibly, an AMBCrypto document discovered that Bitcoin’s community hashrate dropped considerably, along conceivable miner capitulations amidst spikes in Bitcoin Hash Ribbons.

Hash Ribbons monitor quick and long-term transferring averages of Bitcoin’s hashrate. Spikes within the metric reveal low mining job or go out of much less environment friendly Bitcoin miners.

The Hash Ribbons sign has continued, and crypto hedge fund Capriole Investments referred to the most recent flash as a ‘tempting Bitocin purchase sign.’

‘Hash Ribbons is again. In all probability the most productive long-term Bitcoin purchase sign there may be, Hash Ribbons is now tempting us with the present Miner Capitulation, which began two weeks in the past.’

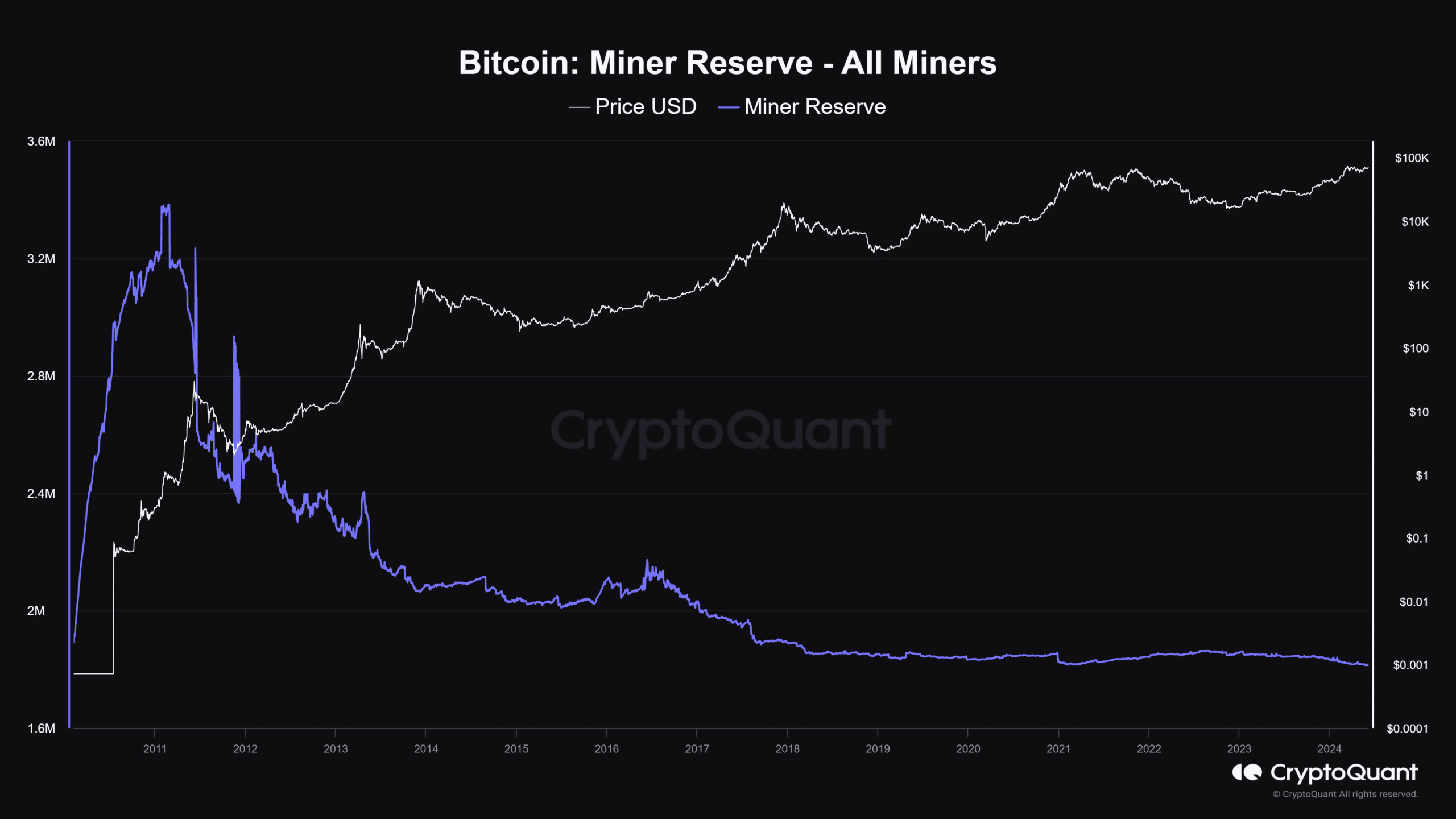

Moreover, the Bitcoin miner reserve hit its once a year low of one.8 million BTC. The low degree used to be remaining noticed 14 years in the past and recommended that miners had been offloading their holdings, most certainly via OTC (over the counter) markets.

