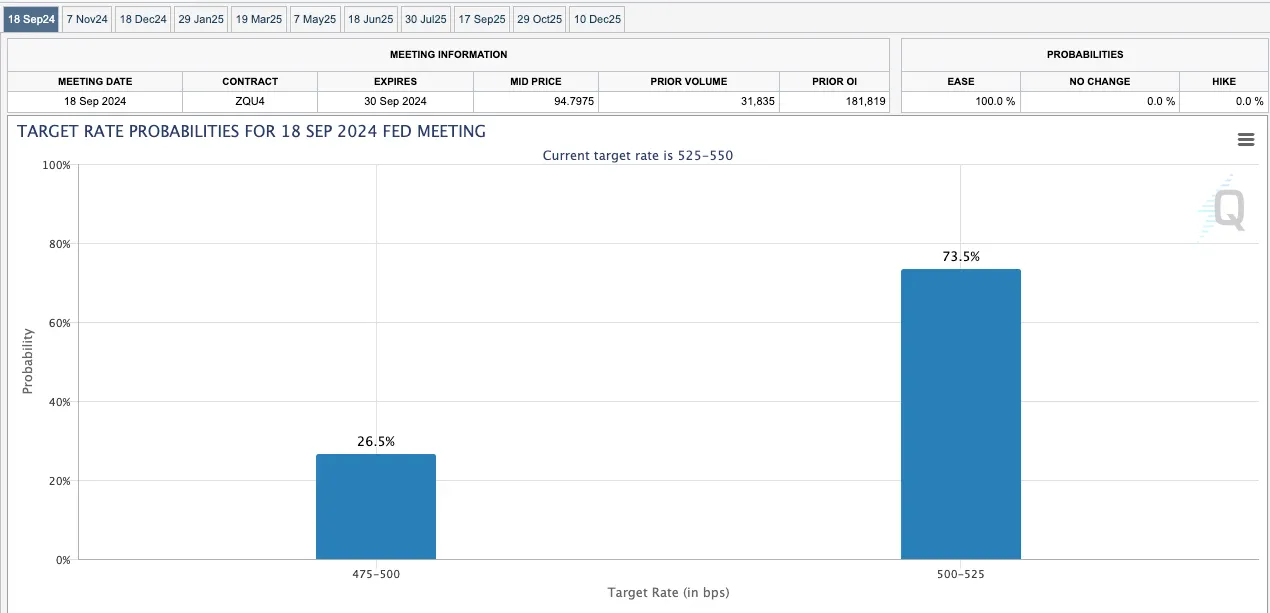

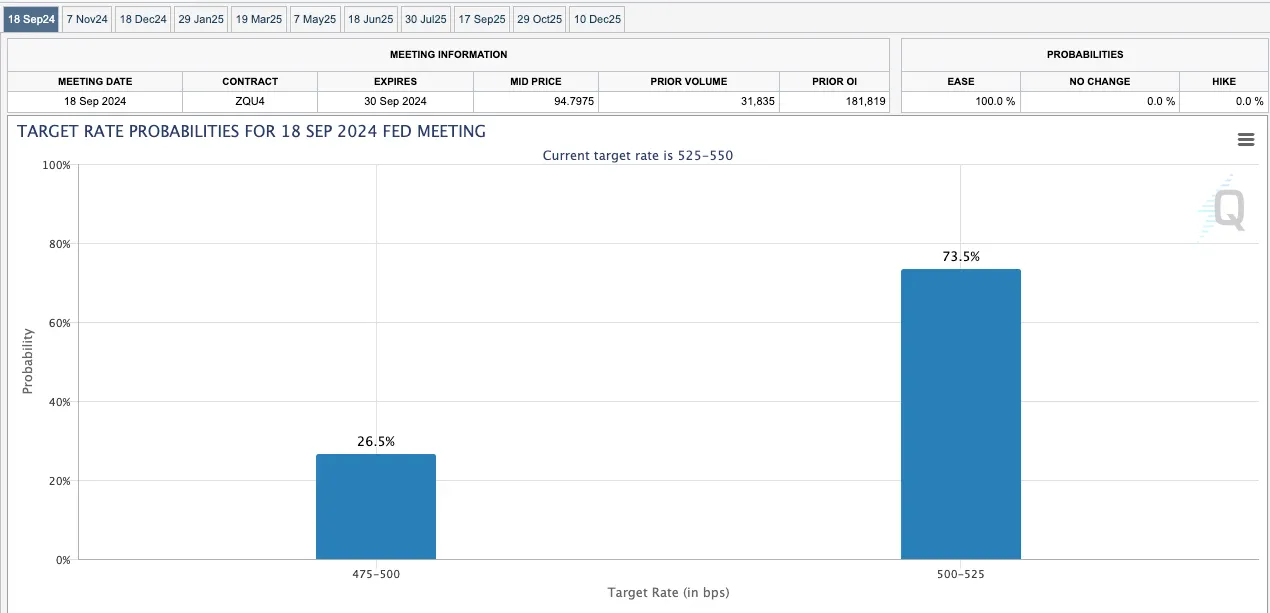

Bitcoin continues to be buying and selling quite flat as traders flip their consideration to Jackson Hollow in Wyoming, the place Federal Reserve Chair Jerome Powell is slated to offer a coverage speech on the Fed’s symposium later lately.Mavens say his feedback will most probably set the tone for September, and that shut consideration must be paid to Powell’s interpretation of marketplace information and any hints concerning the scale and timing of long term cuts.Within the hours main as much as Powell’s cope with, maximum primary cryptocurrencies—now not simply Bitcoin—are buying and selling quite flat.Bitcoin (BTC), the most important cryptocurrency by way of marketplace capitalization, is down 0.8% at $60,766.48, whilst Ethereum (ETH), the second-largest, has won 0.5% to achieve $2,654.94, in keeping with information from CoinGecko.For the crypto marketplace, any surprises on this announcement will have important implications. A extra competitive charge lower or a dovish outlook, may gas a robust bullish momentum, as traders search upper returns in choice property. However a much less accommodating stance or a touch of long term tightening may cause volatility, probably resulting in a brief time period dip as traders think again chance.Talking with Decrypt, Ryan Lee, Bitget Analysis’s leader analyst stated the marketplace may obtain alerts of “charge lower self assurance” and “information dependence.” He expects Powell’s message to be very similar to contemporary communications: the Fed is with reference to chopping charges, however the extent of easing depends upon upcoming information.”As of now, the marketplace expects a 73.5% likelihood of a 25 foundation level lower or a 26.5% likelihood of a 50 foundation level lower in September. The ten-year Treasury yield is round 3.85%, and the USA Greenback Index is at 101.44,” Lee stated.Outlining possible situations, Lee stated if dovish statements are made, the greenback index is more likely to proceed falling, the 10-year Treasury yield would possibly stay declining, and the crypto marketplace may acquire momentum. Conversely, the other would possibly happen.The central focal point of Powell’s speech is predicted to be the Fed’s stance on rates of interest, with analysts expecting that Powell will define the present state of the economic system foundation the to be had datapoints and steering on what can also be anticipated going ahead.In a observe despatched to Decrypt, Jag Kooner, Head of Derivatives at Bitfinex stated Powell’s speech shall be scrutinized for clues concerning the Fed’s charge choices, particularly in mild of the numerous 818,000 downward revision in US payrolls—the most important since 2009. This revision alerts possible exertions marketplace weak spot that would affect the Fed’s manner—and due to this fact motive some uneven motion for Bitcoin.Whilst a 25 foundation level (bps) charge lower in September is extensively anticipated, with the CME Fedwatch Software lately appearing a 73 p.c likelihood of a charge lower in September, the revised process information raises the opportunity of a extra competitive 50 bps lower, because the Fed would possibly act to mitigate faster-than-anticipated financial softening. Supply: CME FedWatch Software”Regardless of the downward revision, the wider financial signs, corresponding to GDP and jobless claims, counsel the economic system isn’t in the similar dire state as all through the 2009 recession,” Kooner stated. “This combined information may