DOT’s value faces a key threshold; if it may possibly wreck throughout the present provide stage, a rally may practice.

Technical signs are sending combined alerts—some recommend a bullish shift, whilst others trace at persisted bearish drive.

During the last month, Polkadot’s [DOT] efficiency has been lackluster, with a dominant bearish sentiment resulting in an 18.97% decline.

Your next step for DOT stays unsure as conflicting metrics stay marketplace sentiment divided, leaving room for volatility throughout upcoming buying and selling periods.

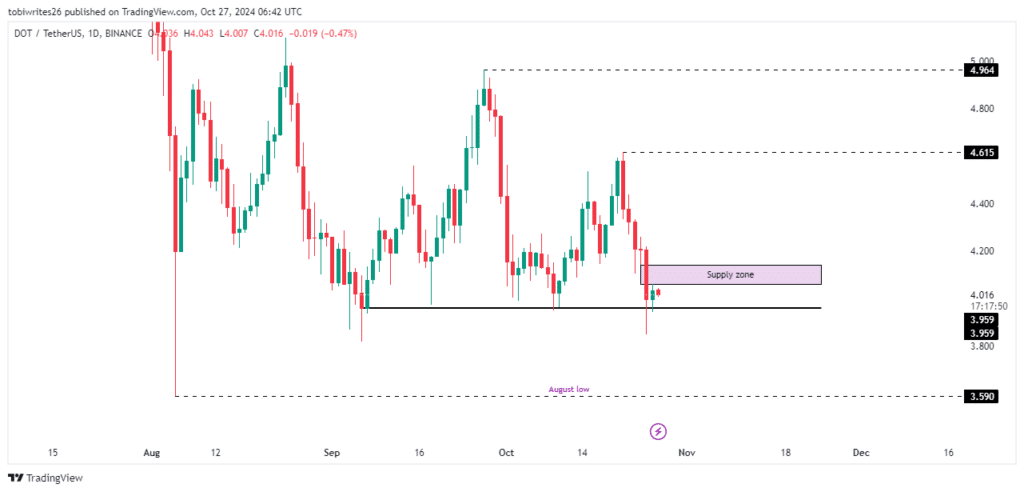

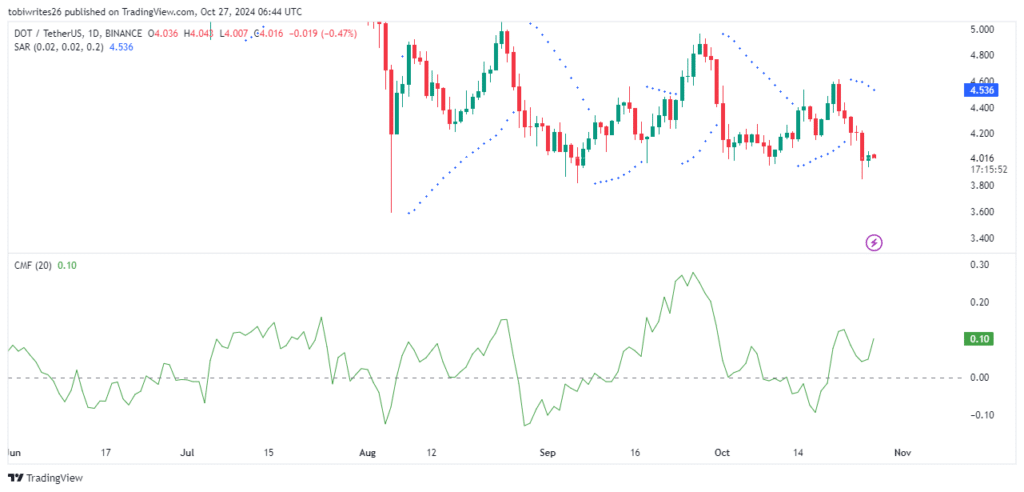

DOT caught between key ranges

DOT is lately buying and selling between two vital ranges that would form its path within the upcoming periods.

After just lately bouncing off a give a boost to stage at 3.959, DOT may rally to 4.615 or 4.964 if this give a boost to holds. On the other hand, a provide zone lies at once above, which might cause promoting drive and push the fee decrease, probably returning DOT to its August low.

Supply: Buying and selling View

Supply: Buying and selling View

To evaluate the possible motion, AMBCrypto analyzed technical signs, however discovered combined alerts, leaving the outlook unsure.

