Bitcoin approaches every other vital milestone — its scheduled halving tournament. This can be a programmed relief within the rewards miners obtain for verifying transactions.

The halving is a pivotal tournament that has traditionally influenced Bitcoin’s worth and the wider cryptocurrency marketplace.

Expanding Shortage Meets Rising Call for

The halving happens roughly each and every 4 years and is a part of Bitcoin’s distinctive financial coverage. It mimics the shortage and worth preservation of treasured metals like gold.

“During the last quite a lot of cycles, we’ve noticed increasingly more call for for Bitcoin, by contrast to the availability staying the similar. So, for those who take a look at it from a macroeconomic viewpoint, extra call for and the similar provide force the fee up,” Sheraz Ahmed, Managing Spouse at STORM Companions, instructed BeInCrypto.

Certainly, because the halving reduces the speed at which new BTC are generated, it adjusts the availability aspect of the equation. This has historically ended in a bullish sentiment amongst traders. Necessarily, the diminished drift of recent cash intensifies pageant for present ones.

Learn extra: Bitcoin Halving Countdown

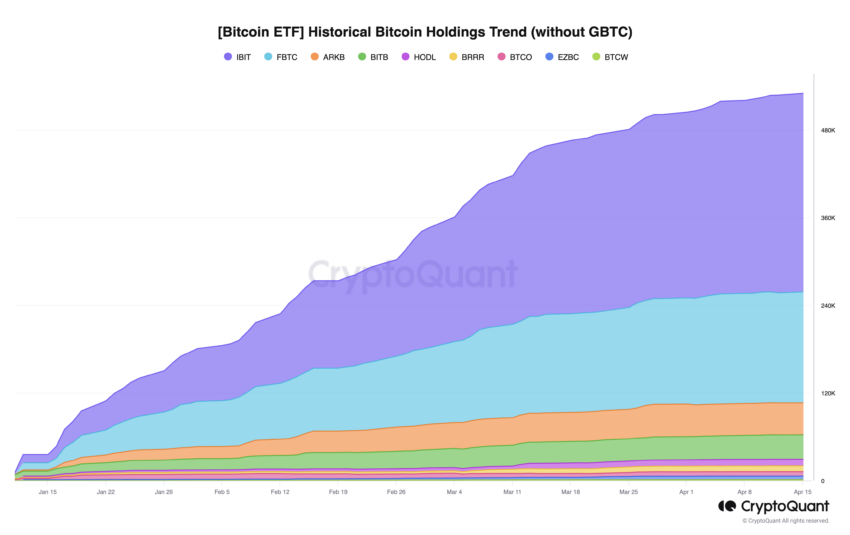

The drawing close halving may just additional exacerbate this pattern, given the expanding involvement of enormous institutional traders via Bitcoin Change-Traded Price range (ETFs).

“In the event you take a look at Bitcoin ETFs in the USA, they’re aggregating numerous the call for from gamers equivalent to pension budget and more or less the smaller institutional gamers. They’re purchasing numerous Bitcoin, once in a while up to they may be able to, every day. The truth that the halving will purpose much less Bitcoin to be minted will imply it’s going to be more difficult for them to fill that call for,” Ahmed added.

Bitcoin ETF Historic Holdings. Supply: CryptoQuant

Bitcoin ETF Historic Holdings. Supply: CryptoQuant

Likewise, nations like El Salvador have already began diversifying a part of their treasury belongings into Bitcoin. This hints at a broader acceptance and normalization of Bitcoin as a mainstream monetary asset. Moreover, governmental involvement may just enlarge call for pressures post-halving, as famous via STORM’s analysts.

Bitcoin’s Secure Bull Run After the Halving

This large buy-in may just stabilize Bitcoin’s worth fluctuations. “I don’t assume we’ll see a dramatic swing up or down. On the other hand, it’s going to be slightly consistent. It’s going to repeatedly develop,” Ahmed advised, indicating a trust within the maturation of the marketplace and a much less unstable Bitcoin.

