Bitcoin stays solid as altcoin metrics display steep declines in engagement and function.

Altcoins display repeated unfavorable momentum indicators, aligning with historic correction classes.

Fresh on-chain knowledge indicators diverging developments between Bitcoin [BTC] and the remainder of the altcoin sector.

Analysts at CryptoQuant showed Bitcoin’s ongoing consolidation above $83,000.

Supply: CryptoQuant

Supply: CryptoQuant

In the meantime, altcoins grapple with heightened volatility, sliding engagement metrics, and depressed valuations.

Momentum developments inform the primary a part of the tale

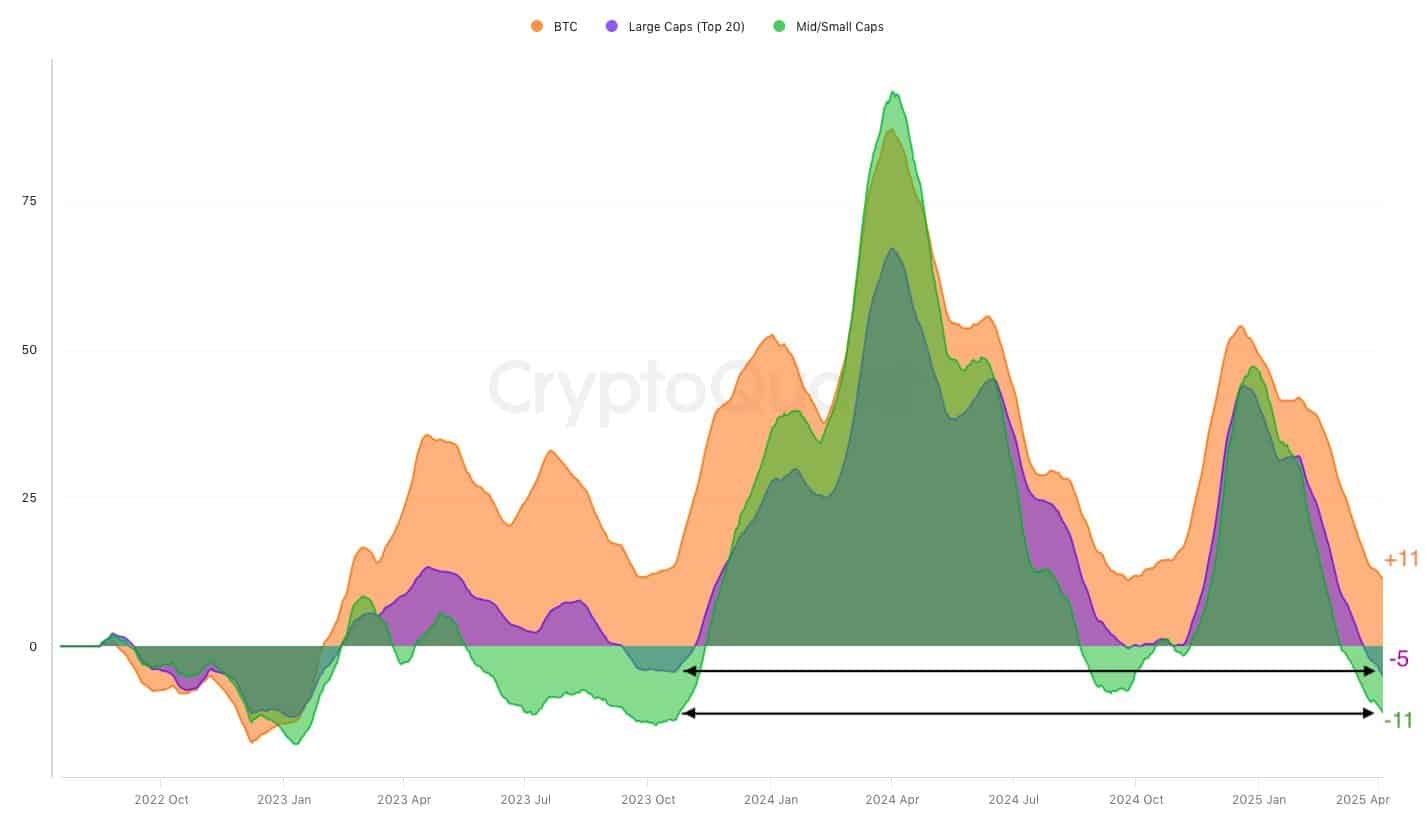

From October 2022 thru April 2025, Bitcoin’s 365-Day Shifting Reasonable (DMA) constantly surpassed 30-day averages around the marketplace, underscoring its dominant momentum.

Altcoins appear to be shedding steam. Since the ratio between 365-day and 30-day averages for non-BTC belongings stood at -11%, at press time, echoing the downturn witnessed in October 2023.

Actually, each large-cap and mid-to-small cap altcoins have sunk into repeated unfavorable territory—reflecting systemic underperformance vis-à-vis Bitcoin.

Transient enlargement spurts did emerge between April and June 2024. Having stated that, those durations proved fleeting, with altcoins failing to maintain any actual momentum.

Bitcoin, alternatively, displayed constant resilience thru bullish and corrective waves alike, reinforcing its place of dominance.

