The investment charge indicated a bullish sign, then again, the Coinbase Top class Index may face up to the uptrend.

BTC may have hit a neighborhood best, therefore, its upward push to a brand new prime may well be not on time.

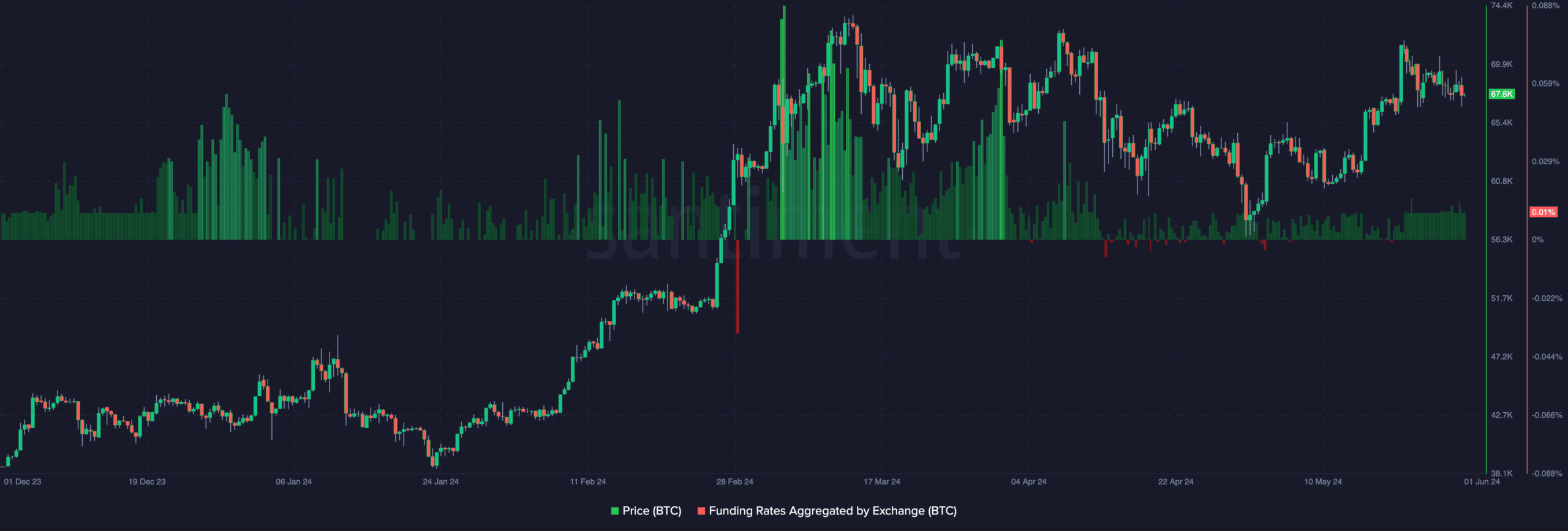

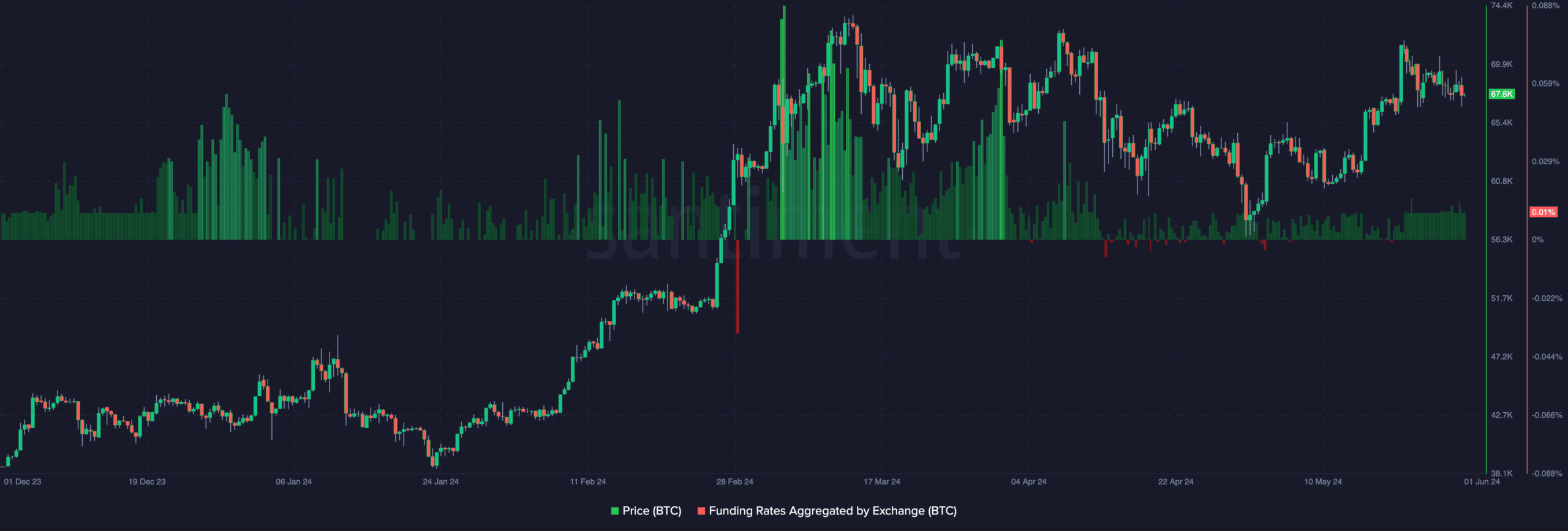

Bitcoin’s [BTC] investment charge has been low since mid-Might, AMBCrypto showed. Although this implied low investor expectancies, it may well be excellent for BTC’s worth.

Investment charge is the price of conserving an open contract available in the market. When the studying is sure, it implies that the perp worth is buying and selling meaningfully above the index price

Decrease optimism, upper BTC costs?

Alternatively, a unfavourable investment charge means that the spot worth is upper than the contract worth. At press time, Bitcoin’s investment charge used to be $0.01%.

However in spite of being sure, this used to be a decrease studying in comparison to what it used to be a couple of weeks in the past. From a buying and selling standpoint, the low investment charge along the declining worth signifies that perp patrons had been fading Bitcoin’s transfer.

Supply: Santiment

Supply: Santiment

Then again, it additionally implies that spot buyers had been changing into competitive. If this continues, Bitcoin may revisit $70,000 inside a brief duration.