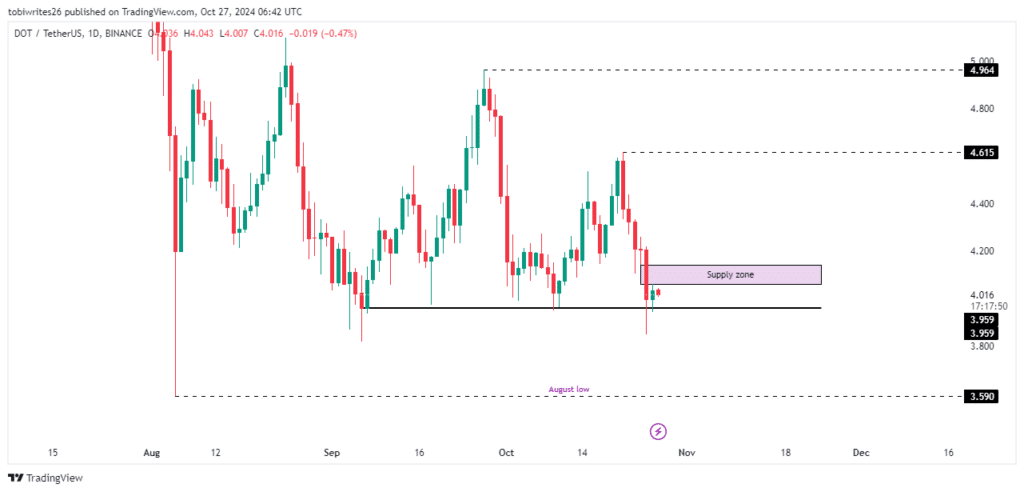

No transparent development from buyers: combined alerts for DOT

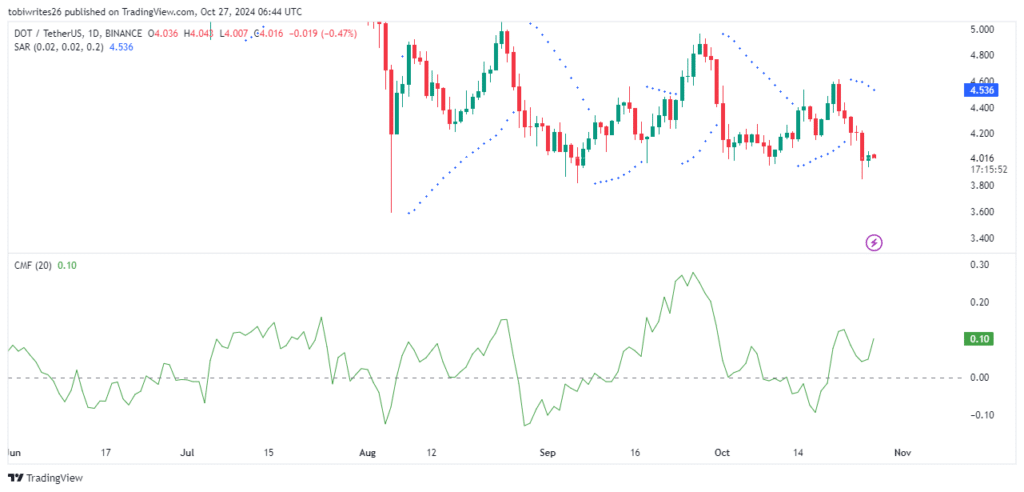

Two primary signs, the Chaikin Cash Go with the flow (CMF) and Parabolic SAR (Forestall and Opposite), provide a mix of bullish and bearish alerts for DOT, leaving its long run path unsure.

The Chaikin Cash Go with the flow (CMF), which assesses the go with the flow of liquidity into or out of an asset, has proven an uptick, with a present studying of 0.11. A good CMF worth suggests expanding purchasing drive, which normally aligns with a possible upward value motion for DOT.

This studying signifies that if this momentum continues, DOT may push thru its present provide zone, probably maintaining a rally.

Conversely, the Parabolic SAR, a trend-following indicator that alerts reversals, presentations a bearish sentiment. That is indicated through more than one dots above DOT’s value, suggesting ongoing promoting drive and a most probably continuation of the downtrend.

When the Parabolic SAR dots seem above the asset’s value, it alerts resistance and the potential of additional value declines.

Supply: Buying and selling View

Supply: Buying and selling View

With those two signs suggesting opposing traits, AMBCrypto became to on-chain job to offer further insights into DOT’s subsequent transfer.

Slow purchasing drive emerges for Polkadot

Information from Coinglass signifies a favorable investment price for DOT, suggesting an building up in lengthy passion from buyers.As of the most recent studying, DOT’s investment price stands at 0.0109%.

Learn Polkadot’s [DOT] Worth Prediction 2024-25

A good investment price implies that buyers retaining lengthy positions are paying the ones retaining quick positions to take care of value equilibrium. This vogue normally issues to an underlying bullish sentiment, as extra buyers are having a bet on value will increase, which might push DOT upper.

If this purchasing drive continues, DOT might wreck thru its present provide zone and vogue additional upward.

Subsequent: Mapping XRP’s trail to key resistance amid emerging Open Passion