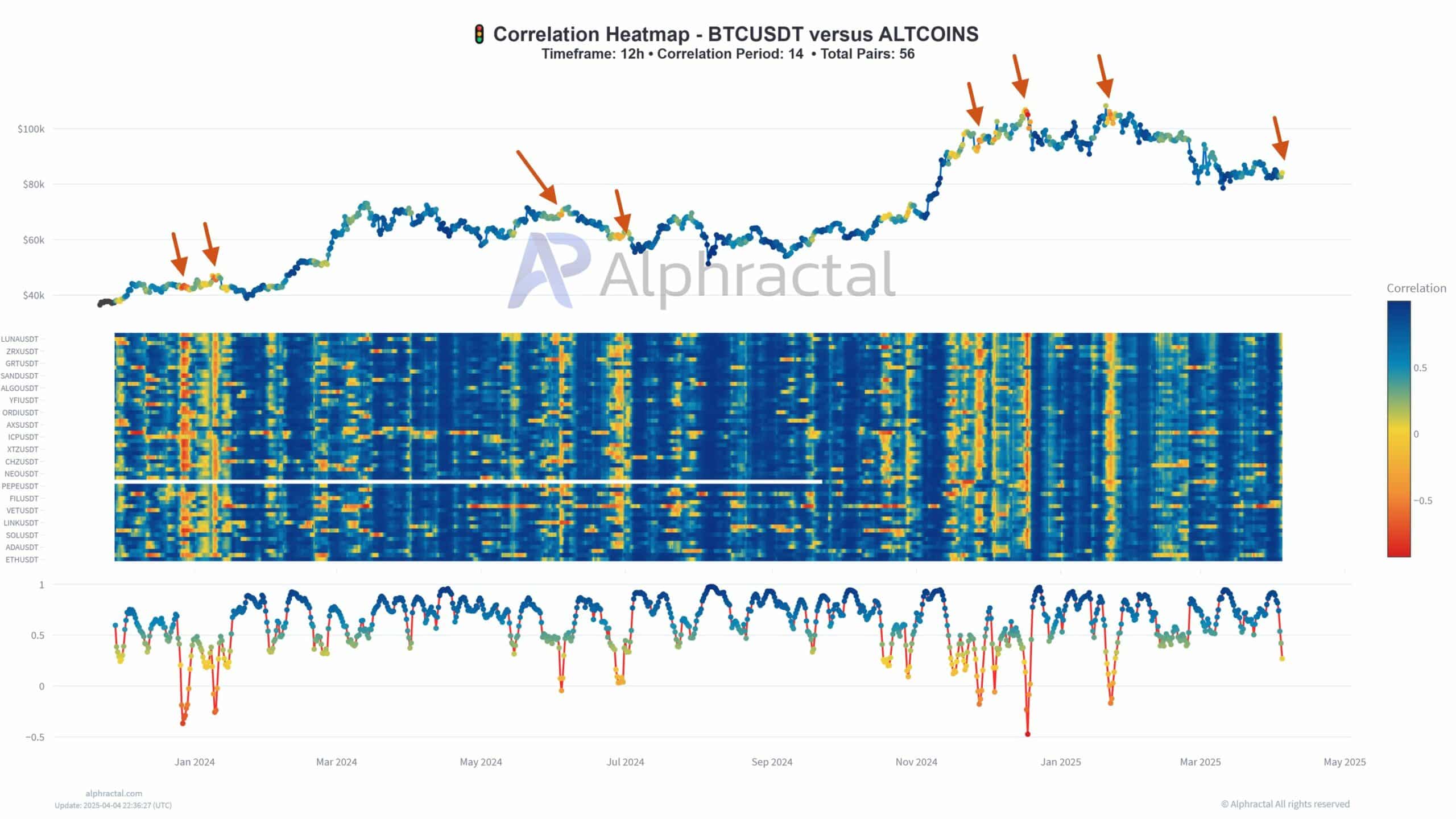

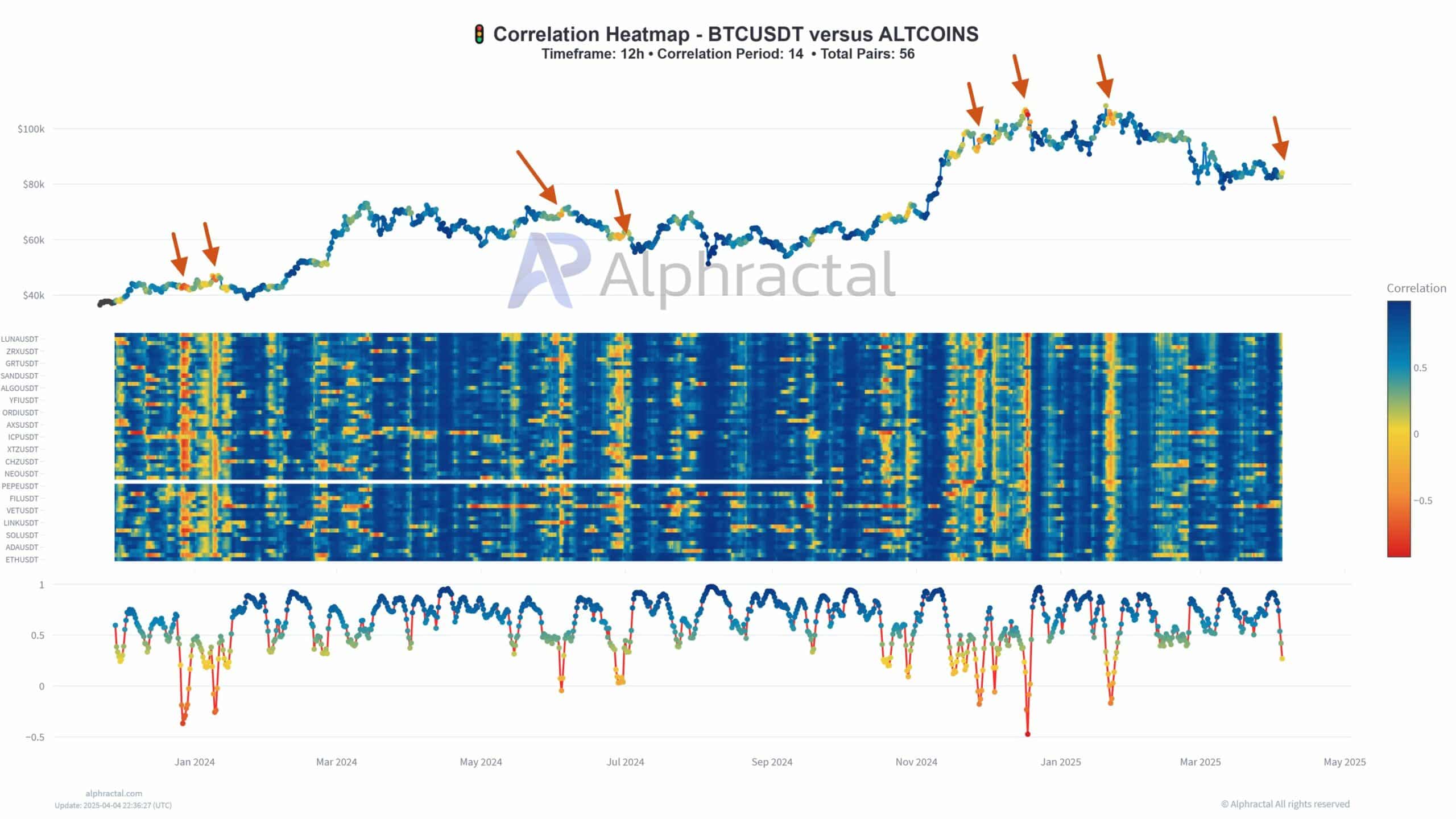

Additionally, Alphractal’s correlation heatmap presentations this divergence.

BTC, against this, stayed resilient

Since early 2024, correlation rankings between BTC and 56 altcoins have swung wildly.

Supply: Alphractal

Supply: Alphractal

On best of that, decrease correlation ranges—frequently marked in blue—generally tend to precede volatility spikes and value reversals for Bitcoin, whilst additionally aligning with native BTC tops.

On the time of writing, the correlation values oscillated between +1 and -0.5, signifying instability in how altcoins reflect Bitcoin’s value motion.

Efficiency knowledge from main altcoins unearths a somber image.

Supply: X

Supply: X

ETHUSDT plunged -9.9% to 0.749, BNBUSDT slumped -25.1% to 0.4299, LTCUSDT just about vanished with -99.66%, buying and selling close to 0.0006, and LINKUSDT tumbled -33.97%.

