Bitcoin used to be experiencing a mental surge, creating a correction not likely for now.

Alternatively, when the basics in the end take over, panic may just ensue.

Fears of marketplace overheating are emerging as Bitcoin [BTC] surges previous the $68K benchmark, breaking a four-month hunch, even because the RSI sees a pointy decline.

In consequence, buying and selling simply above this essential stage might sign a possible most sensible for BTC. If this vary is showed as a resistance level, a worth correction may well be at the horizon, probably forcing mass capitulation. Alternatively,

Bitcoin’s surge — Psychology over basics

Initially, it’s crucial to imagine that Bitcoin is closely influenced through macroeconomic elements.

These days, a confluence of occasions – such because the post-halving surge, the nearing finish of the election cycle, the “Uptober” frenzy, and cuts in Fed charges – has blended to propel Bitcoin to $68K in simply ten days with none cast pullback.

That is essential as a result of, regardless of key technicals pointing to a near-term reversal, those macro elements might fortify massive holders’ trust that it is a key purchasing zone.

In different phrases, large gamers would possibly nonetheless see this stage as a possibility, and this mental momentum may just draw in additional consumers, fueled through emerging FOMO as marketplace sentiment heats up.

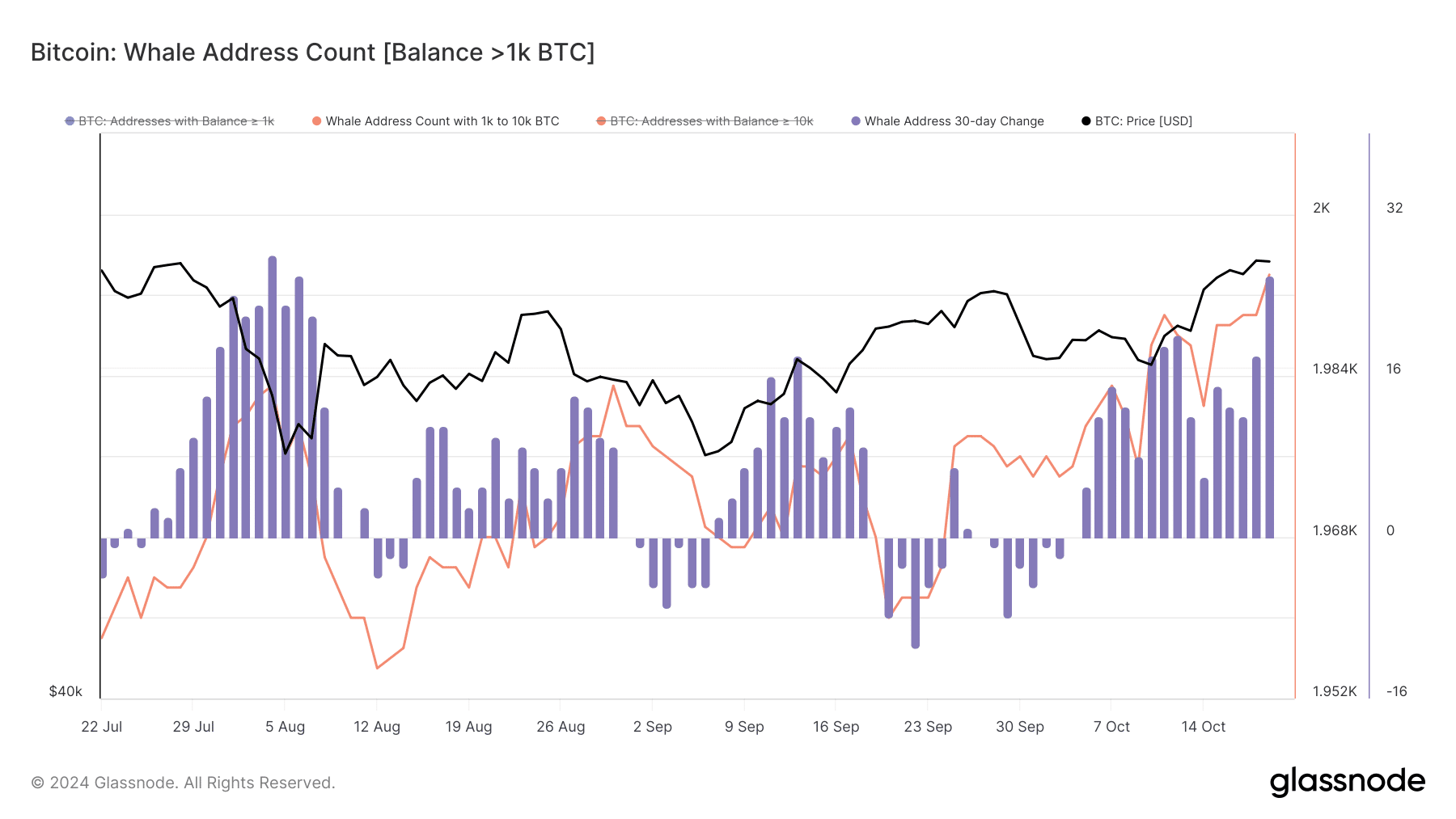

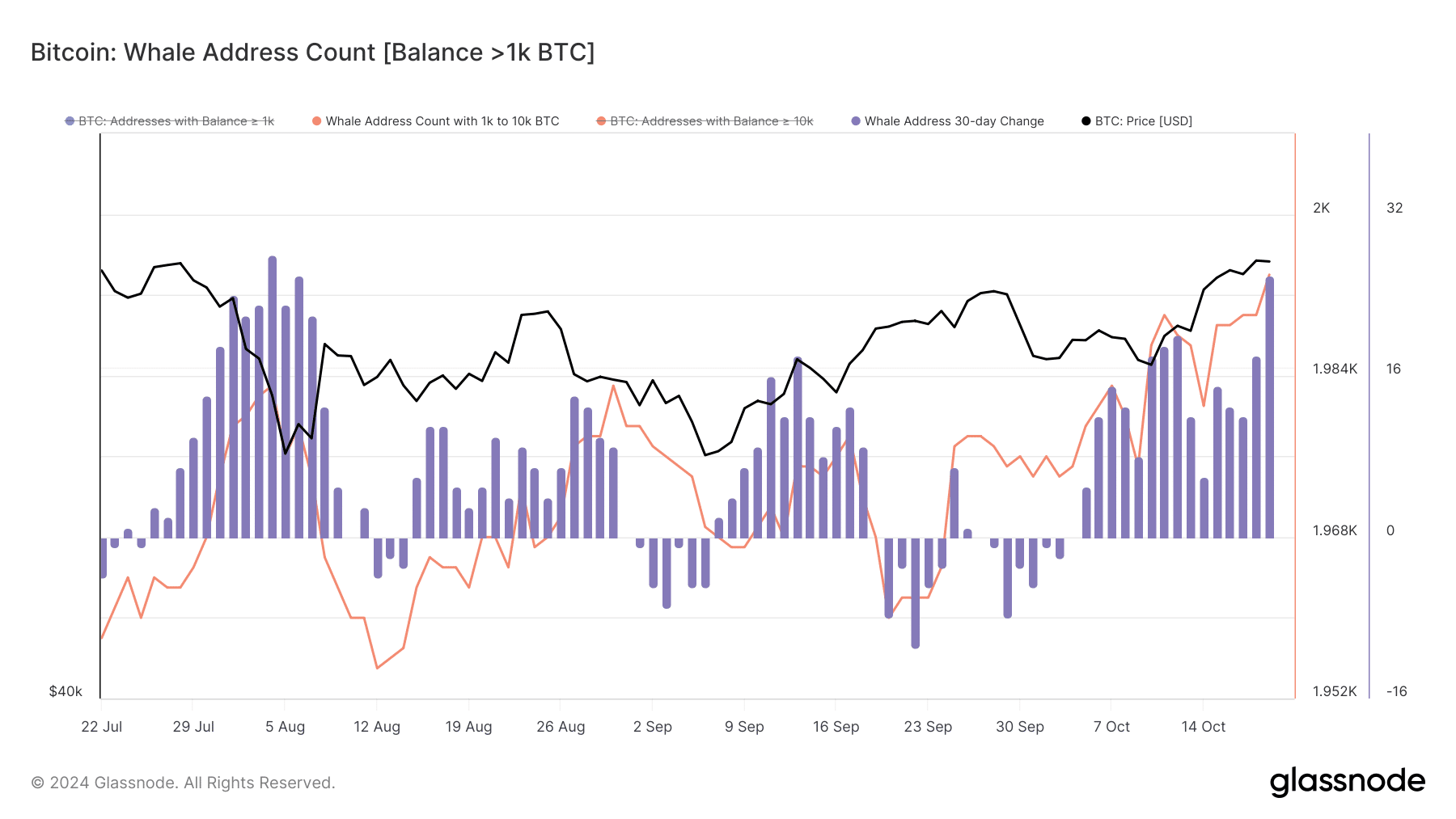

Supply: Glassnode

Supply: Glassnode

Supporting that is the upward push in whale task: addresses maintaining 1K–10K BTC have hit a 3-month top. The final main spike passed off along a 5% day-to-day worth surge, pushing BTC above $66K.