Learn extra: What Came about on the Closing Bitcoin Halving? Predictions for 2024

Whilst some marketplace contributors use halving occasions to forecast Bitcoin worth actions and buying and selling methods, in addition they acknowledge it as a time to mirror on Bitcoin’s technological and regulatory developments. Many jurisdictions craft regulatory frameworks which can be extra favorable to Bitcoin than different speculative crypto belongings, which bodes neatly for its mainstream adoption.

Because of this, there’s a rising trust that Bitcoin must be reclassified clear of being simply every other cryptocurrency.

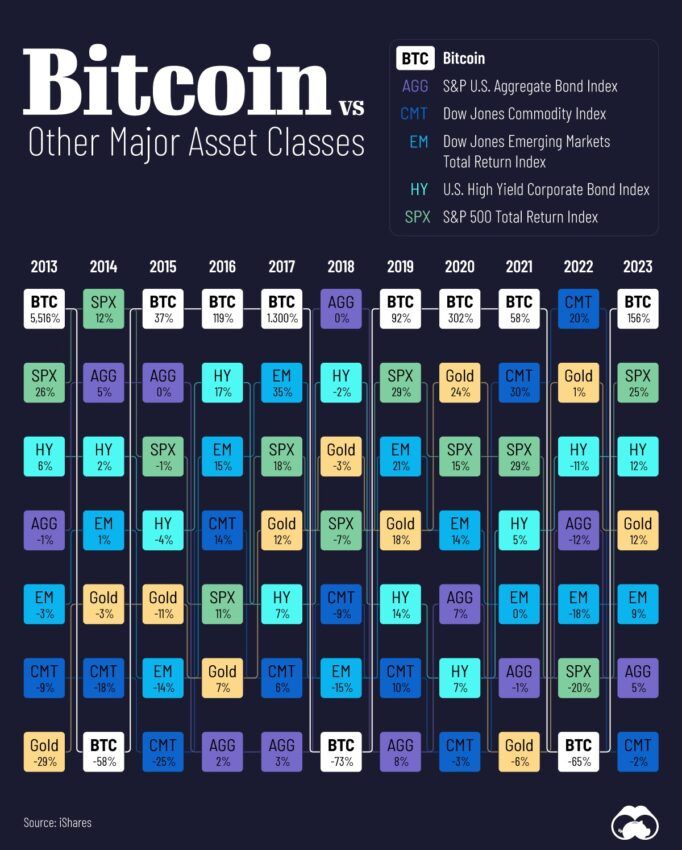

“I don’t imagine Bitcoin must be within the league of alternative cryptocurrencies. Bitcoin is its personal beast, and it’s very other to Ethereum and the others. None of them are competing with it. Bitcoin has round 52% of the marketplace proportion nowadays. I’m a large believer that it must graduate from the “faculty of cryptocurrencies” and change into a real asset that may be traded with different commodities equivalent to gold, silver, copper, and the like,” Ahmed concluded.

Bitcoin vs. Different Main Property. Supply: Visible Capitalist

Bitcoin vs. Different Main Property. Supply: Visible Capitalist

Taking a look ahead, the cap on Bitcoin’s overall provide — simplest 21 million cash can ever be mined — poses attention-grabbing financial inquiries about what occurs when all cash are minted. This shortage may just result in important shifts in Bitcoin’s function in each monetary and technological sectors.

Disclaimer

Following the Consider Challenge pointers, this option article gifts evaluations and views from trade mavens or folks. BeInCrypto is devoted to clear reporting, however the perspectives expressed on this article don’t essentially mirror the ones of BeInCrypto or its body of workers. Readers must examine data independently and discuss with a qualified earlier than making choices in accordance with this content material. Please be aware that our Phrases and Prerequisites, Privateness Coverage, and Disclaimers were up to date.