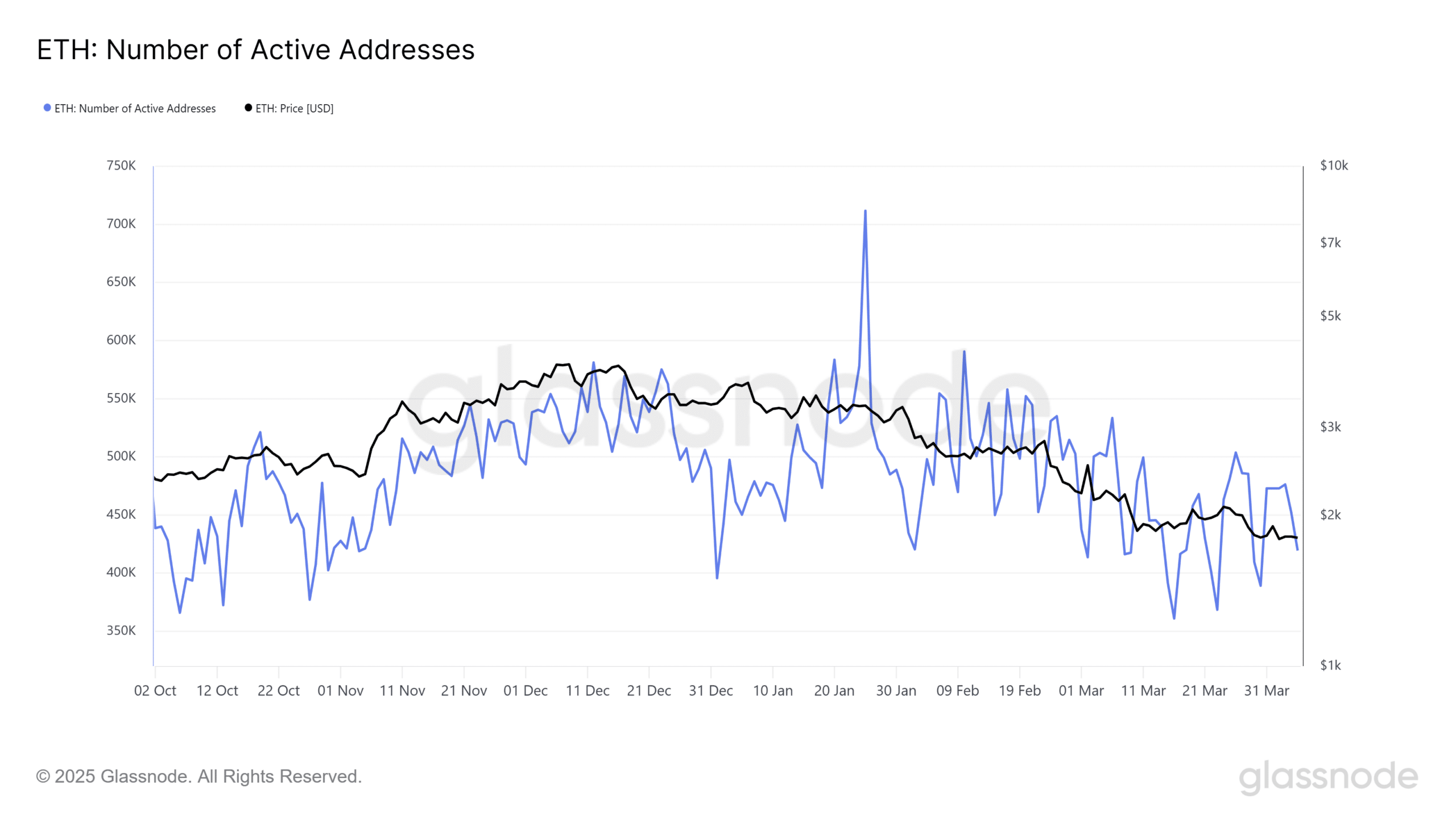

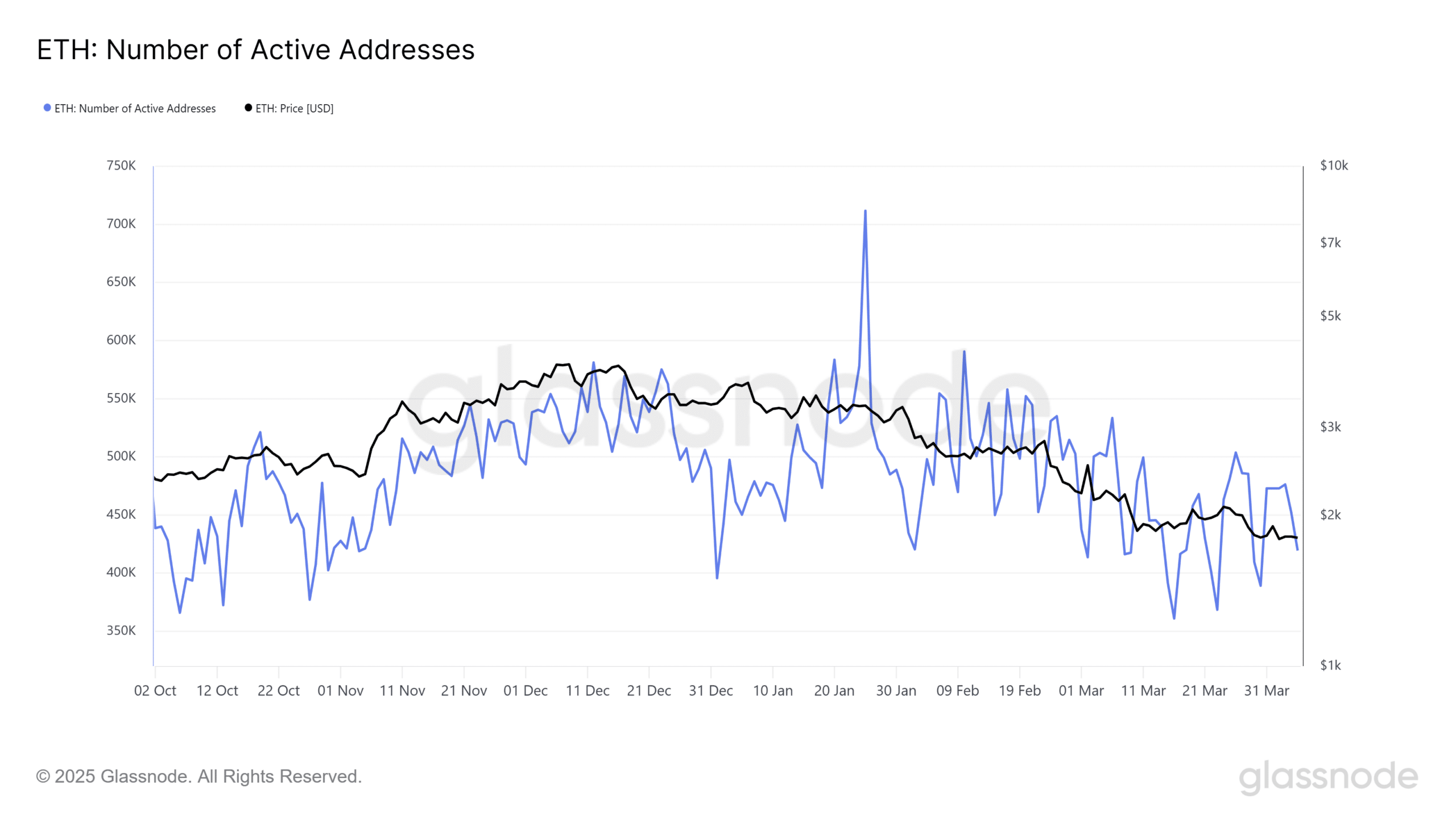

Ethereum’s [ETH] on-chain metrics verify the frailty.

Supply: Glassnode

Supply: Glassnode

For instance, from overdue January to April first week, day by day lively addresses dwindled through 41%, falling from 711,578 to 419,445. However, ETH itself collapsed from $3,319.97 to $1,805.96—a forty five.6% nosedive.

