The USA Securities and Trade Fee (SEC) has licensed BlackRock’s proposal to provide choices buying and selling for its spot Bitcoin ETF (exchange-traded fund).

BlackRock’s ETF Launches Choices Buying and selling 8 Months After Debut

On Friday, September 20, the SEC launched a understand of popularity of choices buying and selling for the iShares Bitcoin Believe (IBIT) on Nasdaq. This could come about 8 months after the SEC greenlighted the arena’s biggest asset supervisor and a dozen different corporations’ programs to release spot Bitcoin ETFs.

Following the spot Bitcoin ETF release in January, BlackRock briefly adopted with an offer to checklist and industry choices on its product. For context, choices are derivatives that give the holders the correct to buy or promote an underlying asset at a predetermined value and time

The regulator’s understand learn:

The Fee is publishing this understand to solicit feedback on Modification Nos. 4 and 5 from individuals, and is approving the proposed rule alternate, as changed by way of Modification Nos. 1, 4, and 5, on an speeded up foundation.

Supply: SEC

It’s value bringing up that different asset control corporations, together with Grayscale and Bitwise, also are taking a look to checklist spot Bitcoin ETFs. Bloomberg analyst Eric Balchunas asserted in a submit on X that he expects those corporations’ proposals to obtain approval in “quick order.”

Balchunas added:

Massive win for the bitcoin ETFs (as it’ll draw in extra liquidity which is able to in flip draw in extra giant fish). This can be a great marvel re timing however no longer a shocker as James Seyffart and I gave 70% odds of approval by way of finish of Might.

The Bloomberg analyst additionally famous that this newest permission to Nasdaq replace is just one level of the approval, because the Workplace of the Comptroller of the Forex (OCC) and Commodity Futures Buying and selling Fee (CFTC) want to validate ahead of buying and selling can formally start.

What Subsequent For Spot Bitcoin ETFs?

ETF skilled Nate Geraci additionally took to the X platform to weigh in on the most recent approval of choices buying and selling by way of the SEC, explaining the following steps for the spot Bitcoin ETFs. The ETFStore president highlighted the sure efficiency of the crypto merchandise in spite of sure barriers.

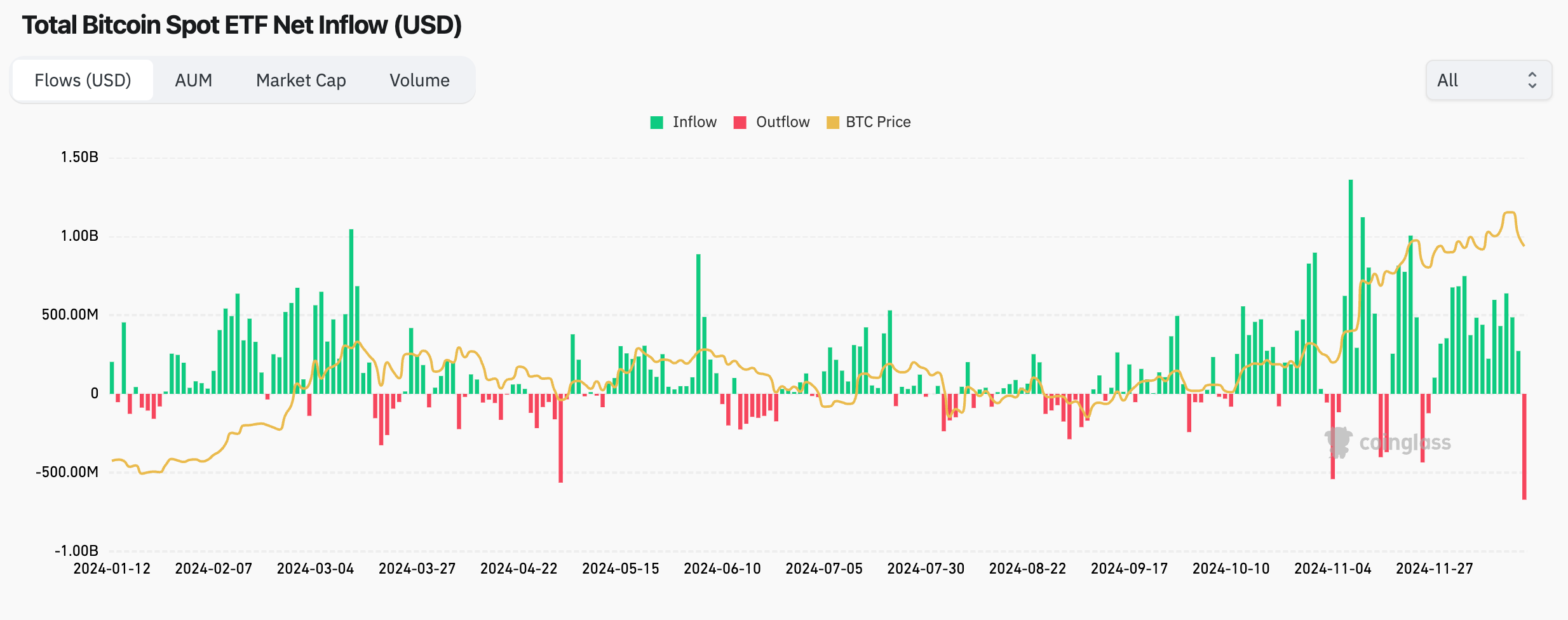

Bear in mind, spot btc ETFs have taken in a web $18bil in 8 months…

Without a choices buying and selling, no in-kind advent & redemption, & restricted approval on main wirehouse platforms (plus no get right of entry to on Forefront).

Huge luck w/ one hand tied at the back of again.

— Nate Geraci (@NateGeraci) September 20, 2024

In step with Geraci, the advent of in-kind advent and redemption must be the following milestone for the Bitcoin exchange-traded price range. For context, in-kind advent and redemption refers back to the procedure in which massive buyers can both create or redeem ETF stocks by way of exchanging them for the underlying asset (Bitcoin, on this state of affairs).

Similar Studying: SEC Vs. Coinbase On Pause: US Regulator Requests 4-Month Truth Discovery Extend

The advent of in-kind advent and redemption will building up the potency of Bitcoin ETF buying and selling, as buyers will be capable of deposit BTC without delay into the fund. This would cut back the price of making an investment within the spot Bitcoin ETFs and lead them to a extra sexy funding product.

The cost of Bitcoin at the day-to-day time-frame | Supply: BTCUSDT chart on TradingView

Featured symbol created with Dall.E, chart from TradingView