Galaxy Virtual settles with NYAG for $200 million over Terra LUNA mishandling.

BitGo CEO urges moral crypto practices and helps principles-based law.

Galaxy Virtual has reached a $200 million agreement with the New York Legal professional Normal (NYAG) over its alleged mishandling of the collapsed Terra LUNA cryptocurrency.

Mike Belshe takes a jab at Galaxy Virtual

Then again, the agreement has sparked industry-wide discussions, with BitGo CEO Mike Belshe weighing in at the subject.

Regardless of his advocacy for deregulation, Belshe said the energy of NYAG’s case towards Galaxy Virtual, signaling a shift in stance towards regulatory oversight.

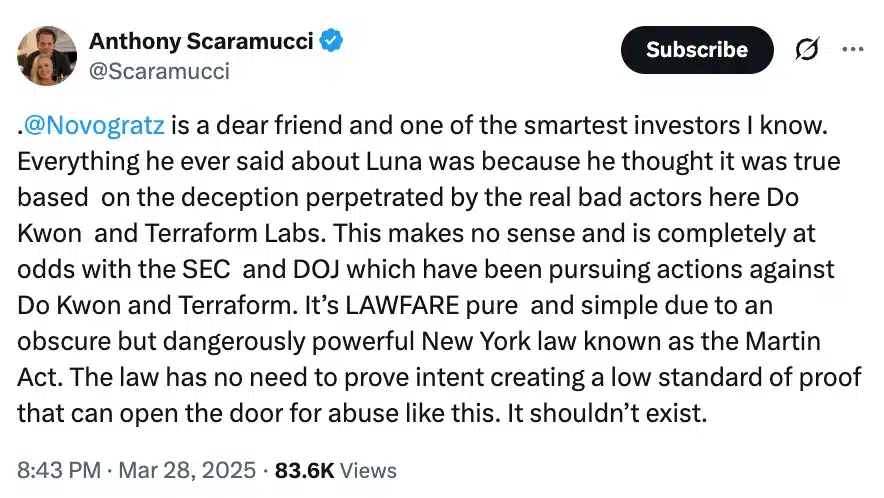

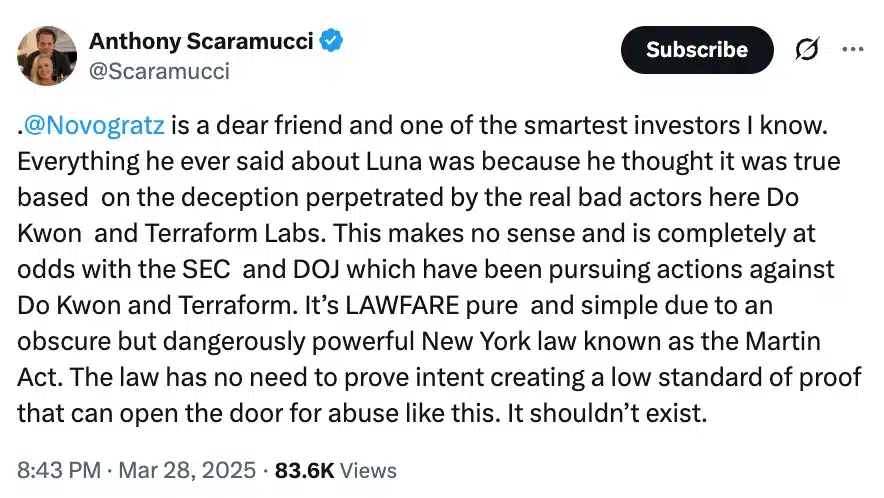

His remarks, made in keeping with a put up via Anthony Scaramucci on X, spotlight rising issues about fraudulent practices within the crypto house.

Supply: Anthony Scaramucci/X

Supply: Anthony Scaramucci/X

Belshe criticized Galaxy Virtual’s pump-and-dump ways, declaring the company’s observe of offloading tokens upon vesting whilst concurrently selling HODLing.

He emphasised the moral issues surrounding such movements but additionally said his appreciate for Novogratz and his contributions to the crypto {industry}.

Belshe mentioned,

“I’ve at all times idea Mike introduced excellent adulthood to crypto and revered him for it, however I used to be stunned to learn the info defined via NYAG. So, prison overreach or no longer, it’s no longer moral, and this kind of habits makes our complete {industry} glance unhealthy. Unchecked, that is what ends up in “over law”.”

Suggesting some way out, he added,

“’Rules founded law’ may are compatible neatly right here: don’t lie to advertise property you dangle; don’t inform others to shop for whilst hiding the truth that you’re promoting.”

Crypto law within the Trump vs. Biden management

As anticipated, Belshe’s emphasis on crypto law subtly displays the stark distinction between the Biden and Trump administrations’ approaches to the {industry}.

Below Biden, primary crypto companies like Consensys, Ripple [XRP], Robinhood, MetaMask, Coinbase, and Kraken confronted relentless prison battles with the SEC.

Then again, with Trump’s go back, many of those disputes have in the end been resolved, signaling a shift in regulatory stance.

This variation is additional strengthened via Paul Atkins, Trump’s SEC chair nominee, who has just lately pledged to ascertain a extra “rational” and “coherent” regulatory framework for crypto, probably ushering in a brand new generation of industry-friendly insurance policies.

In his commentary right through the U.S. Senate Banking Committee listening to, he put it easiest when he mentioned,

“A most sensible precedence of my chairmanship will likely be to paintings with my fellow Commissioners and Congress to offer a company regulatory basis for virtual property thru a rational, coherent, and principled way.”

Subsequent: XRP drops 11% in spite of SEC victory: What’s taking place?