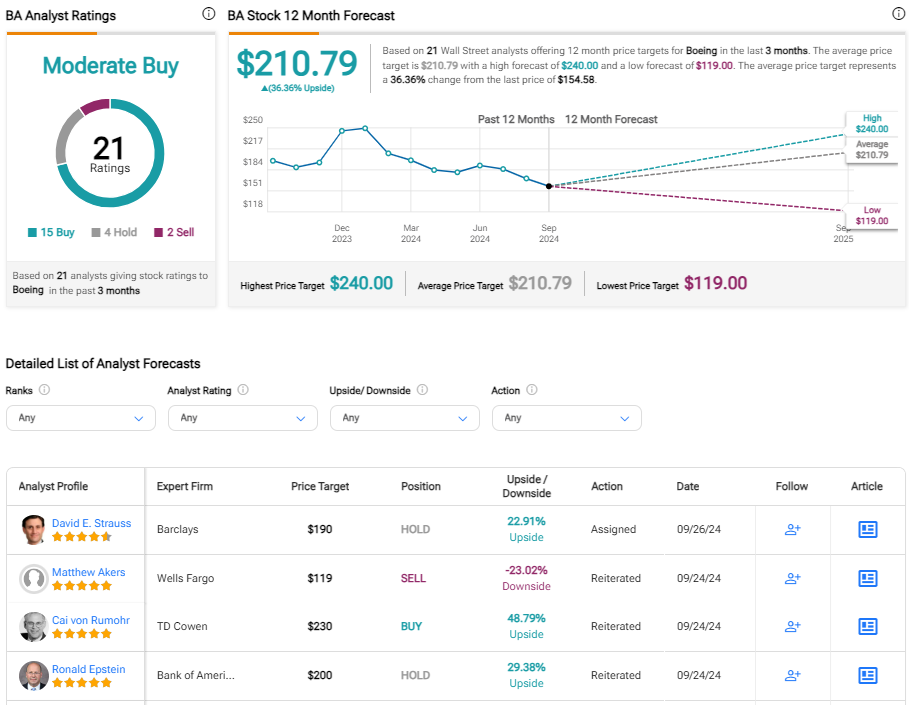

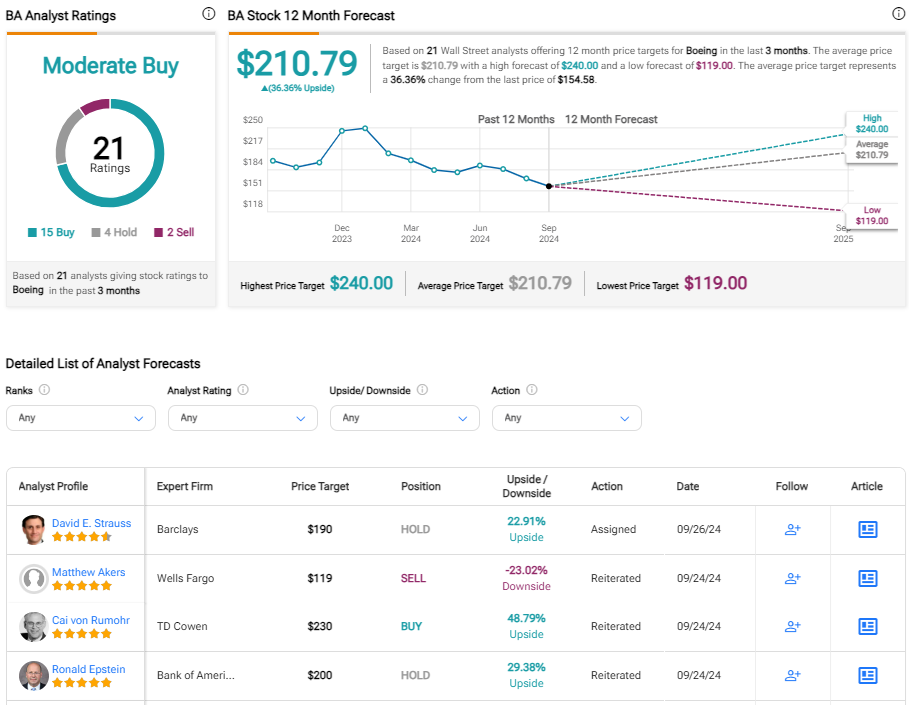

Boeing (BA) inventory has suffered in 2024 as high-profile protection incidents in the case of its civil aviation operations compounded prior issues about construct high quality and protection mechanisms. On the other hand, the corporate’s distress has now prolonged to incorporate hundreds of hanging staff challenging upper pay and advantages. In the meantime, the corporate’s debt place is worsening by way of the day. Regardless of certain profits forecasts for 2025, I’m bearish on Boeing.Boeing Employee Pay DemandsAs maximum traders and participants of most people will know, it’s been difficult sledding for Boeing lately. Amid persevered high quality issues and supply delays, Boeing’s ongoing hard work dispute has reached a essential juncture. The corporate lately introduced its “perfect and ultimate be offering” to hanging staff, however the effort seems to be in useless. Each week there appears to be a brand new reason why to be pessimistic on Boeing.The new proposal integrated a 30% pay elevate over 4 years, up from the former 25% be offering. It additionally promised a doubling of the ratification bonus to $6,000. On the other hand, the World Affiliation of Machinists and Aerospace Employees (IAM) has rejected Boeing’s ultimatum, refusing to carry a vote by way of the corporate’s September 27 cut-off date. Representatives of the hanging staff previous claimed that the proposal used to be made absent negotiation with the union.The strike, involving 33,000 staff, has halted manufacturing of a number of airplane fashions and is costing Boeing a big sum every day. In line with the union, key problems stay unresolved, together with the recovery of a conventional 401-k eradicated a decade in the past.A Evaluation of Boeing’s High quality IssuesAs the standoff continues, the union and Boeing face mounting power. Boeing has applied cost-cutting measures together with furloughs for non-union workers, whilst hanging staff possibility dropping their company-provided medical insurance by way of the top of the month.On the other hand, those moves and layoffs appear more likely to most effective compound manufacturing and high quality problems. Lately, the corporate has confronted complaint for prioritizing manufacturing pace over high quality, with staff reporting insufficient coaching and power to chop corners. A six-week FAA audit printed severe manufacturing problems, together with incorrect documentation, inadequate high quality inspections, and the usage