A take a look at why declining Bitcoin’s Open Hobby may point out decrease urge for food for leverage.

Declining dominance alerts decrease pleasure for Bitcoin.

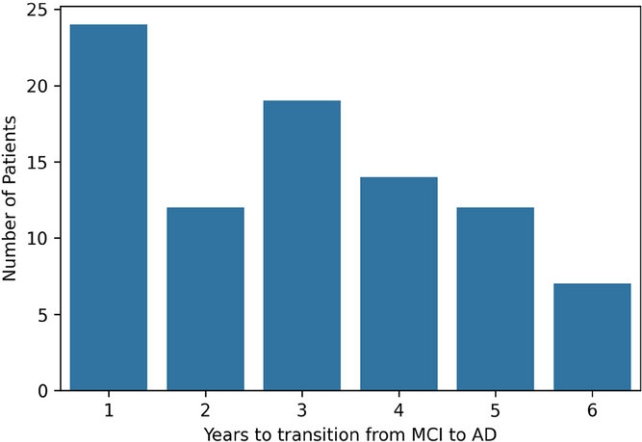

Bitcoin [BTC] simply concluded the final week of November with a noteworthy dip in Open Hobby. Whilst this displays at the contemporary slowdown in pleasure across the king coin, it may additionally be offering insights referring to call for.

A contemporary CryptoQuant research attracts comparisons between Bitcoin’s Open Hobby, urge for food for leverage, and liquidations. Particularly, the Open Hobby top along a euphoric rally intended there have been heavy longs.

A Bitcoin leveraged longs shakedown?

This set Bitcoin up for liquidations that have been answerable for the pullback within the final week of November.

Because of this, BTC lengthy liquidations peaked at $117.88 million on Monday final week as value dipped beneath $93,000. This was once the second-highest degree of liquidations in November.

Supply: Coinglass

Supply: Coinglass

Open Hobby has since dipped over the past seven days. For context, the cryptocurrency had $60.17 Billion in OI on 30 November, a substantial drop from the $64.03 billion OI it accomplished at the twenty second of November.

Nonetheless, the extent of Open Hobby was once nonetheless top.

Supply: CryptoQuant

Supply: CryptoQuant

Liquidations have since then dipped significantly. The prior to now euphoric rally had inspired many derivatives investors to execute leveraged longs.

This might give an explanation for the height liquidations at first of final week as value impulsively pulled again.

The bearish consequence and liquidations additionally aligned with a substantial drop within the estimated leverage ratio.

Supply: CryptoQuant

Supply: CryptoQuant

Is Bitcoin dropping liquidity?

The dip in BTC’s Open Hobby mirrored on its value motion. Bitcoin pulled again from its ancient top of $99,800 to final week’s low at $90,742. Then again, it has since recovered to a $96,532 press time ticket.

Regardless of the slight weekly restoration, the spot marketplace endured to display some call for. For instance, Bitcoin ETFs had over $320 million within the final 24 hours.

However regardless of this, it was once transparent the momentum was once particularly weaker in comparison to the 3rd week of November.

A possible reason for the slower momentum might be the declining Bitcoin dominance. The latter has been rallying frequently for the reason that get started of 2024.

It accomplished a 12-month top at 61.53% at the twenty first of November, however has since dipped to 47.

Supply: TradingView

Supply: TradingView

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Closing week’s BTC dominance dip was once the most important and maximum intense pullback it has skilled to this point this yr, confirming that its liquidity percentage has been declining.

Subsequently, decrease liquidity made its means into Bitcoin final week. That is most likely an indication that the ones deep in benefit are exiting BTC and making an investment into altcoins.

Subsequent: Why POPCAT may now not hang directly to its 79% November good points