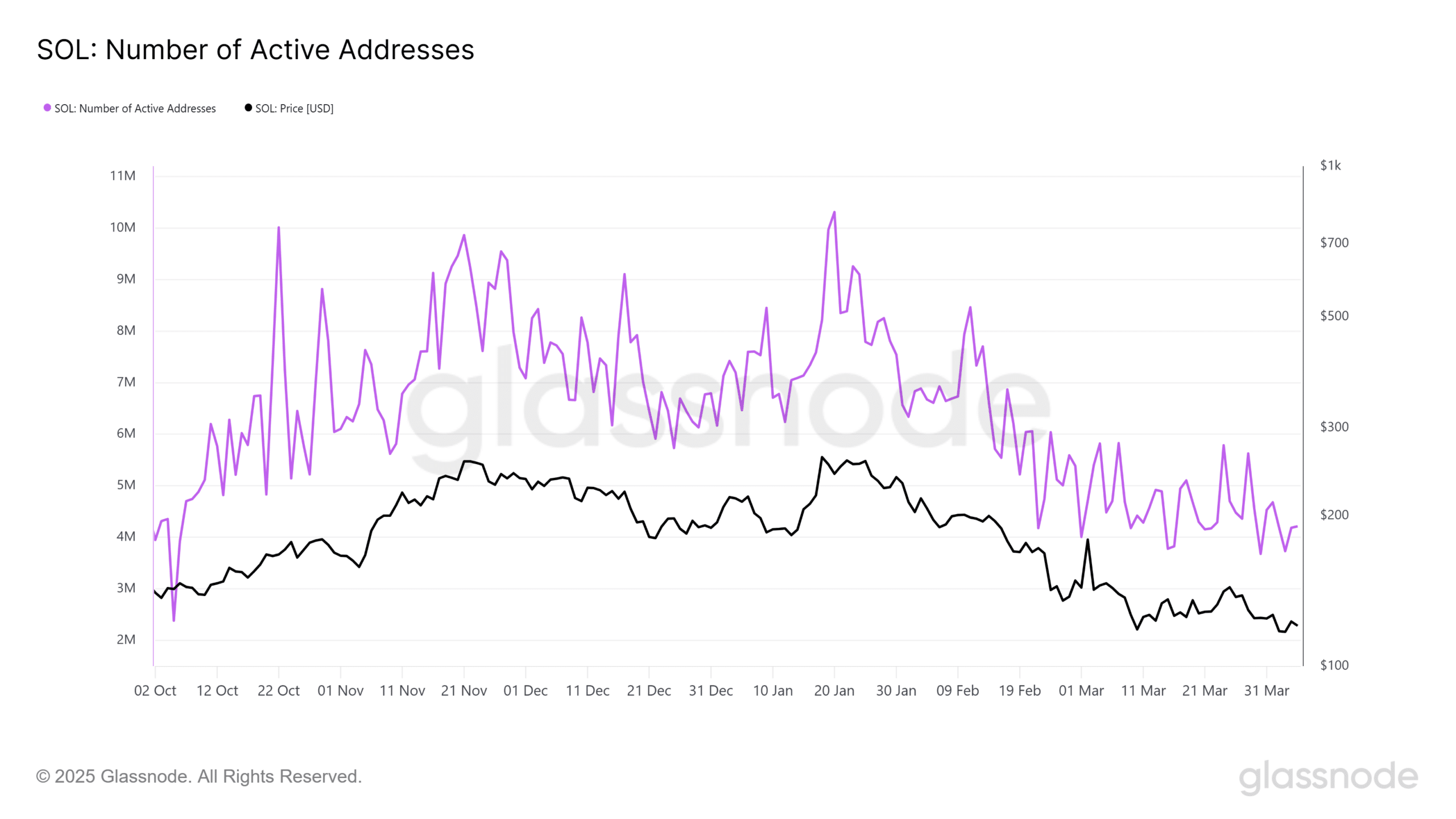

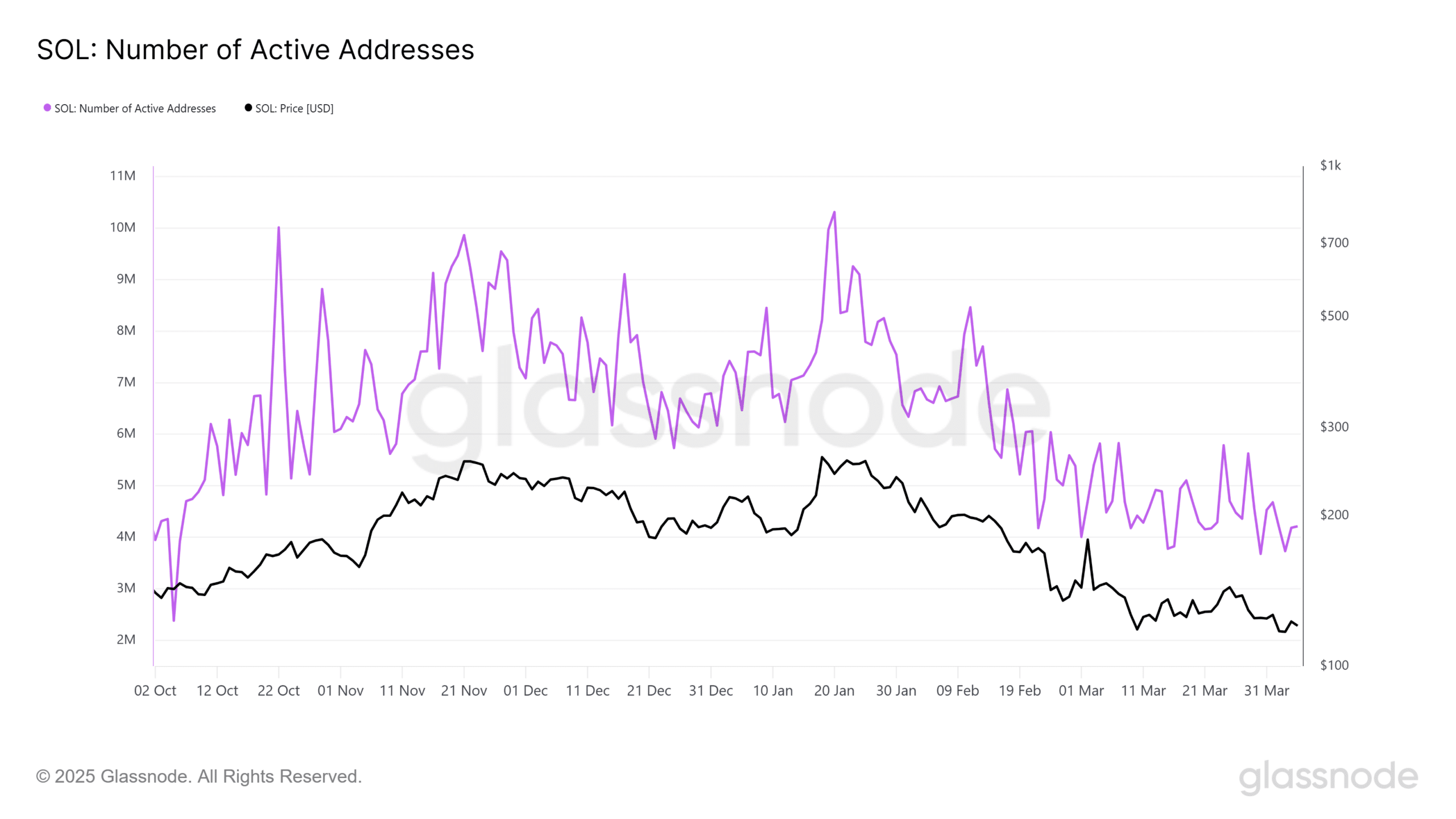

Actually, a equivalent development is clear in Solana [SOL].

Zooming into Solana unearths a deeper correction

Solana lively addresses slid 59%—from 10.3 million on January 20 to 4.18 million at the 4th of April—whilst value receded 49%, from $242.35 to $122.77.

Supply: Glassnode

Supply: Glassnode

BTC appears steadier through comparability.

Lively addresses dropped through simply 26%, from over 1.1 million in December 2024 to 809,254 through the fifth of April. On the similar time, value consolidated between $80,000 and $86,000 thru March and April.

Supply: CryptoQuant

Supply: CryptoQuant

Transaction quantity at the Bitcoin community dropped through 45%, declining from 533,599 at the twenty third of March to 293,310 through the fifth of April. Regardless of this, Bitcoin’s value handiest fell through 4% all the way through the similar length, signaling a segment of consolidation fairly than capitulation.

This knowledge highlights a stark distinction between Bitcoin, the crypto marketplace’s main asset, and its choices.

Altcoins seem to be going through deeper engagement demanding situations, which lengthen past easy value declines. In the meantime, Bitcoin stays essentially the most resilient possibility, despite the fact that some view its decreased community process as an indication of reducing speculative passion.

Subsequent: Ethereum faces 46% annually loss – A steeper decline is imaginable IF…