Bitcoin is dealing with a pullback, however Usual Chartered has a daring outlook—$500,000 ahead of Trump’s presidency ends

With rising institutional passion, and political backing, may BTC be gearing up for its greatest rally but?

Whilst Bitcoin [BTC] faces a bearish pullback pushed by way of macroeconomic uncertainty, Geoffrey Kendrick, Usual Chartered’s Head of Virtual Asset Analysis sees a brighter long run. In reality, he’s within the information lately after he set a daring $500k goal for the main crypto asset ahead of the top of Trump’s presidency.

AMBCrypto unpacks the important thing drivers that would make—or damage—this daring prediction.

What wouldn’t it take?

2025 kicked off with daring predictions – Bitcoin strategic reserves, banks providing BTC services and products, and a $150k value goal.

Two months in, BTC’s nonetheless beneath $100k. Obviously, the marketplace’s long past the wrong way, with buyers taking part in it protected and chasing fast income.

On this setting, a $500k prediction from Usual Chartered would possibly sound a little bit too formidable. On the other hand, what grabbed AMBCrypto’s consideration? This goal was once made beneath Trump’s management – and there’s a reason why in the back of it.

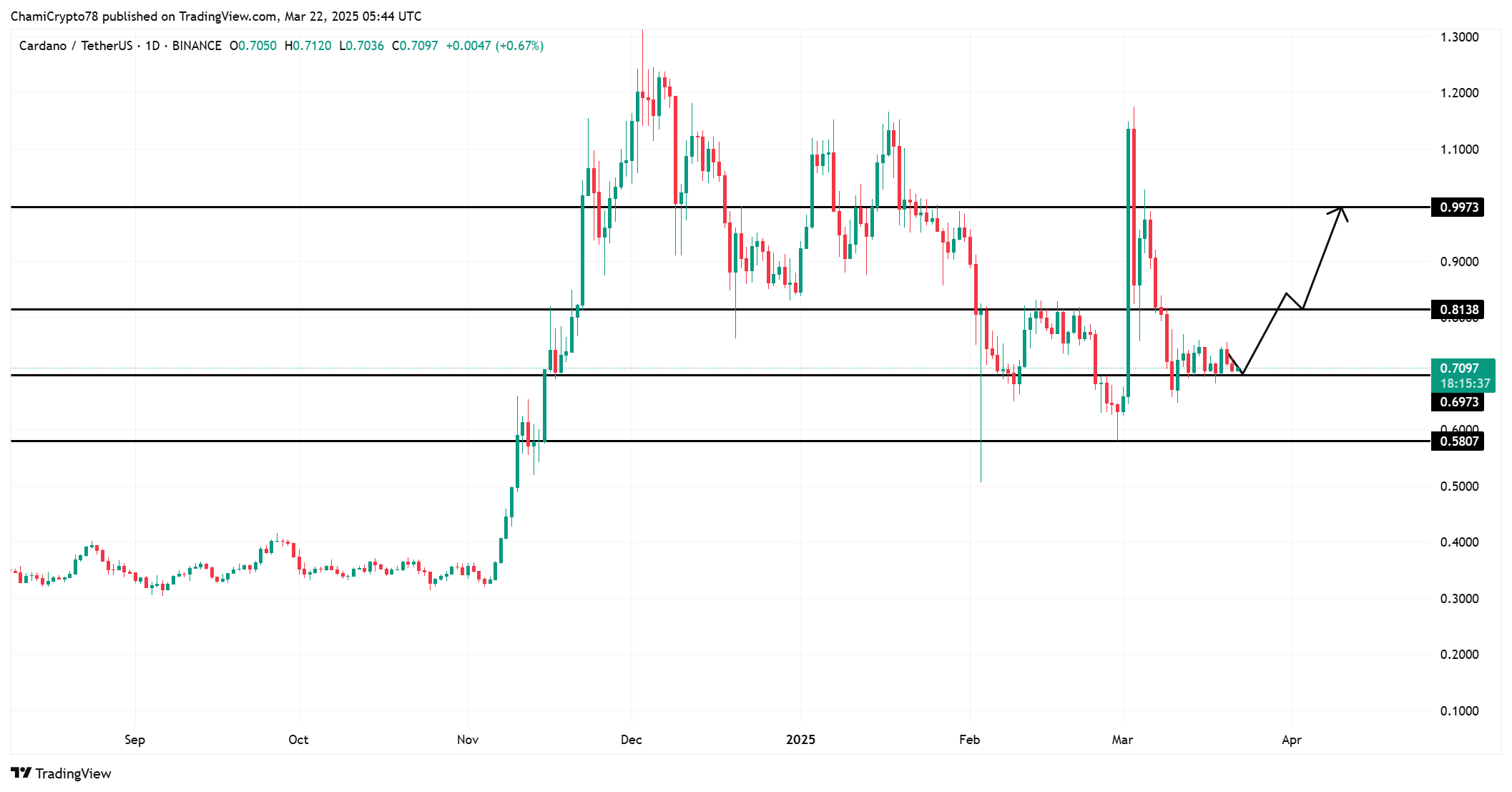

Since November’s elections, BTC has surged by way of over 30%, with $90k as the common marketplace backside. To hit $500k, Bitcoin would want a 455% bounce ahead of 2028.

Supply: TradingView (BTC/USD)

Supply: TradingView (BTC/USD)

Taking a look again, BTC registered features of 156% in 2024. If it pulls off identical enlargement in the following couple of years, Usual Chartered’s daring prediction would possibly simply hit the mark.

