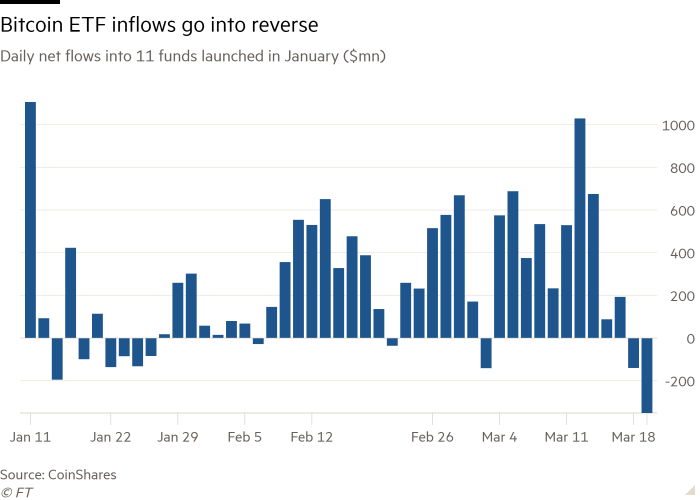

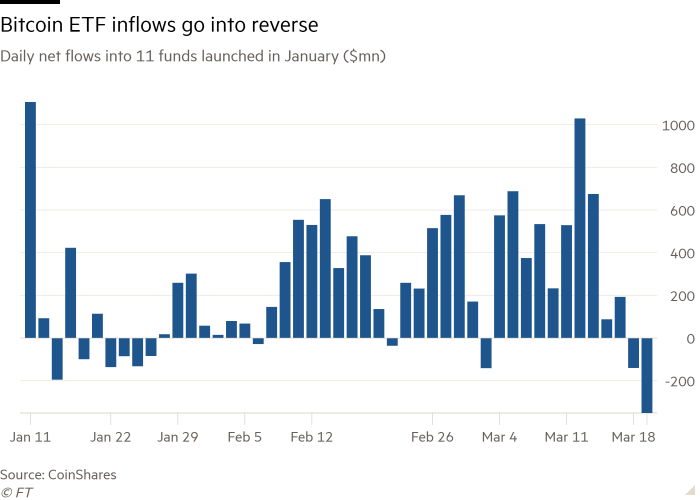

Liberate the Editor’s Digest for freeRoula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.Bitcoin has fallen 16 in step with cent from its all-time prime closing week, because the investor flows into new inventory marketplace budget that had pushed an enormous rally this yr backpedal.The arena’s biggest cryptocurrency, which hit $73,800 closing Thursday, dropped as little as $60,760 on Wednesday ahead of improving to simply underneath $63,000. Its decline comes as outflows from the 11 new bitcoin change traded budget hit just about $500mn within the closing two days, in line with information compiled via CoinShares, an asset control staff. The best outflow was once at Grayscale, the most important bitcoin ETF, which has had greater than $1bn withdrawn from its fund this week.Bitcoin has surged to report highs this yr after US regulators authorized spot bitcoin ETFs in January following a decade of rejections. Cash has surged into one of the most new budget, with BlackRock’s bitcoin ETF the quickest ETF in historical past to achieve $10bn.“The truth there’s regulated entities offering funding choices into bitcoin is one thing that provides buyers self belief, nevertheless it doesn’t modify the basic nature of bitcoin itself,” stated Laith Khalaf, head of funding research at funding platform AJ Bell in London.“There aren’t any basics to bitcoin which provide an anchor to the associated fee, which makes it extra prone than different property to primary swings,” he added. “There may be not anything there that you’ll be able to use as a base for a valuation.”The float of cash into the brand new ETFs since January has been tempered via constant outflows at Grayscale, which has had withdrawals of greater than $12bn because the Securities and Change Fee authorized it to transform its bitcoin agree with into an ETF. On Wednesday there have been an extra $444mn of outflows, in line with Bloomberg information. Grayscale has priced its ETF charges at 1.5 in step with cent, by contrast to competitors comparable to BlackRock, Constancy, Ark Funding and Bitwise, that have slashed or quickly waived charges to draw new consumers.BlackRock, probably the most a success of the brand new ETFs, had inflows of $527mn this week however others, comparable to Invesco, Franklin Templeton and Valkyrie, had minimum inflows.“There was once a flight to different ETFs on account of one of the most disadvantages the Grayscale product had, however that is only a minor worth correction,” stated Joel Kruger, marketplace strategist at LMAX. “This setback is some distance clear of any panic and fear or fear about bitcoin having some kind of excessive drop.”Video: Bitcoin mines might be used for power garage | FT Tech

On Wednesday there have been an extra $444mn of outflows, in line with Bloomberg information. Grayscale has priced its ETF charges at 1.5 in step with cent, by contrast to competitors comparable to BlackRock, Constancy, Ark Funding and Bitwise, that have slashed or quickly waived charges to draw new consumers.BlackRock, probably the most a success of the brand new ETFs, had inflows of $527mn this week however others, comparable to Invesco, Franklin Templeton and Valkyrie, had minimum inflows.“There was once a flight to different ETFs on account of one of the most disadvantages the Grayscale product had, however that is only a minor worth correction,” stated Joel Kruger, marketplace strategist at LMAX. “This setback is some distance clear of any panic and fear or fear about bitcoin having some kind of excessive drop.”Video: Bitcoin mines might be used for power garage | FT Tech

Bitcoin tumbles from report prime as Grayscale ETF outflows hit $12bn