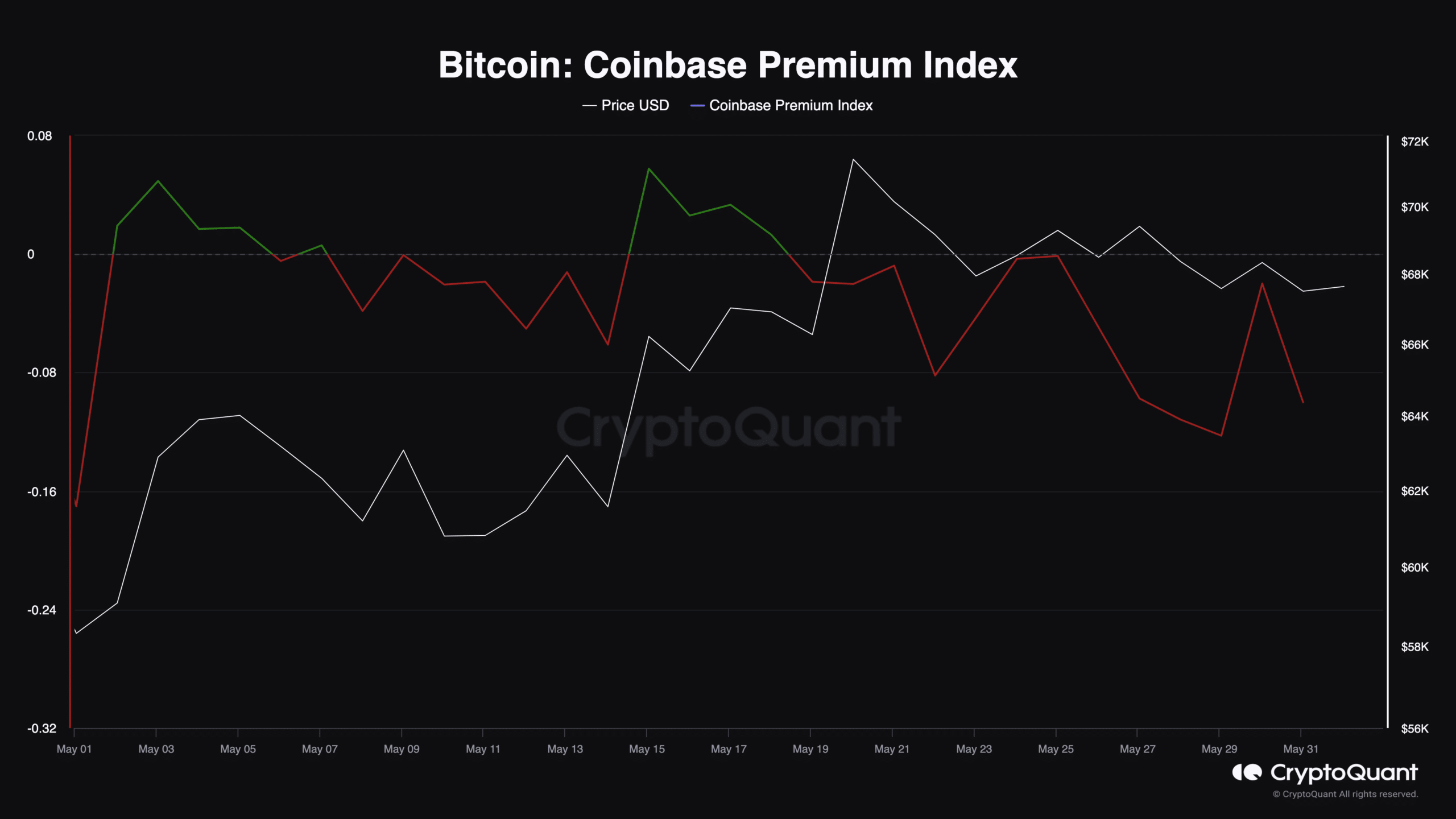

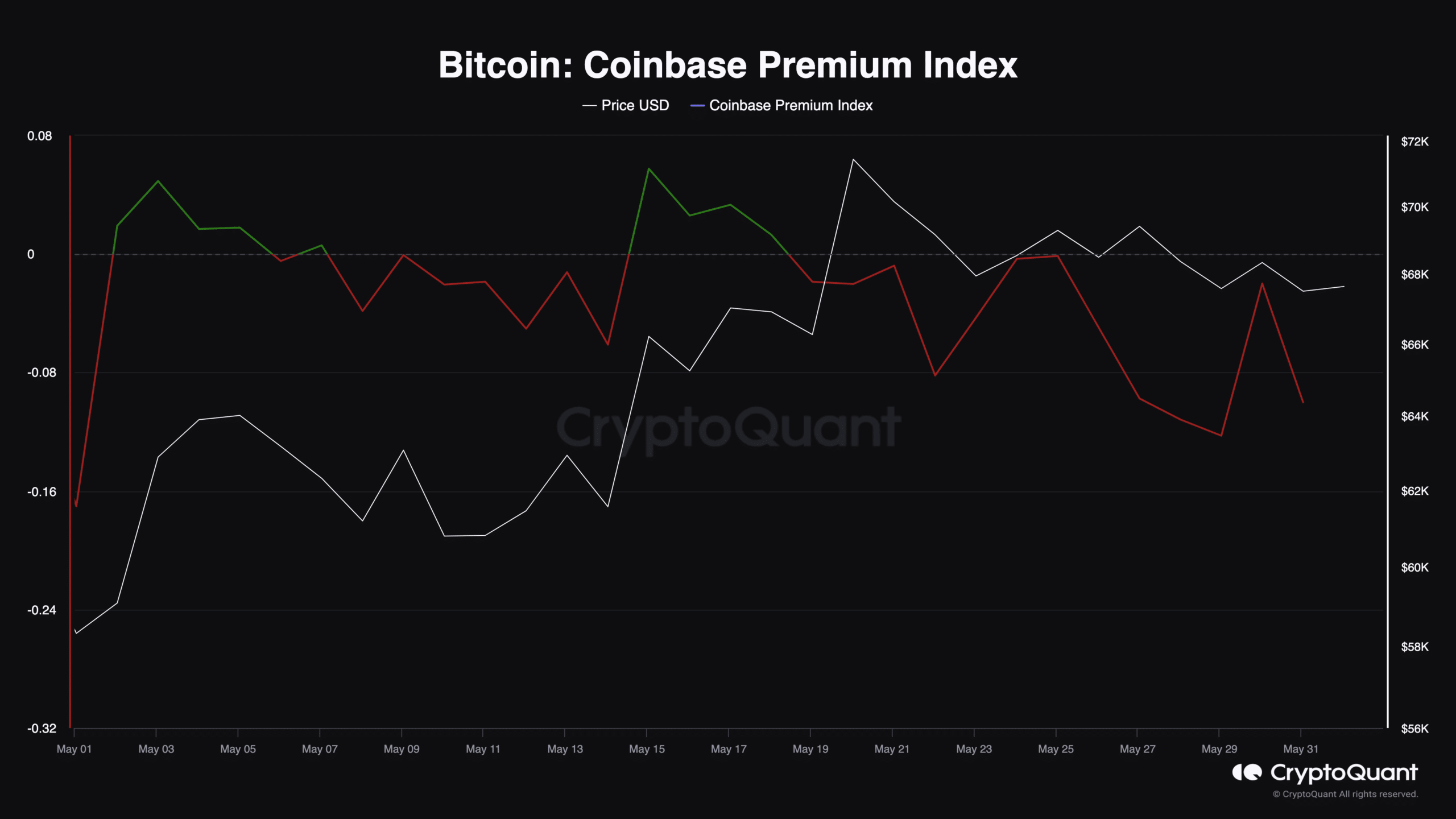

However the revival may not be fast. That is on account of the situation of the Coinbase Top class Index. The index is the adaptation between BTC’s worth at the Coinbase trade and the price on different exchanges.

If the price of the index is prime, it implies that U.S. traders are purchasing numerous BTC, thereby placing excellent drive at the worth. Then again, a decline within the metric signifies an building up in gross sales of Bitcoin via traders within the nation.

As of this writing, the Coinbase Index Top class used to be -0.10, indicating that promoting drive used to be intense. From the chart underneath, AMBCrypto spotted that this lower used to be one of the crucial causes Bitcoin saved getting rejected.

Supply: CryptoQuant

Supply: CryptoQuant

Bearish forces are nonetheless at paintings

Then again, if the studying will increase, it would cause a breakout for BTC. Analyst TraderOasis additionally agreed with this in his research on CryptoQuant, noting that,

“Because of this, when the associated fee reaches the day-to-day hole, the rise within the Coinbase Top class Index indicator shall be our sign.”