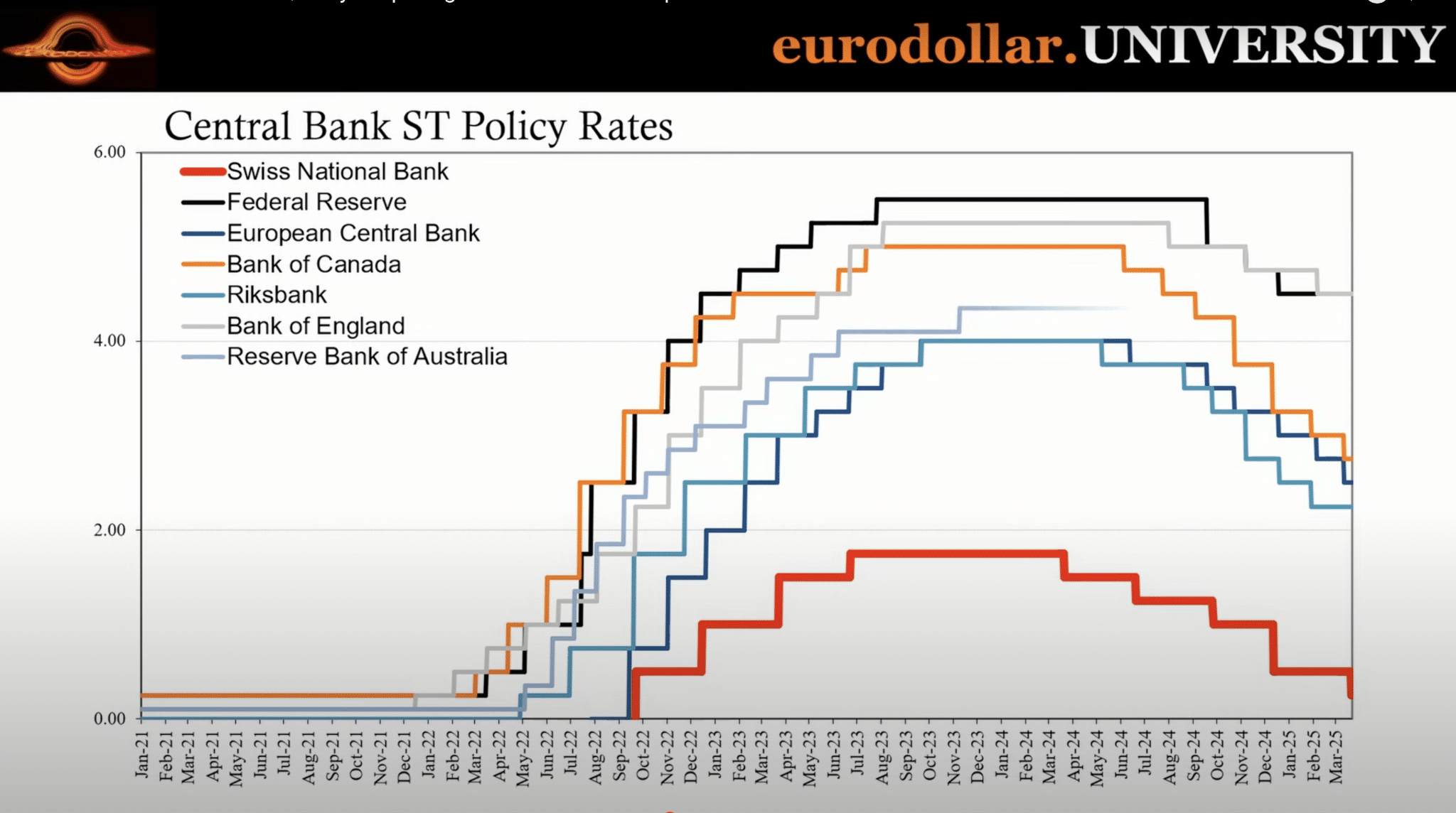

Moreover, Trump’s regulatory shake-up, the SEC overhaul, his dislike of prime rates of interest, the DOGE cupboard, and a brand new crypto activity power are pushing large goals ahead – calling the present volatility as only a “brief dip.”

Is Usual Chartered putting the appropriate guess on Bitcoin?

A large bite of BTC’s 156% YTD bounce is because of U.S Spot ETFs, that have pumped billions into Bitcoin. BlackRock (IBIT) by myself noticed its Bitcoin holdings bounce by way of a staggering 726%, now sitting at 585,393 BTC at press time.

Supply: BitBo

Supply: BitBo

And, it doesn’t forestall there – BlackRock is about to release a Bitcoin ETP (Trade-Traded Product) in Europe, bringing much more international publicity and a flood of recent capital into the marketplace.

With a lot of these components at play, Usual Chartered’s daring Bitcoin prediction is beginning to glance extra like a calculated guess on robust basics, no longer simply hypothesis.

Learn Bitcoin’s [BTC] Value Prediction 2025–2026

So, a repeat of the 2024 pump doesn’t appear too a ways off. However now, all of it comes down as to if Trump’s guarantees are carried out rapidly as 2025 performs out.

The marketplace is gazing intently, particularly as the continuing business warfare has already pushed many into “excessive” concern.

Earlier: Ethereum’s [ETH] value may hike by way of 22% to hit $3,500 ONLY if…

Subsequent: Hyperliquid: Breaking down affect of $7.9M whale pump on HYPE

:quality(70):extract_cover():upscale():fill(ffffff)/2025/03/10/975/n/49351082/b3e5e51867cf66b053d710.87070045_truvaga-imag.jpg)