Bitcoin (BTC) surged on Wednesday to damage above $60,000, striking it inside placing distance of its all-time prime as enthusiasm for the arena’s biggest cryptocurrency reached a degree remaining observed throughout a 2021 increase.The cost of the virtual asset is driving a wave of pleasure sparked by way of a sequence of spot bitcoin exchange-traded price range that began buying and selling in January.Bitcoin climbed as prime as $63,900 Wednesday, touching its easiest level intraday since November 2021, ahead of shedding again to the $60,000 degree amid experiences that some customers of the cryptocurrency change Coinbase (COIN) started appearing a $0 steadiness of their accounts.Coinbase mentioned on its internet web page that “we’re mindful that some customers might see a 0 steadiness throughout their Coinbase accounts and might revel in mistakes in purchasing or promoting. Our staff is investigating this factor and can supply an replace in a while. Your belongings are secure.”We’re mindful that some customers might see a 0 steadiness throughout their Coinbase accounts & might revel in mistakes in purchasing or promoting. Our staff is investigating this & will supply an replace in a while. Your belongings are secure.

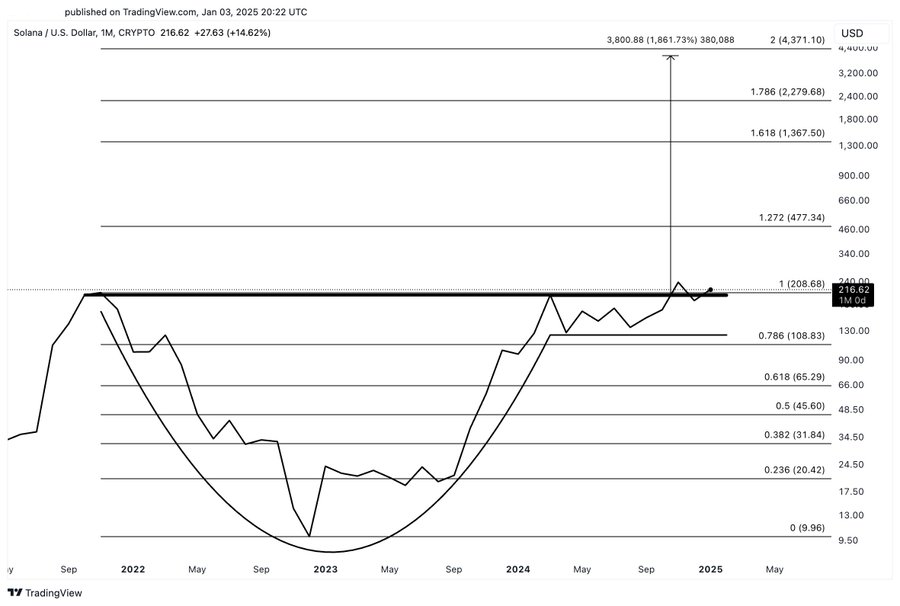

You’ll be able to observe this incident at Coinbase Make stronger (@CoinbaseSupport) February 28, 2024The present rally is pushing the associated fee nearer to the all time mark of $68,789. That apex got here six months ahead of a impressive crash in 2022.”In the long run, what we are seeing is crypto is more or less emerging from the ashes of the 2022 marketplace,” Ryan Rasmussen, a senior crypto analysis analyst for Bitwise Asset Control.”Our assumption is that the cost of bitcoin goes to reach $125,000 by way of the tip of 2025,” Benchmark’s Mark Palmer added on Yahoo Finance Are living.Buyers are bidding different cryptocurrencies and comparable shares upper too. 12 months up to now, the second one biggest cryptocurrency, ether (ETH), has outperformed bitcoin by way of greater than 4% whilst the full marketplace worth for all crypto belongings is up kind of 36% to $2.24 trillion, in line with Coinmarketcap.Tale continuesOne signal of surging enthusiasm for bitcoin is the buying and selling process within the bitcoin ETFs that introduced in January, giving on a regular basis traders fashionable publicity to the virtual asset. They have got logged greater than $6.7 billion in web flows as of Wednesday, in line with knowledge accrued by way of London-based fund Farside Buyers.Thus far this quarter, bitcoin buying and selling quantity has surpassed ranges observed for a similar duration in each quarter of 2023. That process has been a boon to primary crypto buying and selling venues, together with Coinbase and Robinhood (HOOD). As of Wednesday, the ones shares are up 18% and 26%, respectively, because the starting of January.Brian Armstrong, CEO of Coinbase. REUTERS/Brendan McDermid (REUTERS / Reuters)Bitcoin miner Marathon Virtual (MARA) and bitcoin holder Microstrategy (MSTR) have risen 34% and 53%, for a similar duration. MicroStrategy introduced Monday morning that it bought an extra 3,000 BTC, bringing its overall funding to 193,000 BTC, which was once valued at over $11 billion as of Wednesday.Derivatives investors also are now piling into the bitcoin rally, in line with Cumberland Labs analyst Christopher Newhouse.There are kind of $25 billion of open contracts within the bitcoin futures marketplace, in line with crypto derivatives knowledge supplier Coinglass. That’s a brand new prime for exceptional bitcoin futures bets, surpassing a mark remaining set in April 2021.”Within the choices marketplace, the narrative is apparent,” Newhouse added. “Individuals are bullish.”David Hollerith is a senior reporter for Yahoo Finance protecting banking, crypto, and different spaces in finance.Click on right here for the most recent crypto information, updates, and extra associated with ethereum and bitcoin costs, crypto ETFs, and marketplace implications for cryptocurrenciesRead the most recent monetary and trade information from Yahoo Finance