of unauthorized gear.Those issues resulted in incidents such because the door plug detachment on an Alaska Airways (ALK) flight in January 2024. Contemporary incidents have additionally integrated the LATAM Airways 787 mid-air drop in March 2024, and the engine loss incident on a Southwest Airways 737-800 flight in April 2024. All of those compound the fallout from the fatal injuries from 2018 and 2019. With mounting high quality issues, mitigation efforts had already ended in supply delays.Tale continuesIs Debt a Worry for Boeing?Problems stay compounding for Boeing, and its rising debt pile is this kind of. As of the second one quarter of 2024, the corporate’s long-term debt jumped again above $50 billion lately, after a number of quarters within the $47 billion – $48 billion vary. This build up used to be because of the issuance of latest debt. Some traders have floated issues in regards to the corporation’s monetary balance.Additionally, Boeing’s bonds are buying and selling close to junk degree and are vulnerable to dropping their investment-grade standing, which might purpose upper yield spreads for the corporate. The corporate’s money waft has additionally been negatively impacted, with working money waft touchdown at -$3.9 billion for the second one quarter of 2024.Will have to Traders Believe the Forecasts?Whilst I’m bearish because of all this headwinds, many analysts are forecasting a swift go back to profitability. The present consensus estimates counsel that Boeing will reach $3.44 of EPS profitability in 2025. That profits degree would indicate that Boeing is buying and selling at a ahead P/E ratio of 44.2x. From there, analysts be expecting profits will surge to $13.09 in 2027; a two-year ahead P/E of simply 7.26x.For my part, I’m in doubt in regards to the deserves of those forecasts given the reputational harm Boeing has suffered, in addition to a slower order e-book than its peer Airbus (EADSF). Airbus itself is affected by manufacturing delays, however its issues appear to faded compared to the strife its American counterpart goes thru.Is Boeing Inventory a Purchase In line with Analysts?On TipRanks, BA is available in as a Average Purchase according to 15 Buys, 4 Holds, and two Promote rankings assigned by way of Wall Side road analysts previously 3 months. The common Boeing inventory value goal is $210.79, implying a ~35% possible upside. Nearly all of analysts predict BA inventory to rebound above $200 in line with percentage over the following 12 months.

Boeing May just Face Extra Ache as Union Problems Drag On