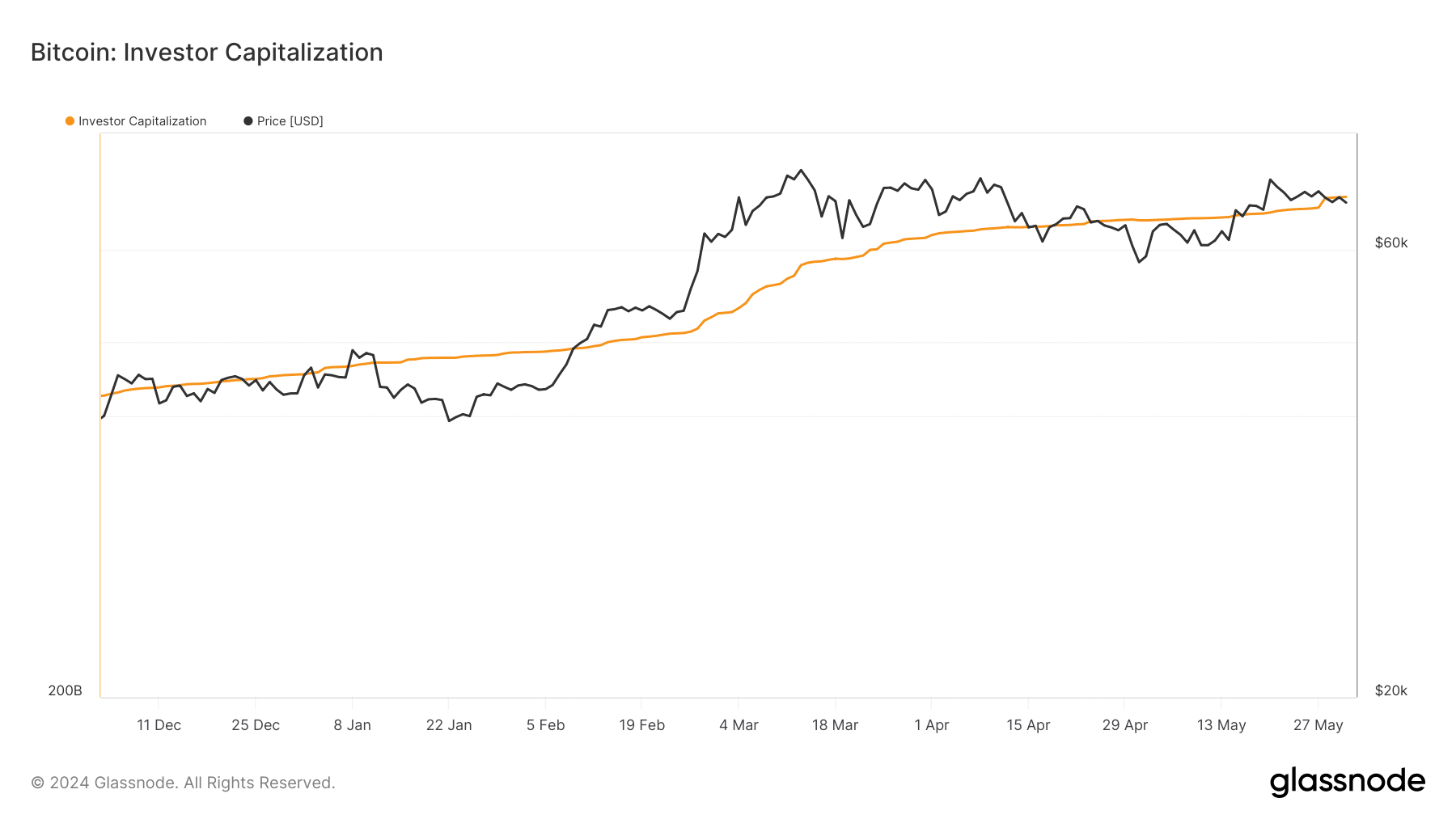

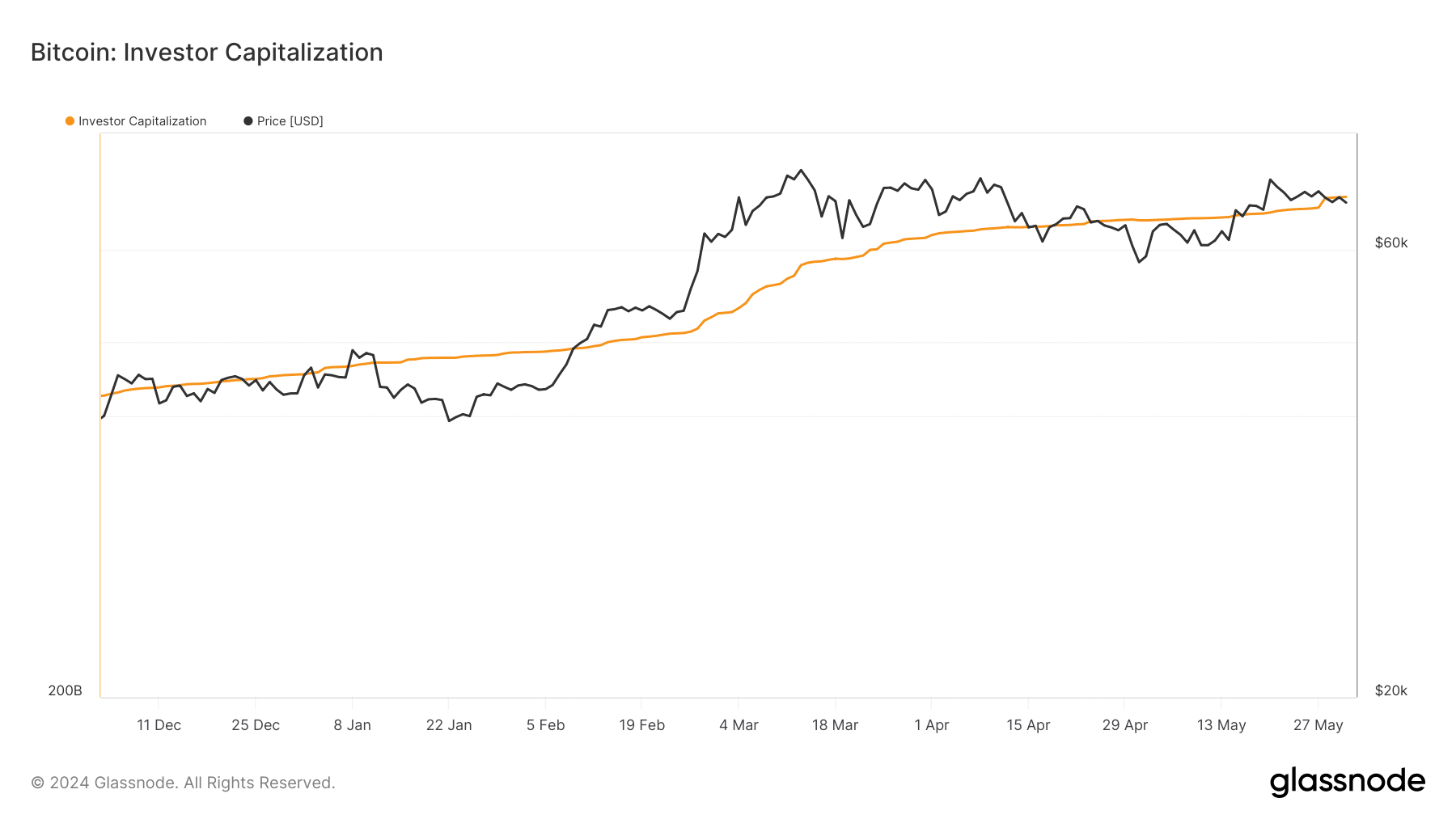

Moreover, AMBCryto tested the investor capitalization supplied via Glassnode. Investor capitalization can inform if BTC is as regards to the ground or has hit a neighborhood best.

At press time, the metric used to be round the similar spot as Bitcoin’s worth, indicating that the coin used to be in a important house. Will have to the metric upward push above BTC, then it could point out a neighborhood best and pressure a correction.

Conversely, if the cost of Bitcoin jumps a lot upper than it, the price may respect, and it could retest $70,000.

Supply: Glassnode

Supply: Glassnode

Is your portfolio inexperienced? Take a look at the Bitcoin Benefit Calculator

Then again, volatility round BTC remained low at press time. This means that the associated fee may stay swinging in a good vary for a while.

Shifting on, there’s a likelihood that the metrics discussed above may transfer to the sure signal. If that is so, the cost of the coin may try to surpass its all-time prime sooner than the top of June.

Subsequent: Is Bitcoin in a position to rally? Inspecting key signs for BTC’s subsequent transfer