Making an investment.com– Bitcoin worth fell moderately on Monday amid continual considerations over distributions via now defunct crypto change Mt Gox, which additionally battered sentiment in opposition to broader cryptocurrency markets.

Nonetheless, the sector’s biggest cryptocurrency discovered some give a boost to across the $57,000 stage after sinking to over four-month lows previous on Monday. fell 0.8% up to now 24 hours to $57,072.0 via 08:09 ET

The token and the wider crypto house took little give a boost to from a weaker greenback, with reviews suggesting that main Bitcoin pockets holders had additionally begun mobilizing their wallets for possible gross sales.

Bitcoin hammered as Mt Gox distribution starts

Trustees for the now defunct Mt Gox crypto change stated they’d begun distributing tokens to purchasers suffering from a 2014 hack.

Whilst the trustees have now not defined the price of the distributions, wallets related to the change had been noticed transferring round $9 billion price of Bitcoin previous this 12 months.

Buyers dumped Bitcoin on fears that receivers of the tokens will likely be in large part inspired to promote their holdings, given Bitcoin’s large worth soar over the last decade. The sort of state of affairs gifts large promoting drive at the token.

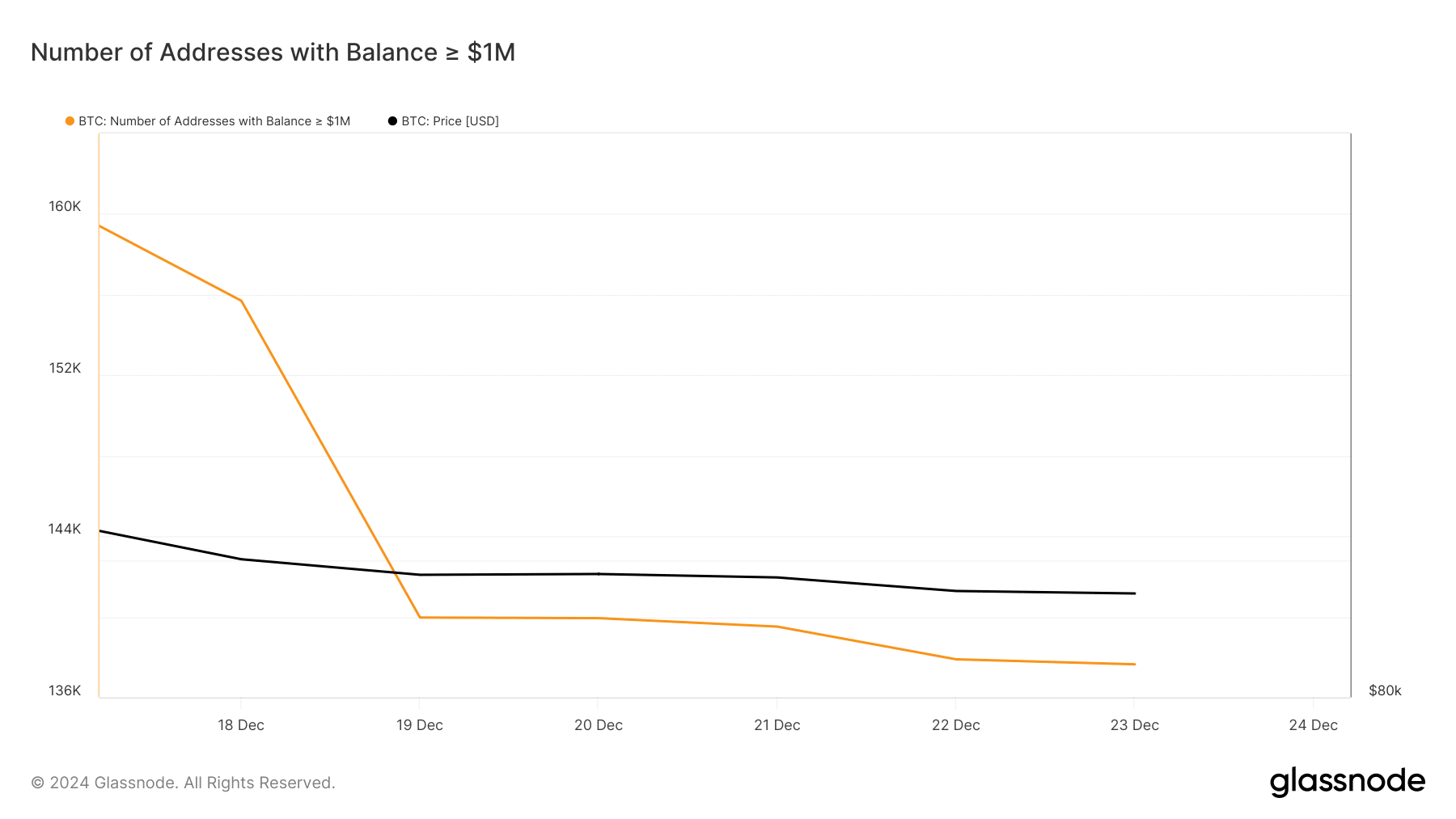

A number of Bitcoin “whale” wallets had been noticed coming on-line for possible gross sales in their holdings, whilst inflows into crypto funding merchandise had been additionally noticed in large part drying up in the course of the previous few weeks.

Crypto worth lately: Altcoins combined, price alerts in center of attention

Amongst broader crypto markets, main altcoins noticed combined efficiency regardless of Bitcoin’s drop.

International no.2 token climbed 1% to $3,043.14. Previous to this, the token broke underneath $3,000 for the primary time since Would possibly.

and rose 2.5% and zero.7%, respectively, whilst fell 0.4%. Amongst meme tokens, dropped 1.8%, whilst added 0.8%.

Promoting drive on Bitcoin spilled over into main altcoins, for the reason that the token typically acts as a figurehead for the crypto trade.

As such, crypto costs in large part brushed aside contemporary weak spot within the , amid rising optimism over rate of interest cuts via the Federal Reserve. This pattern noticed Wall Boulevard hit file highs.

A is about to provide extra cues on rates of interest this week. Key U.S. inflation knowledge could also be on faucet.

Virtual asset funding finances see inflows for the primary time in 4 weeks

Virtual asset funding merchandise noticed internet inflows of $441 million ultimate week, breaking a three-week streak of internet outflows, CoinShares stated in a brand new document. The ultimate time those merchandise recorded internet inflows used to be the week finishing June 7, when traders added over $2 billion.

Bitcoin accounted for $398 million of the inflows. CoinShares famous that it’s extraordinary for BTC to constitute simplest 90% of the whole inflows. Amongst altcoins, Solana stood out, with SOL-linked merchandise attracting $16 million.

CoinShares attributed the inflows to contemporary worth weak spot, pushed via defunct crypto change Mt. Gox making ready to pay off collectors and the German govt’s regulation enforcement company transferring massive quantities of bitcoin to exchanges.

Buyers most likely noticed this as a purchasing alternative, CoinShares stated, then again, the certain sentiment didn’t lengthen to blockchain equities, which skilled $8 million in outflows, bringing their year-to-date general to $556 million.

Bitcoin worth lately: slips to $57k as Mt Gox jitters rattle crypto Via Making an investment.com

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/25799626/247465_Barbie_Phone_AJohnson_0002.jpg)

:max_bytes(150000):strip_icc()/GettyImages-2190687584-73d2fde2b83c4d429c888c0bf249a930.jpg)