In easy phrases, whales have performed a key function in countering bearish power. Because the get started of October, their task has bolstered AMBCrypto’s preliminary speculation: macro elements are drawing in large gamers.

Total, this cycle seems to be psychologically pushed. So, regardless of bearish makes an attempt to brief Bitcoin, the chance of an important correction turns out narrow for now.

Marketplace buzz main easy methods to $73K

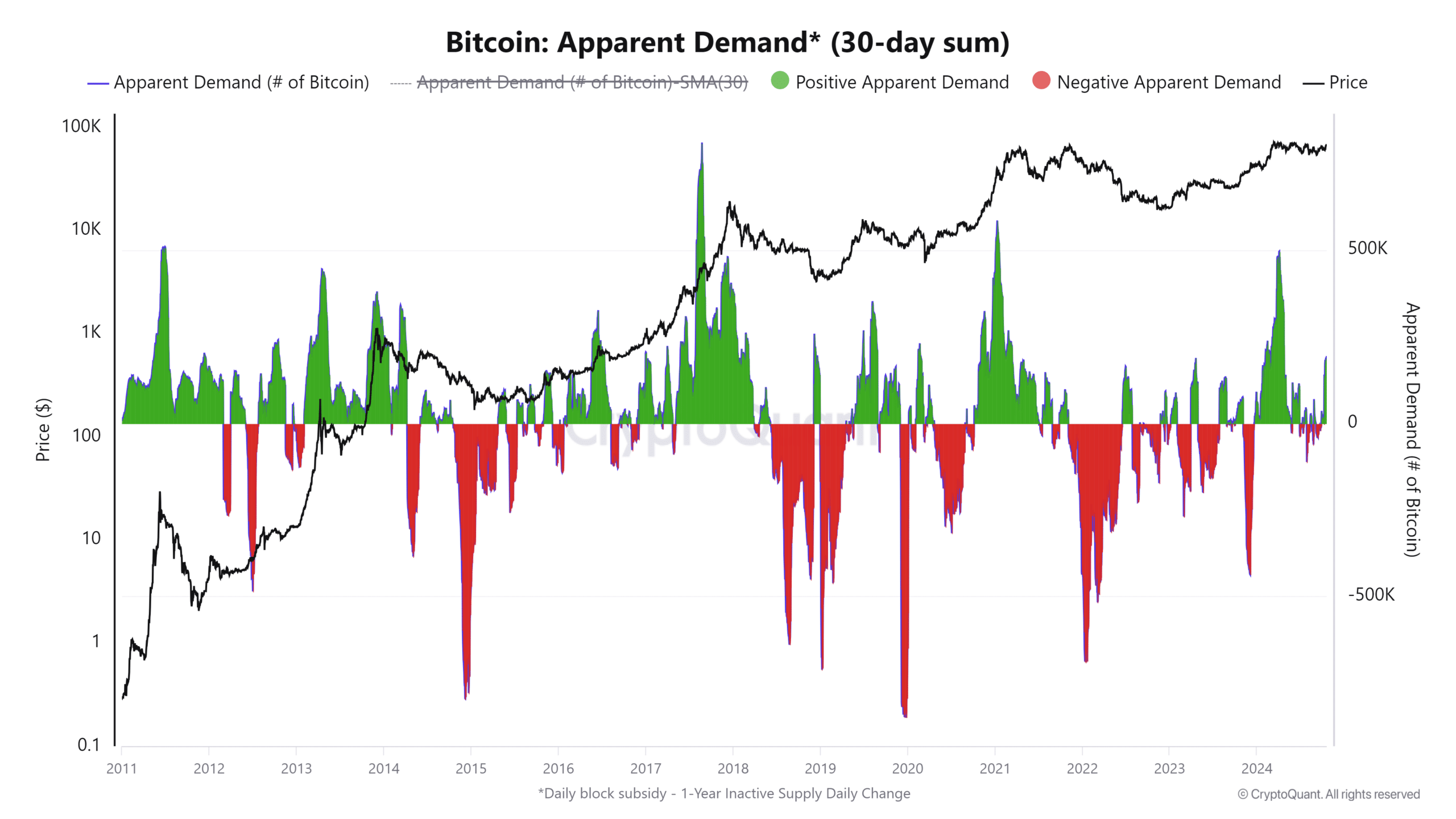

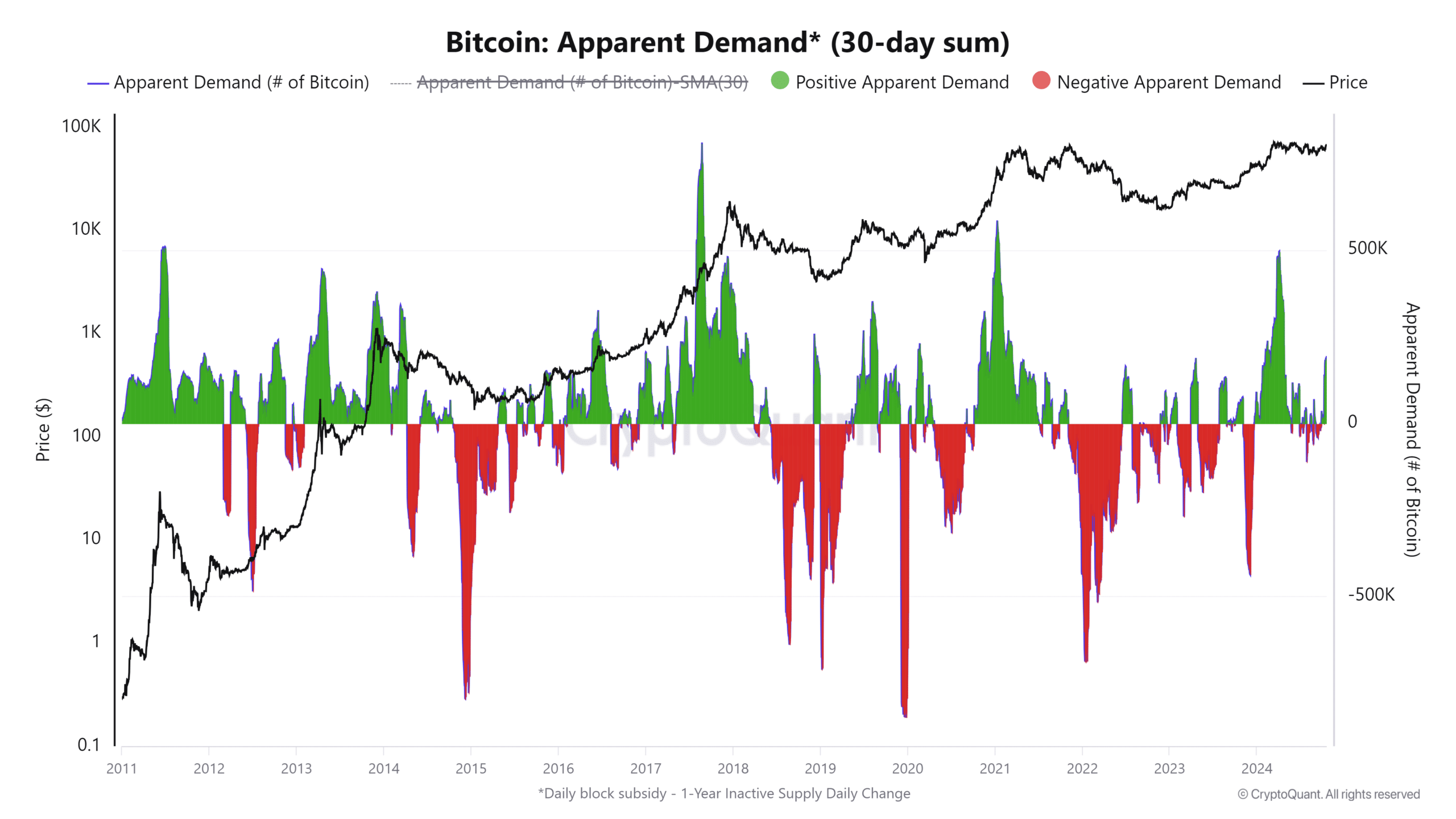

Traditionally, the halving yr has been a competent indicator of when a bull cycle would possibly happen. Spikes within the 30-day call for reasonable (marked in inexperienced) have persistently coincided with Bitcoin provide cuts throughout halving occasions.

Those provide discounts usually spark long-term rallies, handing over oversized returns to stakeholders.

Supply: CryptoQuant

Supply: CryptoQuant

Apparently, although the basics don’t right away play out, the fashionable anticipation on my own can cause a breakout.

Is your portfolio inexperienced? Take a look at the BTC Benefit Calculator

This cycle is a chief instance: the marketplace buzzed with expectancies of a halving-driven rally, and true to shape, Bitcoin surged to $68K in a remarkably brief time frame.

That mentioned, if whale task continues in this upward development— which turns out most probably—Bitcoin may well be set to hit its all-time top of $73K prior to the tip of This autumn.

Subsequent: BOME marketplace sentiment shifts to bearish: Is a pullback forward?