lead to Powell keeping up a wary tone, emphasizing the Fed’s data-dependent stance.”The crypto group is carefully looking at for any alerts that would affect marketplace sentiment.Offering context at the possible implications for the crypto marketplace, intergovernmental blockchain skilled Anndy Lian informed Decrypt that in accordance with the present marketplace sentiments, the expectancy of a charge lower is inevitable and is already priced in.If it occurs, it’s going to be the primary in over 4 years. Price cuts most often make riskier asset categories, together with cryptocurrencies and shares, glance extra horny to asset managers.”I imagine there shall be an building up in liquidity. This occurs as a result of decrease rates of interest inspire borrowing and spending, hanging extra money into move,” Lian stated. “A few of this liquidity has a tendency to go with the flow into riskier property like crypto, in quest of probably upper returns.”A charge lower too can weaken the U.S. greenback, which might push traders to hunt upper yields in other places.A weaker greenback could make dollar-denominated property, like Bitcoin, extra horny to global consumers, probably riding up call for and value, Lian stated.Alternatively, if inflation persists regardless of the velocity lower, the Fed may well be compelled to extend rates of interest, leading to lowered marketplace liquidity and decrease investor chance urge for food.Edited by way of Stacy Elliott.Day by day Debrief NewsletterStart on a daily basis with the highest information tales presently, plus unique options, a podcast, movies and extra.

Supply: CME FedWatch Software”Regardless of the downward revision, the wider financial signs, corresponding to GDP and jobless claims, counsel the economic system isn’t in the similar dire state as all through the 2009 recession,” Kooner stated. “This combined information may lead to Powell keeping up a wary tone, emphasizing the Fed’s data-dependent stance.”The crypto group is carefully looking at for any alerts that would affect marketplace sentiment.Offering context at the possible implications for the crypto marketplace, intergovernmental blockchain skilled Anndy Lian informed Decrypt that in accordance with the present marketplace sentiments, the expectancy of a charge lower is inevitable and is already priced in.If it occurs, it’s going to be the primary in over 4 years. Price cuts most often make riskier asset categories, together with cryptocurrencies and shares, glance extra horny to asset managers.”I imagine there shall be an building up in liquidity. This occurs as a result of decrease rates of interest inspire borrowing and spending, hanging extra money into move,” Lian stated. “A few of this liquidity has a tendency to go with the flow into riskier property like crypto, in quest of probably upper returns.”A charge lower too can weaken the U.S. greenback, which might push traders to hunt upper yields in other places.A weaker greenback could make dollar-denominated property, like Bitcoin, extra horny to global consumers, probably riding up call for and value, Lian stated.Alternatively, if inflation persists regardless of the velocity lower, the Fed may well be compelled to extend rates of interest, leading to lowered marketplace liquidity and decrease investor chance urge for food.Edited by way of Stacy Elliott.Day by day Debrief NewsletterStart on a daily basis with the highest information tales presently, plus unique options, a podcast, movies and extra.

Bitcoin Worth Placid Forward of Fed Chair Remarks in Jackson Hollow – Decrypt