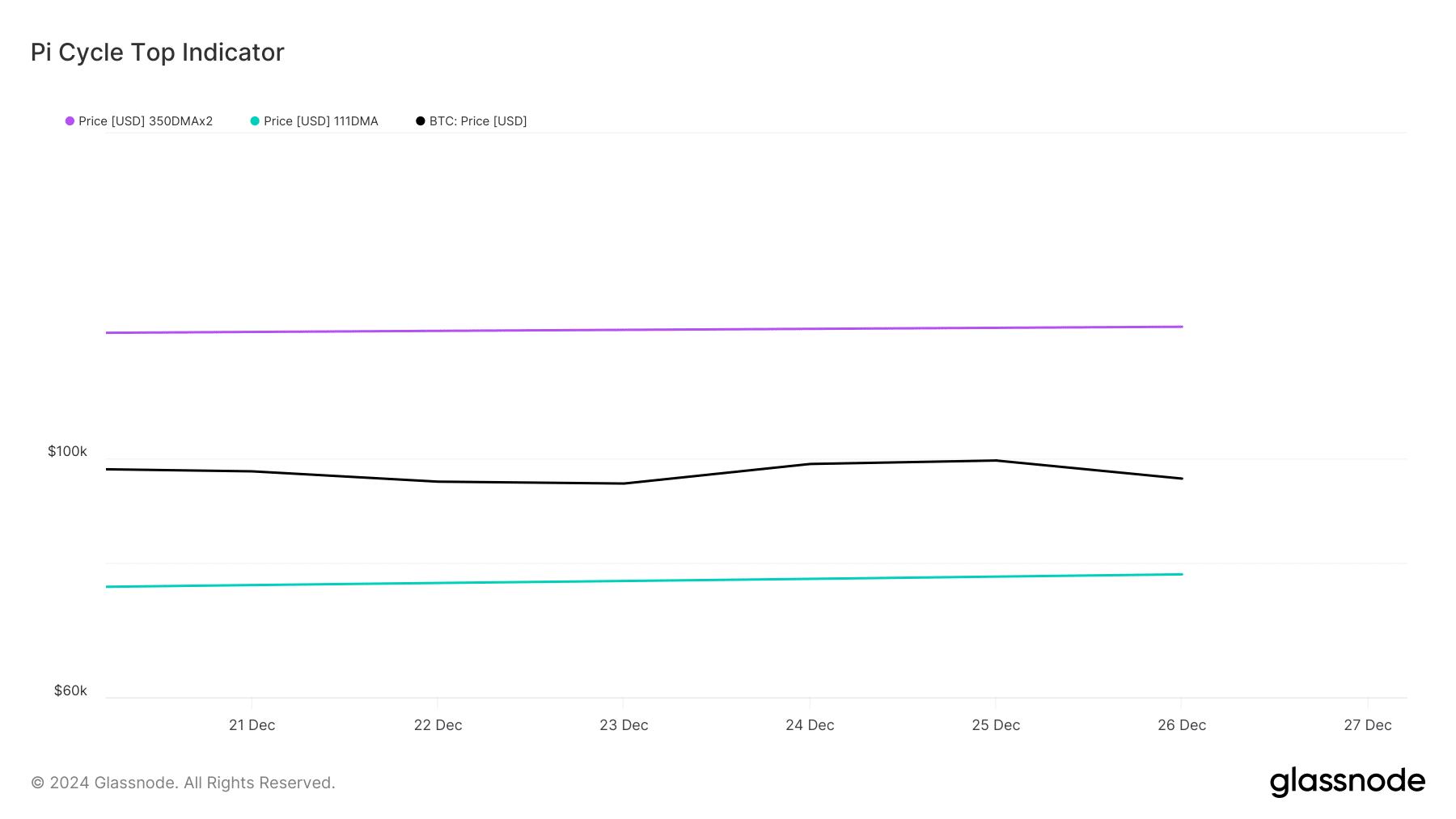

Supply: CryptoQuant

Supply: CryptoQuant

In all probability any other piece that corroborated the Hash Ribbons’ ‘purchase sign’ used to be Willy Woo’s declare that institutional investors had been ‘risk-on’ and feature pivoted to shopping for. Will have to you replica pros or look forward to a spread breakout to leap in?