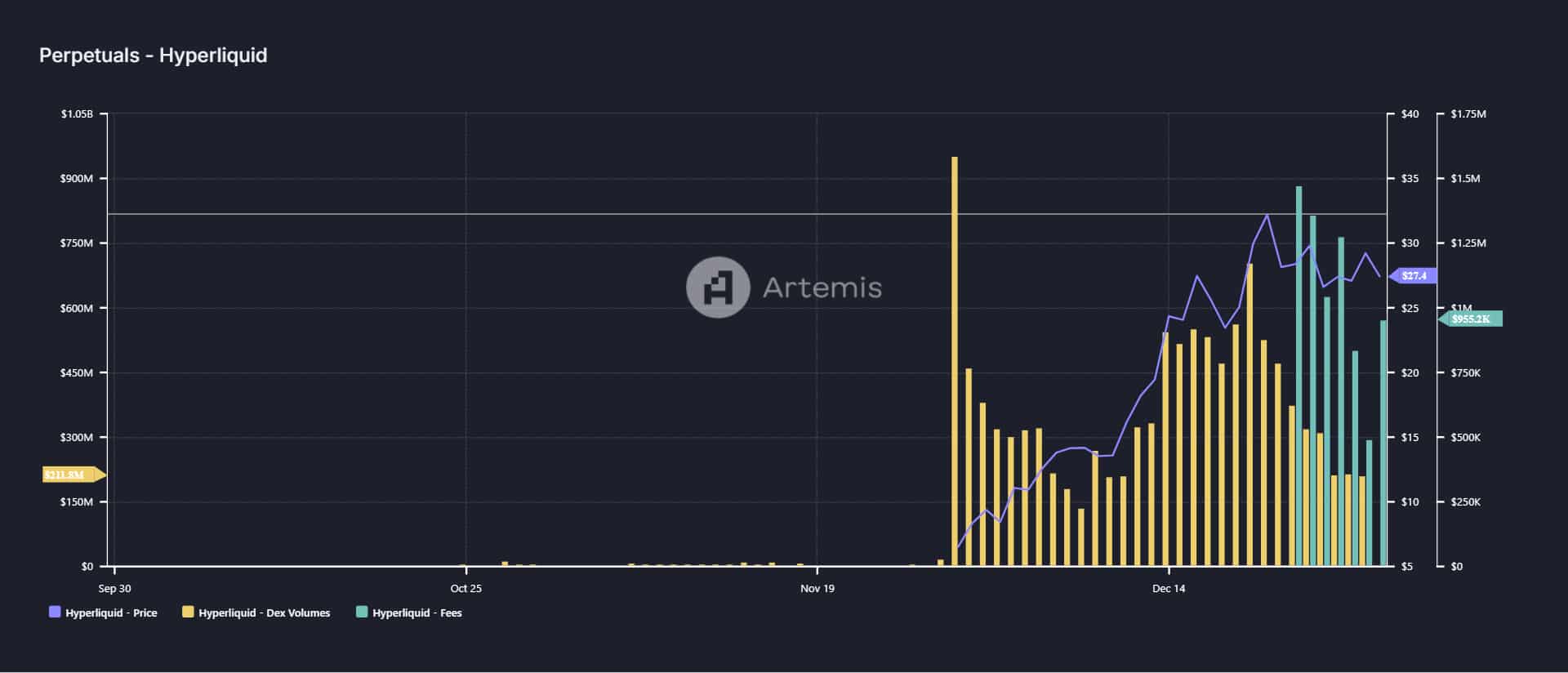

Bitcoin continues to set new information this yr as investors start eyeing a six-figure worth for the arena’s biggest crypto—and consistent with research of the asset’s derivatives marketplace, it is but to overheat.The asset climbed to way past $97,000 past due Wednesday night time, blasting thru its earlier highs above $95,000 in not up to an hour, CoinGecko knowledge displays.Its seesawing worth has induced a $100 million cascade of liquidations over the past 24 hours, with 80% of the ones coming from quick dealers or the ones having a bet the fee would head decrease, consistent with knowledge from CoinGlass.Volatility has returned considerably this yr, thank you partially to more than one spot exchange-traded fund listings within the U.S. in January and the graduation of choices buying and selling on the ones merchandise this week.A Republican victory all over this yr’s U.S. presidential election has additionally spurred hopes for favorable business law and a rest of oversight from Wall Side road’s best cop—the Securities and Alternate Fee—with an anticipated exchange of the guard.Dubbed the “Trump Business,” crypto and equities investors are scrambling to scoop up belongings forward of the President-elect’s inauguration on January 20, which has helped force sentiment throughout primary markets.Previous this month, the Nasdaq climbed to its best possible height above 21,180 issues, whilst the S&P 500 crowned out over 6,000 for the primary time.That’s been pushed by way of post-election optimism, Federal Reserve price cuts, and powerful company profits, specifically within the tech sector. Developments in AI and supportive financial prerequisites additional boosted investor sentiment, propelling the indices to new peaks.Bitcoin is on course to exceed analyst expectancies of a December worth above $100,000, with Bernstein Analysis forecasting the asset may double to $200,000 by way of the tip of 2025.“If you happen to simply seemed on the scale and pace of the marketplace, the knee-jerk pondering can be that buyers are in a state of euphoria,” Pav Hundal, lead analyst at Australian crypto change Swyftx, advised Decrypt.“There’s 0 signal of any overheating within the futures marketplace, he added. “All of it seems very rational, very planned.”The analyst pointed to Bitcoin’s investment price for perpetuals contracts, which “at this time are sitting at round 10%.”“That’s no longer with reference to overheated, and indubitably not anything just like the 107% annualized rate of interest we noticed on Bitcoin longs in March,” he mentioned. “We must get a sexy excellent thought in the following few hours on whether or not this is the general push to $100,000.”Day-to-day Debrief NewsletterStart on a daily basis with the highest information tales at this time, plus authentic options, a podcast, movies and extra.

Bitcoin Value Blasts Previous $97,000 as Futures Trace at Extra Room to Run – Decrypt

:max_bytes(150000):strip_icc()/GettyImages-2039372699-78777b3657d14158a2c2ee30c0773dd2.jpg)